|

市場調查報告書

商品編碼

1687332

相機鏡頭:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Camera Lens - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

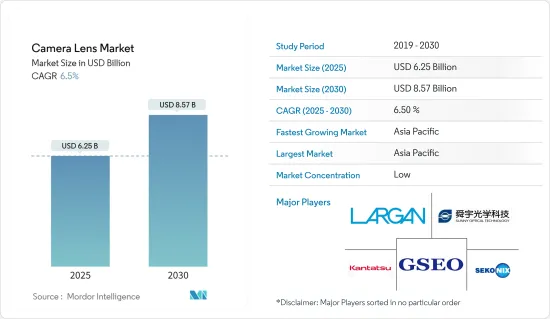

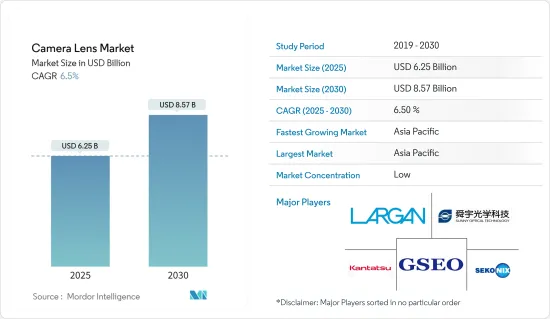

預計 2025 年相機鏡頭市場規模為 62.5 億美元,到 2030 年將達到 85.7 億美元,預測期內(2025-2030 年)的複合年成長率為 6.5%。

相機鏡頭是一種光學機身,方便將單一鏡頭或一組鏡頭安裝到相機機身上。各種鏡頭都可以互換,而其他鏡頭則內建於相機結構中。現代鏡頭將入射角和屈光設為相等,以最大限度地減少像差,並且它們還具有聚焦元件,使操作者能夠決定影像的哪些部分應該Sharp Corporation、哪些部分應該模糊。

主要亮點

- 智慧型手機相機技術的最新進展集中於提高鏡頭的光學性能以及加入諸如防手震和先進的自動對焦系統等附加功能。這些改進正在改善智慧型手機相機並擴大行動攝影和攝影的可能性。

- 配備專業相機的智慧型手機越來越受歡迎。推動該市場成長的關鍵因素包括智慧型手機相機技術的進步以及社交媒體平台對引人注目的視覺內容的需求不斷成長。智慧型手機製造商在相機技術方面取得了長足的進步,使他們能夠提供更高品質的鏡頭、感光元件和影像處理能力。這些進步縮小了傳統相機和智慧型手機之間的差距,使用戶能夠用智慧型手機拍攝專業品質的照片和影片。這些進步包括更大的感測器、多個鏡頭、光學影像防手震、先進的自動對焦系統、計算攝影技術等等。這些功能使智慧型手機能夠捕捉具有更詳細、動態範圍和低照度性能的高品質影像。

- 相機鏡頭在自動駕駛汽車中發揮著至關重要的作用,它提供有關車輛周圍環境的視覺資訊。攝影機固定在車輛的四側(前、後、左、右),以提供車輛周圍環境的 360 度全方位視野。這使它能夠偵測到障礙物、行人和其他附近的車輛。

- 大規模生產相機鏡頭面臨多項挑戰。這些挑戰包括設計和製造鏡頭元件、確保光學品質、控制製造成本以及滿足市場需求。鏡頭元件的設計和製造是製造過程中至關重要的一步。

- 由於生產停頓,COVID-19 疫情對電子產業產生了重大影響。這導致各個領域對電子設備和半導體產品的需求增加。新冠肺炎疫情的影響包括歐洲製造業大規模中斷以及中國製造的零件出口暫停。這些因素對全球相機鏡頭市場產生了負面影響。

相機鏡頭市場趨勢

攜帶式消費電子應用領域預計將佔據主要市場佔有率

- 行動電話的相機鏡頭在捕捉光線並將其引導至相機感應器(然後轉換成影像)方面發揮著至關重要的作用。鏡頭是一個關鍵部件,對所獲得的影像的品質和清晰度有很大影響。鏡頭越貴,拍出的照片越精確、越詳細。隨著行動電話的日益普及,該領域的市場前景看好。

- 近年來,行動電話相機鏡頭取得了長足的進步,某些機型現在配備多個鏡頭以滿足不同的需求。例如,有些型號配備廣角鏡頭,非常適合拍攝令人驚嘆的風景或集體照,而有些型號配備長焦鏡頭,可以讓您放大遠處的物體。毫無疑問,行動電話相機鏡頭在智慧型手機中發揮著至關重要的作用,並且近年來取得了令人難以置信的進步。隨著技術的進步,智慧型手機相機鏡頭及其卓越的影像品質預計將繼續改善。

- 智慧型手機需求的不斷成長和智慧型手機技術的不斷進步是行動電話相機鏡頭需求上升的主要驅動力。根據 GSMA 預測,亞太地區智慧型手機普及率將從 2022 年的 76% 上升至 2030 年的 94%。

- 隨著消費者在購買時更加重視攝影和攝影功能,智慧型手機相機鏡頭的需求預計將大幅成長。此外,受多種因素推動,對提高影像品質的需求日益成長,預計將推動相機鏡頭技術的進步,以滿足日益成長的行動應用需求。

- 因此,智慧型手機相機採用了創新的鏡頭技術,提高了影像品質和功能。其中一個例子就是玻璃+塑膠鏡頭技術,它結合了不同的材料來最佳化光學性能。現在的智慧型手機有多個相機鏡頭,每個鏡頭都有特定的用途。這使得用戶可以探索廣角、遠攝和微距等各種拍攝模式。對專用鏡頭技術的需求不斷成長預計將促進市場成長。

亞太地區佔市場主導地位

- 亞太地區是智慧型手機製造的重要樞紐,需要穩定的相機鏡頭供應。該地區的消費者越來越喜歡配備高解析度相機的智慧型手機來拍攝照片和影片。這種需求推動了對先進智慧型手機相機鏡頭的需求。

- 亞太地區是智慧型手機的主要市場之一,主要因為其通訊業高度發展且基本客群龐大。根據中國國家統計局的數據,2022年中國智慧型手機產量將達到近16億支。中國是全球最大的智慧型手機生產國。 2021年和2020年的智慧型手機產量分別為16.7億支和14.7億支。據IBEF稱,印度是世界主要企業的行動電話出口國之一。印度的目標是到 2026 會計年度生產價值 3,000 億美元的電子產品。智慧型手機製造可能是印度實現雄心勃勃目標的關鍵。

- 印度、中國、韓國和台灣等國家對智慧型手機和其他消費性電子產品的需求不斷成長,促使許多公司在亞太國家設立工廠。例如,全球智慧型裝置品牌 OPPO 最近在印度設立了生產智慧型手機的製造部門。憑藉高科技製造能力、創新自動化和最先進的設施,OPPO 印度諾伊達工廠目前每三秒生產一支智慧型手機。為了確保智慧型手機供應鏈無縫銜接,OPPO 印度手機工廠隨時儲備可供 120 多萬支智慧型手機使用的材料。

- 此外,該地區的汽車產業佔該地區相機鏡頭總需求的很大佔有率。例如,中國是全球最大的汽車市場,預計2022年乘用車銷售量為2,356萬輛(OICA統計)。根據國際能源總署預測,2022年中國將成為最大的電動車市場,佔全球電動車銷量的60%左右。目前,全球道路上超過一半的電動車都在中國,中國已經超額完成了2025年的新能源車銷售目標,這將推動某些產品的推出。

- 2023年8月,合肥海圖微電子完成1億元人民幣(約1,375萬美元)Pre-B輪股權融資。這使得本輪資金籌措金額超過 5,000 萬美元。本輪融資資金將用於影像感測器的量產以及加大對基於新技術的機器視覺、汽車電子、醫療等領域CIS產品的研發投入。此類投資可能為所研究的市場帶來更多的機會。

相機鏡頭市場概覽

相機鏡頭市場高度分散,大立光精密股份有限公司的合併、收購和產品發布等多種市場策略正在擴大所研究市場的範圍。

例如,2024年1月,Panasonic發布了基於L-Mount系統標準的全新LUMIX S 100mm F2.8 MACRO(S-E100)鏡頭。

2023年12月,TECNO發表了明年三大前沿成像技術:突破性的W型可變物理光圈、業界首款液體遠攝微距鏡頭、AI賦能的多膚色影像解決方案。

2023年9月,騰龍宣布推出適用於SONYE卡口全片幅無反光鏡相機的廣角變焦鏡頭17-50mm F/4 Di III VXD(型號A068)。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 評估宏觀經濟因素和新冠肺炎疫情的影響

- 技術簡介

- 內建鏡頭

- 可更換鏡頭

第5章 市場動態

- 市場促進因素

- 配備商務用相機的智慧型手機越來越受歡迎

- 自動駕駛汽車中相機鏡頭的使用越來越多

- 市場挑戰

- 大規模生產挑戰

- 行業利潤率下降

第6章 市場細分

- 按應用

- 消費性電子產品

- 移動的

- AR/VR/MR

- 其他家電

- 車

- 醫療

- 其他用途

- 消費性電子產品

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- 供應商定位分析

- 公司簡介

- Largan Precision Co. Ltd

- Sunny Optical Technology(Group)Company Limited

- Kantatsu Co. Ltd

- Genius Electronic Optical Co. Ltd

- Sekonix Co. Ltd

- Canon Inc.

- AAC Technologies Holdings Inc.

- Ability Opto-Electronics Technology Co. Ltd

- Sunex Inc.

- Tamron Co. Ltd

- Haesung Optics Co. Ltd

- O-film Group Co. Ltd

- Samsung Electro-mechanics Co. Ltd

第8章投資分析

第9章 市場機會與未來趨勢

The Camera Lens Market size is estimated at USD 6.25 billion in 2025, and is expected to reach USD 8.57 billion by 2030, at a CAGR of 6.5% during the forecast period (2025-2030).

A camera lens is an optical body that facilitates a single lens or a collection of lenses that mount to a camera body. Various lenses are interchangeable, while others are built into the camera's construction. Modern lenses always look forward to setting the angle of incidence and the angle of refraction to equal values to minimize aberration and feature a focus element that permits the operator to dictate which portions of the image are sharp and which are blurred.

Key Highlights

- Recent advances in smartphone camera technology have focused on improving the optical performance of the lens, as well as incorporating additional features such as visual image stabilization and advanced autofocus systems. These improvements have helped make smartphone cameras more capable and opened up many mobile photography and videography possibilities.

- The adoption of smartphones equipped with professional-grade cameras has steadily increased. Prime factors responsible for the market's growth include advancements in smartphone camera technology and the rising demand for social media platforms for attractive visual content. Smartphone manufacturers have significantly advanced camera technology, allowing them to incorporate high-quality lenses, sensors, and image processing capabilities. These advancements have bridged the gap between traditional cameras and smartphones, enabling users to capture professional-grade photos and videos with their smartphones. These advancements include larger sensors, multiple lenses, optical image stabilization, advanced autofocus systems, and computational photography techniques. These features enable smartphones to capture high-quality images with robust detail, dynamic range, and low-light performance.

- Camera lenses play a crucial role in autonomous vehicles by providing visual information about the vehicle's surroundings. Cameras are fixed on all four sides of the car (front, rear, right, and left) to provide a comprehensive 360-degree view of the vehicle's surroundings. This allows the car to detect obstacles, pedestrians, and other vehicles nearby.

- Manufacturing camera lenses on a large scale presents several challenges. These challenges include designing and fabricating lens elements, ensuring optical quality, managing production costs, and meeting market demands. The design and fabrication of lens elements are crucial steps in the manufacturing process.

- The COVID-19 pandemic significantly impacted the electronics industry because of the halt in production. This led to increased demand for electronics and semiconductor products in various sectors. The effects of COVID-19 include widespread disruption of manufacturing in Europe and a halt in the export of Chinese parts. These factors adversely impacted the global cameral lens market.

Camera Lens Market Trends

Mobile Consumer Electronics Application Segment is Expected to Hold Significant Market Share

- The camera lens in mobile phones plays a vital role in capturing and directing light onto the camera sensor, which is transformed into an image. It is an essential component that significantly influences the quality and sharpness of the resulting image. Higher-end lenses may produce more precise and more detailed photos. With the increasing popularity of mobile phones, there are anticipated market prospects in this field.

- In the past few years, there has been a notable advancement in phone camera lenses, with specific models now equipped with multiple lenses to cater to various needs. For instance, certain phones are equipped with a wide-angle lens, perfect for capturing breathtaking landscapes or group shots, while others boast a telephoto lens, allowing users to zoom in on distant subjects. Undoubtedly, the phone camera lens plays a pivotal role in our smartphones and has witnessed remarkable progress recently. As technology evolves, we can anticipate further enhancements in phone camera lenses and their exceptional image quality.

- The increasing demand for smartphones and continuous advancements in smartphone technology are the main driving forces behind the rising demand for cell phone camera lenses. According to GSMA, smartphone adoption in Asia-Pacific is expected to increase from 76% in 2022 to 94% in 2030.

- As consumers place more importance on photography and videography features when purchasing, the demand for smartphone camera lenses is projected to grow significantly. Additionally, the growing need for improved image quality, which has become more prominent due to various factors, is expected to fuel advancements in camera lens technology to meet the increasing demands of mobile applications.

- As a result, smartphone cameras are integrating innovative lens technologies to improve the quality and functionality of images. An instance of this is using glass+plastic lens technology, which combines different materials to optimize optical performance. Nowadays, smartphones have multiple camera lenses, each designed for a specific purpose. This lets users explore various photography modes, including wide-angle, telephoto, and macro. The increasing demand for purpose-driven lens technologies is expected to contribute to the market's growth.

Asia-Pacific to Dominate the Market

- Asia-Pacific is a significant hub for smartphone manufacturing, which requires a steady supply of camera lenses. Consumers in the region show a growing preference for smartphones with high-resolution cameras for capturing photos and videos. This demand leads to an increased need for advanced smartphone camera lenses.

- Asia-Pacific has been one of the significant markets for smartphones, primarily due to the highly developing telecom sector and large customer base. According to the National Bureau of Statistics of China, in 2022, the production volume of smartphones in China amounted to almost 1.6 billion units. China was the most prominent smartphone producer worldwide. In 2021 and 2020, smartphone production volume was 1.67 and 1.47 billion units, respectively. According to IBEF, India is one of the leading players in cell phone exports by country. The country aims to produce electronics worth USD 300 billion by FY 2026. Manufacturing smartphones would be the key to achieving India's ambitious goal.

- Growing demand for smartphones and other consumer electronics products from countries such as India, China, the Republic of Korea, and Taiwan encourages many companies to set up factories in the Asia-Pacific countries. For instance, OPPO, a global smart device brand, recently established a manufacturing unit in India for smartphone manufacturing. With its high-tech manufacturing prowess, innovative automation, and state-of-the-art equipment, the Noida factory of OPPO India currently manufactures one smartphone every three seconds. To ensure a seamless supply chain of smartphones to market, the OPPO India mobile factory stocks materials for over 1.2 million phones at any given point.

- The automotive sector in the region also contributes to a significant share of the total demand for camera lenses in the region. For instance, China is the world's largest automotive market, with 23.56 million passenger cars purchased in 2022 (as per OICA). According to IEA, China was the largest market for electric vehicles in 2022, accounting for around 60% of global electric car sales. More than half of the electric cars on roads worldwide are currently in China, and the country has already exceeded its 2025 target for new energy vehicle sales, therefore driving specific product launches.

- In August 2023, Hefei Haitu Microelectronics Co. Ltd completed a Pre-B round of equity financing worth CNY 100 million, which equals about USD 13.75 million. This puts the funding round at about USD 50 million or more. The money will be used for the mass production of image sensors and to increase investment in the R&D of CIS products in the fields of machine vision, automotive electronics, and medical treatment based on novel technology. These investments will further create opportunities for the market studied.

Camera Lens Market Overview

The camera lens market is highly fragmented, with prominent players like Largan Precision Co., SEKONIX, and Sunny Optical. Several market strategies, such as mergers, acquisitions, and product launches, have been expanding the scope of the market studied.

For instance, in January 2024, Panasonic introduced the brand new LUMIX S 100mm F2.8 MACRO (S-E100) lens based on the L-Mount system standard.

In December 2023, TECNO showcased its three latest imaging technologies for the coming year: A game-changing W-shaped Adjustable Physical Aperture, an industry-first Liquid Telephoto Macro Lens, and an AI-powered Universal Tone multi-skin tone imaging solution.

In September 2023, Tamron Co. Ltd announced the launch of the 17-50mm F/4 Di III VXD (Model A068), a wide-angle zoom lens for Sony E-mount full-frame mirrorless cameras.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Factors and COVID-19

- 4.5 Technology Snapshot

- 4.5.1 Built-in Lens

- 4.5.2 Interchangeable Lens

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Smartphones Equipped with Professional Grade Cameras

- 5.1.2 Increased Usage of Camera Lens in Autonomous Vehicles

- 5.2 Market Challenges

- 5.2.1 Mass Manufacturing Challenges

- 5.2.2 Decreasing Profit Margins in the Industry

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Consumer Electronics

- 6.1.1.1 Mobile

- 6.1.1.2 AR/VR/MR

- 6.1.1.3 Other Consumer Electronics

- 6.1.2 Automotive

- 6.1.3 Medical

- 6.1.4 Other Applications

- 6.1.1 Consumer Electronics

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles

- 7.2.1 Largan Precision Co. Ltd

- 7.2.2 Sunny Optical Technology (Group) Company Limited

- 7.2.3 Kantatsu Co. Ltd

- 7.2.4 Genius Electronic Optical Co. Ltd

- 7.2.5 Sekonix Co. Ltd

- 7.2.6 Canon Inc.

- 7.2.7 AAC Technologies Holdings Inc.

- 7.2.8 Ability Opto-Electronics Technology Co. Ltd

- 7.2.9 Sunex Inc.

- 7.2.10 Tamron Co. Ltd

- 7.2.11 Haesung Optics Co. Ltd

- 7.2.12 O-film Group Co. Ltd

- 7.2.13 Samsung Electro-mechanics Co. Ltd