|

市場調查報告書

商品編碼

1523321

築路施工機械:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Road Construction Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

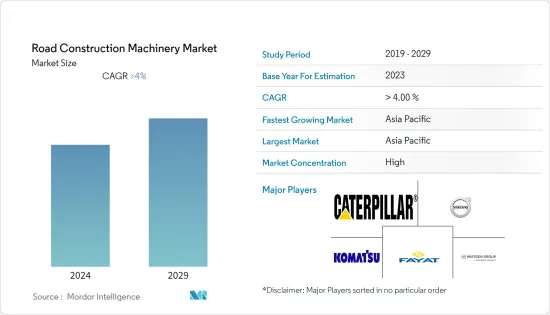

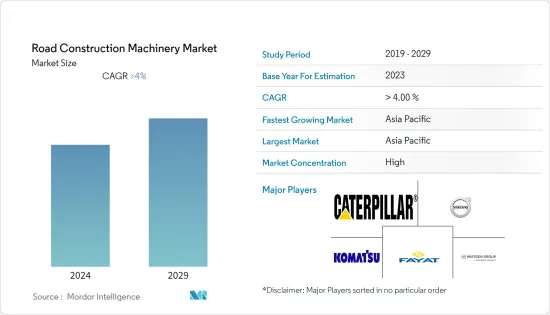

道路施工機械市場規模預計到2024年為1891.6億美元,預計到2029年將達到2318.1億美元,預計在預測期內(2024-2029年)複合年成長率為4.15%。

道路建設活動的增加預計將推動道路施工機械的需求。經濟獎勵策略和基礎建設開拓等各種政府計畫正在提振築路施工機械,預計2024年至2029年市場將擴大。

從長遠來看,隨著道路施工機械銷量的飆升,道路計劃投資的增加、電動式道路施工機械的推出以及新機器更換舊車輛正在創造施工機械行業的需求。然而,對租賃機械服務的需求不斷成長預計將成為市場成長的限制因素。租賃機械因其降低人事費用、培訓成本、機械採購成本而受到中小企業的青睞。

此外,數位化、連結性和自動化正在推動市場開拓並對建築計劃產生重大影響。建築和建築材料公司正在投資新技術,並用新的或升級的車隊替換舊的施工機械,以滿足對先進施工機械日益成長的需求。此外,旨在鼓勵官民合作關係(PPP)模式的政府政策的不斷增加預計也將預示著2024年至2029年道路施工機械市場的成長。

施工機械市場趨勢

馬達平土機市場預計將在 2024 年至 2029 年實現最快成長

道路建設產業是世界各地平土機馬達需求的主要驅動力。高速公路、機場和公共設施等大型計劃需要使用這些機器對道路和其他表面進行平整和平整。

都市化趨勢也推動了平土機馬達的需求,因為開發商希望在擁擠的城市中心建造和維護更好的道路和交通網路。由於對平土機馬達的明顯需求,世界各地的多家設備製造商正在推出新產品來滿足市場需求。例如

- 2023 年 4 月,貝爾設備推出新系列平土機馬達G140。這款新型號適用於所有維護以及輕型和中型建築作業,並配備 ZF Ergopower 變速箱。

- 2023年3月,克萊蒙特設備公司將把日本小松公司銷售區域從聖地牙哥擴大到洛杉磯,擴大業務範圍。透過此次擴建,該公司將成為日本小松公司施工機械在美國南加州的銷售和服務基地。

此外,在開發中國家,高速公路延伸和連接城鎮和鄉村的高速公路等大型計劃正在進行中。因此,預計2024年至2029年築路施工機械的需求量較大。馬達、後鏟式裝載機、挖土機數量的增加顯示築路施工機械市場逐漸成長。

- 2023 年 9 月,德國政府宣布投資 2,696 億歐元(2,996 億美元)用於改善全國道路交通基礎設施。

由於上述因素以及建築和基礎設施開發活動的增加,預計該細分市場從 2024 年到 2029 年將顯著成長。

預計亞太地區將佔據主要市場佔有率

亞太地區預計將發揮主要作用,其次是北美和歐洲。亞太地區是馬達、平土機機、壓路機和攤舖機等築路施工機械的重要市場。印度和中國是全球最大的築路機械市場之一,佔全球築路機械銷售量的25%以上,使亞太地區成為築路施工機械最賺錢的市場。

印度政府的目標是到2026年將該國發展成為數兆美元的經濟體,基礎設施發展發揮著至關重要的作用。建築業約佔印度GDP的8%,是第二大雇主,預計將大幅成長,為超過5000萬人提供就業機會。未來幾年建築業的價值預計將達到 1.4 兆美元,這是一個前所未有的機會。例如

- 2022年6月,道路運輸和公路部部長在比哈爾邦巴特那和哈吉布爾舉行了15個國家高速公路相關計劃的奠基儀式,總投資17億美元。

- 根據總理 GATI SHAKTI 的舉措,印度已撥款 26.7 億美元,到 2022 年將國家高速公路網擴展 25,000 公里。

- 同樣,中國於2022年設立了746.9億美元的基礎建設基金,以增加基礎建設支出。這些努力預計將進一步增加亞太地區對道路施工機械的需求。

此外,亞太道路施工機械市場的一些參與者已經制定了各種商務策略來增強其市場供應,並且一些公司推出了新產品。例如

- 2023年3月,瑞典建築和採礦設備製造商Sandvik AB宣佈在馬來西亞建立新的生產單位,生產地下裝載機和建築自動卸貨卡車。該設備預計將於 2023 年第四季開始生產。公司設定的年產能預計到2030年將分階段提高到裝載機和自動卸貨卡車300台、電池籠500台。

- 2023年9月,中國工業和施工機械製造商三一集團在菲律賓馬尼拉奎松市開設了子公司。

考慮到上述因素以及印度、中國、日本、馬來西亞和菲律賓等主要國際市場的產品推出,亞太築路施工機械市場預計在研究期間將穩定成長。

築路施工機械行業概況

道路施工機械市場適度分散。該市場的特點是多個參與者與主要基礎設施公司和政府機構簽訂了長期供應合約。這些參與者還進行合資、併購、新產品發布和產品開拓,以擴大其品牌組合併鞏固其市場地位。例如

- 2023 年 7 月,瑞典施工機械製造商沃爾沃建築機械宣佈在馬來西亞婆羅洲建立新的經銷商設施,以便更好地服務客戶。 Borneo VCE Dealer 是馬來西亞沃爾沃建築設備的子經銷商,負責銷售鉸接式卡車、緊湊型挖土機、緊湊型輪圈裝載機、履帶挖土機、輪圈裝載機和輪圈挖土機。我們也將為公司產品線的銷售和服務提供全面支援。

- 2023年4月,NBK集團旗下納賽爾·本·哈立德重型設備公司宣布,將向卡達市場供應山東海信機械旗下知名品牌「Hixen」的最新機械設備。海信機械主要包括履帶挖土機、輪圈挖土機、輪圈裝載機、後鏟式裝載機和滑移裝載機。

- 2023年2月,凱斯工程機械推出了適用於836C和856C平土機馬達的新型操縱桿。新的操縱桿增加了平土機的卓越功能,並提供改進的犁板控制和轉向升級。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 基礎建設開拓和高速公路建設活動增加活性化市場

- 市場限制因素

- 缺乏技術純熟勞工可能會阻礙市場擴張

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模單位:十億美元)

- 按機器類型

- 平土機馬達

- 壓路機

- 輪圈裝載機

- 混凝土攪拌機

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Sany Heavy Industry Co. Ltd

- Caterpillar Inc.

- Palfinger AG

- Terex Corporation

- Liebherr-International AG

- Deere & Company

- Zoomlion Heavy Industry Science and Technology Co. Ltd

- Komatsu Ltd

- Wirtgen Group

- Fayat Group

- Wacker Neuson Group

- Ammann Group

- CNH Industrial

- Volvo CE

- Hitachi Sumitomo Heavy Industries Construction Cranes Co. Ltd

第7章 市場機會及未來趨勢

The Road Construction Machinery Market size is estimated at USD 189.16 billion in 2024, and is expected to reach USD 231.81 billion by 2029, growing at a CAGR of 4.15% during the forecast period (2024-2029).

The increase in road construction activity is expected to drive the demand for road construction machinery. Various government programs, such as stimulus packages and infrastructure developments, encouraged road construction equipment to drive market expansion between 2024 and 2029.

Over the long term, increasing investments in road projects, the launch of electric road construction machinery, and the replacement of older fleets by newer machines are creating demand in the construction equipment industry with a surge in sales of road construction machinery. However, the increasing demand for rental machinery services is expected to act as a restraint for the market's growth, as renting machinery is preferred by small and medium-scale companies to lessen the costs of labor, training, and equipment purchases.

Furthermore, digitalization, connectivity, and automation are driving market development forward, substantially impacting construction projects. Construction and construction materials companies are geared up to invest in new technologies to cope with the increasing demand for advanced construction machinery and replace the older ones with new or upgraded machinery fleets. Additionally, an increase in the number of favorable government policies aimed at encouraging the Public-Private Partnership (PPP) model is also expected to bode well for the growth of the road construction equipment market from 2024 to 2029.

Road Construction Machinery Market Trends

The Motor Graders Segment is Expected to Register the Fastest Growth Between 2024 and 2029

The road construction industry is a significant driver of demand for motor graders across the world, with major projects such as highways, airports, and public facilities requiring the use of these machines for grading and leveling roads and other surfaces.

The increasing trend toward urbanization also fuels demand for motor graders as developers seek to build and maintain better roads and transport networks in crowded city centers. As a result of the evident need for motor graders, multiple equipment manufacturers across the world have been introducing new products to cater to the market demand. For instance,

- In April 2023, Bell Equipment's new range of motor graders, G140, was announced. This new equipment is well suited to all maintenance and light to medium construction tasks and is fitted with the ZF Ergopower transmission.

- In March 2023, Clairemont Equipment Company is set to broaden its operational reach by extending its Komatsu territory from San Diego to Los Angeles. This expansion positions the company as the designated sales and service provider for Komatsu construction equipment across the entirety of southern California, United States.

Moreover, developing nations are undertaking large-scale projects such as highway extensions and expressways to connect towns and villages. As a result, road construction equipment is expected to see a significant demand between 2024 and 2029. The increase in motor graders, backhoe loaders, and excavators count indicates the road construction equipment market's incremental growth.

- In September 2023, the Government of Germany announced an investment of EUR 269.6 billion (USD 299.6 billion) for the development of road transport infrastructure across the country.

Due to such aforementioned factors and the rise in construction and infrastructure development activities, this market segment is anticipated to witness a significant growth rate between 2024 and 2029.

Asia-Pacific is Anticipated to Capture a Major Market Share in the Market

Asia-Pacific is expected to play a significant role, followed by North America and Europe. Asia-Pacific is a significant market for road construction machinery, such as motor graders, compactors, road rollers, and pavers. India and China are some of the largest markets for road machinery in the world, contributing more than 25% of the worldwide road machinery sales, thus making Asia-Pacific the most lucrative market for road construction machinery.

The Indian government aims to elevate the country to a multi-trillion-dollar economy by 2026, with infrastructure development playing a pivotal role. The construction sector, constituting about 8% of India's GDP and being the second-largest employer, is poised for significant growth, offering over 50 million job opportunities. With an expected valuation of USD 1.4 trillion in the coming years, the construction segment presents unprecedented opportunities. For instance,

- In June 2022, the Minister of Road Transport and Highways inaugurated 15 projects related to national highways in Patna and Hajipur, Bihar, with a total investment of USD 1.7 billion.

- India allocated USD 2.67 billion to expand its national highway networks by 25000 kilometers under the PM GATI SHAKTI initiative in 2022.

- Similarly, China had set up a USD 74.69 billion infrastructure fund to spur infrastructure spending in 2022. These initiatives are anticipated to further boost the demand for road construction machinery in Asia-Pacific.

Furthermore, several players in the Asia-Pacific road construction machinery market are establishing various business strategies to enhance the market offering, and a few companies are introducing new products. For instance,

- In March 2023, Sandvik AB, a Sweden-based construction and mining equipment manufacturer, announced the establishment of a new production unit in Malaysia for manufacturing underground loaders and construction dump trucks. Equipment production is planned to begin in Q4 2023. The company set an annual manufacturing capacity that is planned to increase gradually to 300 loaders and dump trucks and 500 battery cages by 2030.

- In September 2023, SANY Group, a China-based industrial and construction equipment manufacturer, opened its subsidiary in Quezon City, Manila, Philippines.

Considering the aforementioned factors and product launches in major international markets, like India, China, Japan, Malaysia, and the Philippines, the Asia-Pacific road construction machinery market is expected to have steady growth during the study period.

Road Construction Machinery Industry Overview

The road construction machinery market is moderately fragmented. The market is characterized by the presence of several players who have secured long-term supply contracts with major infrastructure companies and government agencies. These players also engage in joint ventures, mergers and acquisitions, new product launches, and product development to expand their brand portfolios and cement their market positions. For instance,

- In July 2023, Volvo Construction Equipment, a Sweden-based construction equipment manufacturer, announced a new dealership facility in the Malaysian state of Borneo to better serve customers. The Borneo VCE dealership is a sub-dealer of Volvo Construction Equipment Malaysia, and it will be responsible for sales of articulated haulers, compact excavators, compact wheel loaders, crawler excavators, wheel loaders, and wheeled excavators. It will provide total sales and service support to the company's product line.

- In April 2023, Nasser Bin Khaled Heavy Equipment, a subsidiary of NBK Group, announced the supply of the latest machinery and equipment from the prominent brand "Hixen" by Shandong Hixen Machinery to the Qatari market. Hixen machinery mainly includes crawler excavators, wheel excavators, wheel loaders, backhoe loaders, and skid steer loaders.

- In February 2023, CASE Construction Equipment launched the new joystick levers for the 836C and 856C motor graders. The new joystick control delivers improved moldboard control, along with a range of steering upgrades, which are an addition to the grader's already great features.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Infrastructure Development and Highway Construction Activities to Drive the Market

- 4.2 Market Restraints

- 4.2.1 Lack of Skilled Labor May Hamper the Market Expansion

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market size Value in USD billion)

- 5.1 By Machine Type

- 5.1.1 Motor Graders

- 5.1.2 Road Roller

- 5.1.3 Wheel Loaders

- 5.1.4 Concrete Mixer

- 5.1.5 Others

- 5.2 By Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 India

- 5.2.3.2 China

- 5.2.3.3 Japan

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 South America

- 5.2.4.2 Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Sany Heavy Industry Co. Ltd

- 6.2.2 Caterpillar Inc.

- 6.2.3 Palfinger AG

- 6.2.4 Terex Corporation

- 6.2.5 Liebherr-International AG

- 6.2.6 Deere & Company

- 6.2.7 Zoomlion Heavy Industry Science and Technology Co. Ltd

- 6.2.8 Komatsu Ltd

- 6.2.9 Wirtgen Group

- 6.2.10 Fayat Group

- 6.2.11 Wacker Neuson Group

- 6.2.12 Ammann Group

- 6.2.13 CNH Industrial

- 6.2.14 Volvo CE

- 6.2.15 Hitachi Sumitomo Heavy Industries Construction Cranes Co. Ltd