|

市場調查報告書

商品編碼

1523345

浸漬樹脂:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Impregnating Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

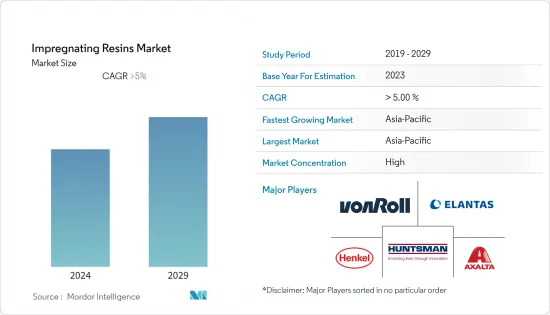

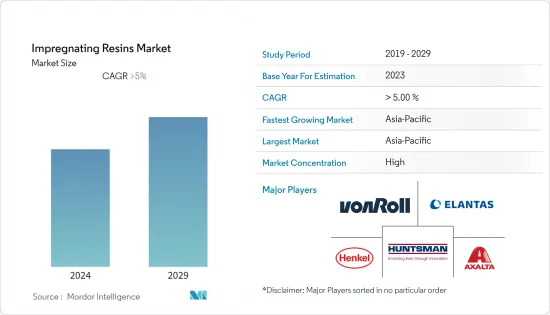

浸漬樹脂市場規模預計2024年為15.8億美元,預計2029年將達到20.6億美元,在預測期內(2024-2029年)複合年成長率預計將超過5%。

由於封鎖、社交距離和貿易制裁導致全球供應鍊網路嚴重中斷,COVID-19 大流行阻礙了市場成長。由於活動停止,所有主要最終用戶行業均出現下滑。然而,這種情況預計將在 2021 年恢復,並在預測期內使市場受益。

主要亮點

- 該市場是由電氣和電子領域浸漬樹脂的廣泛使用以及電動車產量的增加所推動的。

- 然而,溶劑型樹脂的低效率限制了市場的成長。

- 然而,環保配方的開發為可再生能源、航太和先進電氣系統等應用的成長和創新指明了道路。

- 亞太地區主導市場,其中印度、中國和日本為主要消費地區。

浸漬樹脂市場趨勢

對電氣和電子元件的需求增加

- 浸漬樹脂被認為是二次絕緣體,並作為液體樹脂佔據重要地位,可提供電絕緣、防止環境變化並確保機械穩定性。

- 以樹脂浸漬繞組和銅線可增強絕緣,防止振動,提高正常運作期間的抗應力、溫度負載和熱交換能力,並降低繞組短路的風險。

- 樹脂因其能夠阻擋電流而被廣泛應用於電子和電氣領域,使其成為絕緣積體電路、電晶體和印刷電路基板的理想選擇。

- 浸漬樹脂在電腦和配件中極為重要,為印刷電路基板、電連接器、電源、電子設備和電路組件等組件提供絕緣和保護,有助於提高可靠性和耐用性。

- 根據美國人口普查局的數據,2022 年美國電腦及電腦配件出口達 184.3 億美元,較 2021 年的 175.7 億美元有所成長。

- 同樣,根據加拿大廣播電視和通訊委員會的數據,2022 年加拿大電視總收入達 65.72 億加元(48.4182 億美元),較上年資料有所成長。

- 在全球對尖端消費性電子產品的需求迅速成長的推動下,浸漬樹脂市場具有擴大的潛力。特別是在德國,根據 ZVEI 的報告,電子和數位產業到 2023 年將創造 2,390 億歐元的收入,佔該國工業總產值的 10%。

- 德國是全球領先的發電機、變壓器和馬達生產國,根據德國聯邦統計局的預測,到2025年德國馬達、發電機和變壓器的生產收益將增加至195.1億美元左右,比去年同期成長185億美元前為185 億美元。

- 此外,根據JEITA(電子情報技術產業協會)資料,2022年11月電子產業實現總產值70.9834億美元,日本2022年12月實現總產值83954.5億美元出口。

- 由於這些因素,對電氣和電子元件的需求不斷成長預計將在未來幾年推動對浸漬樹脂的需求。

亞太地區主導市場

- 預計亞太地區在預測期內將在浸漬樹脂市場佔據較高佔有率。由於中國、印度和日本的電氣和汽車製造設施不斷成長,浸漬樹脂的需求和使用可能會在預測期內擴大市場範圍。

- 中國是全球最大的電子產品生產基地。電視、智慧型手機、電線、電纜、可攜式運算設備、遊戲系統和其他個人電子產品等電子產品在家用電子電器領域中成長最快。

- 根據中國國家統計局的數據,2023年12月中國家電和家用電子電器零售額約為772.5億元人民幣(107.3億美元)。

- 近年來,印度對電子產品的需求不斷增加。印度是全球第二大行動電話製造國,網路普及率很高。印度政府對電子硬體非常感興趣,因為它是「印度製造」、「數位印度」和「印度新創公司」計畫中最重要的部分之一。

- 印度商工部數據顯示,2022年4月至12月印度電子產品出口額為66.7億美元,較去年同期的109.9億美元成長51.56%。

- 半導體也用於汽車工業。隨著全球電動車銷量的不斷增加,電動車生產中對半導體的需求不斷增加,這對浸漬樹脂的需求產生正面影響。

- 根據國際能源總署的數據,2021 年至 2022 年日本電動車銷量從 1.2% 成長至 3%。

- 同樣,根據國土交通省的數據,2022年韓國註冊的389,960輛電動車中,約303,300輛將被歸類為乘用車,同期另有81,240輛電動貨車已註冊。

- 因此,由於各種應用的需求不斷成長,亞太地區可能成為未來幾年浸漬樹脂最重要的市場。

浸漬樹脂產業概況

浸漬樹脂市場是部分一體化的,由國際和地區參與者組成。排名前五的公司佔據了相當大的市場佔有率。主要企業(排名不分先後)包括 Elantas GmbH、Henkel AG &Co.KGaA、Axalta Coating Systems、Huntsman International LLC 和 3M。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 擴大在電氣和電子領域的應用

- 電動車產量增加

- 其他司機

- 抑制因素

- 溶劑型樹脂的效率降低

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 依技術

- 無溶劑樹脂

- 溶劑型樹脂

- 依樹脂類型

- 聚酯纖維

- 環氧樹脂

- 聚酯醯亞胺

- 其他樹脂類型

- 按用途

- 馬達和發電機

- 家用電器

- 變壓器

- 電氣/電子零件

- 車

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析**/市場排名分析

- 主要企業策略

- 公司簡介

- 3M

- AEV Ltd

- Axalta Coating Systems LLC

- Borger GmbH

- Chetak Manufacturing Company

- ELANTAS GmbH

- Henkel AG & Co. KGaA

- Huntsman International LLC

- NIPPON RIKA INDUSTRIES CORPORATION

- Momentive

- Polycast Industries Inc.

- Wacker Chemie AG

第7章 市場機會及未來趨勢

- 開發環保配方

The Impregnating Resins Market size is estimated at USD 1.58 billion in 2024, and is expected to reach USD 2.06 billion by 2029, growing at a CAGR of greater than 5% during the forecast period (2024-2029).

The COVID-19 pandemic hindered market growth due to massive disruptions to global supply chain networks resulting from lockdowns, social distances, and trade sanctions. All major end-user industries witnessed a decline due to the halt in activities. However, the condition was expected to recover in 2021 and benefit the market during the forecast period.

Key Highlights

- The market is driven by the growing use of impregnating resins in the electrical and electronics sectors and the increasing electric vehicle production.

- However, the low efficiency of solvent-based resins is restraining the growth of the market.

- Nevertheless, the development of eco-friendly formulations presents avenues for growth and innovation in applications such as renewable energy, aerospace, and advanced electrical systems.

- Asia-Pacific dominates the market studied, with India, China, and Japan recording primary consumption.

Impregnating Resins Market Trends

Increasing Demand for Electrical and Electronics Components

- Impregnating resins, recognized as secondary insulators, hold significance as liquid resins that offer electrical insulation, safeguard against environmental variations, and ensure mechanical stability.

- Impregnating windings and copper wires with resin enhances insulation, prevents vibration, and increases resistance to stresses, temperature loads, and heat exchange during regular operation, thereby reducing the risk of short circuits in the windings.

- Resins are extensively employed in the electronics and electrical sectors due to their efficacy in impeding the flow of electricity, serving as the predominant choice for insulating integrated circuits, transistors, and printed circuit boards.

- Impregnating resins are crucial in computers and accessories, providing insulation and protection for components such as printed circuit boards, electrical connectors, power supplies, electronic devices, and circuit assemblies, contributing to reliability and durability.

- According to the US Census Bureau, the export value of computers and computer accessories from the United States reached USD 18.43 billion in 2022 and registered growth when compared to USD 17.57 billion in 2021.

- Similarly, according to the Canadian Radio-television and Telecommunications Commission, the total television revenue in Canada was valued at CAD 6,572 million (USD 4841.82 million ) in 2022 and registered a hike when compared to the previous year's data.

- The impregnating resins market has the potential for expansion, driven by the surging demand for cutting-edge consumer electronics on a global scale; notably, in Germany, the electronics and digital industry generated EUR 239 billion in 2023, constituting 10% of the country's total industrial output, as reported by the ZVEI.

- Germany stands as a prominent global producer of generators, transformers, and electric motors, with projections from the Statistisches Bundesamt indicating that the revenue from manufacturing electric motors, generators, and transformers in Germany is expected to reach around USD 19.51 billion by 2025, showing an increase from the previous year's USD 18.5 billion.

- Further, as per JEITA (Japan Electronics and Information Technology Industries Association) data, the electronics industry achieved a total production of USD 7,098.34 million in November 2022, while Japan exported electronics valued at USD 8,395.45 million in December 2022.

- Owing to these factors, the escalating demand for electrical and electronic components is anticipated to drive the demand for impregnating resins in the forthcoming years.

Asia-Pacific to Dominate the Market

- Asia-Pacific is expected to capture a high share of the impregnating resins market during the forecast period. Due to growing electrical and automobile manufacturing facilities in China, India, and Japan, the demand for and utilization of impregnating resins may increase the scope of the market during the forecast period.

- China is the largest base for electronics production in the world. Electronic products like TVs, smartphones, wires, cables, portable computing devices, gaming systems, and other personal electronic devices recorded the highest growth in the consumer electronics segment.

- According to the National Bureau of Statistics of China, in December 2023, retail sales of household appliances and consumer electronics in China accounted for about CNY 77.25 billion (USD 10.73 billion).

- India has witnessed a rise in demand for electronic goods in recent years. This is because India is the world's second-largest maker of mobile phones and registers a high internet penetration rate. The Indian government gives electronics hardware a lot of attention because it is one of the most important parts of the Make in India, Digital India, and Start-up India programs.

- In India, according to the Commerce and Industry Ministry, the exports of electronic goods recorded USD 6.67 billion from April to December 2022, compared to USD 10.99 billion during the same period last year, registering a growth of 51.56%.

- Semiconductors are also used in the automotive industry. The demand for semiconductors in manufacturing electric vehicles is increasing with the growing number of electric vehicles sold worldwide, therefore positively impacting the demand for impregnating resins.

- According to the International Energy Agency, sales of electric vehicles in Japan increased from 1.2% to 3% from 2021 to 2022.

- Likewise, according to the Ministry of Land, Infrastructure and Transport, in 2022, around 303.3 thousand out of the 389.96 thousand registered electric vehicles in South Korea were categorized as passenger cars, with an additional approximately 81.24 thousand electric vans registered during the same period.

- Therefore, Asia-Pacific is likely to be the most significant market for impregnating resins over the next few years because of the growing demand from different applications.

Impregnating Resins Industry Overview

The impregnating resins market is partially consolidated and consists of international and regional players. The top five players account for a notable share of the market. The major companies (not in any particular order) are Elantas GmbH, Henkel AG & Co. KGaA, Axalta Coating Systems, Huntsman International LLC, and 3M.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Usage in the Electrical and Electronics Segment

- 4.1.2 Increasing Electric Veichles Production

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Less Efficiency of Solvent-based Resin Systems

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Technology

- 5.1.1 Solventless Resins

- 5.1.2 Solvent-based Resins

- 5.2 By Resin Type

- 5.2.1 Polyester

- 5.2.2 Epoxy

- 5.2.3 Polyesterimide

- 5.2.4 Other Resin Types

- 5.3 By Application

- 5.3.1 Motors and Generators

- 5.3.2 Home Appliances

- 5.3.3 Transformer

- 5.3.4 Electrical and Electronics Components

- 5.3.5 Automotive

- 5.3.6 Other Applications

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 NORDIC Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 South Africa

- 5.4.5.3 Nigeria

- 5.4.5.4 Qatar

- 5.4.5.5 Egypt

- 5.4.5.6 United Arab Emirates

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis**/Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 AEV Ltd

- 6.4.3 Axalta Coating Systems LLC

- 6.4.4 Borger GmbH

- 6.4.5 Chetak Manufacturing Company

- 6.4.6 ELANTAS GmbH

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Huntsman International LLC

- 6.4.9 NIPPON RIKA INDUSTRIES CORPORATION

- 6.4.10 Momentive

- 6.4.11 Polycast Industries Inc.

- 6.4.12 Wacker Chemie AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Development of Eco-Friendly Formulations