|

市場調查報告書

商品編碼

1522863

汽車電池:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

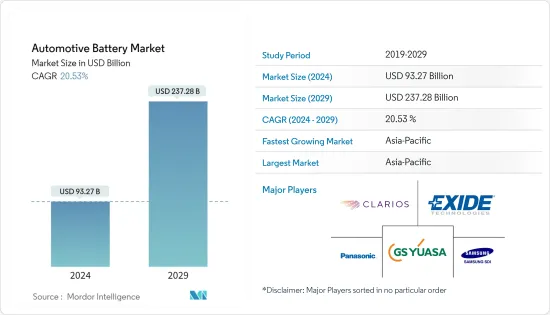

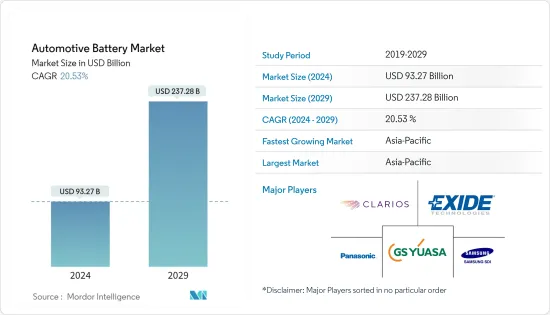

預計2024年汽車電池市場規模為932.7億美元,預計2029年將達2,372.8億美元,預測期內(2024-2029年)複合年成長率為20.53%。

汽車電池是一種可以儲存和產生電能的電化學裝置。啟動引擎時,汽車電池提供電流為啟動馬達和點火系統供電。當交流發電機不處理負載時,它會向燈、收音機和其他電氣配件提供電流,並充當安定器。

世界對永續交通和清潔能源不斷成長的需求正在推動對純電動車的需求。諸如車輛範圍、較高的初始價格、有限的車型可用性和缺乏知識等消費者限制正在透過促銷活動和政府法規得到解決。這些變數將影響電動車的需求並推動目標市場。除此之外,全球電池產能的增加有助於汽車電池產業實現規模經濟,這也是市場成長的關鍵驅動力。

汽車電池市場趨勢

電動車領域可望推動市場發展

世界各國政府都在製定雄心勃勃的排放目標,而增加電動車的使用被視為實現這些目標的一種方式。例如,歐盟的目標是到2030年將溫室氣體排放減少55%,中國則制定了2025年使新車銷售的25%為電動車的目標。大多數電動車中使用的鋰離子電池在能量密度、充電時間和整體性能方面都有了顯著的改進。這使得電動車更加實用,對消費者也更有吸引力。

電動車需求的不斷成長將導致電池化學和材料的技術進步,需要更先進、更有效率的汽車電池來確保安全和性能。許多著名的汽車製造商都致力於與汽車電池製造公司建立長期的業務關係。例如

2023年6月,松下控股的負責人表示,該日本公司打算在三年內將與特斯拉共同管理的內華達州工廠的電動車電池產量提高10%。松下能源計畫在內華達州超級工廠增設第 15 條生產線。松下能源在會上宣布,計劃在2026年3月將內華達工廠的產能提高10%。

隨著電動車市場的擴大,許多公司也涉足商用車汽車電池的開發和製造。 Stellantis NV 和三星 SDI 於 2022 年 5 月宣布,將投資超過 25 億美元在印第安納州科科莫新建一家合資電池工廠。

隨著電動車市場持續快速成長,汽車電池的需求預計將隨之增加,為該領域的公司創造重大機會。

亞太地區可望主導汽車電池市場

由於乘用車和商用車對電動車的需求不斷增加,預計亞太地區的汽車電池金額將成長最快。大多數電池製造商和汽車製造商都位於該地區。中國是全球最大的電動車生產國和消費國。銷售目標、有利的立法和城市空氣品質目標支持國內需求。例如,中國對電動和混合動力汽車製造商實施配額,其比例必須至少佔新車銷量的10%。此外,北市每月僅發放1萬張內燃機汽車登記許可證,以鼓勵民眾轉換電動車。

中國擁有全球約80%的鋰離子電池製造能力,是電池競爭中壓倒性的領跑者。它還控制電池供應鏈的其他方面,包括電池中使用的兩種關鍵礦物鋰和石墨的提取和加工。該地區的一些參與企業已經制定了各種商務策略來佔領市場產品。例如

- 2023年6月,日本汽車製造商馬自達汽車與松下公司就建立中長期合作夥伴關係進行討論,以滿足快速擴大的市場對電池式電動車和汽車電池的需求。

- 2023年5月,歐安諾集團與XTC新能源集團簽署協議,成立兩家專門生產電動車電池關鍵材料的合資企業。

韓國、印度、馬來西亞和印尼等國家對汽車應用產品的需求增加,可能會影響該地區 2024 年至 2030 年的成長。

汽車電池產業概況

汽車電池市場正在整合。主要企業包括松下公司、Exide Technologies、Clarios、GS Yuasa Corporation、三星 SDI 和 LG Chem Ltd。市場上的一些公司正致力於改進其產品和服務組合,以擴大基本客群。其他一些主要企業的目標是透過推出產品或服務、擴大產品範圍、與其他公司合併或合作來擴大其市場佔有率。例如,2023年3月,美國和日本達成協議,對電動車電池中使用的關鍵礦物進行貿易,以確保電池材料的供應。

2023年3月,Li-Cycle Holdings Corp.與凱傲集團簽署了全球鋰離子電池回收合作夥伴關係的最終協議,並宣布計劃在法國開發一座新的鋰離子電池回收設施。

2023年3月,莫羅電池(Morrow)投資2,000萬歐元在韓國生產磷酸鋰鐵(LFP)電池。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場動態

- 市場促進因素

- 電動車需求不斷成長預計將提振市場

- 市場限制因素

- 電動車相關的高成本預計將抑制市場成長

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 電池類型

- 鉛酸蓄電池

- 鋰離子

- 其他電池類型

- 汽車模型

- 客車

- 商用車

- 驅動類型

- 內燃機

- 試車

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 其他

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- A123 Systems

- Panasonic Corporation

- Exide Technologies

- VARTA

- Clarios

- GS Yuasa Corporation

- Hitachi Group Ltd

- Robert Bosch GmbH

- China Aviation Lithium Battery Co. Ltd

- Contemporary Amperex Technology Co. Limited

- 南美洲 SUNG SDI Co. Ltd

- East Penn Manufacturing Co.

- LG Chem Ltd

第7章 市場機會及未來趨勢

The Automotive Battery Market size is estimated at USD 93.27 billion in 2024, and is expected to reach USD 237.28 billion by 2029, growing at a CAGR of 20.53% during the forecast period (2024-2029).

An automotive battery is an electrochemical device that can store and generate electrical energy. When starting the engine, the automotive battery provides electric current to power the starting motor and ignition system. When the alternator is not handling the load, it works as a voltage stabilizer by giving current to the lights, radio, and other electrical accessories.

Globally rising demand for sustainable transportation and cleaner energy has engaged the demand for battery electric vehicles. Consumer constraints such as vehicle range, greater upfront prices, limited model availability, and lack of knowledge are being solved by promotional activities and government legislation. These variables will have an impact on the demand for electric vehicles, which will drive the target market. In addition to this, an increase in the global battery production capacity has helped achieve economies of scale in the automotive battery industry, another major driver for market growth.

Automotive Battery Market Trends

The Electric Vehicles Segment is Anticipated to Drive the Market

Governments around the world are setting ambitious targets to reduce emissions, and promoting the use of electric vehicles is seen as one way to achieve these goals. For instance, the European Union aims to reduce its greenhouse gas emissions by 55% by 2030, and China has set a target of having 25% of new cars sold by 2025 to be electric. Lithium-ion batteries, which are used in most electric vehicles, have seen significant improvements in terms of energy density, charging time, and overall performance. This has made electric vehicles more practical and appealing to consumers.

The increasing demand for EVs will lead to technological advancements in battery chemistry and materials, which will require more sophisticated and efficient automotive batteries to ensure safety and performance. Many prominent automobile manufacturers are focusing on building long-term business relationships with automotive battery manufacturing companies. For instance,

In June 2023, according to a Panasonic Holdings representative, the Japanese corporation intends to increase the output of electric vehicle batteries at a Nevada factory jointly managed with Tesla by 10% within three years. Panasonic Energy plans to add a 15th production line to the Gigafactory Nevada. At a meeting, Panasonic Energy announced a proposal to boost the Nevada factory's manufacturing capacity by 10% by March 2026.

As the electric vehicle market is growing, many companies are involved in the development and manufacturing of automotive batteries for commercial vehicles as well. Stellantis NV and Samsung SDI announced in May 2022 that they would invest more than USD 2.5 billion in a new joint-venture battery plant in Kokomo, Indiana.

With the electric vehicle market set to continue its rapid growth, the demand for automotive batteries is expected to rise in tandem, presenting significant opportunities for companies operating in this space.

Asia-Pacific is Expected to Dominate the Automotive Battery Market

Asia-Pacific is expected to have the fastest growth in the value of automotive batteries, owing to the increasing demand for electric passenger and commercial vehicles. The region has most of the battery manufacturers' presence and automobile vehicle manufacturers. China is the largest manufacturer and consumer of electric vehicles in the world. Sales targets, favorable laws, and municipal air-quality targets are supporting domestic demand. For instance, China has imposed a quota on manufacturers of electric or hybrid vehicles, which must represent at least 10% of total new sales. Also, the city of Beijing only issues 10,000 permits for the registration of combustion engine vehicles per month to encourage its inhabitants to switch to electric vehicles.

China has approximately 80% of the world's Li-ion manufacturing capacity, and it is by far the front-runner in the battery race. The nation also controls other facets of the battery supply chain, such as the extraction and processing of lithium and graphite, two of the crucial minerals used in batteries. Several players in the region are establishing various business strategies to gain market offerings. For instance,

- In June 2023, Mazda Motor, a Japan-based vehicle manufacturer, and Panasonic Corporation agreed to enter discussions on establishing a medium- to long-term partnership to meet the demand for battery electric vehicles and automotive batteries in a rapidly expanding market.

- In May 2023, the Orano group and the XTC New Energy group signed agreements to create two joint ventures devoted to the production of critical materials for electric vehicle batteries.

Increasing product demand for automotive applications in various countries, including South Korea, India, Malaysia, and Indonesia, is likely to influence the region's growth between 2024 and 2030.

Automotive Battery Industry Overview

The automotive battery market is consolidated. A few prominent companies include Panasonic Corporation, Exide Technologies, Clarios, GS Yuasa Corporation, Samsung SDI Co. Ltd, and LG Chem Ltd. Several companies in the market are focusing on improving their products and service portfolios to widen their customer base. Some other key players aim to expand their presence in the market through product and service launches, offerings expansion, mergers, and collaborations with other companies. For instance, in March 2023, the United States and Japan reached an agreement regarding the trade of critical minerals used for EV batteries to secure the supplies of battery materials.

In March 2023, Li-Cycle Holdings Corp. signed a definitive agreement for a global lithium-ion battery recycling partnership with the KION Group and announced plans to develop a new lithium-ion battery recycling facility in France.

In March 2023, Morrow Batteries (Morrow) invested EUR 20 million in the production of Lithium iron phosphate (LFP) battery cells in South Korea.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand For Electric Vehicles is Anticipated to Boost the Market

- 4.2 Market Restraints

- 4.2.1 High Cost Associated with Electric Vehicles is Anticipated to Restrain the Growth of the Market

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-Acid

- 5.1.2 Lithium-Ion

- 5.1.3 Other Battery Types

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Drive Type

- 5.3.1 Internal Combustion Engine

- 5.3.2 Electric Vehicles

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 A123 Systems

- 6.2.2 Panasonic Corporation

- 6.2.3 Exide Technologies

- 6.2.4 VARTA

- 6.2.5 Clarios

- 6.2.6 GS Yuasa Corporation

- 6.2.7 Hitachi Group Ltd

- 6.2.8 Robert Bosch GmbH

- 6.2.9 China Aviation Lithium Battery Co. Ltd

- 6.2.10 Contemporary Amperex Technology Co. Limited

- 6.2.11 SAMSUNG SDI Co. Ltd

- 6.2.12 East Penn Manufacturing Co.

- 6.2.13 LG Chem Ltd