|

市場調查報告書

商品編碼

1522858

甲醇 -市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Methanol - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

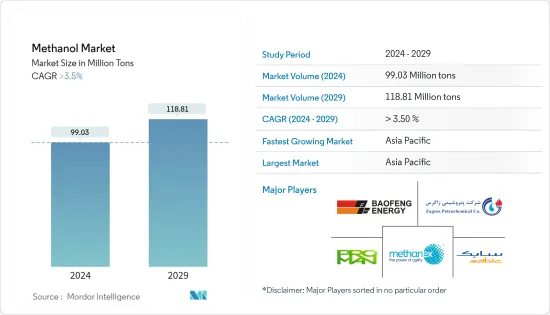

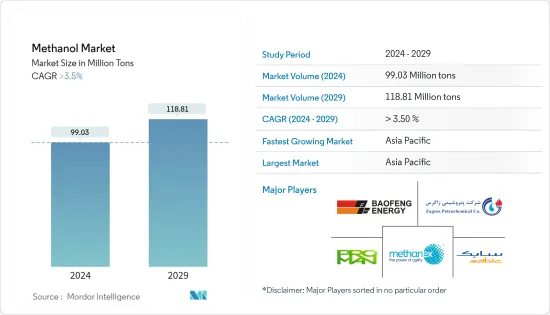

預計2024年甲醇市場規模為9,903萬噸,預計2029年將達到1,1881萬噸,預測期(2024-2029年)複合年成長率超過3.5%。

由於2020年和2021年上半年政府實施的禁令和限制,COVID-19大流行嚴重抑制了工業活動,限制了甲醇市場的成長。由於原物料供不應求、工時和勞動力限制、需求減少、資金緊張等因素,化工業面臨困難。然而,自2021年中疫情消退以來,化工石化產業已步入復甦之路。各個最終用戶行業對化學品的需求快速成長預計將有助於甲醇市場的成長。

主要亮點

- 中期來看,石化產業的擴張以及中國、美國和其他亞太國家對甲醇燃料的需求增加是甲醇市場成長的主要驅動力。此外,透過 MTO 生產烯烴時甲醇的使用量不斷增加,推動了化學工業承購量的增加。

- 另一方面,乙醇燃料和生質乙醇比甲醇更受青睞,與甲醇相關的不利健康影響預計將在預測期內限制目標產業的成長。

- 然而,甲醇在新的和不斷擴大的燃料應用中的使用以及行業對可再生甲醇的日益關注預計將在短期內為市場提供利潤豐厚的成長機會。

- 亞太地區已成為最大的甲醇市場。預計在預測期內複合年成長率將達到最高。亞太地區的主導地位是由於中國、日本和其他東南亞國家對甲醇的高需求,以及化學和其他應用領域的擴大。

甲醇市場趨勢

能源相關應用主導市場

- 近年來,甲醇在能源相關應用中的使用顯著增加。甲醇廣泛用於甲醇-烯烴(MTO)轉化反應,為從煤炭和天然氣等非石油資源生產基本石化產品(例如乙烯、丙烯、Butene、丁二烯)提供了機會。

- 甲醇是生產甲基叔丁基醚 (MTBE) 的前體,將其添加到汽油中以增加其氧氣含量並提高其辛烷值。由於MTBE完全燃燒汽油,因此可以抑制一氧化碳等有害氣體的排放,並減少空氣污染。

- 甲醇已成功用於擴大全球許多汽油市場的汽油供應。在汽油供應中添加甲醇可以提供石油的替代能源和清潔且燃燒高效的高辛烷值燃料。據甲醇協會稱,與其他醇不同,將甲醇混合到汽油中是經濟的,無需政府補貼或燃料混合指令。

- 此外,對汽油等石油產品的需求預計將逐年增加。例如,根據石油輸出國組織(OPEC)的預測,2030年全球汽油需求預計將達到2,820萬桶/日,比2021年的2,570萬桶/日成長9.7%。

- 甲醇也用於生產二甲醚,由於其良好的可燃性和高十六烷值,它作為替代燃料具有重要用途。二甲醚在柴油引擎中的燃燒非常清潔並且不產生煙灰。它可用於柴油引擎作為傳統柴油的替代。

- 甲醇是生產生質柴油的重要原料,生物柴油作為可替代原油柴油的可再生燃料而受到關注。甲醇與三酸甘油酯具有優異的反應活性和較高的鹼溶解度,使其比乙醇更適合酯交換反應。

- 生質柴油是一種清潔燃燒燃料,可提高能源安全並減少碳足跡。生物柴油具有高閃點(最低100°C),可以與柴油以任何比例混合。生物柴油的環境效益在過去幾年中刺激了生物柴油產量的持續成長,但2020年疫情爆發期間除外。

- 根據經濟合作暨發展組織(OECD)預測,2029年全球生質燃料(包括生質柴油)消費量將達到2,107億公升,預計2022年為1,863.5億公升,成長13.1%。生物柴油等生質燃料的生產和消費趨勢正在增加,預計在預測期內消費量將增加。

- 考慮到上述因素,能源相關應用中甲醇的使用和需求預計在預測期內將會成長。

亞太地區主導市場

- 亞太地區在全球市場中佔據主導地位,擁有龐大的市場佔有率。預計這一優勢將在預測期內保持下去。光是中國就生產和消費了全球60%以上的甲醇,位居世界領先地位。一座「最先進」的二氧化碳甲醇化工廠在中國河南省安陽市開始生產,成為世界上第一個利用回收的廢棄二氧化碳和氫氣生產甲醇的商業規模設施。

- 根據甲醇研究院統計,中國700萬輛汽車使用甲醇,佔中國燃料池的5%以上。即使主要採用煤炭技術生產,甲醇的二氧化碳排放量也比傳統汽油汽車排放26%。中國工業和資訊化部宣布了「擴大甲醇汽車普及」計劃,並正在研究「綠色甲醇+甲醇汽車」概念。

- 在印度,NITI Aaayog 制定了一項策略,到 2030 年僅以甲醇取代 10% 的原油進口。這需要大約 30 公噸甲醇。由於甲醇和二甲醚比汽油和柴油便宜得多,印度預計到 2030 年將燃料成本降低 30%。

- 在日本,川崎重工、 Yamaha、豐田、本田、日產和鈴木等主要汽車製造商正計劃開發使用甲醇作為燃料的汽車。日本國家能源策略的重點是到2030年將汽油依賴度從50%降低到40%,提高能源效率30%,並以甲醇等替代燃料取代20%的運輸燃料,增加了甲醇市場的需求。

- 新加坡是最新加入持續努力建立全球基礎設施以生產和分配作為船用燃料的甲醇的國家。新加坡已被公認為全球最大的航運業燃料庫中心,透過航運業和燃料產業的合作,新加坡將成為東南亞第一個綠色電子甲醇設施。

- 所有上述因素預計將在預測期內推動亞太地區甲醇市場的成長。

甲醇產業概況

甲醇市場較為分散,主要企業所持佔有率較小,無法單獨影響市場需求。該市場的主要企業(排名不分先後)包括 SABIC、Proman、寧夏寶豐能源集團、Macetex Corporation 和 ZPCIR。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 中國、美國和其他亞太國家石化產業的擴張

- 對甲醇燃料的需求增加

- 增加烯烴生產中甲醇的使用

- 抑制因素

- 與甲醇相比,乙醇燃料或生質乙醇的使用情況

- 對健康的不利影響

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 世界甲醇主要原料產能

- 技術簡介

- 貿易分析

- 價格趨勢

第5章市場區隔(市場規模)

- 目的

- 傳統化學品

- 甲醛

- 醋酸

- 溶劑

- 甲胺

- 其他傳統化學品

- 能源相關

- 甲醇-烯烴 (MTO)

- 甲基三級丁基醚(MTBE)

- 汽油混合物

- 二甲醚(DME)

- 生質柴油

- 傳統化學品

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 越南

- 泰國

- 印尼

- 馬來西亞

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 土耳其

- 俄羅斯

- 北歐的

- 西班牙

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Atlantic Methanol

- BASF SE

- Celanese Corporation

- Coogee

- Enerkem

- Eni SpA

- Gujarat State Fertilizers & Chemicals Limited(GSFC)

- Ineos

- Kingboard Holdings Limited

- Lyondellbasell Industries Holdings BV

- Methanex Corporation

- Mitsubishi Gas Chemical Company Inc.

- Mitsui & Co. Ltd

- Ningxia Baofeng Energy Group Co. Ltd

- OCI NV

- Petroliam Nasional Berhad

- Proman

- SABIC

- ZPCIR

第7章 市場機會及未來趨勢

- 甲醇在新的和不斷擴大的燃料應用中的使用

- 可再生甲醇的成長趨勢

The Methanol Market size is estimated at 99.03 Million tons in 2024, and is expected to reach 118.81 Million tons by 2029, growing at a CAGR of greater than 3.5% during the forecast period (2024-2029).

The COVID-19 pandemic drastically curtailed industrial activities due to imposed government bans and restrictions in 2020 and the first half of 2021, limiting the growth of the methanol market. The chemical industry was struggling due to scarce raw material supply, limited working hours/labor strength, reduced demand, and constrained financials. However, the chemical and petrochemical industries have been on track for recovery since the retraction of the pandemic in mid-2021. The exponential rise in demand for chemicals across various end-user industries is expected to contribute to the growth of the methanol market.

Key Highlights

- Over the medium term, the expanding petrochemical sector in China, the United States, and other Asia-Pacific countries and the rising demand for methanol-based fuels are the major driving factors augmenting the growth of the market studied. Furthermore, the growing utilization of methanol in producing olefins using MTO propels increased offtakes in the chemical industries.

- On the other side, the higher preference for ethanol fuel or bioethanol over methanol and the health hazardous impacts associated with it are anticipated to restrain the growth of the target industry over the forecast period.

- Nevertheless, the use of methanol in new and expanding fuel applications and the growing industrial inclination toward renewable methanol are expected to create lucrative growth opportunities for the market soon.

- The Asia-Pacific emerged as the largest market for methanol. It is expected to witness the highest CAGR during the forecast period. The dominance of the Asia-Pacific region is attributed to the high demand for methanol in China, Japan, and other Southeast Asian countries, expanding chemical and other application sectors.

Methanol Market Trends

Energy-related Applications to Dominate the Market

- The use of methanol in energy-related applications has increased significantly in the past few years. Methanol is widely used in methanol-to-olefins (MTO) transformation reactions, which provides a chance to produce basic petrochemicals (such as ethene, propene, butene, and butadiene) from non-oil resources like coal and natural gas.

- Methanol is a precursor for producing methyl tertiary-butyl ether (MTBE), which is added to gasoline to enhance the octane number by increasing the oxygen content. MTBE leads to the complete combustion of gasoline and, thus, lowers the exhaust of harmful gases, like carbon monoxide and other emissions from vehicles, reducing air pollution.

- Methanol has been successfully used to extend gasoline supplies in many gasoline markets worldwide. Adding methanol to the gasoline supply provides non-petroleum alternative energy and a clean-burning, high-octane fuel. According to the Methanol Institute, unlike other alcohols, methanol blending in gasoline has been economical without government subsidies or fuel-blending mandates.

- Moreover, the demand for oil products such as gasoline is expected to increase year-on-year. For instance, the global demand for gasoline is anticipated to reach 28.2 million barrels per day in 2030, registering a 9.7% increase over 25.7 million barrels per day in 2021, according to the Organization of the Petroleum Exporting Countries (OPEC).

- Methanol is also used to produce dimethyl ether, which registers significant usage as a fuel substitute due to its good ignition quality and high cetane number. DME in diesel engines burns very cleanly with no soot. It can be used in diesel engines as a substitute for conventional diesel fuel.

- Methanol is a crucial starting material for the production of biodiesel, which is viewed as an alternative renewable fuel for crude oil-derived diesel. Methanol is preferred over ethanol for the transesterification reaction due to its superior reactivity with triglycerides and high alkaline dissolution properties.

- Biodiesel is a clean burning fuel that increases energy security and leads to a lower carbon footprint. It exhibits a higher flash point (100°C minimum) and can be blended with diesel fuel at any proportion; both fuels can be mixed during the fuel supply to vehicles. The environmental benefits of biodiesel have spurred the continued increase in biodiesel production in the historical years, except for 2020, when the pandemic was at large.

- According to the Organisation for Economic Co-operation and Development (OECD), the global consumption of biofuels, including biodiesel, is expected to register a growth of 13.1% to reach 210.7 billion liters in 2029 compared to 186.35 billion liters in 2022. The increasing production and consumption trend in biofuels such as biodiesel is likely to increase the share of methanol consumption in biodiesel production during the forecast period.

- Considering all the abovementioned factors, the use and demand of methanol for energy-related applications are expected to grow in the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region dominated the worldwide market with a significant market share. It is projected to maintain its dominance during the forecast period. China alone is the largest producer and consumer of over 60% of the world's methanol, making the country the world leader. In Anyang, Henan Province, China, a 'cutting-edge' carbon dioxide-to-methanol plant has begun production, becoming the world's first commercial-scale facility to manufacture methanol from captured waste carbon dioxide and hydrogen gases.

- According to the Methanol Institute, methanol powers up to 7 million automobiles in China, contributing to more than 5% of the country's fuel pool. Methanol emits 26% less carbon dioxide than conventional gasoline-powered automobiles, even when generated primarily using coal-based techniques. The Chinese Ministry of Industry and Information Technology announced plans to "increase the popularity of methanol automobiles" and study the 'green methanol + methanol cars' concept.

- In India, NITI Aaayog designed a strategy to replace 10% of crude imports with methanol alone by 2030. This takes about 30 MT of methanol. Methanol and DME are significantly less expensive than petrol and diesel; India expects to lower its fuel expense by 30% by 2030.

- Japan is home to some major automotive producers, including Kawasaki, Yamaha, Toyota, Honda, Nissan, and Suzuki, who are planning to develop vehicles that use methanol as fuel. The National Energy Strategy of Japan focuses on reducing petrol dependency from 50% to 40% by 2030, improving energy efficiency by 30%, and replacing 20% of transport fuel with an alternative fuel, such as methanol, enhancing the demand in the market studied.

- Singapore is the most recent country to join the ongoing efforts to establish a worldwide infrastructure for producing and distributing methanol as a marine fuel. Singapore, which is already recognized as the world's largest bunkering center for the shipping sector, is set to become the first green e-methanol facility in Southeast Asia, a collaboration between the shipping and fuel industries.

- All the abovementioned factors are expected to fuel the growth of the methanol market in the Asia-Pacific region over the forecast period.

Methanol Industry Overview

The methanol market is fragmented, with top players holding insignificant shares in order to affect market demand individually. Some major players in the market (in no particular order) include SABIC, Proman, Ningxia Baofeng Energy Group Co. Ltd, Methanex Corporation, and ZPCIR, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Expanding Petrochemical Sector in China, United States, and Other Asia-Pacific Countries

- 4.1.2 Rising Demand for Methanol-based Fuel

- 4.1.3 Increasing Utilization of Methanol in the Production of Olefins

- 4.2 Restraints

- 4.2.1 Usage of Ethanol Fuel or Bioethanol in Comparison to Methanol

- 4.2.2 Hazardous Impacts on Health

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Global Methanol Production Capacity by Key Feedstock

- 4.6 Technological Snapshot

- 4.7 Trade Analysis

- 4.8 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Traditional Chemical

- 5.1.1.1 Formaldehyde

- 5.1.1.2 Acetic Acid

- 5.1.1.3 Solvent

- 5.1.1.4 Methylamine

- 5.1.1.5 Other Traditional Chemicals

- 5.1.2 Energy Related

- 5.1.2.1 Methanol-to-olefin (MTO)

- 5.1.2.2 Methyl Tert-butyl Ether (MTBE)

- 5.1.2.3 Gasoline Blending

- 5.1.2.4 Dimethyl Ether (DME)

- 5.1.2.5 Biodiesel

- 5.1.1 Traditional Chemical

- 5.2 Geography

- 5.2.1 Asia-Pacific

- 5.2.1.1 China

- 5.2.1.2 India

- 5.2.1.3 Japan

- 5.2.1.4 South Korea

- 5.2.1.5 Vietnam

- 5.2.1.6 Thailand

- 5.2.1.7 Indonesia

- 5.2.1.8 Malaysia

- 5.2.1.9 Rest of Asia-Pacific

- 5.2.2 North America

- 5.2.2.1 United States

- 5.2.2.2 Canada

- 5.2.2.3 Mexico

- 5.2.3 Europe

- 5.2.3.1 Germany

- 5.2.3.2 United Kingdom

- 5.2.3.3 Italy

- 5.2.3.4 France

- 5.2.3.5 Turkey

- 5.2.3.6 Russia

- 5.2.3.7 NORDIC

- 5.2.3.8 Spain

- 5.2.3.9 Rest of Europe

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 South Africa

- 5.2.5.3 Nigeria

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 United Arab Emirates

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Atlantic Methanol

- 6.4.2 BASF SE

- 6.4.3 Celanese Corporation

- 6.4.4 Coogee

- 6.4.5 Enerkem

- 6.4.6 Eni SpA

- 6.4.7 Gujarat State Fertilizers & Chemicals Limited (GSFC)

- 6.4.8 Ineos

- 6.4.9 Kingboard Holdings Limited

- 6.4.10 Lyondellbasell Industries Holdings BV

- 6.4.11 Methanex Corporation

- 6.4.12 Mitsubishi Gas Chemical Company Inc.

- 6.4.13 Mitsui & Co. Ltd

- 6.4.14 Ningxia Baofeng Energy Group Co. Ltd

- 6.4.15 OCI NV

- 6.4.16 Petroliam Nasional Berhad

- 6.4.17 Proman

- 6.4.18 SABIC

- 6.4.19 ZPCIR

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Use of Methanol in New and Expanding Fuel Applications

- 7.2 Growing Trends Toward Renewable Methanol