|

市場調查報告書

商品編碼

1687898

C-RAN:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)C-RAN - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

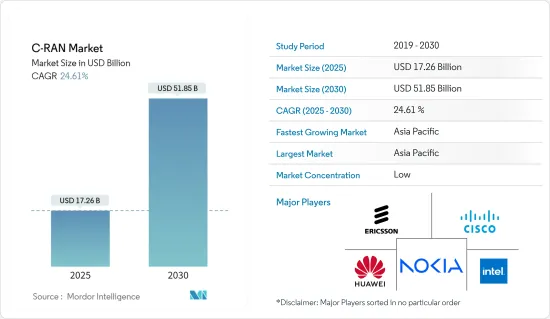

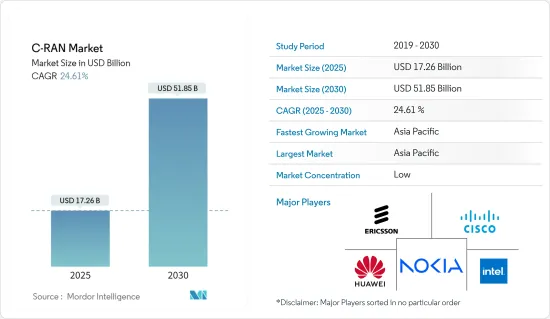

2025 年 C-RAN 市場規模預計為 172.6 億美元,預計到 2030 年將達到 518.5 億美元,預測期內(2025-2030 年)的複合年成長率為 24.61%。

在預計預測期內,資本支出的激增和營運支出的下降將推動雲端無線接取網路市場的發展。此外,無線和通訊技術的不斷升級將提高4G和5G的可及性,為市場成長提供光明前景。

主要亮點

- 5G 技術的不斷進步也在推動 Cloud RAN 市場的發展方面發揮關鍵作用。 5G網路需要更高的容量、更低的延遲和更佳的網路效能,這與C-RAN架構提供的功能非常契合。 C-RAN 支援具有集中處理和先進無線資源管理的 5G 網路部署,可協助營運商充分發揮 5G 技術的潛力,提供卓越的使用者體驗。

- 此外,行動通訊業者RAN 網路預計將向雲端基礎的RAN 解決方案大幅發展。現實中,Cloud RAN將需要與擁有自己專用基頻的Classic RAN共存於網路中,因此大多數營運商在邁向6G的道路上將採用混合策略。

- 物聯網 (IoT) 正在推動各個領域的連網型設備的發展,包括智慧城市、醫療保健、農業和製造業。 5G網路正在建置中,旨在同時連接數十億台物聯網設備,實現大規模連接。 5G 網路得益於其 C-RAN 架構,具有更高的擴充性和靈活性,可實現物聯網應用的無縫整合。 C-RAN 透過提供動態資源配置來滿足不斷變化的連接需求、實現軟體定義網路 (SDN) 的理念以及集中管理業務,從而簡化了物聯網流量管理。

- C-RAN可以顯著降低維護和部署無線網路的成本。透過整合基頻處理的用途,C-RAN 消除了每個基地台對專用硬體的需求,從而減少了設備需求。此外,透過使用SDN(軟體定義網路)和虛擬技術,可以更有效地利用資源,有望進一步降低成本。

- 我們這個快速發展的互聯互通的世界正在推動對無線通訊的需求。從智慧型手機到智慧家庭、自動駕駛汽車到工業物聯網設備,對安全、高速無線網路的需求從未如此強烈。此外,隨著網路連線需求的成長,頻譜稀缺的挑戰也隨之增加,這意味著可用於傳輸行動資料的無線電頻率數量有限。

雲端無線接取網路市場趨勢

5G將成為成長最快的網路類型

- C-RAN 將透過降低硬體和營運成本,使營運商能夠更經濟高效地部署 5G 網路。隨著高速行動連線的需求不斷成長,尤其是物聯網設備、自動駕駛汽車、擴增實境和其他新興技術的普及,5G C-RAN 市場預計將在未來幾年大幅成長。

- 5G固定無線存取的日益普及可能會在預測期內推動市場的發展。圖表顯示,分析顯示5G連接數將達到驚人的53億,從而促進市場成長率。

- 按地區分類,北美在全球佔有主要佔有率。 5G技術正在被廣泛採用,尤其是在雲端無線接取網路(C-RAN)市場。 C-RAN 利用雲端運算來集中和虛擬基頻功能,提供靈活性和擴充性。

- 5G的高資料速率、低延遲和海量連接能力使其非常適合C-RAN部署,從而提高網路效能並支援物聯網和擴增實境等先進服務。 5G和C-RAN的結合將推動整個北美通訊業的創新和效率。

- 2023 年 12 月,AT&T 宣布計畫成為美國領先的商業規模開放無線接取網路(Open RAN) 部署供應商。透過與愛立信合作,這項產業舉措將加速通訊業的發展,並有助於建立更強大的網路基礎設施供應商和供應商生態系統。 AT&T 和愛立信對 Open RAN 部署的多年共同承諾正值 5G 創新週期的關鍵時刻。

亞太地區預計將經歷最快成長

- 推動中國 C-RAN 市場發展的因素有幾個,首先中國擁有華為、中興等多家主要企業,其次中國擁有蓬勃發展的 C-RAN 生態系統。隨著中國積極部署5G網路,C-RAN被視為實現高效網路效能和支援多樣化5G用例的關鍵技術。

- 在中國,5G行動網路的廣泛部署將支援許多不同類型的服務,包括醫療保健、汽車、物流、能源和公共。網路切片可以實現可編程的網路實例,以滿足各個使用案例、用戶類型和應用程式的要求。

- 從網路類型來看,5G網路成長速度顯著。這種成長歸因於多種因素,包括對高速連接、軟體定義網路、虛擬、技術進步和產業協作的需求不斷增加。日本政府最近一直在尋求透過支援開放無線存取網路 (RAN) 技術來促進安全 5G通訊網路的部署。

- 其他亞太地區通訊業者正在積極採用 C-RAN 結構和網路虛擬來應對不斷上升的部署成本。近年來,隨著區域通訊業者尋求健康的經營模式以及設備供應商嘗試重組以更好地適應其業務,融合無線接取網路的重要性日益增加。印度、韓國和馬來西亞等國家正在開發 C-RAN 架構,以有效滿足不斷成長的客戶需求。

雲端無線接取網路產業概覽

雲端無線接取網路市場較為分散,競爭對手之間的競爭非常激烈,策略聯盟顯著增加。來自買家的需求正在推動現有企業投資解決方案並保留合約。市場的主要企業包括思科系統公司、諾基亞公司、華為科技公司、愛立信公司和英特爾公司。

- 2023 年 10 月,諾基亞和 Elisa 宣布他們已經完成了業界首次使用內聯加速的 Cloud RAN 試驗。此次試驗在芬蘭 Elisa 總部進行,利用了該公司的商用 5G 獨立 RAN 和 5G Core。此試驗主要基於諾基亞的 anyRAN 方法,旨在確保 Cloud RAN 與專用 RAN 相比功能豐富、節能高效且效能優異。透過內聯第 1 層 (L1) 加速,可以確保上述每個方面,並可以靈活地在 x86 和基於 ARM 的生態系統之間進行選擇。

- 2023年9月,愛立信與Google擴大了與Google雲端的合作,在Google分散式雲端(GDC)上開發愛立信的Cloud RAN解決方案。愛立信表示,在 GDC 上開發愛立信 Cloud RAN 的夥伴關係旨在提供整合自動化和編配,利用 AI/ML 為通訊服務供應商帶來利益。合作夥伴在位於加拿大渥太華的愛立信OpenLab的即時網路上運行此解決方案,並成功展示了愛立信vDU(虛擬分散式單元)和vCU(虛擬中央單元)在GDC Edge上的完整實作。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 市場促進因素與限制因素簡介

- 市場促進因素

- 各個終端使用者群體對 5G 趨勢的需求不斷增加

- 需要降低4G-5G網路使用的硬體設備成本

- 市場限制

- 網路擴展所需頻寬不足,加上監管限制

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 購買者/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 技術簡介

- 雲端虛擬

- 集中式 RAN

第5章 市場區隔

- 按組件

- 解決方案

- 服務

- 專業的

- 託管

- 依網路類型

- 5G

- 4G

- LTE

- 3G(EDGE)

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 其他亞太地區

- 拉丁美洲

- 中東和非洲

- 北美洲

第6章 競爭格局

- 公司簡介

- Cisco System Inc.

- Nokia Corporation

- Huawei Technologies Co. Ltd

- Telefonaktiebolaget LM Ericsson

- Intel Corporation

- Fujitsu Limited

- Mavenir Systems Inc.

- Artiza Networks Inc.

第7章投資分析

第 8 章:市場的未來

The C-RAN Market size is estimated at USD 17.26 billion in 2025, and is expected to reach USD 51.85 billion by 2030, at a CAGR of 24.61% during the forecast period (2025-2030).

The rapid increase in capital expenditure and reduction in operational spending is expected to drive the Cloud Radio Access Network Market over the forecasted years. Also, the increasing upgrade in wireless and telecommunication technology improves 4G and 5G accessibility, thereby imposing a positive outlook on market growth.

Key Highlights

- The constant advancements in 5G technology also play a key role in driving the Cloud RAN market. 5G networks require increased capacity, low latency, and enhanced network performance, which align well with the abilities offered by C-RAN architecture. C-RAN enables the deployment of 5G networks with its centralized processing and progressive radio resource management, allowing operators to unlock the complete potential of 5G technology and provide a superior user experience.

- Furthermore, mobile operator RAN networks are expected to evolve significantly toward Cloud-based RAN solutions. In practice, most operators will adopt a hybrid strategy during the journey toward 6G simply because Cloud RAN will have to co-exist in the network with Classic RAN with a purpose-built baseband.

- The Internet of Things (IoT) is driving the development of connected devices across different sectors, such as smart cities, healthcare, agriculture, and manufacturing. To connect billions of IoT devices at once, 5G networks are being built, enabling massive connectivity. 5G networks are made more scalable and flexible by C-RAN architecture, which makes it likely to integrate IoT applications with them seamlessly. C-RAN provides dynamic resource provision to meet changing connectivity needs and rationalizes IoT traffic management by putting software-defined networking (SDN) ideas into practice and centralizing management operations.

- C-RAN can significantly decrease the cost of maintaining and deploying a wireless network. By consolidating the baseband processing purposes, C-RAN removes the requirement for dedicated hardware at each base station, decreasing the need for equipment. In addition, using software-defined networking (SDN) and virtualization technologies enables more efficient utilization of resources, further reducing costs.

- The demand for wireless communication is rising in a rapidly connected world. The need for a secure and fast wireless network has never been more critical, from smartphones to smart homes, from autonomous cars to Industrial Internet of Things devices. The challenge of spectrum scarcity, the limited number of radio frequencies that can be used to transmit mobile data, also increases with increasing demand for Internet connectivity.

Cloud Radio Access Network Market Trends

5G to be the Fastest Growing Network Type

- C-RAN enables operators to deploy 5G networks more cost-effectively by reducing hardware and operational costs, along with demand for high-speed mobile connectivity continues to rise, especially with the proliferation of IoT devices and emerging technologies like autonomous vehicles and augmented reality, the market for 5G C-RAN is expected to grow significantly in the coming years.

- The rise in adopting 5G fixed wireless access would drive the studied market over the forecasted period. The graph indicates that the 5G connections are analyzed to reach a notable 5.3 billion subscriptions, thereby contributing to the market growth rate.

- By geography, the North American region has a substantial share globally. 5G technology is widely adopted, particularly in the Cloud Radio Access Network (C-RAN) market. C-RAN leverages cloud computing to centralize and virtualize baseband processing functions, offering flexibility and scalability.

- With 5G's high data rates, low latency, and massive connectivity capabilities, it is well-suited to C-RAN deployments, enhancing network performance and enabling advanced services like IoT and augmented reality. This combination of 5G and C-RAN drives innovation and efficiency in the telecommunications industry across North America.

- In December 2023, AT&T announced plans to be a key provider in the United States in commercial-scale open radio access network (Open RAN) deployment. In collaboration with Ericsson, this industry move will further the telecommunications industry efforts and help build a more robust ecosystem of network infrastructure providers and suppliers. AT&T's and Ericsson's multiyear joint commitment to Open RAN deployment comes at a pivotal moment in the 5G innovation cycle.

Asia-Pacific is Expected to Register the Fastest Growth

- Several factors drive the C-RAN market in China as the country has a thriving domestic C-RAN ecosystem with several significant players, such as Huawei and ZTE. China is aggressively deploying 5G networks, and C-RAN is considered a key technology to allow efficient network performance and support diverse 5G use cases.

- In China, the widespread adoption of 5G mobile networks is supporting various service types, such as healthcare, automotive, logistics, energy, and public safety. Network slicing enables programmable network instances that match the requirements of individual use cases, subscriber types, and applications.

- By network type, the 5G network is growing at a considerable rate. This growth is attributed to several factors, including increased demand for high-speed connectivity, software-defined networking, virtualization, technological advancements, and industry collaboration. The Japanese government has been trying significantly to promote the deployment of secure 5G telecommunications networks in recent years by supporting open radio access network (RAN) technology, which can further accommodate better vendor flexibility when building those networks.

- Operators in the Rest of Asia-Pacific region are actively embracing C-RAN structure and network virtualization to tackle increasing deployment costs. Centralized radio access networks have gained increased significance in recent years as regional operators seek sound business models and equipment vendors try to reshape the landscape to suit their businesses. Countries such as India, South Korea, and Malaysia are developing C-RAN architectures to cater to growing customer demands effectively.

Cloud Radio Access Network Industry Overview

The cloud radio access network market is fragmented, and the intensity of competitive rivalry is high due to the significant growth in strategic collaborations. The demand from the buyers has actively led the incumbents to invest in solutions and keep the contracts intact; some of the key players in the market are Cisco Systems Inc., Nokia Corporation, Huawei Technologies Co. Ltd, Telefonaktiebolaget LM Ericsson, and Intel Corporation.

- In October 2023, Nokia and Elisa declared that they had completed the industry's first trial of Cloud RAN, which was powered by In-Line acceleration. The successful trial occurred at Elisa's headquarters in Finland, where it utilized its commercial 5G Standalone RAN and 5G Core. The trial mainly builds on Nokia's anyRAN approach, which was established to ensure the feature richness, energy efficiency, and high performance of Cloud RAN compared to purpose-built RAN. Using In-Line layer 1 (L1) acceleration ensures each of these aspects while allowing flexibility to select between x86 and ARM-based ecosystems.

- In September 2023, Ericsson and Google expanded their partnership with Google Cloud to develop an Ericsson Cloud RAN solution on Google Distributed Cloud (GDC). As per Ericsson, the partnership to develop an Ericsson Cloud RAN on GDC aims to offer integrated automation and orchestration and leverage AI /ML for communications service providers to benefit from. The partners successfully demonstrated the complete implementation of the Ericsson vDU (virtualized distributed unit) and vCU (virtualized central unit) on GDC Edge, running the solution on a live network in the Ericsson Open Lab in Ottawa, Canada.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Rising Demand of 5G Trend Across Various End-user Segment

- 4.3.2 Need to Eliminate the Cost of Hardware Equipment Used in 4G-5G Network

- 4.4 Market Restraints

- 4.4.1 Scarce Spectrum Availability for Network Expansion When Combined With Regulatory Limits

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.6.1 Cloud-Virtualization

- 4.6.2 Centralized-RAN

5 MARKET SEGMENTATION

- 5.1 By Components

- 5.1.1 Solution

- 5.1.2 Services

- 5.1.2.1 Professional

- 5.1.2.2 Managed

- 5.2 By Network Type

- 5.2.1 5G

- 5.2.2 4G

- 5.2.3 LTE

- 5.2.4 3G (EDGE)

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cisco System Inc.

- 6.1.2 Nokia Corporation

- 6.1.3 Huawei Technologies Co. Ltd

- 6.1.4 Telefonaktiebolaget LM Ericsson

- 6.1.5 Intel Corporation

- 6.1.6 Fujitsu Limited

- 6.1.7 Mavenir Systems Inc.

- 6.1.8 Artiza Networks Inc.