|

市場調查報告書

商品編碼

1522877

主動車距控制巡航系統(ACC) 和盲點偵測 (BSD) -市場佔有率分析、產業趨勢和成長預測(2024-2029 年)Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

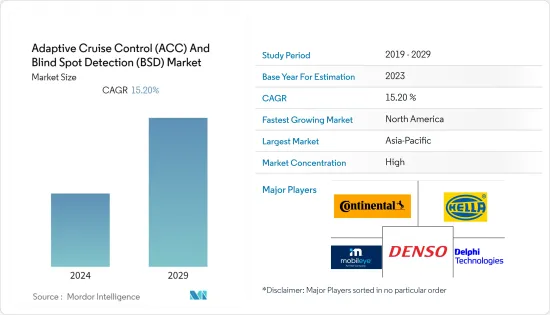

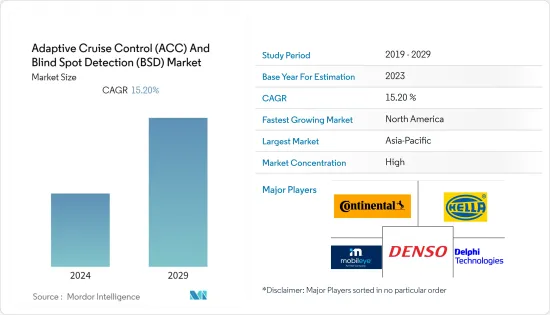

主動車距控制巡航系統和盲點偵測市場規模預計到 2024 年為 35.8 億美元,預計到 2029 年將達到 72.7 億美元,預測期內(2024-2029 年)複合年成長率為 15.20,預計將成長%。

近年來,主動式車距維持定速系統和盲點偵測市場經歷了顯著的快速成長。提高車輛安全意識是開發主動式車距維持定速系統和盲點偵測等先進安全系統的重要因素之一。

此外,全球豪華車銷售的成長也推動了 ACC 和 BSD 市場。 2023 年,全球豪華車銷量超過 183,000 輛,而 2022 年為 157,000 輛。這意味著增幅超過 16%。

此外,嚴格的安全法規的頒布以及消費者對車輛安全日益濃厚的興趣也正在推動 ACC 和 BSD 市場的發展。根據世界衛生組織 (WHO) 統計,每年有近 135 萬人死於道路交通事故。這些事故大多數是由於駕駛人無法評估具體情況並做出正確決定而造成的。政府為減少交通事故死亡人數所做的努力正在增加新車安全系統的安裝。

OEM廠商佔了調查市場的90%以上,盲點偵測系統的售後市場有限且無組織。認知到市場的成長機會,領先公司擴大在其車輛中添加這些功能,以滿足消費者的需求。

所有這些因素共同顯示了 ACC 和 BSD 市場在預測期內的潛在成長。

主動車距控制巡航系統(ACC)和盲點偵測(BSD)市場趨勢

乘用車細分市場是最大的汽車細分市場

按車型分類,乘用車細分市場在主動式車距維持定速系統(ACC)和盲點偵測(BSD)方面擁有最大的市場規模。由於對安全性的日益重視以及消費者對改善駕駛體驗的需求,ADAS(高級駕駛員輔助系統)整合已在現代乘用車中廣泛應用。

乘用車製造商提供尖端功能,以提高安全性和便利性。 ACC系統適合高速公路行駛,對於日常通勤者和使用乘用車的遠距旅行者尤其有吸引力。感測器技術的進步、經濟性以及向半自動駕駛功能的轉變推動了 ACC 在乘用車中的主流採用。

同樣,盲點偵測已成為一項重要的安全功能,尤其是在繁忙的城市環境中。乘用車是汽車市場中保有量最大的細分市場,變換車道、併道操作發生率較高。透過使用偵測盲點車輛的感測器,BSD 解決了駕駛因素可見度限制,並降低了變換車道(乘用車使用中的常見情況)時發生事故的風險。

此外,優先考慮具有先進安全功能的車輛的管理方案和安全評級也有助於 ACC 和 BSD 在乘用車中的廣泛採用。在北美,美國新車評估計劃(US NCAP)是美國運輸安全管理局(NHTSA)的旗艦計劃,旨在重點關注這些安全系統的納入,並減輕買家對安全的擔憂。

汽車製造商正在將這些技術融入他們的乘用車模型中,以增加對更廣泛客戶的吸引力。市場參與者已註冊多項與車輛自動駕駛功能相關的有效專利。 2022年,豐田的案件數量最多,為1,823起,其次是百度和本田。

除乘用車外,商用車,尤其是重型卡車,對先進駕駛輔助和防撞系統的需求也不斷增加。商用車比乘用車車身更長、更寬,因此盲點更大。因此,為了提高安全性並消除盲點,企業正在與商用車製造商合作開發適合這些車輛的盲點偵測系統。

對車輛安全的日益關注以及與盲點相關的事故數量的增加是預測期內推動 ACC 和 BSD 系統市場的因素之一。

亞太地區及北美地區引領市場

亞太地區預計將成為成長最快的區域市場,對 BSD 和 ACC 產業的成長做出重大貢獻,其次是北美。這些地區的成長是由汽車銷量增加(尤其是豪華車)以及每輛車安全設備增加等因素所推動的。

印度和韓國等快速發展的新興市場的存在,以及該地區對汽車實施的安全法規,正在對亞太地區的駕駛輔助系統市場產生重大影響。這些規定與歐洲和北美一樣嚴格。

- 巴拉特新車評估計畫(也稱為巴拉特 NCAP)是全球第 10 個 NCAP,由印度政府設立。該計劃於 2023 年 10 月啟動。該計劃旨在評估在印度銷售的汽車的安全性能,並根據其安全功能和性能授予星級評級。 Bharat NCAP 為測試車輛提供從 1 到 5 的星級評級,其中 1 為最低評級。這些評估包括成人乘員保護 (AOP)、兒童乘員保護 (COP) 和安全輔助技術安裝。

此外,印度、泰國和印尼社會經濟經濟狀況的改善也創造了對豪華乘用車領域的需求,從而增加了這些國家對 ACC 和 BSD 的需求。

此外,人們對駕駛因素安全系統的認知不斷提高,亞太國家配備 ADAS 的車輛市場不斷擴大。政府法規迫使汽車製造商設計配備先進 ADAS 模組的車輛。此外,該地區自動駕駛汽車的發展為層級製造商創造了利用最新技術和方便用戶使用系統設計和提供 ADAS 的機會。

所有這些新興市場的開拓預計將推動亞太地區主動式車距維持定速系統(ACC)和盲點偵測(BSD)市場的發展。

主動式車距維持定速系統(ACC) 和盲點偵測 (BSD) 產業概述

主動式車距維持定速系統(ACC)和盲點偵測(BSD)市場高度整合。 Continental AG、Hella KGaA Hueck & Co、Mobileye、Denso Corporation 和 Delphi Automotive PLC 等公司是該市場的主要企業。

為了跟上日益提高的車輛安全功能標準,市場上領先的 ACC 和 BSD 製造商已開始投資研發活動。例如

*2023年7月,工業汽車在泰國曼谷首次推出了重新設計的1噸皮卡「Triton」。該卡車公司計劃於 2024 年初在日本推出,這是 12 年來的首次。透過採用主動式車距維持定速系統(ACC) 和使用連網型汽車技術的緊急支援等新型安全設備,安全性和舒適性已顯著提高。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 消費者對車輛安全的興趣日益濃厚,推動市場發展

- 市場限制因素

- ACC 和 BSD 的初始安裝成本較高是一個問題

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章 市場區隔(金額單位)

- 類型

- 主動式車距維持定速系統(ACC)

- 盲點偵測 (BSD)

- 車輛類型

- 客車

- 商用車

- 銷售管道

- OEM

- 售後市場

- 秘密藝術

- 紅外線的

- 雷達

- 影像

- 其他技術

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 阿根廷

- 其他國家

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Continental AG

- Delphi Technologies PLC

- DENSO Corp

- Autoliv Inc.

- Magna International

- WABCO Vehicle Control Services

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Bendix Commercial Vehicle Systems LLC(Knorr-Bremse AG)

- Mobileye

- Mando-Hella Electronics Corp.

第7章 市場機會及未來趨勢

- 在汽車中擴大使用 ADAS 功能提供了充足的成長機會

第8章 基於數量的市場規模和預測

第9章 ACC和BSD技術的技術進展分析

第 10 章:深入了解地區/國家層級有關車輛安全和 ADAS 功能的法規

The Adaptive Cruise Control And Blind Spot Detection Market size is estimated at USD 3.58 billion in 2024, and is expected to reach USD 7.27 billion by 2029, growing at a CAGR of 15.20% during the forecast period (2024-2029).

The market for adaptive cruise control and blind spot detection has witnessed a significant surge in recent years. The growing awareness about vehicle safety has been one of the vital factors in the development of advanced safety systems, such as adaptive cruise control and blind-spot detection.

Additionally, the increase in the sales of luxury vehicles worldwide is also driving the market for ACC and BSD. In 2023, over 183 thousand units of luxury cars were sold worldwide, compared to 157 thousand units in 2022. This indicated a significant surge of over 16%.

Further, the enactment of stringent safety regulations and increasing vehicle safety concerns among consumers have also propelled the market for ACC and BSD. According to the World Health Organization, nearly 1.35 million people die annually due to road accidents. The cause of these accidents is mostly attributed to the driver's inability to judge certain conditions and make the right decisions. The efforts of governments to reduce fatalities due to road accidents have led to increased installation of safety systems in new vehicles.

More than 90% of the market studied is captured by OEMs, with a limited and unorganized aftermarket for the blind spot detection system. Eyeing the growth opportunities present in the market, the leading players are increasingly incorporating these features in their vehicles to cater to consumer demand.

All these factors combined indicate potential growth for the ACC and BSD market during the forecast period.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Market Trends

Passenger Car Segment is The Largest Vehicle Type Segment

The passenger car segment is the largest market segment for adaptive cruise control (ACC) and blind spot detection (BSD) among vehicle types. There has been a widespread integration of advanced driver assistance systems (ADAS) in modern passenger cars, driven by a growing emphasis on safety and the increasing consumer demand for enhanced driving experiences.

Passenger car manufacturers are largely offering cutting-edge features that enhance both safety and convenience. ACC systems are well-suited for highway driving, making them particularly attractive for daily commuters and long-distance travelers using passenger cars. The mainstream adoption of ACC in passenger cars is fuelled by advancements in sensor technologies, affordability, and a shift toward semi-autonomous driving features.

Similarly, blind spot detection has also become a crucial safety feature, especially in urban environments with dense traffic. The passenger car segment, being the largest volume contributor in the automotive market, experiences a higher incidence of lane changes and merging movements. BSD addresses the limitations of driver visibility by using sensors to detect vehicles in blind spots, reducing the risk of accidents during lane changes-a common scenario in passenger car usage.

Furthermore, regulatory initiatives and safety ratings that prioritize vehicles equipped with advanced safety features contribute to the prevalence of ACC and BSD in passenger cars. In North America, the United States New Car Assessment Program (US NCAP), a flagship program of the country's National High Traffic Safety Administration (NHTSA), focused on the incorporation of these safety systems, was introduced to reduce the safety-related concerns of buyers.

Automakers are integrating these technologies into their passenger car models, making them more appealing to a broader customer base. Market players have multiple active patents registered to their name related to autonomous features in their vehicles. In 2022, Toyota had the most number of active patents, amounting to 1,823, followed by Baidu and Honda Motors.

Apart from passenger cars, commercial vehicles, particularly large trucks, are also seeing an increase in demand for sophisticated driver assistance systems and collision avoidance systems. Commercial vehicles are longer and broader than passenger vehicles, resulting in substantially greater blind areas. Thus, to enhance safety and eliminate blind spots, companies, in consultation with commercial vehicle manufacturers, are developing blind spot detection systems that are suitable for these vehicles.

The rising vehicle safety concerns and a growing number of blind spot-related accidents are some of the factors that will drive the market for ACC and BSD systems during the forecast period.

Asia-Pacific and North America Driving the Market

Asia-Pacific is projected to be the fastest-growing regional market, contributing significantly to the growth of both the BSD and ACC industries, followed by North America. The growth in these regions is driven by factors such as increasing vehicle sales, particularly of luxury cars, and an increase in safety installations per vehicle.

The presence of fast-developing countries, like India and South Korea, and the safety regulations imposed on vehicles in the region have influenced the Asia-Pacific market for driving assistance systems significantly. These regulations are as stringent as those of Europe and North America.

- The Bharat New Car Assessment Program, commonly known as Bharat NCAP, is the 10th NCAP in the world and has been set up by the Government of India. The program commenced in October 2023. The program aims to evaluate the safety performance of cars sold in India and assign star ratings based on their safety features and performance. Bharat NCAP will assign star ratings ranging from 1 to 5 for cars tested, with 1 being the lowest rating. These ratings cover Adult Occupant Protection (AOP), Child Occupant Protection (COP), and Fitment of Safety Assist Technologies.

Additionally, the improvement in socioeconomic conditions in India, Thailand, and Indonesia has also created a demand for the premium passenger cars segment, thereby increasing the demand for ACC and BSD in these countries.

Further, the rising awareness of driver safety systems is enhancing the market for ADAS-equipped vehicles in Asia-Pacific countries. Government regulations are compelling car manufacturers to design their vehicles with advanced ADAS modules. Moreover, the evolution of autonomous cars in this region is creating the opportunity for tier-1 manufacturers to design and deliver ADAS with the latest technologies and user-friendly systems.

All these developments combined are expected to drive the market for adaptive cruise control (ACC) and blind spot detection (BSD) in Asia-Pacific.

Adaptive Cruise Control (ACC) And Blind Spot Detection (BSD) Industry Overview

The adaptive cruise control (ACC) and blind spot detection (BSD) market is fairly consolidated. Companies such as Continental AG, Hella KGaA Hueck & Co., Mobileye, Denso Corporation, and Delphi Automotive PLC are some of the major players in the market.

To meet the increasing standards for safety features in the vehicles, major ACC and BSD manufacturers in the market have started investing in R&D activities. For instance,

* In July 2023, Mitsubishi Motors Corporation premiered the completely redesigned Triton 1-ton pickup truck in Bangkok, Thailand. The truck company scheduled a launch in Japan in early 2024 for the first time in 12 years. Safety and comfort have been greatly improved in the vehicle with the adoption of Adaptive Cruise Control (ACC), among other new safety features and emergency support using connected car technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 The Increasing Concern of Consumers Toward Vehicle Safety is Driving the Market

- 4.2 Market Restraints

- 4.2.1 High Initial Installation Costs of ACC and BSD Act as a Major Challenge

- 4.3 Industry Attractiveness - Porter's Five Forces' Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Value in USD Billion)

- 5.1 Type

- 5.1.1 Adaptive Cruise Control (ACC)

- 5.1.2 Blind Spot Detection (BSD)

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

- 5.3 Sales Channel

- 5.3.1 OEM

- 5.3.2 Aftermarket

- 5.4 Technology

- 5.4.1 Infrared

- 5.4.2 Radar

- 5.4.3 Image

- 5.4.4 Other Technologies

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Rest of the World

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Other Countries

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Delphi Technologies PLC

- 6.2.3 DENSO Corp

- 6.2.4 Autoliv Inc.

- 6.2.5 Magna International

- 6.2.6 WABCO Vehicle Control Services

- 6.2.7 Robert Bosch GmbH

- 6.2.8 ZF Friedrichshafen AG

- 6.2.9 Bendix Commercial Vehicle Systems LLC (Knorr-Bremse AG)

- 6.2.10 Mobileye

- 6.2.11 Mando-Hella Electronics Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Use of ADAS Features in Vehicles Presents Ample Growth Opportunities