|

市場調查報告書

商品編碼

1641852

除生物劑:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Biocides - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

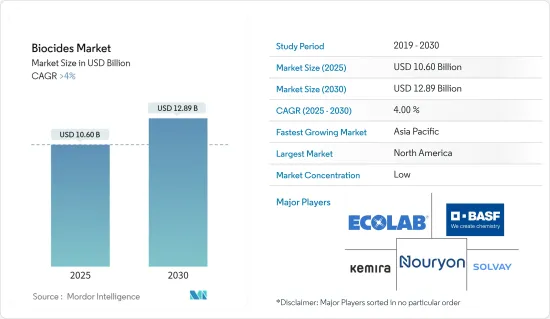

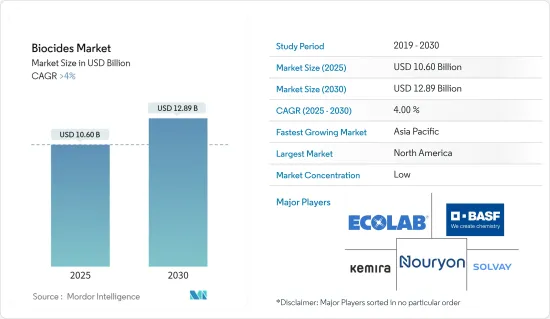

除生物劑市場規模預計在 2025 年為 106 億美元,預計到 2030 年將達到 128.9 億美元,預測期內(2025-2030 年)的複合年成長率將超過 4%。

關鍵亮點

- 推動全球對除生物劑需求的因素包括食品和飲料行業的需求不斷增加以及全球對水處理廠的需求不斷增加。

- 然而,大量使用除生物劑所帶來的環境問題和健康危害預計會阻礙市場的成長。

- 全球對農業領域使用除生物劑的認知不斷提高,以及對醫療保健和衛生產品的需求不斷增加,可能在未來一段時間為除生物劑市場提供機會。

- 預計預測期內北美將佔據市場主導地位。

除生物劑市場趨勢

水處理領域可望主導市場

- 除生物劑廣泛應用於各種水處理應用,包括市政水處理、工業水處理、泳池衛生、冷卻、水處理和污水處理。除生物劑在水處理領域的廣泛應用使得其佔據了較大的市場佔有率。

- 全球人口不斷成長、都市化、工業化和水資源短缺日益嚴重,推動了對水處理解決方案(包括除生物劑)的需求。隨著對清潔安全水的需求不斷成長,水處理領域預計仍將是除生物劑的主要市場。

- 根據聯合國兒童基金會2023年7月發布的報告,2022年,58.2億人飲用的飲用水來自改善的水源,這些水源可在室內獲取,且不受糞便和化學污染。此外,15億人從主要水源獲取水源。

- 根據聯合國兒童基金會發布的資料,到2022年,大約76%的人將能夠獲得安全的飲用水,其中德國、法國、瑞典和西班牙四國將有99%以上的人口能夠獲得安全的飲用水。

- 聯合國(UN)預計,到2050年,全球將有18億人居住在完全缺水的地區,其中撒哈拉以南非洲是缺水國家最多的地區。聯合國正在敦促各國開發水處理技術。

- 因此,隨著水處理應用重要性的日益增加,對除生物劑的需求也隨之增加。

北美可望主導市場

- 預計北美將佔據市場主導地位。以美國是該地區最大的經濟體。美國最大的除生物劑市場之一,由於水處理、油漆和塗料以及食品和飲料等終端用戶行業的增加,預計預測期內殺菌劑市場將實現成長。

- 美國環保署(USEPA)高度重視改善用水和污水服務,尤其是當地的污水處理廠。根據美國環保署(EPA)2023年10月發布的資料,該機構向該州撥款超過3.36億美元,以支持紐約州的水質清潔。

- 北美對治療設施的需求日益增加。例如,美國人口普查局發布的資料顯示,美國廢水和廢棄物管理計劃的公共建設支出從2018年的235.2億美元增加到2022年的319.5億美元。

- 因此,該國正大力投資興建水處理廠。

- 根據墨西哥國家水務及化學品管理局 (INEGI) 發布的資料顯示,墨西哥水淨化和瓶裝業的產值預計將從2023 年1 月的27.0481 億墨西哥元(1.6099 億美元)成長至2023 年10 月的27.9307億美元(1.6099 億美元)。

- 因此,由於上述因素,北美在污水處理中使用除生物劑的數量預計會增加。

除生物劑產業概況

除生物劑市場比較分散。主要參與企業包括BASF SE、Kemira、Solvay、Ecolab 和 Nouryon。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 調查前提條件

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場動態

- 驅動程式

- 全球對水處理的需求不斷增加

- 食品和飲料行業的需求增加

- 限制因素

- 與除生物劑有關的環境和健康問題

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場區隔(市場規模(基於數量))

- 類型

- 鹵素化合物

- 金屬化合物

- 有機硫化合物

- 有機酸

- 酚類

- 其他(季銨化合物)

- 應用

- 水處理

- 藥物和個人護理

- 木材防腐

- 飲食

- 油漆和塗料

- 其他用途(殺菌、消毒)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 俄羅斯

- 土耳其

- 北歐的

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東和非洲地區

- 亞太地區

第6章 競爭格局

- 併購、合資、合作與協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Albemarle Corporation

- Baker Hughes Company

- BASF SE

- BWA WATER ADDITIVES

- Dow

- Ecolab

- Kemipex

- Kemira

- Lonza

- Merck KGaA

- Nouryon

- Solvay

- SUEZ

- The Lubrizol Corporation

- Thor

- Troy Corporation

- Valtris Specialty Chemicals

- Veolia

第7章 市場機會與未來趨勢

- 農業領域意識不斷增強

- 醫療和衛生產品需求增加

簡介目錄

Product Code: 59595

The Biocides Market size is estimated at USD 10.60 billion in 2025, and is expected to reach USD 12.89 billion by 2030, at a CAGR of greater than 4% during the forecast period (2025-2030).

Key Highlights

- The rise in demand from the food and beverage industry and the increasing demand for water treatment plants globally are some factors driving the demand for biocides globally.

- However, the environmental issues and health hazards related to the high usage of biocides are expected to hinder the growth of the market.

- The increasing global awareness of the use of biocides in the agricultural sector and increasing demand for healthcare and hygiene products are likely to provide an opportunity for the biocides market in the upcoming period.

- North America is expected to dominate the market during the forecast period.

Biocides Market Trends

The Water Treatment Segment is Expected to Dominate the Market

- Biocides are extensively used in various water treatment applications, including municipal water treatment, industrial water treatment, swimming pool sanitation, cooling, water treatment, and wastewater treatment. The wide range of applications within the water treatment segment contributes to the significant market share held by biocides.

- The growing global population, urbanization, industrialization, and increasing water scarcity drive the demand for water treatment solutions, including biocides. As the demand for clean and safe water continues to rise, the water treatment segment is expected to remain a dominant market for biocides.

- As per a UNICEF report released on July 2023, in 2022, 5.82 billion people consumed drinking water from an improved source that was accessible on-premises and free from fecal and chemical contamination. Moreover, 1.5 billion people consumed water from primary sources.

- According to the data published by UNICEF, almost 76 % of people consumed safe drinking water in 2022, and more than 99% of people consumed safe drinking water in Germany, France, Sweden, and Spain.

- The United Nations (UN) estimates that approximately 1.8 billion people will be residing in regions with complete water scarcity by 2050, with Sub-Saharan Africa having the most significant number of water-stressed countries. The United Nations is urging countries to develop water treatment technologies.

- Thus, the demand for biocides is increasing as water treatment applications become increasingly important.

North America is Expected to Dominate the Market

- North America is expected to dominate the market. The United States is the region's largest economy in terms of GDP. With the increasing number of end-user industries such as water treatment, paint, coatings, food and beverages, and others, the United States, which is one of the largest markets for biocides, is expected to witness growth over the forecast period.

- The US Environmental Protection Agency (USEPA) is emphasizing improvements to water and sewage services, particularly local wastewater treatment facilities. The organization awarded over USD 336 million to the state of New York to support cleaner water across the state, according to the data released by the US Environmental Protection Agency (EPA) on October 2023.

- The demand for treatment plants is increasing in North America. For instance, according to the data released by the US Census Bureau, public construction spending in the United States on sewage and waste disposal projects increased from USD 23.52 billion in 2018 to USD 31.95 billion in 2022.

- Thus, the country is investing heavily in the construction of water treatment plants.

- In Mexico, the production value in the purification and bottling of water sector increased from MEX 2,704.81 million (USD 160.99 million) in January 2023 to MEX 2,793,07 million (USD 166.24 million) in October 2023, according to the data published by INEGI.

- Thus, the above-mentioned factors are expected to increase the use of biocides for the treatment of wastewater in North America.

Biocides Industry Overview

The biocides market is fragmented in nature. The major players include BASF SE, Kemira, Solvay, Ecolab, and Nouryon.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Water Treatment Globally

- 4.1.2 Growing Demand From the Food and Beverage Industry

- 4.2 Restraints

- 4.2.1 Environmental Issues and Health Hazards Related to Biocides

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Halogen Compounds

- 5.1.2 Metallic Compounds

- 5.1.3 Organosulfurs

- 5.1.4 Organic Acids

- 5.1.5 Phenolics

- 5.1.6 Other Types (Quaternary Ammonium-based Compounds)

- 5.2 Application

- 5.2.1 Water Treatment

- 5.2.2 Pharmaceutical and Personal Care

- 5.2.3 Wood Preservation

- 5.2.4 Food and Beverage

- 5.2.5 Paints and Coatings

- 5.2.6 Other Applications (Disinfectant and Sanitization)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 Turkey

- 5.3.3.8 NORDIC

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Albemarle Corporation

- 6.4.2 Baker Hughes Company

- 6.4.3 BASF SE

- 6.4.4 BWA WATER ADDITIVES

- 6.4.5 Dow

- 6.4.6 Ecolab

- 6.4.7 Kemipex

- 6.4.8 Kemira

- 6.4.9 Lonza

- 6.4.10 Merck KGaA

- 6.4.11 Nouryon

- 6.4.12 Solvay

- 6.4.13 SUEZ

- 6.4.14 The Lubrizol Corporation

- 6.4.15 Thor

- 6.4.16 Troy Corporation

- 6.4.17 Valtris Specialty Chemicals

- 6.4.18 Veolia

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Awareness in the Agricultural Sector

- 7.2 Increasing Demand from Healthcare and Hygiene Products

02-2729-4219

+886-2-2729-4219