|

市場調查報告書

商品編碼

1523340

滴灌:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Drip Irrigation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

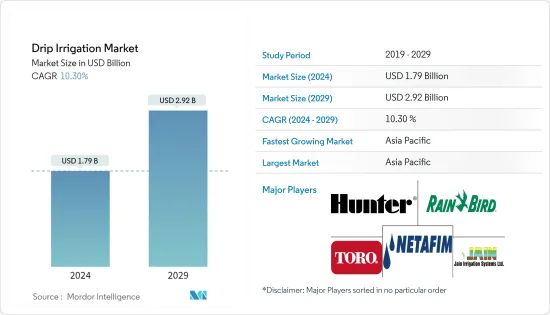

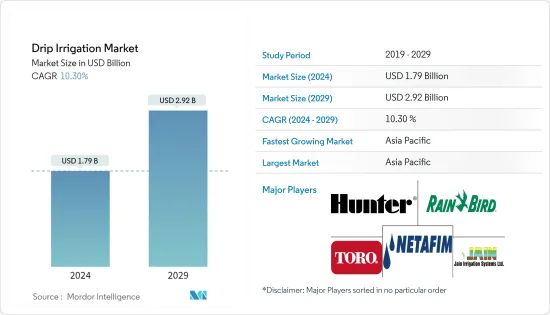

滴灌市場規模預計到 2024 年為 17.9 億美元,預計到 2029 年將達到 29.2 億美元,在市場估計和預測期間(2024-2029 年)複合年成長率為 10.30%。

灌溉是農業和作物生產的重要組成部分。製造商創造了設備和技術,為農民提供最重要的滴灌系統。政府補貼和政策、技術創新以及對水資源短缺日益成長的擔憂等因素正在推動市場的發展。近年來,滴灌技術在各地的推廣應用有所增加。滴灌系統最大的市場是亞太地區。亞太地區最大的滴灌市場是印度。滴灌系統市場的主要市場參與者專注於策略規劃、產品開拓活動和併購。例如,2024年2月,Mayar Holding子公司沙烏地阿拉伯滴灌公司與美國Hunter Industries合作,設計滴灌產品,廣泛應用於農業、住宅、商業房地產和高爾夫球場等領域。此次合作超越了傳統製造,專注於灌溉領域創新節水和節能解決方案的開發和自訂製造。

滴灌市場趨勢

缺水與棚蔬菜產量快速成長

自動滴灌對於土壤濕度管理至關重要,特別是對於專業溫室蔬菜。滴灌系統的全自動化為土壤濕度保持和澆水提供了一種簡單而深入的方法。有效的時間管理、消除人為錯誤以及估計和調整可用土壤濕度水平正在增加對自動滴灌系統的需求。此外,這些系統預計將增加單位產量的利潤。

缺水是一些棚菜農面臨的主要問題。溫室蔬菜需要大量的水,因此農民正在轉向噴灌或滴灌系統來提高作物生產力。因此,滴灌系統獲得了極大的普及,主要是在東南歐國家等地區,主要是為了增加溫室蔬菜的產量。此外,這些系統還可以提高作物生產力,最大限度地減少化學肥料和水的使用,並降低病原體侵襲的風險。無肥栽培主要用於美國、加拿大、日本、中東和歐洲的溫室蔬菜生產。

亞太地區是滴灌的主要市場

微灌溉系統的日益普及、農業技術的不斷升級以及對現代農業技術和灌溉系統的認知不斷增強,正在推動該地區的市場發展。此外,人口成長、糧食安全問題、作物生產力提高以及政府對永續農業實踐的舉措(特別是在印度和中國)正在加強市場成長。例如,2023年,耐特菲姆透過中央邦Shivpuri區Khajuri、Kolaras和Pohari地區的四個美好生活農業(BLF)中心向番茄種植者提供滴灌系統。該舉措預計將使馬哈拉斯特拉邦的番茄產量提高 40%,並鼓勵採用滴灌系統。此外,中國實行大量用水農業,耕地用水量佔全國比例最高,達60%以上。為了滿足人民的高糧食需求,該國實施了高效灌溉措施,糧食產量從2021年的6.186億噸增加到2022年的6.351億噸。

滴灌行業概況

全球滴灌市場整合,領導企業控制大部分市場佔有率。市場上主要企業包括 Netafim Limited、Jain Irrigation Systems Limited、The Toro Company、Hunter Industries 和 Rain Bird Corporation。最常用的策略是透過向市場推出創新的新產品來擴大產品系列。其他主要企業透過聯盟和合併鞏固了自己的地位。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 缺水威脅

- 政府優惠政策及補貼

- 市場限制因素

- 初始資本投資高

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 目的

- 地表滴灌

- 地下滴灌

- 作物類型

- 田間作物

- 蔬菜作物

- 果園作物

- 葡萄園

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Jain Irrigation Systems Ltd

- The Toro Company

- Netafim Limited

- Rain Bird Corporation

- Chinadrip Irrigation Equipment Co. Ltd

- Antelco Pty Ltd

- TL Irrigation

- Sistema Azud

- Metzer Group

- Hunter Industries Inc.

第7章 市場機會及未來趨勢

The Drip Irrigation Market size is estimated at USD 1.79 billion in 2024, and is expected to reach USD 2.92 billion by 2029, growing at a CAGR of 10.30% during the forecast period (2024-2029).

Irrigation is a critical component of agriculture and crop production. Manufacturers have created equipment and techniques to provide farmers with paramount drip irrigation systems. Factors such as government subsidies and policies, technological innovations, and increasing concerns over water scarcity drive the market. In recent years, drip irrigation implementation has increased in different regions. The Asia-Pacific has the largest market for drip irrigation systems. India is the largest market in Asia-Pacific for drip irrigation. The major market players operating in the drip irrigation systems market are focusing on strategic planning, product development activities, and mergers and acquisitions. For instance, in February 2024, the Saudi Drip Irrigation Company, a subsidiary of Mayar Holding, collaborated with the American firm Hunter Industries to design drip irrigation products for a broad spectrum of applications, including agriculture, residential, commercial, and golf courses. The collaboration seeks to transcend conventional manufacturing, focusing on developing innovative water and energy-saving solutions and custom manufacturing within the irrigation sector.

Drip Irrigation Market Trends

Water Scarcity and Rapid Growth in Greenhouse Vegetable Production

Automatic drip irrigation is essential for controlling soil moisture, especially for specialized greenhouse vegetables. Total automation of drip irrigation systems provides a simple, meticulous method for maintaining soil moisture and applying water. Effective time management, elimination of human errors, estimation, and adjustment of available soil moisture levels augment the demand for automatic drip irrigation systems. Furthermore, these systems are expected to increase profits generated per yield.

Water scarcity is a primary issue faced by several greenhouse vegetable farmers. As greenhouse vegetables require ample water, farmers are switching to sprinkler and drip irrigation systems to achieve higher crop productivity. Thus, drip irrigation systems are gaining immense popularity in regions, mainly southeast European countries, primarily to increase the production of greenhouse vegetables. Furthermore, these systems improve crop productivity and minimize the use of fertilizers and water, along with the risk of pathogen attacks. In the United States, Canada, Japan, the Middle East, and Europe, soilless culture is primarily used to produce greenhouse vegetables.

Asia-Pacific Is The Major Market For Drip Irrigation

Growing adoption of micro-irrigation systems, rising technological upgradation in the agriculture industry, and increasing awareness of modern farming technology and irrigation systems are driving the market in the region. In addition, the increasing population, especially in India and China, food security concerns, improvement in crop productivity, and government initiatives toward sustainable farming practices are strengthening the market growth. For instance, in 2023, under the initiative, Netafim provided drip irrigation systems for tomato growers through four Better Life Farming (BLF) Centers present in the Khajuri, Kolaras, and Pohari regions of the Shivpuri district in Madhya Pradesh. The initiative would increase the tomato crop yield by 40%, resulting in higher adoption of drip irrigation systems in Maharashtra. Moreover, China is involved in water-intensive agricultural practices and consumes the highest proportions of its water, with more than 60% usage in cultivated land. To meet the high population demand for food, efficient irrigation practices are being implemented in the country, resulting in increased cereal production from 618.6 million tons in 2021 to 635.1 million tons in 2022.

Drip Irrigation Industry Overview

The global drip irrigation market is consolidated, with major players occupying most of the market share. Some key players in the market include Netafim Limited, Jain Irrigation Systems Limited, The Toro Company, Hunter Industries, and Rain Bird Corporation. The most adopted strategy is broadening the product portfolio by introducing new and innovative products into the market. The other prominent players are strengthening their position through partnerships and mergers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Threat of Water Scarcity

- 4.2.2 Favorable Government Policies and Subsidies

- 4.3 Market Restraints

- 4.3.1 High Initial Capital Investments

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Surface Drip Irrigation

- 5.1.2 Subsurface Drip Irrigation

- 5.2 Crop Types

- 5.2.1 Field Crops

- 5.2.2 Vegetable Crops

- 5.2.3 Orchard Crops

- 5.2.4 Vineyards

- 5.2.5 Other Crops

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Spain

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Rest of the Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of the Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Jain Irrigation Systems Ltd

- 6.3.2 The Toro Company

- 6.3.3 Netafim Limited

- 6.3.4 Rain Bird Corporation

- 6.3.5 Chinadrip Irrigation Equipment Co. Ltd

- 6.3.6 Antelco Pty Ltd

- 6.3.7 T-L Irrigation

- 6.3.8 Sistema Azud

- 6.3.9 Metzer Group

- 6.3.10 Hunter Industries Inc.