|

市場調查報告書

商品編碼

1523331

醫藥物流-市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Pharmaceutical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

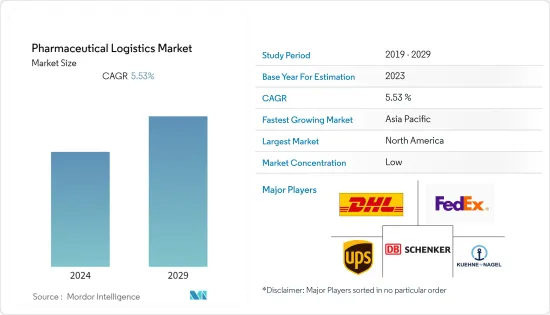

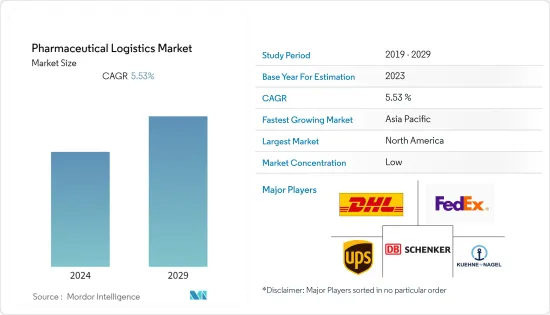

醫藥物流市場規模預計將從2024年的5,314.2億美元擴大到2029年的6,955.3億美元,預測期內(2024-2029年)複合年成長率為5.53%。

主要亮點

- 藥品製造商擴大向第三方提供者尋求包裝和標籤服務。其中許多公司正在向以前開拓的地區擴張,例如撒哈拉以南非洲和南美洲。然而,這些公司強調與擁有強大製藥專業知識的當地物流供應商合作的重要性。儘管有這些好處,但人們也擔心外包可能會降低服務品質和失去控制。

- 海運和空運醫藥物流的需求預計將在未來幾年推動產業成長。尤其是海運,可以降低高達 80% 的成本並減少對人員的需求,同時最大限度地減少包裝、儲存和碳足跡。航空貨運物流擴大用於貴重疫苗和藥品的遠距、洲際配送,進一步促進了該行業的擴張。對維生素、礦物質和補充品(VMS) 等非處方藥 (OTC)、感冒藥和止咳藥、腸胃藥和皮膚科治療的需求也有所增加。

- 此外,醫療保健產業對快速援助的需求日益成長,從而推動了醫藥物流市場的發展。建立單一來源分銷管道被認為是降低醫藥物流分銷成本和提高效率的一種方式。

醫學物流市場趨勢

低溫運輸物流需求不斷成長

- 低溫運輸物流領域預計在未來幾年將顯著成長。這種擴張的關鍵促進因素是對疫苗等常溫產品的需求增加,這需要物流,其中精確的溫度控制對於確保產品在分銷過程中的有效性至關重要。

- 政府法規要求對溫度敏感的藥物進行精確的溫度維持,預計也將有助於該領域的成長。遠端資訊處理在低溫運輸醫藥物流中的採用不斷增加,使公司能夠提高貨物運輸的效率、連結性和安全性。生物製藥和醫療產品的製造和分銷需要溫控環境,導致製藥公司越來越依賴溫控運輸和冷藏系統。

- 供應鏈管理和整合技術的最新進展促進了用於運輸溫度敏感貨物的有效低溫運輸物流的無縫整合。這確保了藥品的品質和安全,同時發展了供應鏈業務。總體而言,專業公司提供的低溫運輸物流正在推動溫控物流行業的成長,並為該行業帶來光明的前景。

亞太地區預計創最高成長率

- 亞太地區預計將在未來幾年創下最高成長率,這主要是由於藥品需求的快速成長和對醫療保健基礎設施的大量投資。例如,在印度新德里,由於印度政府宣布了與藥品生產掛鉤的激勵制度,預計截至 2023 年 9 月將投資 2,581.3 億印度盧比,新增就業 5,6171 個。

- 亞太地區擁有全球最大、成長最快的醫藥市場,包括中國、印度、日本和韓國。這些國家對醫療保健服務和藥品的需求不斷增加,因此更需要高效的物流解決方案以確保及時交付。

- 對機場、海港和公路網路等交通基礎設施的投資正在提高全部區域的物流能力。現代化努力的目的是簡化藥品的流動、減少運輸時間並提高供應鏈效率。

醫藥物流產業概況

該市場高度分散,許多公司分佈在世界各地。該行業的頂尖公司包括 DHL、DB Group 和 FedEx。為了維持市場地位,醫藥物流企業不斷實施併購等策略性措施。此外,企業也投資遠端資訊處理、遙感探測和監控、GPS和GIS整合等技術來運輸貨物,並為客戶提供安全、便利的醫藥物流服務。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查主要結果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章 市場考量與動態

- 目前的市場狀況

- 政府措施和監管方面

- 產業技術趨勢

- 市場動態

- 市場促進因素

- 線上藥局推動成長

- 對非處方藥的需求增加

- 市場限制因素

- 物流成本高

- 嚴格的政府法規

- 市場機會

- 增加無人機給藥技術的投資

- 市場促進因素

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者/買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 價值鏈/供應鏈分析

- COVID-19 對市場的影響

第4章市場區隔

- 依產品

- 學名藥

- 品牌藥品

- 按運輸方式

- 低溫運輸運輸

- 非低溫運輸運輸

- 按用途

- 生物製藥

- 化學藥物

- 特殊藥物

- 透過交通工具

- 航空運輸

- 鐵路運輸

- 道路運輸

- 海運

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲

- 世界其他地區

- 北美洲

第5章競爭狀況

- 公司簡介

- Deutsche Post DHL

- Kuehne+Nagel

- UPS(Marken)

- DB Group

- FedEx

- Nippon Express

- World Courier

- SF Express

- CEVA Logistics

- Agility

- DSV

- Kerry Logistics

- CH Robinson

- Air Canada Cargo

- Lineage Logistics

- United States Cold Storage

- Americold Logistics LLC

- Nichirei Logistics Group Inc.

- Kloosterboer

- NewCold Advanced Cold Logistics

- VersaCold Logistics Services

- Cloverleaf Cold Storage Co.*

- 其他公司

第6章 市場的未來

第7章 附錄

第8章 免責聲明

The Pharmaceutical Logistics Market size in terms of Equal-5.53 is expected to grow from USD 531.42 billion in 2024 to USD 695.53 billion by 2029, at a CAGR of 5.53% during the forecast period (2024-2029).

Key Highlights

- Pharmaceutical manufacturing companies are increasingly turning to third-party providers for packaging and labeling services. Many of these companies are expanding their operations into previously untapped regions like Sub-Saharan Africa and South America. However, they emphasize the importance of partnering with local logistics providers who possess strong expertise in pharmaceuticals. Despite the benefits, there are concerns about potential service quality deterioration and loss of control associated with outsourcing.

- The demand for sea and air freight pharmaceutical logistics is expected to drive industry growth in the coming years. Sea freight, in particular, offers cost savings of up to 80% and reduces staffing needs while also minimizing packaging, storage, and carbon footprint. Air freight logistics are increasingly used for long-distance and intercontinental distribution of valuable vaccines and medicines, further contributing to industry expansion. The market is also witnessing increased demand for over-the-counter (OTC) medications such as vitamins, minerals, supplements (VMS), common cold and cough remedies, gastrointestinal drugs, and dermatology treatments.

- Furthermore, there is a growing need for fast-track assistance in the healthcare sector, which is boosting the pharmaceutical logistics market. The establishment of a single-source distribution channel is seen as a way to reduce distribution costs and enhance efficiency in pharmaceutical logistics.

Pharmaceutical Logistics Market Trends

Increasing Demand for Cold Chain Logistics in the Sector

- The cold chain logistics sector is poised for significant growth in the coming years. This expansion is primarily driven by increasing demand for ambient products, such as vaccines, necessitating precise temperature-controlled logistics to ensure product efficacy during distribution.

- Government regulations mandating accurate temperature maintenance for highly temperature-sensitive pharmaceuticals are also expected to contribute to the segment's growth. The adoption of telematics in cold-chain pharmaceutical logistics is on the rise, enabling companies to improve efficiency, connectivity, and safety in cargo transportation. Given the requirement for temperature-controlled environments in the manufacturing and distribution of biological and medical products, pharmaceutical companies are increasingly relying on temperature-controlled transportation and cold storage systems.

- Recent advancements in supply chain management and integration technologies have facilitated the seamless integration of effective cold-chain logistics for transporting temperature-sensitive goods. This has led to the growth of supply chain businesses while ensuring the quality and safety of pharmaceutical products. Overall, the provision of cold chain logistics by specialized firms is driving growth in the temperature-controlled logistics sector, promising a bright future for the industry.

Asia-Pacific is Poised to Witness the Highest Growth Rate

- Asia-Pacific is poised to witness the highest growth rate in the future, primarily driven by a surge in demand for pharmaceutical products and substantial investments in healthcare infrastructure. For example, New Delhi, India, witnessed investments of INR 25,813 crore and the addition of 56,171 new jobs as of September 2023 under the production-linked incentive scheme for pharmaceuticals, as announced by the government of India.

- Asia-Pacific is home to some of the world's largest and fastest-growing pharmaceutical markets, including China, India, Japan, and South Korea. The increasing demand for healthcare services and pharmaceutical products in these countries drives the need for efficient logistics solutions to ensure timely delivery.

- Investments in transportation infrastructure, such as airports, seaports, and road networks, are improving logistics capabilities across the region. Modernization efforts aim to streamline the movement of pharmaceutical goods, reducing transit times and enhancing supply chain efficiency.

Pharmaceutical Logistics Industry Overview

The market is highly fragmented, with the presence of many companies across the globe. Some of the top names in this industry include DHL, DB Group, and FedEx. To maintain their position in the market, pharmaceutical logistics companies are continuously undertaking strategic initiatives such as mergers and acquisitions. Furthermore, players are investing in technologies such as telematics, remote sensing and monitoring, and GPS and GIS integration in transporting cargo, thereby providing customers with safe and convenient pharmaceutical logistics services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Key Deliverables of the Study

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 MARKET INSIGHTS AND DYNAMICS

- 3.1 Current Market Scenario

- 3.2 Government Initiatives and Regulatory Aspects

- 3.3 Technological Trends in the Industry

- 3.4 Market Dynamics

- 3.4.1 Market Drivers

- 3.4.1.1 Online Pharmacies to Facilitate Growth

- 3.4.1.2 Increasing Demand for Over-the-counter (OTC) Medicines

- 3.4.2 Market Restraints

- 3.4.2.1 High Cost of Logistics

- 3.4.2.2 Stringent Government Regulations

- 3.4.3 Market Opportunities

- 3.4.3.1 Increasing Investments in Drone Technology for Medication Delivery

- 3.4.1 Market Drivers

- 3.5 Industry Attractiveness - Porter's Five Forces Analysis

- 3.5.1 Bargaining Power of Suppliers

- 3.5.2 Bargaining Power of Consumers/Buyers

- 3.5.3 Threat of New Entrants

- 3.5.4 Threat of Substitute Products

- 3.5.5 Intensity of Competitive Rivalry

- 3.6 Value Chain/Supply Chain Analysis

- 3.7 Impact of COVID-19 on the Market

4 MARKET SEGMENTATION

- 4.1 By Product

- 4.1.1 Generic Drugs

- 4.1.2 Branded Drugs

- 4.2 By Mode of Operation

- 4.2.1 Cold Chain Transport

- 4.2.2 Non-Cold Chain Transport

- 4.3 By Application

- 4.3.1 Biopharma

- 4.3.2 Chemical Pharma

- 4.3.3 Specialized Pharma

- 4.4 By Mode of Transport

- 4.4.1 Air Shipping

- 4.4.2 Rail Shipping

- 4.4.3 Road Shipping

- 4.4.4 Sea Shipping

- 4.5 Geography

- 4.5.1 North America

- 4.5.1.1 United States

- 4.5.1.2 Canada

- 4.5.2 Europe

- 4.5.2.1 United Kingdom

- 4.5.2.2 Germany

- 4.5.2.3 France

- 4.5.2.4 Italy

- 4.5.2.5 Rest of Europe

- 4.5.3 Asia-Pacific

- 4.5.3.1 China

- 4.5.3.2 India

- 4.5.3.3 Japan

- 4.5.3.4 South Korea

- 4.5.3.5 Rest of Asia-Pacific

- 4.5.4 Latin America

- 4.5.4.1 Brazil

- 4.5.4.2 Argentina

- 4.5.4.3 Rest of Latin America

- 4.5.5 Rest of the World

- 4.5.1 North America

5 COMPETITIVE LANDSCAPE

- 5.1 Overview (Market Concentration and Major Players)

- 5.2 Company Profiles

- 5.2.1 Deutsche Post DHL

- 5.2.2 Kuehne + Nagel

- 5.2.3 UPS (Marken)

- 5.2.4 DB Group

- 5.2.5 FedEx

- 5.2.6 Nippon Express

- 5.2.7 World Courier

- 5.2.8 SF Express

- 5.2.9 CEVA Logistics

- 5.2.10 Agility

- 5.2.11 DSV

- 5.2.12 Kerry Logistics

- 5.2.13 C.H. Robinson

- 5.2.14 Air Canada Cargo

- 5.2.15 Lineage Logistics

- 5.2.16 United States Cold Storage

- 5.2.17 Americold Logistics LLC

- 5.2.18 Nichirei Logistics Group Inc.

- 5.2.19 Kloosterboer

- 5.2.20 NewCold Advanced Cold Logistics

- 5.2.21 VersaCold Logistics Services

- 5.2.22 Cloverleaf Cold Storage Co.*

- 5.3 Other Companies