|

市場調查報告書

商品編碼

1522864

石灰石:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Limestone - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

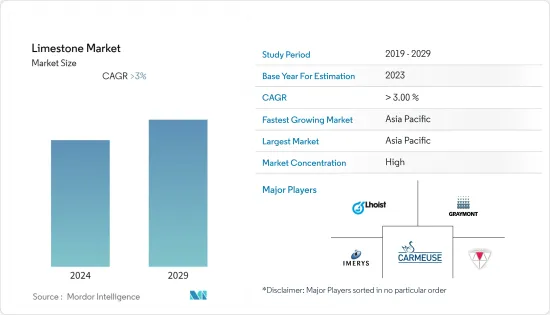

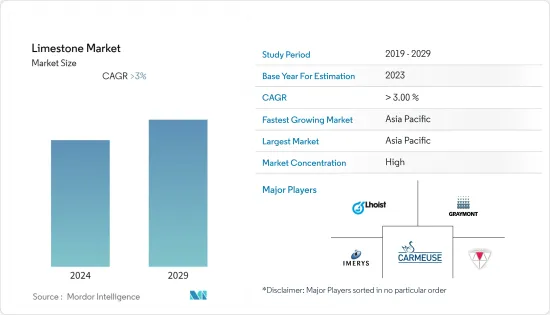

預計2024年石灰石市場規模為8.7億噸,預計2029年將達到10.4億噸,在預測期(2024-2029年)複合年成長率超過3%。

COVID-19 大流行對市場產生了負面影響,因為它導致世界各國停工,擾亂了製造活動和供應鏈。然而,由於紙漿和造紙、水處理、農業和建築等各個最終用戶行業的需求增加,限制解除後,市場已經復甦。

*短期內,建設產業需求的增加和全球鋼鐵產量的增加是預計推動市場需求的一些因素。

*另一方面,與石灰石消耗和農業鈣化導致的高碳排放相關的健康風險可能會阻礙市場成長。

*即將推出的全球污水處理計劃可能為市場提供利潤豐厚的成長機會。

*亞太地區預計將主導市場,同時在預測期內複合年成長率最高。

石灰石市場趨勢

鋼鐵製造和其他行業的使用量增加推動市場成長

- 石灰石用於在鋼鐵製造中形成爐渣。二氧化矽和氧化鋁含量低的石灰石是煉鋼的首選,因為需要額外的助焊劑來中和這些元素。需要額外的熱量來保持額外的爐渣的流動性。

- 為了生產 1,000 公斤粗鋼,採用綜合煉鋼和電爐的兩條主要鋼鐵生產路線分別需要約 270 公斤和 88 公斤石灰石。

- 鋼是最重要的合金,在建築、汽車、電子、航太和國防等許多產業有著廣泛的應用。

- 根據世界鋼鐵協會統計,2023年1月至11月全球鋼鐵產量達約17.151億噸,與前一年同期比較增加0.5%。此舉可能會增加鋼鐵製造業對石灰石的需求。

- 中國是世界上最大的粗鋼生產國。不過,根據中國國家統計局的數據,2023年12月中國粗鋼產量達6,744萬噸,較2023年11月的7,610萬噸產量減少。鋼鐵產量下降是由於中國最近的政策變化所致,該政策旨在減少鋼鐵產量以解決與污染水平相關的問題。

- 根據美國鋼鐵協會(AISI)數據,2023年12月美國鋼廠出貨7,082,921噸鋼材,較2022年12月的6,901,567噸增加2.6%。

- 同樣,根據德國鋼鐵經濟協會的數據,2023年德國粗鋼產量達3,281萬噸,低於2022年的3,685萬噸產量。

- 此外,石灰石在鐵生產中用作助焊劑,有助於去除雜質、促進溶解,並有助於提高高爐製程的效率。

- 根據巴西地區統計局統計,2023年巴西鋼鐵鑄造廠工業收入達7.9323億美元。與 2022 年的 7.9082 億美元相比,該價值保持不變。

- 因此,根據上述趨勢,未來幾年市場可能會受到鋼鐵業石灰石使用量增加的推動。

亞太地區主導市場

- 預計亞太地區將在未來幾年主導市場。在該區域市場中,中國是GDP最大的經濟體,中國和印度是全球成長最快的經濟體。由於本地原料供應和龐大的化學工業,中國在消費和生產方面佔據石灰石市場的主導地位。

- 鋼鐵業是世界和中國最大的石灰石消費國。中國是全球主要粗鋼生產國,佔全球市場佔有率50%以上。歐洲、印度和日本緊隨中國之後。

- 根據國家統計局(NBS)的數據,中國建設業活動指數(BASI)從2023年11月的55.9上升至截至12月的56.9。 BASI 得分高於 50 表示行業成長,2023 年 10 月的 BASI 得分為 53.5 表示調查市場的需求增強。

- 同樣,2023年12月中國加工紙和紙板產量為1359萬噸,較2022年12月的1203萬噸增加12.9%。

- 隨著中國城市人口的不斷成長,預計到2030年,全國70%的人口將居住在都市區。隨著城市人口的增加,他們也面臨污水和污泥的湧入。目前,中國80%的污泥都被不當傾倒,都市區都在競相透過改善污水處理廠(WWTP)來減少污染。

- 印度造紙業約佔世界紙張產量的5%。據OEA稱,2023會計年度全印度紙張及紙製品批發價格指數將達152。

- 印度是世界第二大鋼鐵生產國。印度鋼鐵管理局預計,2023年印度鋼鐵需求將達1.199億噸,2024年將達1.289億噸。

- 石灰石在建設產業中發揮著至關重要的作用,因為它基本上是水泥和混凝土生產的主要成分。當石灰石在水泥製造過程中與其他材料結合時,它會發生化學變化,有助於形成耐用且堅固的建築材料。由此產生的混凝土廣泛應用於各種建築計劃,包括建築物、橋樑、道路和其他基礎設施,使石灰石成為現代建築實踐中的重要元素。

- 到2025年,印度建築業預計將成長至1.4兆美元。到2030年,預計將有6億人居住在城市中心,這將需要額外2500萬套中型和超豪華住宅。根據國家投資計畫(NIP),印度基礎設施投資預算為1.4兆美元,其中24%專門用於可再生能源、道路和高速公路以及城市基礎設施,12%用於鐵路。

- 上述因素預計將在預測期內增加對石灰石的需求並推動市場。

石灰石行業概況

石灰石市場已部分整合。市場主要企業包括(排名不分先後)Imerys、Carmeuse、Graymont Limited、Mineral Technologies Inc. 和 Omya International AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場動態

- 促進因素

- 建設產業需求增加

- 全球鋼鐵產量增加

- 其他司機

- 抑制因素

- 與石灰石相關的健康風險

- 農業鈣化造成的高碳排放

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 進出口趨勢

- 價格趨勢

第5章市場區隔(市場規模(基於數量))

- 目的

- 工業石灰

- 化學石灰

- 建築石灰

- 耐火石灰

- 最終用戶產業

- 紙漿

- 水處理

- 農業

- 塑膠

- 建築/施工

- 鋼鐵及其他產業

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- AMR India Limited

- CARMEUSE

- GLC Minerals LLC

- Graymont Limited

- Gujarat Mineral Development Corporation Ltd

- Imerys

- Kerford Limestone

- LafargeHolcim

- Lhoist Group

- Minerals Technologies Inc.

- Okutama Kogyo Co. Ltd

- Omya AG

- RSMM Limited

- Ryokolime Industry Co. Ltd(Mitsubishi Materials Corporation)

- Schaefer Kalk

- The National Lime & Stone Company

- United States Lime & Minerals Inc.

第7章 市場機會及未來趨勢

- 即將進行的全球污水處理計劃

The Limestone Market size is estimated at 0.87 Billion tons in 2024, and is expected to reach 1.04 Billion tons by 2029, growing at a CAGR of greater than 3% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market due to lockdowns in various countries worldwide, which resulted in disruptions in manufacturing activities and supply chains. However, the market has been recovering since restrictions were lifted, in line with rising demand from various end-user industries, such as paper and pulp, water treatment, agriculture, and construction.

* Over the short term, increasing demand from the construction industry and growing global steel production are some factors expected to drive market demand.

* On the flip side, the health risks associated with limestone consumption and the high carbon dioxide emissions from agricultural liming may hinder the market's growth.

* The upcoming global wastewater treatment projects are likely to create lucrative growth opportunities for the market in the coming years.

* The Asia-Pacific region is expected to dominate the market while also witnessing the highest CAGR during the forecast period.

Limestone Market Trends

Increasing Usage in Steel Manufacturing and Other Industries Driving Market Growth

- Limestone is used for the formation of slag in iron and steel manufacturing. Limestone, with low silica and alumina, is preferred for steel production, as these elements will need additional flux to neutralize them. Additional heat is required to keep the additional slag in a fluid state.

- To manufacture 1,000 kg of crude steel, the two key steel production routes using integrated steelmaking and the electric arc furnace require around 270 kg and 88 kg of limestone, respectively.

- Steel is the most critical alloy, with diversified applications in numerous industries, such as building and construction, automotive, electronics, and aerospace and defense.

- According to the World Steel Association, global steel production reached about 1,715.1 million tons from January to November of 2023, registering an increase of 0.5% compared to the previous year. Such developments are likely to increase the demand for limestone in the steel manufacturing industry.

- China is the largest producer of crude steel globally. However, according to the National Bureau of Statistics of China, crude steel production in China reached 67.44 million metric tons in December 2023, registering a decline in production compared to 76.1 million metric tons in November 2023. This decline in steel production was due to recent policy changes in China that sought to reduce steel output to tackle problems related to pollution levels.

- According to the American Iron and Steel Institute (AISI), US steel mills shipped 7,082,921 net tons of steel in December 2023, a 2.6% increase compared to 6,901,567 net tons in December 2022.

- Similarly, according to the Steel Economic Association of Germany, crude steel production in Germany reached 32.81 million tons in 2023; however, there was a decline in production compared with the production of 36.85 million tons in 2022.

- Furthermore, limestone is utilized in the production of iron as a fluxing agent, aiding in the removal of impurities, facilitating melting, and contributing to the efficiency of the blast furnace process.

- According to the Brazilian Institute of Geography and Statistics, the industry revenue of iron and steel foundries in Brazil reached USD 793.23 million in 2023. They maintained a similar value compared to USD 790.82 million in 2022.

- Therefore, in line with the above trends, the market is likely to be driven by the growing use of limestone in steel and iron industries over the next few years.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to dominate the market over the coming years. In the regional market, China is the largest economy by GDP, while China and India are among the fastest-emerging economies worldwide. China dominates the limestone market in terms of consumption and production due to the local availability of raw materials and its huge chemical industry.

- The iron and steel industry consumes the most limestone globally and in China. China is a major crude steel producer globally, accounting for more than 50% of the global share. Europe, India, and Japan follow China.

- According to the National Bureau of Statistics (NBS), in China, the construction industry's business activity index (BASI) rose to 56.9 as of December 2023 from 55.9 in November 2023. A BASI score above 50 indicates growth in the industry, and the October 2023 BASI score was 53.5, which suggested a strengthening of demand for the market studied.

- Similarly, China produced 13.59 million metric tons of processed paper and cardboard in December 2023, registering a growth of 12.9% compared to 12.03 million metric tons in December 2022.

- Due to the increase in urban population throughout China, 70% of the nation's population is expected to reside in cities by 2030. As the urban population increases, they also face an influx of wastewater and sludge. Currently, 80% of sludge in China is improperly dumped, an increasingly controversial environmental issue with urban centers scrambling to decrease pollution by improving their wastewater treatment plants (WWTPs).

- India's paper industry accounts for about 5% of the world's production of paper. According to OEA, the wholesale price index of paper and paper products across India reached 152 in the financial year 2023.

- India is the second-largest producer of steel globally. According to the Indian Steel Association, demand for steel in India was 119.9 million metric tons in 2023 and forecasted to reach 128.9 million metric tons in 2024.

- Limestone plays a pivotal role in the construction industry due to its fundamental use as a primary component for producing cement and concrete. When limestone is combined with other materials in the cement-making process, it undergoes a chemical transformation, contributing to the formation of durable and robust construction materials. The resulting concrete is widely employed in various construction projects, including buildings, bridges, roads, and other infrastructure, making limestone a crucial element in modern construction practices.

- India's construction industry is projected to grow to USD 1.4 trillion by 2025. By 2030, an estimated 600 million people will live in urban centers, resulting in a need for 25 million additional mid- and ultra-luxury units. Under the National Investment Plan (NIP), India has an infrastructure investment budget of USD 1.4 trillion, with 24% earmarked for renewable energy, roads & highways, and urban infrastructure and 12% for railways.

- All the factors mentioned above are expected to boost the demand for limestone during the forecast period and, thereby, drive the market.

Limestone Industry Overview

The limestone market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) Imerys, Carmeuse, Graymont Limited, Mineral Technologies Inc., and Omya International AG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Driver

- 4.1.1 Increasing Demand from the Construction Industry

- 4.1.2 Increasing Steel Production Globally

- 4.1.3 Other Drivers

- 4.2 Restraint

- 4.2.1 Health Risks Associated with Limestone

- 4.2.2 High Carbon Dioxide Emissions from Agricultural Liming

- 4.2.3 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

- 4.5 Import-export Trends

- 4.6 Price Trends

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Application

- 5.1.1 Industry Lime

- 5.1.2 Chemical Lime

- 5.1.3 Construction Lime

- 5.1.4 Refractory Lime

- 5.2 End-user Industry

- 5.2.1 Paper and Pulp

- 5.2.2 Water Treatment

- 5.2.3 Agriculture

- 5.2.4 Plastics

- 5.2.5 Building and Construction

- 5.2.6 Steel Manufacturing and Other Industries

- 5.2.7 Other End-user Industries

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AMR India Limited

- 6.4.2 CARMEUSE

- 6.4.3 GLC Minerals LLC

- 6.4.4 Graymont Limited

- 6.4.5 Gujarat Mineral Development Corporation Ltd

- 6.4.6 Imerys

- 6.4.7 Kerford Limestone

- 6.4.8 LafargeHolcim

- 6.4.9 Lhoist Group

- 6.4.10 Minerals Technologies Inc.

- 6.4.11 Okutama Kogyo Co. Ltd

- 6.4.12 Omya AG

- 6.4.13 RSMM Limited

- 6.4.14 Ryokolime Industry Co. Ltd (Mitsubishi Materials Corporation)

- 6.4.15 Schaefer Kalk

- 6.4.16 The National Lime & Stone Company

- 6.4.17 United States Lime & Minerals Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Global Wastewater Treatment Projects