|

市場調查報告書

商品編碼

1522859

安瓿包裝:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Ampoules Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

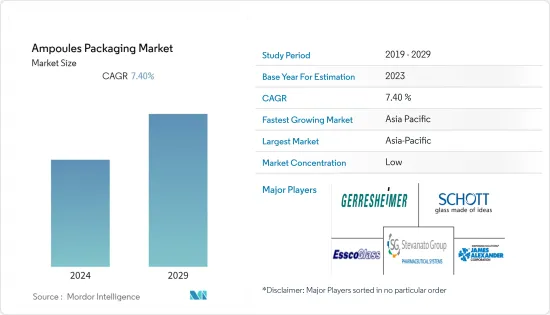

安瓿包裝市場規模預計到2024年為50.8億美元,預計到2029年將達到71.7億美元,在預測期內(2024-2029年)複合年成長率為7.40%。

主要亮點

- 安瓿包裝是保護產品免受外部污染的重要製造步驟。安瓿的特點是密封性高,能夠確保產品包裝的無菌性。製藥業長期以來一直使用安瓿,尤其是玻璃安瓿作為主要包裝解決方案。

- 藥品包裝對防竄改包裝的需求不斷增加。因為藥品包裝的防篡改包裝可確保患者收到在無菌環境中生產的原始、安全和有效形式的藥物。對防篡改包裝的需求不斷成長正在推動成長。在此背景下,2023年3月,肖特在過去三年內投資了約7,500萬歐元(8,100萬美元),旨在擴大其在印度的藥用玻璃產量。位於古吉拉突邦的工廠將成為硼矽酸玻璃管的製造地。硼矽酸玻璃管是一種可重新用於管瓶、安瓿和注射器等藥物容器的材料,用於儲存救生藥物。

- 此外,玻璃 100% 可回收,其品質在此過程中不會受到影響。這意味著大多數玻璃包裝永遠不會進入垃圾掩埋場,並且可以多次重複使用,而不會影響新產品的完整性。回收玻璃可以減少您的碳排放。與生產新玻璃相比,回收玻璃需要更少的原料和能源,因為它消除了採礦和精製步驟。此外,回收現有玻璃產品所需的能源少於熔化原料所需的能源。由於玻璃環保且可回收,需求預計會增加。

- 塑膠安瓿的引入有助於緩解人們對破裂時玻璃碎片進入安瓿內容物的擔憂。塑膠安瓿製造商將從中受益,但監管變化和標準可能會產生影響。此外,製藥和生命科學最終用戶對安瓿的需求極大地影響了他們的使用,因此市場仍然向這些最終用戶傾斜,以應對需求的波動。

安瓿包裝市場趨勢

玻璃安瓿預計將佔據很大的市場佔有率

- 由於玻璃安瓿的鹼性和耐水解性有限,玻璃是製藥和個人護理行業的主要包裝材料之一。玻璃高度透明,可以輕鬆看到內容物,而且由於相對不滲透空氣和濕氣,因此具有很強的保護性,並且對大多數藥物具有化學耐受性。 Schott 等企業於 2023 年 3 月開始在印度生產琥珀色藥用玻璃,以滿足亞洲對安瓿、注射器和管瓶等藥品容器不斷成長的需求。

- 安瓿在注射劑包裝中扮演重要角色。老年人口的不斷成長、慢性病盛行率的增加以及對注射治療的日益偏好正在推動全球對注射劑包裝的需求。此外,玻璃安瓿市場的公司推出高速填充線,以改善尺寸穩定的玻璃安瓿的功能並提高其製造能力。此外,Nipro Pharma Packaging 還承諾在未來三年內進行大量投資,以提高其在印度的產能。第一次擴建將為印度和全球市場生產更多玻璃管。

- 全球快速成長的製藥業正在推動市場成長。藥用玻璃安瓿的需求源自印度、巴西和中國等人口稠密的經濟體。藥物產量的增加為患者在慢性發炎疾病的治療中提供更多的舒適度和自主權正在推動市場成長。

- 例如,2023年1月,專門從事類風濕性關節炎和新發炎性腸道疾病開發和製造的韓國生物製藥公司Celltrion Healthcare自體免疫贏得向巴西衛生署。根據協議,Celltrion Healthcare 將向巴西供應 342,000 個安瓿。透過合作,國內藥品製造商可以滿足全球對關鍵藥品不斷成長的需求。 SGD Pharma 和 Corning Life Sciences 等公司正在共同努力,透過為客戶進行在地化製造來支持持續的全球擴張。

- 玻璃安瓿因其氣密性和防篡改特性,廣泛應用於製藥業,用於包裝疫苗和注射藥物,確保內容物的無菌和完整性。乙型肝炎、結核病、水痘和脊髓灰質炎等疾病的疫苗接種支持了市場的成長,這些疾病需要適當儲存疫苗。除藥品外,玻璃安瓿還用於化妝品和化學工業,用於包裝高純度物質和精緻配方。

從長遠來看,亞太地區預計將出現顯著成長。

- 中國製藥業的成長預計將為該國安瓿創造成長機會。鼓勵我國醫藥包裝企業建立自主研發團隊,探索創新、環保、安全、功能性、永續的包裝材料和產品。藥品製造領域的技術創新、合作研究、收購和生產擴張正在推動市場成長。

- 德國特種玻璃製造商肖特最近在中國浙江省金雲縣開設了第一家藥用玻璃管工廠。該公司進一步投資 7,000 萬歐元(8,080 萬美元)擴大其熔化基礎設施,包括在 Gold Cloud 增加熔化罐,以滿足初級藥品包裝對高品質玻璃管不斷成長的需求。新坦克於2023年運作。

- 護膚品需求的增加預計將推動市場成長。本地和國際品牌正在投資開發含有視黃醇的抗衰老、抗氧化、發炎、保濕、提視網醇膠原蛋白促進劑和快速見效的抗炎產品。此外,該地區的抗衰老化妝品類別包括乳霜、精華液、安瓿和眼霜。

- 此外,根據中國國家統計局的數據,中國批發零售企業化妝品零售額從2019年的433億美元增加到2023年的約585.3億美元。美容安瓿提供高濃縮、有針對性的護膚護理,針對保濕、抗衰老、提亮等問題。中國化妝品零售的成長可能會對未來幾年的安瓿需求產生正面影響。

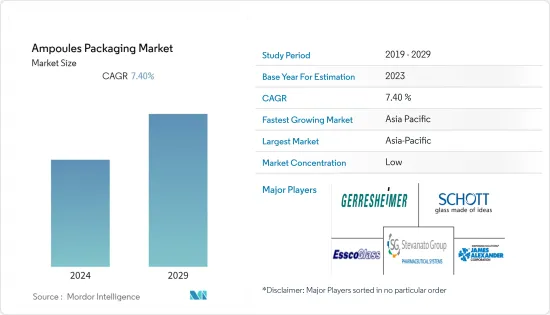

安瓿包裝產業概況

安瓿包裝市場較為分散。政府舉措的激增以及對注射劑和其他藥品的需求不斷增加,為安瓿包裝市場提供了利潤豐厚的機會。整體而言,現有企業之間的競爭非常激烈。不同製藥業大公司的擴張和合併預計將增加對安瓿包裝的需求。市場上的主要企業是 Schott AG、Amposan SA 和 Gerresheimer AG。

- 2023 年 12 月 - 肖特製藥宣布計劃擴大其全球製造網路,並決定投資兩位數百萬歐元在塞爾維亞中部雅戈丁那建立一個新的藥物封裝解決方案和輸送系統製造製造地。製藥業安瓿生產預計將於 2024 年推出。

- 2023 年 9 月 - 年輕的法國香水品牌 Ormaie 決定在其香水中僅使用 100% 天然成分,並推出了一系列帶有玻璃安瓿的小尺寸可再填充瓶。 Ormaie 的 9 款香水系列填充用,可在家中或旅途中使用。 Ormaie 提出了一種時尚且環保的補充系統的創新解決方案。 Ormaie 現在提供填充用的玻璃安瓿瓶,其中裝有相同尺寸的香水,而不是傳統的再填充系統。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 對砸道機竄改藥品包裝的需求

- 提高可回收玻璃的產品價值

- 政府法規和標準

- 市場限制因素

- 對傾倒使用過的安瓿的擔憂

第6章 市場細分

- 按材質

- 玻璃

- 塑膠

- 按最終用戶產業

- 藥品

- 個人護理/化妝品

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 西班牙

- 亞洲

- 中國

- 印度

- 日本

- 韓國

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 中東/非洲

- 沙烏地阿拉伯

- 埃及

- 阿拉伯聯合大公國

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- Schott AG

- Gerresheimer AG

- Stevanato Group

- ESSCO Glass

- AAPL Solutions

- Global Pharmatech Pvt Ltd

- James Alexander Corporation

- Nipro Pharma Packaging International NV

- SGD Pharma

- Shandong Pharmaceutical Glass Co. Ltd

第8章投資分析

第9章市場的未來

The Ampoules Packaging Market size is estimated at USD 5.08 billion in 2024, and is expected to reach USD 7.17 billion by 2029, growing at a CAGR of 7.40% during the forecast period (2024-2029).

Key Highlights

- Ampoules packaging is an essential procedure in manufacturing to protect the product from external contamination. Ampoules are unique because they seal and ensure an aseptic condition factor for the product packaging. The pharmaceutical industry has been using ampoules, especially glass, for a very long period as a primary packaging solution.

- The demand for tamper-proof packaging for pharmaceutical packaging is growing, as tamper-proof packaging in pharmaceutical products ensures that the patient receives the drug in its original, safe, and effective form as it was manufactured in a sterile environment. The increasing demand for tamper-proof packaging has propelled growth. In reference to this, in March 2023, Schott invested around EUR 75 million (USD 81 million) over the last three years with an aim to expand its pharma glass production in India. The Gujarat-based facility emerges as the company's manufacturing hub for borosilicate glass tubing, a material converted to pharmaceutical containers, such as vials, ampoules, or syringes, to store life-saving drugs.

- Additionally, glass is 100% recyclable, and the process does not compromise the quality. It means that most glass packaging never ends up in a landfill and can be reused many times without compromising the integrity of the new product. Glass recycling reduces the carbon footprint. Recycling glass requires fewer raw materials and less energy compared to producing new glass, as it avoids the mining and refining processes. Moreover, the energy required to recycle existing glass products is less than that needed to melt the raw materials. It is eco-friendly and recyclable in nature, which is expected to boost the demand.

- The advent of plastic ampoules in the market has helped ease some of the concerns related to glass fragments getting into the contents of the ampoules during breakage. Manufacturers of plastic ampoules will benefit from this, but regulatory changes and standards may impact them. Additionally, since the demand for ampoules from the pharmaceutical and life sciences end users significantly impacts their usage, the market remains inclined toward these end users for demand variations.

Ampoules Packaging Market Trends

Glass Ampoules are Expected to Hold a Significant Share in the Market

- Glass is one of the primary packaging materials for the pharmaceutical and personal care industry, as it limits the alkalinity and hydrolytic resistance of glass ampoules. It offers high transparency, enabling easy inspection of their contents, and higher protection because they are relatively impermeable to air and moisture and chemically resistant to most medicinal products. Players such as Schott launched the production of amber pharma glass in India to meet the increasing demand for pharmaceutical containers, such as ampoules, syringes or vials, and other drugs in Asia, in March 2023.

- Ampoules play a significant role in parenteral packaging. The growing geriatric population, increasing prevalence of chronic diseases, and rising preference for injection-based treatments drive the global demand for parenteral packaging. Further, players operating in the glass ampoules market are launching high-speed filling lines to improve the functionalities of glass ampoules with highly stable dimensional qualities, increasing their manufacturing capabilities. Further, Nipro Pharma Packaging has pledged to invest substantially in a capacity extension in India in the coming three years. The first expansion will produce additional glass tubing quantities for the Indian and global markets.

- The rapidly growing pharmaceutical industry worldwide is driving the market's growth. The demand for pharmaceutical glass ampoules is emerging from densely populated economies such as India, Brazil, and China. Increasing medication production to offer patients greater comfort and autonomy in treating chronic inflammatory diseases propels the market's growth.

- For instance, in January 2023, South Korean biopharmaceutical company Celltrion Healthcare, specializing in the development and production of biosimilars and new molecules, won a tender to supply the Ministry of Health in Brazil, with infliximab, used for the treatment of 8 autoimmune diseases, including Rheumatoid Arthritis (RA) and Inflammatory Bowel Disease (IBD). As per the contract, Celltrion Healthcare intends to supply 342,000 ampoules to Brazil. The players collaborate in their efforts, enabling domestic drug makers to meet the rising demand for critical medicines globally. Players such as SGD Pharma and Corning Life Sciences have collaborated to support their continued global expansion as the companies localize manufacturing for their customers.

- Glass ampoules are extensively used in the pharmaceutical industry for packaging vaccines and injectable medications due to their airtight and tamper-evident properties, ensuring the sterility and integrity of the contents. The market's growth is supported by vaccination for diseases such as Hepatitis B, tuberculosis, Chicken Pox, and Polio, which require proper vaccine storage. Beyond pharmaceuticals, glass ampoules are also used in the cosmetics and chemical industries to package high-purity substances and sensitive formulations.

Asia-Pacific is Expected to Show a Significant Growth in the Long Term

- The growth of the Chinese pharmaceutical sector is expected to create growth opportunities for ampoules in the country. Chinese pharmaceutical packaging companies are encouraged to develop independent research and development teams to explore innovative, environmentally friendly, safe, functional, and sustainable packaging materials and products. The growing innovation, collaboration, acquisition, and production in drug manufacturing have boosted the market growth.

- Schott, a Germany-based specialty glass manufacturer, recently opened its first pharma glass tubing factory in Jinyun County, Zhejiang province, China. The company invested another EUR 70 million (USD 80.8 million) to expand its melting infrastructure, including additional melting tanks in Jinyun, to meet the rising demand for high-quality glass tubing for primary pharmaceutical packaging. The new tanks were operational in 2023.

- Increasing demand for skin care products is expected to boost the market's growth. Domestic and foreign brands invest in developing products with anti-aging, antioxidants, anti-inflammatory, hydration, brightening collagen boosters with retinol, and de-puffing properties that deliver rapid results. Furthermore, the category of anti-aging cosmetics in the region will include creams, serums, ampoules, and eye creams.

- Moreover, according to the National Bureau of Statistics of China, the retail sales of cosmetics by wholesale and retail companies in China totaled about USD 58.53 billion in 2023 from USD 43.30 billion in 2019. Ampoules in cosmetics provide highly concentrated, targeted skincare treatments that address concerns like hydration, anti-aging, or brightening. The growth in retail sales of cosmetics products in China can positively impact the demand for ampoules in the coming years.

Ampoules Packaging Industry Overview

The ampoules packaging market is fragmented. The surge in government initiatives and increasing demand for injectables and other medicines provide lucrative opportunities in the ampoules packaging market. Overall, the competitive rivalry among existing competitors is high. Expansion and mergers of large companies in different pharmaceutical industries are expected to increase the demand for ampoule packaging. Key players in the market are Schott AG, Amposan SA, and Gerresheimer AG.

- December 2023 - SCHOTT Pharma announced plans to expand its global manufacturing network and decided to invest a double-digit million Euro amount in a new production site for pharmaceutical drug containment solutions and delivery systems in Jagodina in central Serbia. The ramp-up for the manufacturing of ampoules for the pharmaceutical industry is expected to start in 2024.

- September 2023 - Ormaie, a young French fragrance brand, decided to use only 100% natural ingredients in its fragrances and launched a collection of small-size refillable bottles using a glass ampoule. Ormaie's collection of nine perfumes is available in refillable 20ml formats, perfect for use at home or on the go. Ormaie has come up with an innovative solution for a refillable system that's both stylish and eco-friendly. Instead of traditional refillable systems, Ormaie now offers refillable glass ampoules that are the same size and filled with perfumes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value-Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Demand for Tamper-proof Pharmaceutical Product Packaging

- 5.1.2 Commodity Value of Glass Increased with Recyclability

- 5.1.3 Government Regulations and Standards

- 5.2 Market Restraints

- 5.2.1 Concerns Regarding Dumping Used Ampoules

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Glass

- 6.1.2 Plastic

- 6.2 By End-user Industry

- 6.2.1 Pharmaceutical

- 6.2.2 Personal Care and Cosmetic

- 6.3 By Region ***

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 France

- 6.3.2.3 Germany

- 6.3.2.4 Italy

- 6.3.2.5 Spain

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia and New Zealand

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.5 Middle East and Africa

- 6.3.5.1 Saudi Arabia

- 6.3.5.2 Egypt

- 6.3.5.3 United Arab Emirates

- 6.3.5.4 South Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schott AG

- 7.1.2 Gerresheimer AG

- 7.1.3 Stevanato Group

- 7.1.4 ESSCO Glass

- 7.1.5 AAPL Solutions

- 7.1.6 Global Pharmatech Pvt Ltd

- 7.1.7 James Alexander Corporation

- 7.1.8 Nipro Pharma Packaging International NV

- 7.1.9 SGD Pharma

- 7.1.10 Shandong Pharmaceutical Glass Co. Ltd