|

市場調查報告書

商品編碼

1522869

金屬矽:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Silicon Metal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

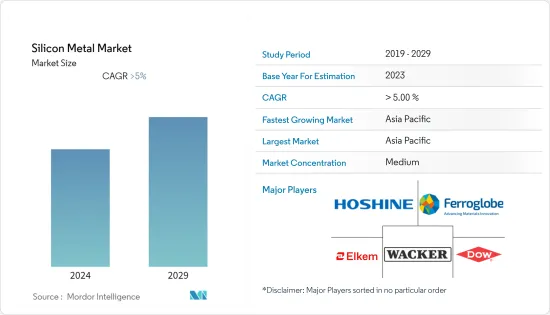

預計2024年金屬矽市場規模為327萬噸,預計2029年將達425萬噸,預測期間(2024-2029年)複合年成長率為5.41%。

COVID-19 阻礙了有機矽膠金屬市場。由於景氣衰退、消費者支出減少以及生產和供應鏈中斷,許多依賴矽膠金屬的行業,如汽車、建築和電子產品,在疫情期間需求下降。然而,隨著停產和監管的放鬆,使用矽膠金屬的行業復甦,基礎設施計劃、汽車生產、半導體製造和可再生能源設備對矽膠的需求增加,推動了對矽膠金屬的需求。

主要亮點

- 汽車產業對矽膠的需求快速成長、太陽能電池產業的使用增加以及其他各種最終用戶對矽膠的需求不斷增加,預計將導致全球矽膠金屬市場的擴大。

- 然而,能源成本的波動正在阻礙金屬矽市場的成長。

- 透過改善現有技術和增加可再生能源產業的需求來降低生產成本的多項措施預計將在未來一段時間內為市場相關人員提供成長機會。

- 亞太地區擁有最高的市場佔有率,並可能在預測期內主導矽金屬市場。

金屬矽市場趨勢

太陽能板領域主導市場

- 矽約佔當今銷售模組的 95%,是太陽能發電中使用最廣泛的半導體材料。冶金矽可以透過精製製程轉化為高純度矽,用於半導體和太陽能電池。因此,適合製造太陽能電池。

- 太陽能是世界上規模最大、成長最快的產業之一。根據國際能源總署(IEA)的數據,該部門佔世界淨能源產能的近三分之二。

- 國際能源總署(IEA)公佈的資料顯示,2022年,太陽能發電量增加了創紀錄的270太瓦時,達到約1,300太瓦時,增加了26%。 2022年,太陽能在所有可再生技術中表現出最強勁的絕對發電量成長,歷史上首次超過風電。

- 美國在 2022 年推出的《通貨膨脹削減法案》(IRA) 中納入了對太陽能發電的慷慨新資助。投資稅額扣抵和生產稅額扣抵預計將顯著促進太陽能產能和供應鏈的成長。

- 國際能源總署(IEA)公佈的資料顯示,巴西2022年新增太陽能發電容量約11吉瓦,是2021年成長速度的兩倍。鑑於工業和電力零售商對可再生能源的持續需求,預計中期部署將保持在這一水平。

- 根據新和可再生能源部(MNRE)發布的資料,截至年終,印度太陽能發電裝置量排名世界第四。截至2022年11月,太陽能發電累積設備容量已達約720萬千瓦。目前,印度太陽能電價極具競爭力,已實現市電平價。

- 上述新興市場預計將在整個預測期內推動太陽能產業市場中的矽膠。

亞太地區主導市場

- 亞太地區,尤其是中國,是全球最大的矽膠金屬生產國。該地區受惠於石英、煤炭等原料蘊藏量豐富以及低成本勞動力,支持建立大型金屬矽生產設施。

- 金屬矽最重要的用途是矽膠黏劑、密封劑、潤滑劑、化學品、其他物質和鋁合金。汽車、建築、工業和其他最終用戶領域是這些產品的主要應用。

- 中國新能源車產銷量將大幅成長,到2022年銷量將達722萬輛,佔全球電動車銷量的64%。

- 政府對電動車、混合動力汽車和燃料電池車的推廣預計將在預測期內推動市場發展。該國對電動車不斷成長的需求正在推動對半導體、鋁合金和有機矽黏劑的需求。

- 中國工業協會發布的報告顯示,2022年,中國汽車出口311萬輛,其中乘用車253萬輛,商用車58萬輛,比2021年成長54.4%。

- 晶科能源、天合光能、晶澳太陽能等全球頂級太陽能製造公司的總部均位於中國。過去兩年,中國的太陽能電池製造業大幅成長。國際能源總署(IEA)公佈的資料顯示,2022年將新增太陽能發電容量100GW,較2021年成長近60%,中國計畫新增太陽能發電容量持續領先。

- 行動電話、筆記型電腦和其他電器產品製造業的投資是中國的重要投資領域。全球各大製造商都在中國市場投入大量資金,以滿足未來的需求成長。

- 由於這些因素,中國預計在亞太地區主導金屬矽市場。

金屬矽產業概況

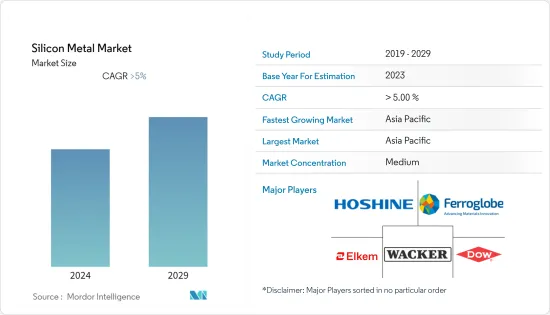

金屬矽市場部分整合。主要企業(排名不分先後)包括合盛矽業、Ferroglobe、Elkem ASA、Dow 和 Wacker Chemie AG。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 汽車產業需求快速成長

- 增加太陽能產業的使用

- 各種最終用戶對矽膠的需求增加

- 抑制因素

- 能源成本波動

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 產品類別

- 冶金級

- 化學級

- 目的

- 鋁合金

- 半導體

- 太陽能板

- 矽膠衍生物

- 其他用途(建築/基礎設施)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 印尼

- 泰國

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 西班牙

- 法國

- 土耳其

- 俄羅斯

- 北歐的

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Anyang Huatuo Metallurgy Co., Ltd.

- Dow

- Elkem ASA

- Ferroglobe

- Hoshine Silicon Industry Co., Ltd.

- Liasa

- Minasligas

- Mississipi Silicon

- PCC SE

- RIMA INDUSTRIAL

- RusAL

- Shin-Etsu Chemical Co., Ltd.

- Wacker Chemie AG

- Zhejiang kaihua yuantong silicon industry co. LTD.

第7章 市場機會及未來趨勢

- 透過創新現有技術降低生產成本的舉措

- 可再生能源領域需求增加

The Silicon Metal Market size is estimated at 3.27 Million tons in 2024, and is expected to reach 4.25 Million tons by 2029, growing at a CAGR of 5.41% during the forecast period (2024-2029).

The COVID-19 hampered the silicone metal market. Many industries that utilize silicone metal, such as automotive, construction, and electronics, experienced decreased demand during the pandemic due to economic downturns, reduced consumer spending, and disruptions in production and supply chains. However, as lockdowns and restrictions eased, industries that utilize silicone metal recovered, and there was increased demand for silicone from infrastructure projects, automotive production, semiconductor manufacturing, and renewable energy installations, which boosted the demand for silicone metals.

Key Highlights

- Surging demand for silicone from the automotive industry, increasing use in the solar industry, and increasing demand for silicones from various other end users are expected to increase the market for silicone metal globally.

- However, volatility in energy costs is hindering the growth of the silicon metal market.

- Several measures to reduce production costs by improving current technologies and increasing demand from the renewable energy sector are expected to create growth opportunities for the market players in the upcoming period.

- The Asia-Pacific holds the highest market share and is likely to dominate the silicon metal market during the forecast period.

Silicon Metal Market Trends

Solar Panels Segment to Dominate the Market

- Silicon, which accounts for about 95% of the modules sold today, is the most extensively used semiconductor material in photovoltaics. In the process of purification, metallurgical silicon can be transformed into high-purity silicon that is used to make semiconductors and solar cells. Therefore, it is suitable for the manufacture of photovoltaic cells.

- Solar energy is one of the largest and fastest-growing sectors worldwide. The sector is responsible for nearly two-thirds of global net energy capacity, according to the International Energy Agency.

- According to the data published by the International Energy Agency (IEA), in 2022, solar PV production increased by a record 270 TWh, which increased by 26%, reaching almost 1300 TWh. It demonstrated the most considerable absolute generation growth of all renewable technologies in 2022, surpassing wind for the first time in history.

- The United States included generous new funding for solar PV in the Inflation Reduction Act (IRA) introduced in 2022. Investment and production tax credits will likely significantly boost the growth of PV capacity and supply chains.

- According to the data published by the International Energy Agency (IEA), in 2022, Brazil added almost 11 gigawatts of solar PV capacity, doubling its growth rate for 2021. In view of the continued demand for renewable energy from industry and power retailers, deployment is projected to be maintained at this level over the medium term.

- According to the data published by the Ministry of New and Renewable Energy (MNRE), India held the fourth position in solar PV deployment worldwide as of the end of 2022. The Cumulative installed capacity of solar power reached around 7.2 GW as of November 2022. Today, India's solar tariffs are very competitive, and grid parity has been achieved.

- The developments mentioned above are expected to drive the market for silicone metal in the solar industry through the forecast period.

Asia-Pacific to Dominate the Market

- Asia-Pacific, particularly China, is the largest producer of silicone metal globally. The region benefits from abundant reserves of raw materials like quartz and coal, as well as access to low-cost labor, which supports the establishment of large-scale silicon metal production facilities.

- The most critical applications of silicon metal are silicone adhesives, sealants, lubricants, chemicals, and other substances, as well as aluminum alloys. The automotive, building and construction, industrial, and other end-user sectors are the primary uses of these products.

- The production and sales of new energy vehicles increased significantly in China, with the number of units sold reaching 7.22 million by 2022, representing 64 % of all EV sales worldwide.

- The market is projected to be driven by the government's promotion of EVs, hybrids, and fuel-cell vehicles in the forecast period. The rising demand for electric vehicles in this country increases the need for semiconductors, aluminum alloys, and silicon adhesives.

- According to the report released by the China Association of Automobile Manufacturers (CAAM), in 2022, China exported 3.11 million vehicles, including 2.53 million passenger cars and 580,000 commercial vehicles, an increase of 54.4 % compared to 2021.

- The top global solar PV manufacturing companies, such as JinkoSolar, Trina Solar, and JA Solar, are headquartered in China. Solar cell manufacturing in China has been increasing significantly in the past two years. According to the data published by the International Energy Agency (IEA), with 100 GW capacity of solar PV added in 2022, almost 60% more than in 2021, China continues to lead in terms of solar PV capacity additions.

- Investment in the manufacture of mobile phones, laptops, and other electrical appliances is a significant area for investment in China. In order to meet the upcoming increase in demand, large manufacturers from around the world have invested substantial capital into China's market.

- Due to these factors, Asia-Pacific region China is expected to dominate the silicon metal market.

Silicon Metal Industry Overview

The silicon metal market is partially consolidated. The major players (not in any particular order) include Hoshine Silicon Industry Co., Ltd, Ferroglobe, Elkem ASA, Dow, and Wacker Chemie AG, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Surging Demand from the Automotive Industry

- 4.1.2 Increasing Use in the Solar Industry

- 4.1.3 Increasing Demand for Silicones from Different End Users

- 4.2 Restraints

- 4.2.1 Volatility in Energy Costs

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Metallurgy Grade

- 5.1.2 Chemical Grade

- 5.2 Application

- 5.2.1 Aluminum Alloys

- 5.2.2 Semiconductors

- 5.2.3 Solar Panels

- 5.2.4 Silicone Derivatives

- 5.2.5 Other Applications (Construction and Infrastructure)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Indonesia

- 5.3.1.7 Thailand

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 Spain

- 5.3.3.5 France

- 5.3.3.6 Turkey

- 5.3.3.7 Russia

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Anyang Huatuo Metallurgy Co., Ltd.

- 6.4.2 Dow

- 6.4.3 Elkem ASA

- 6.4.4 Ferroglobe

- 6.4.5 Hoshine Silicon Industry Co., Ltd.

- 6.4.6 Liasa

- 6.4.7 Minasligas

- 6.4.8 Mississipi Silicon

- 6.4.9 PCC SE

- 6.4.10 RIMA INDUSTRIAL

- 6.4.11 RusAL

- 6.4.12 Shin-Etsu Chemical Co., Ltd.

- 6.4.13 Wacker Chemie AG

- 6.4.14 Zhejiang kaihua yuantong silicon industry co. LTD.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Efforts to Reduce the Cost of Production by Innovating the Existing Technology

- 7.2 Increasing Demand from Renewable Energy Sector