|

市場調查報告書

商品編碼

1523353

機器人割草機:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Robotic Lawn Mower - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

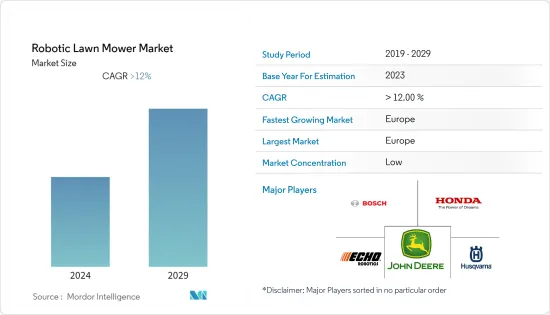

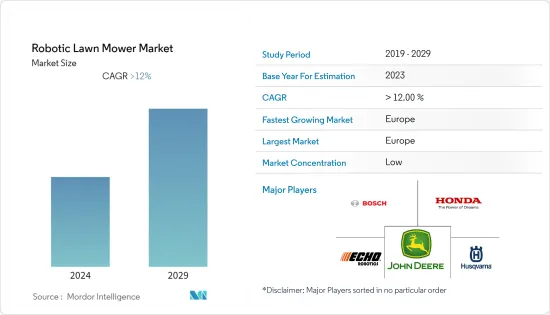

預計2024年機器人割草機市場規模為18.9億美元,2029年達37.7億美元,在預測期間(2024-2029年)複合年成長率超過12%。

人工智慧和機器人技術的進步正在創造更有效率的家用電器並減少人為干預。隨著世界各地人們收入水準的提高,這些提高美觀和使用者體驗的家用電器的銷售量不斷增加。低噪音運作、感測器、自充電和耐用性等功能預計將推動市場成長。

然而,由於機器人割草機初始設定所需的安裝成本較高,預計目標市場的成長將受到限制。

歐洲在全球市場中佔有很大佔有率,由於該地區對商務用割草機、園藝設備和自動化工具的需求很高,因此預計將快速成長。此外,客戶從傳統的汽油動力手動割草機轉向更新、更安靜、更有效率、更智慧的電池驅動機器人割草機正在拓寬歐洲的成長前景。

自主機器在清潔和割草等家庭應用中的使用顯著增加,預計這也將在預測期內推動市場成長。物聯網(IoT)和機器學習(ML)等技術的部署也在推動市場成長。這些技術可幫助割草機感知障礙物,感測器根據加速度和方向發揮作用,以提高性能並提供更好的結果。例如,博世在其割草機中同時使用人工智慧和機器學習來識別障礙物。

機器人割草機市場趨勢

從最終用戶來看,住宅領域預計將是最大的

由於都市化,世界各地人們的快節奏和忙碌的生活方式正在增加對協助日常任務的自主機器和系統的需求。此外,節省花在後院景觀、後院烹飪、花園派對和草坪維護活動上的時間的願望正在推動對各種園藝工具的需求,從而推動目標市場的發展。

全球擴張的建築業和旅遊業也正在影響市場。此外,消費者對高效割草機偏好的改變以及需要最少用戶干預的自主設備的日益普及預計將推動全球對機器人割草機的需求。

主要企業正大力投資研發,以增強機器人割草機的功能。主要企業正在將壁架感測器和雷射視覺、草坪測繪、智慧導航和自動排空等附加功能整合到其產品中,以提高性能和效率。預計市場將在不久的將來受益於更有效率的機器人割草機的增加。例如,

- 2022 年 5 月,Toro 宣布推出電池供電的住宅花園護理機器人割草機。它是業界首款具有無線導航功能的基於視覺的定位系統,使該設定易於管理。安裝可以針對每個花園進行客製化,無需進行昂貴且容易發生故障的地下邊界線建設。該公司還提供專用的智慧型手機應用程式,允許用戶自訂割草時間表。

此外,毫無疑問,鋰離子電池和機器人技術發展的最新趨勢是機器人割草機銷售增加的原因。

歐洲有望成為市場領導者

機器人割草機在歐洲的住宅和商業領域用於各種園藝和草坪維護應用。

推動該地區成長的主要因素之一是草坪的受歡迎,因為它提供了美觀的場地和花園。英國和荷蘭等國家擴大採用機器人割草機,預計將推動市場成長。

此外,許多歐洲人擁有獨立的住宅空間,通常是個人草坪和花園,這推動了對機器人割草機的需求。此外,商業領域對自動化的需求不斷成長,以及人們對機器人割草機的好處(例如無噪音工作、時間管理和節能)的認知不斷增強,正在推動該地區的市場成長。在機器人割草機中配備智慧感測控制裝置,能夠自動割草指定景觀,預計將在預測期內影響市場需求。

歐洲主要企業正在採用新技術為其客戶提供高品質的產品。促銷活動的活性化預計也將對該地區的市場產生正面影響。例如

- 2022年6月,Segway宣布將於5月底在歐洲12個國家推出Navimow機器人割草機。此列表包括英國、荷蘭、義大利和瑞典。 Navimow 提供三種型號,其中最大的一次充電可剪草面積達 3,000 平方米(32,392 平方英尺)。

機器人割草機產業概況

機器人割草機市場較為分散,多家廠商爭奪重要佔有率。機器人割草機市場的一些知名公司包括約翰迪爾、羅伯特博世、本田和富世華。本公司投入大量資金研發,開發創新、技術先進的新產品。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 除了消費者支出之外,住宅活動的活性化也將提振市場需求

- 市場限制因素

- 電動車滲透率上升將長期阻礙市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 範圍

- 低的

- 期間~

- 高的

- 最終用戶

- 商業

- 住宅

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Deere & Company

- Honda Motor Company

- Autmow Robotic Mowing

- Husqvarna AB

- ANDREAS STIHL AG & Co. KG

- WORX(Positec Tool Corporation)

- Ambrogio Robot

- The Toro Company

- Mammotion

- MTD Products Inc.

- Robert Bosch GmBH

第7章 市場機會及未來趨勢

- 技術進步

The Robotic Lawn Mower Market size is estimated at USD 1.89 billion in 2024, and is expected to reach USD 3.77 billion by 2029, growing at a CAGR of greater than 12% during the forecast period (2024-2029).

Technological advancements in artificial intelligence and robotics have created more efficient household appliances and reduced human intervention. With an increase in the income level of people living worldwide, there is an increase in sales of these appliances that enhance the aesthetics and user experience. Features like low-noise operation, sensors, self-charging, and durability are expected to drive the market growth.

However, the high installation cost required for the initial setup of a robotic lawn mower is expected to limit the growth of the target market.

Europe is expected to hold a significant share of the global market and grow rapidly due to the region's high demand for professional lawn mowers, landscaping devices, and automated tools. Furthermore, the shift of customers away from traditional gasoline-powered manual lawn mowers and toward newer, silent, efficient, smart, and battery-powered robotic mowers is broadening Europe's growth prospects.

The usage of autonomous machines in household applications such as cleaning and cutting grass has witnessed a significant increase, which is also expected to boost the market growth during the forecast period. The inclusion of technologies, such as the Internet of Things (IoT) and machine learning (ML), are also facilitating market growth. These technologies help lawn mowers sense obstacles, and the sensors work on acceleration and orientation to improve performance and provide better results. For instance, Bosch uses both AI and ML in its lawn mowers for obstacle identification.

Robotic Lawn Mower Market Trends

The Residential Segment is Expected to be the Largest Segment by End User

The fast and busy lifestyle of people across the world due to urbanization has increased the demand for autonomous machinery/systems to help people in everyday work. Additionally, increased spending on backyard beautification, backyard cookouts, and garden parties, as well as the desire to save time spent on lawn maintenance activities, are driving demand for a variety of gardening tools, which is driving the target market.

The market is also influenced by the expanding construction and tourism industries around the globe. Furthermore, shifting consumer preference for efficient lawn mowers and the growing popularity of autonomous equipment requiring minimal user intervention is expected to boost global demand for robotic lawn mowers.

Major players are investing heavily in research and development to enhance the features of robotic lawn mowers. Key players are integrating ledge sensors and additional features such as laser vision, lawn mapping, smart navigation, and self-emptying into their products to improve their performance and efficiency. The market is expected to benefit from the increased availability of more efficient robotic lawn mowers in the near future. For instance,

- In May 2022, Toro announced the launch of a battery-powered residential yard care category robotic mower. It is the industry's first vision-based localization system with wire-free navigation, making this setup manageable. It is tailored to each yard without a pricey and failure-prone underground boundary wire installation. The company also offers a dedicated smartphone application that helps users customize their mowing schedule.

Furthermore, recent advances in the development of lithium-ion batteries and robot technology are undoubtedly responsible for this increase in the sales of robotic mowers.

Europe is Expected to be the Market Leader

Robotic lawn mowers are used for various gardening and lawn-maintenance applications in Europe's residential and commercial sectors.

One of the major factors driving growth in the region is the popularity of lawns to provide aesthetic and pleasing premises and gardens. The increased adoption of robotic lawn mowers in countries like the United Kingdom and the Netherlands is expected to drive market growth.

Furthermore, many Europeans own independent residential spaces, typically private lawns and gardens, boosting demand for robotic lawn mowers. Aside from that, the rising demand for automation in the commercial sector and increased awareness of the benefits of robotic lawn mowers, such as noise-free operations, time management, and energy conservation, have boosted the market growth in the region. The inclusion of smart sensory controls in robotic lawn mowers, which enable automated mowing of a given landscape, is expected to impact market demand during the forecast period.

Key players in Europe are adopting new technologies to provide quality products to their customers. The rise in promotional activities is also expected to have a positive impact on the market in the region. For instance,

- In June 2022, Segway announced that its Navimow robot lawn mower would be available in 12 European countries by the end of May. The countries on this list include the United Kingdom, Netherlands, Italy, and Sweden. Navimow is available in three models, with the largest able to mow an area up to 3,000 m2 (32,392 ft2) between charges.

Robotic Lawn Mower Industry Overview

The robotic lawn mower market is fragmented, with several players competing for a considerable share of the market. Some of the prominent companies in the robotic lawn mower market include John Deere, Robert Bosch, Honda, and Husqvarna. The companies spend heavily on R&D to innovate and develop new and technologically advanced products.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rising Residential Activities in Addition to Consumer Spending to Enhance Market Demand

- 4.2 Market Restraints

- 4.2.1 Rising Electric Vehicle Adoption to Hinder Market Growth in the Long Run

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Range

- 5.1.1 Low

- 5.1.2 Medium

- 5.1.3 High

- 5.2 End User

- 5.2.1 Commercial

- 5.2.2 Residential

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 Italy

- 5.3.2.3 Spain

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Deere & Company

- 6.2.2 Honda Motor Company

- 6.2.3 Autmow Robotic Mowing

- 6.2.4 Husqvarna AB

- 6.2.5 ANDREAS STIHL AG & Co. KG

- 6.2.6 WORX (Positec Tool Corporation)

- 6.2.7 Ambrogio Robot

- 6.2.8 The Toro Company

- 6.2.9 Mammotion

- 6.2.10 MTD Products Inc.

- 6.2.11 Robert Bosch GmBH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements