|

市場調查報告書

商品編碼

1523344

己烷:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Hexane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

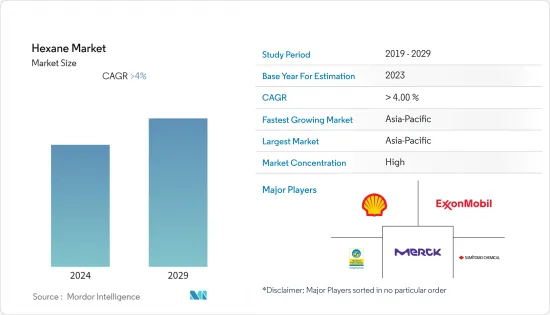

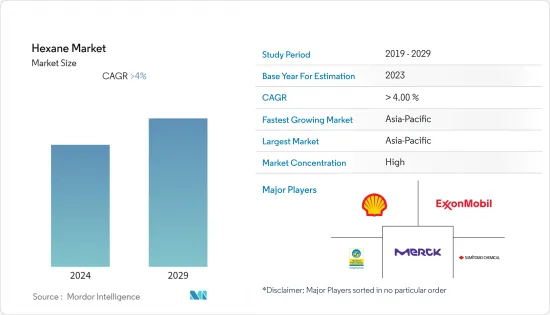

己烷市場規模預計到2024年為22.4億美元,預計到2029年將達到28億美元,在預測期內(2024-2029年)複合年成長率為4.57%。

COVID-19大流行對2020年市場產生了負面影響,主要是由於工業活動減少和供應鏈中斷。然而,從2021年起,食用油銷售量的增加正在提振疫情後的己烷需求。

*短期內,食用油提取需求的增加和石化行業需求的增加預計將在預測期內推動市場成長。

*環己烷等更安全的石油採集替代品的出現預計將在預測期內推動市場成長。

*己烷作為溶劑在油漆和塗料行業的新興應用預計將在未來幾年帶來新的成長機會。

*在預測期內,亞太地區預計將擁有最大的市場佔有率和最高的複合年成長率。食用油消費的快速成長,尤其是在中國、印度和日本,預計將推動該地區的市場成長。

己烷市場趨勢

食用油提取佔市場主導地位

- 己烷是一種越來越受歡迎的溶劑,用於從花生、大豆、玉米以及各種種子和蔬菜中提取食用油。

- 己烷是一種比石油醚或乙酸乙酯更有效的油萃取溶劑。它很容易與植物油混合,可以清洗纖維、蛋白質、糖和不需要的牙齦,而不會干擾它們。

- 因此,消費者越來越意識到精製如何影響他們的健康,導致食用油的消費量增加。

- 此外,與食品相關的健康問題(例如高膽固醇和肥胖)的增加導致消費者願意為健康食品支付更高的價格。

- 在全球範圍內,具有其他健康益處的食用油,例如富含Omega-3、維生素、谷維素和天然抗氧化劑的油,在許多國家越來越受歡迎。

- 根據美國農業部預測,2023-2024年全球植物油產量約2,2285萬噸。據估計,90%的棕櫚油用於食品,其餘10%用於工業用途,如化妝品和燃料/柴油。豆油是消費量最大的油料,2022年全球消費量將達6,168萬噸。

- 在美國,2023年豆油是所有食用油中消費量最大的。那一年,美國人消費了約 1,234 萬噸豆油,而棕櫚油消費量約 189 萬噸。大豆油常用於煎炸食品、魚罐頭、調味品和人造奶油。

- 基於上述情況,在預測期內,食用油提取應用可能是市場上最受歡迎的。

亞太地區主導市場

- 在預測期內,預計己烷市場將由亞太地區主導。己烷主要用於萃取食用油,然後用作油漆、清漆和油墨的溶劑。它也用於實驗室分析,從土壤和水中提取油污和脂肪污漬。

- 該地區是七個主要植物油生產國中的四個的所在地:印度尼西亞、中國、馬來西亞和印度。這些國家分別是世界第一、第二、第三和第七大植物油生產國。這四個國家的植物油產量合計約佔全球整體植物油產量的50%。

- 根據美國農業部統計,2023年至2024年,印尼、中國、馬來西亞和印度的植物油生產總量預計分別為5,332萬噸、2,950萬噸、2,127萬噸和947萬噸,分別。

- 從消費量來看,中國是最大的植物油消費國,其次是印尼和印度。

- 在中國,大豆油是消費最多的食用油,其次是菜籽油、棕櫚油和花生油。

- 己烷不僅在石油開採中具有重要的應用,而且在工業製程和添加劑燃料中也有重要的應用。

- 亞太地區是世界上一些最有價值的汽車製造商的所在地。中國、印度、日本和韓國等國家正在努力透過加強製造基礎和創建高效的供應鏈來提高盈利。

- 根據中國工業協會(CAAM)統計,中國是全球最重要的汽車生產基地,2023年汽車產量達30,160,966輛,比去年的27,020,615輛成長11.6%。根據國際貿易管理局(ITA)預測,到2025年,國內汽車產量預計將達到3,500萬輛。

- 所有上述因素都可能對未來幾年的市場產生重大影響。

己烷市場產業概況

己烷市場部分整合,少數大公司佔了市場的很大一部分。主要公司(排名不分先後)包括埃克森美孚、巴拉特石油公司(BPCL)、中國石油化學股份有限公司(中石化)、住友化學和殼牌公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 石化產業需求增加

- 食用油萃取需求增加

- 其他司機

- 抑制因素

- 更安全的替代油的可用性

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 按類型

- 正己烷

- 異己烷

- 新己烷

- 按年級

- 聚合物級

- 食品級

- 其他等級

- 按用途

- 工業溶劑

- 食用油抽取劑

- 清洗/除油

- 其他用途(熱分析液、農業化學品、添加劑燃料、黏劑/密封劑)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- Bharat Petroleum Corporation Limited(BPCL)

- China Petrochemical Corporation(Sinopec)

- Exxon Mobil Corporation

- GFS Chemicals Inc.

- Hindustan Petroleum Corporation Limited(HPCL)

- Indian Oil Corporation Ltd

- Jun Yuan Petroleum Group

- Liaoning Yufeng Chemical Co. Ltd

- Phillips 66 Company

- Rompetrol

- Shell plc

- Shenyang Huifeng Petrochemical Co. Ltd

- Sumitomo Chemical Co. Ltd

- THAI OIL GROUP

第7章 市場機會及未來趨勢

- 己烷作為油漆和塗料溶劑的新用途

- 其他機會

The Hexane Market size is estimated at USD 2.24 billion in 2024, and is expected to reach USD 2.80 billion by 2029, growing at a CAGR of 4.57% during the forecast period (2024-2029).

The COVID-19 pandemic negatively impacted the market in 2020, primarily due to reduced industrial activities and disruptions in the supply chain. However, since 2021, rising sales of edible oils have propelled the demand for hexane after the pandemic.

* Over the short term, the increasing demand for edible oil extraction and growing demand from petrochemical industries is expected to drive the market's growth during the forecast period.

* The availability of safer alternatives for oil extraction, such as cyclohexane, is expected to spur market growth during the forecast period.

* The emerging application of hexane in the paint and coatings industry as a solvent is expected to offer new growth opportunities during the coming years.

* During the forecast period, Asia-Pacific is expected to have the largest market share and the highest CAGR. The surging consumption of edible oils, especially in China, India, and Japan, is projected to drive regional market growth.

Hexane Market Trends

Edible Oil Extraction to Dominate the Market

- For the extraction of edible oils from peanuts, soybeans, corn, and various seed and vegetable crops, hexane has become an increasingly common solvent.

- Hexane is a more efficient solvent than petroleum ether and ethyl acetate for extracting oil. It's easy to mix with vegetable oil and wash it without disturbing the fiber, protein, sugar, or undesirable gum.

- As a result, consumers are becoming more aware of how refined oils affect their health, and this is leading to an increase in the consumption of edible oils.

- In addition, due to the increasing health problems related to food, such as high cholesterol and obesity, consumers are increasingly willing to pay higher prices for healthy food products.

- Globally, edible oils with additional health benefits, such as oils high in omega-3, vitamins, oryzanol, natural antioxidants, and others, are gaining popularity in many countries.

- As per the US Department of Agriculture, global vegetable oil production amounted to around 222.85 million metric tons during 2023-2024. It is estimated that 90% of palm oil is used for food consumption, whereas industrial consumption, such as cosmetic products or fuel and diesel, claims the remaining 10%. Soybean oil is the most significant consumed oil, amounting to 61.68 million tons globally in 2022.

- In the United States, soybean oil had the highest level of consumption of any edible oil in 2023. In that year, Americans consumed about 12.34 million tons of soybean oil, compared to about 1.89 million tons of palm oil. Soybean oil is often found in fried foods, canned fish, salad dressing, and margarine.

- Owing to all the abovementioned facts, it is likely that the edible oil extraction application will be the most popular in the market during the forecast period.

Asia-Pacific to Dominate the Market

- The hexane market is expected to be dominated by the Asia-Pacific during the forecast period. Hexane is majorly used in edible oil extraction, followed as a solvent in paints, varnishes, and inks. In addition, for analysis in laboratories, it is used to extract oil and grease contamination from soil and water.

- The region is home to four out of seven top major vegetable oil-producing nations, i.e., Indonesia, China, Malaysia, and India. These countries are first, second, third, and seventh largest vegetable oil-producing countries worldwide, respectively. These four countries combined accounted for about 50% of the total vegetable oil produced globally.

- According to the US Department of Agriculture, for the year 2023-2024, the total vegetable oil produced by Indonesia, China, Malaysia, and India was estimated at 53.32 million metric tons, 29.50 million metric tons, 21.27 million metric tons, and 9.47 million metric tons, respectively.

- On the basis of consumption, China is the largest consumer of vegetable oils, followed by Indonesia and India.

- In China, soybean oil is the most consumed edible oil, followed by rapeseed oil, palm oil, and peanut oil; collectively, these four significant oils account for approximately 90% of the country's total consumption.

- Along with oil extraction, hexane also finds significant application in industrial processes as well as additive fuel.

- The Asia-Pacific region is home to some of the world's most valuable vehicle manufacturers. Countries like China, India, Japan, and South Korea have been working hard to strengthen their manufacturing bases and develop efficient supply chains for greater profitability.

- According to the China Association of Automobile Manufacturers (CAAM), China has the most significant automotive production base in the world, with a total vehicle production of 30,160,966 units in 2023, registering an increase of 11.6% compared to 27,020,615 units produced last year. As per the International Trade Administration (ITA), domestic automotive production is expected to reach 35 million units by 2025.

- All the above factors are likely to have a significant effect on the market over the next few years.

Hexane Market Industry Overview

The hexane market is partially consolidated and consists of a few major players dominating a significant portion of the market. Some of the major companies (in no particular order) are Exxon Mobil Corporation, Bharat Petroleum Corporation Limited (BPCL), China Petrochemical Corporation (Sinopec), Sumitomo Chemical Co. Ltd, and Shell PLC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand from Petrochemical Industries

- 4.1.2 Increasing Demand for Edible Oil Extraction

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Availability of Safer Alternatives for Oil Extraction

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 n-Hexane

- 5.1.2 Isohexane

- 5.1.3 Neohexane

- 5.2 By Grade

- 5.2.1 Polymer Grade

- 5.2.2 Food Grade

- 5.2.3 Other Grades

- 5.3 By Application

- 5.3.1 Industrial Solvents

- 5.3.2 Edible Oil Extractant

- 5.3.3 Cleansing and Degreasing

- 5.3.4 Other Applications ( Thermometric Fluid, Agricultural Chemicals, Additive Fuel, and Adhesives and Sealants)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share(%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Bharat Petroleum Corporation Limited (BPCL)

- 6.4.2 China Petrochemical Corporation (Sinopec)

- 6.4.3 Exxon Mobil Corporation

- 6.4.4 GFS Chemicals Inc.

- 6.4.5 Hindustan Petroleum Corporation Limited (HPCL)

- 6.4.6 Indian Oil Corporation Ltd

- 6.4.7 Jun Yuan Petroleum Group

- 6.4.8 Liaoning Yufeng Chemical Co. Ltd

- 6.4.9 Phillips 66 Company

- 6.4.10 Rompetrol

- 6.4.11 Shell plc

- 6.4.12 Shenyang Huifeng Petrochemical Co. Ltd

- 6.4.13 Sumitomo Chemical Co. Ltd

- 6.4.14 THAI OIL GROUP

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Application of Hexane in the Paints and Coatings as a Solvent

- 7.2 Other Opportunities