|

市場調查報告書

商品編碼

1523369

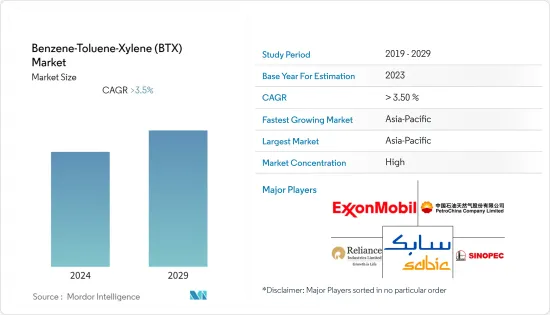

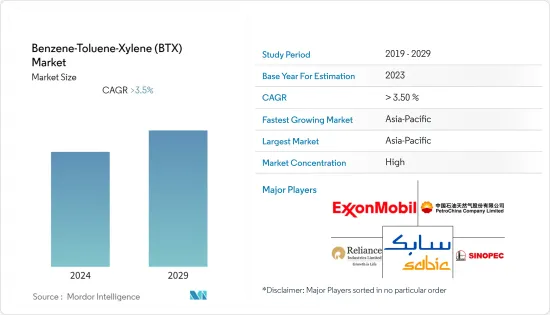

苯甲苯二甲苯(BTX)的全球市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Benzene-Toluene-Xylene (BTX) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

2024年全球苯甲苯二甲苯(BTX)市場規模將達到13761萬噸,2024-2029年預測期間複合年成長率超過4%,2029年將達到16561萬噸,預計將達到1000萬噸噸。

主要亮點

- 全球範圍內的COVID-19爆發嚴重影響了各行業的市場成長。為遏制 COVID-19 疫情而導致的計劃暫停和放緩、流動限制、生產暫停和勞動力短缺導致 BTX 市場成長放緩。然而,由於油漆和塗料、黏劑和密封劑以及化學工業等各種應用的消耗增加,2021年顯著復甦。

- 油漆、被覆劑和黏劑對甲苯的需求不斷成長預計將推動 BTX 市場的發展。此外,產能擴張投資的增加正在推動對二甲苯、二甲苯和苯的成長。

- 苯甲苯二甲苯(BTX)的毒性預計將阻礙市場成長。

- 此外,開發苯甲苯二甲苯(BTX)的永續技術的興起預計將在未來幾年為市場創造機會。

- 由於印度、中國和日本等主要國家正在獲得市場開拓,預計亞太地區將在 2024 年至 2029 年期間主導市場。

苯甲苯二甲苯 (BTX) 市場趨勢

乙苯有望在應用領域佔據主導地位

- 乙苯是在工業工廠中由苯和乙烯進行商業性生產,並透過精製石油副產品流來少量分離。它也天然存在於原油、某些天然氣和煤焦油。乙苯是一種透明、無色液體,具有芳香氣味。

- 比利時是世界主要乙苯出口國之一。 2022年,比利時乙苯出口額為3.4253億美元。位居第二的是捷克共和國,乙苯出口額約1.3627億美元。同年,乙苯的主要進口國是荷蘭,進口額為3.5367億美元。

- 乙苯的次要用途包括製造非苯乙烯化學品以及用作溶劑、農業和家用殺蟲劑噴霧劑、染料、家用除油劑、橡膠黏劑和防銹劑。

- 98%以上的合成乙苯用作苯乙烯單體生產的原料。乙苯主要用於生產苯乙烯,由乙苯催化脫氫生產氫氣和苯乙烯。

- 苯乙烯主要用於生產聚苯乙烯、丙烯腈-丁二烯-苯乙烯(ABS)、苯乙烯-丙烯腈(SAN)樹脂、苯乙烯-丁二烯合成橡膠和乳膠以及不飽和聚酯樹脂等聚合物。各國苯乙烯產能如下:

- 2022年,韓國苯乙烯單體產量約245萬噸。這比上年的約291萬噸減少。

- 觀察期內俄羅斯苯乙烯產量波動。 2022年產量減少至71.5萬噸,較上年略為下降。

- 苯乙烯產業的主要市場包括包裝、電氣和電子設備、建築、汽車和消費品。

- 乙苯作為抗爆劑添加到汽油中,以減少引擎爆震並提高辛烷值。它也是汽車和航空燃料的成分。我們也生產苯乙酮、醋酸纖維素、二乙苯、乙基蒽醌、磺酸鹽、環氧丙烷和α-甲基苯甲醇等化學物質。

- 乙苯也用作溶劑、瀝青和石腦油、合成橡膠、燃料、油漆、油墨、地毯黏劑、清漆、菸草產品和殺蟲劑的成分。

- 因此,2024年至2029年,隨著苯乙烯生產用量的增加,乙苯的需求可能會增加。

亞太地區預計將主導市場

- 亞太地區佔整個市場的最大佔有率,預計將成為 2024 年至 2029 年成長最快的地區。

- 在亞太地區,苯和甲苯在各種化學應用中的重要性日益增加,以及二甲苯作為溶劑和單體的使用不斷增加,正在推動所研究市場的成長。

- 該地區有多家苯、甲苯和二甲苯生產商,產能各異。例如

- 2023年4月,中國旭陽Group Limited旗下唐山旭陽化工有限公司將新建二期年產36萬噸粗苯精製裝置和一期年產20萬噸天然苯加氫精製精製噸。的工廠改造計劃已成功開始生產。

- 同樣,唐山旭陽粗苯加工能力預計將增加至56萬噸/年,成為中國最大的粗苯精製計劃。這樣,純苯市場將會擴大。

- 2023年8月,門格洛爾煉油石化有限公司(MRPL)宣布很快將建立全球異丁苯生產設施。異丁苯的生產涉及甲苯。因此,這項新設施可能會增加 2024 年至 2029 年間對甲苯的需求。

- 日本能源公司、三菱化學公司(現為三菱化學控股公司)、三菱商事株式會社是日本最大的生產能力之一,對二甲苯年產量約52萬噸,苯年產量約23萬噸。

- 同樣,三井化學在千葉縣擁有苯生產設施,年產能為14.5萬噸。

- SK仁川石油化學的芳烴業務生產和銷售用作日常用品、建築、家用電器和紡織品原料的通用產品。隨著公司的持續投資,BTX產能預計將擴大至每年300萬噸,為該地區最大。

- 此外,根據韓國統計局的數據,2022年韓國生產了約761萬噸對二甲苯。這比上年的869萬噸減少。對二甲苯通常用作製造其他化學品和酸的基礎材料,特別是用於塑膠製造的化學品和酸。

- 由於上述因素,預計2024年至2029年該地區的BTX市場將大幅成長。

苯甲苯二甲苯(BTX)產業概況

全球苯-甲苯-二甲苯(BTX)市場本質上是部分整合的,主要企業之間正在展開競爭,以增加他們在研究市場中的佔有率。該市場的主要企業包括中國石油化學集團公司(中石化)、埃克森美孚公司、沙烏地阿拉伯基礎工業公司、信實工業有限公司和中國石油天然氣股份有限公司。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 產能擴張投資加大帶動對二甲苯、二甲苯、純苯成長

- 油漆、被覆劑和黏劑對甲苯的需求增加

- 抑制因素

- 與苯甲苯二甲苯 (BTX) 相關的危害

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:數量)

- 類型

- 苯

- 甲苯

- 二甲苯

- 鄰二甲苯

- 間二甲苯

- 對二甲苯

- 按產品用途

- 苯的用途

- 乙苯

- 環己烷

- 烷基苯

- 異丙苯

- 硝基苯

- 其他用途

- 甲苯按用途

- 油漆/塗料

- 黏劑和墨水

- 火藥

- 化學工業

- 其他用途

- 透過二甲苯應用

- 溶劑

- 單體

- 其他用途

- 苯的用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 市場排名分析

- 主要企業策略

- 公司簡介

- BASF SE

- BP PLC

- Chevron Phillips Chemical Company LLC

- China National Offshore Oil Corporation(CNOOC)

- Dow

- Exxon Mobil Corporation

- Formosa Plastics Group

- GS Caltex Corporation

- INEOS

- IRPC Public Company Limited

- JFE Chemical Corporation

- JX Nippon Oil & Gas Exploration Corporation(Eneos)

- MITSUBISHI GAS CHEMICAL COMPANY INC.

- OCI LTD

- China National Petroleum Corporation

- Reliance Industries Limited

- Shell PLC

- China Petroleum & Chemical Corporation Limited(SINOPEC)

- SABIC

- S-OIL Corporation

- SK Innovation Co. Ltd

- Totalenergies

- YEOCHUN NCC CO. LTD

第7章 市場機會及未來趨勢

- BTX 開發的永續新技術

The Benzene-Toluene-Xylene Market size is estimated at 137.61 Million tons in 2024, and is expected to reach 165.65 Million tons by 2029, growing at a CAGR of greater than 4% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 outbreak across the world severely impacted market growth in various sectors. Stoppage or slowdown of projects, movement restrictions, production halts, and labor shortages to contain the COVID-19 outbreak have led to a decline in the BTX market growth. However, it recovered significantly in 2021, owing to rising consumption from various applications, including paints and coating, adhesive and sealants, and the chemical industry.

- The increasing demand for toluene from paints, coatings, and adhesives is expected to drive the BTX market. Moreover, increasing investments in capacity expansions drive the growth of paraxylene, xylene, and benzene.

- The harmful effects of benzene-toluene-xylene (BTX) are expected to hinder the market's growth.

- Moreover, emerging sustainable technologies to develop Benzene-Toluene-Xylene (BTX) are expected to create opportunities for the market in the coming years.

- Asia-Pacific is expected to dominate the market between 2024 and 2029, owing to its growing development in major countries such as India, China, and Japan.

Benzene-Toluene-Xylene (BTX) Market Trends

Ethylbenzene is Expected to Dominate the Benzene by Application Segment

- Ethylbenzene is commercially produced from benzene and ethylene in industrial plants, and a minor amount is isolated by purifying petroleum by-product streams. It is also present naturally in crude oil, some natural gas streams, and coal tar. Ethylbenzene appears as a clear, colorless liquid with an aromatic odor.

- Belgium is the world's leading exporter country of ethylbenzene. In 2022, Belgium exported USD 342.53 million of ethylbenzene. Ranking second was the Czech Republic, which exported some USD 136.27 million of ethylbenzene. That year, the Netherlands was the top country importing ethylbenzene worldwide, with an import value of USD 353.67 million.

- Minor ethylbenzene applications include the production of chemicals other than styrene or as a solvent, as well as some agricultural and home insecticide sprays, dyes, household degreasers, rubber adhesives, and rust preventives.

- Over 98% of synthetic ethylbenzene is used as a raw material to manufacture styrene monomer. Ethylbenzene is used primarily in the production of styrene, which is produced by the catalytic dehydrogenation of ethylbenzene, which gives hydrogen and styrene.

- Styrene is used mainly in polymer production for polystyrene, acrylonitrile-butadiene-styrene (ABS), styrene-acrylonitrile (SAN) resins, styrene-butadiene elastomers and latexes, and unsaturated polyester resins. Production capacity of styrene across countries are;

- In 2022, around 2.45 million metric tons of styrene monomer were produced in South Korea. This represents a decrease from about 2.91 million metric tons in the previous year.

- The volume of styrene production in Russia has fluctuated during the observed period. In 2022, production of the product fell to 715 thousand metric tons, having decreased slightly from the year earlier.

- The major styrene industry markets include packaging, electrical and electronic appliances, construction, automotive, and consumer products.

- Ethylbenzene is added to gasoline as an anti-knock agent to reduce engine knocking and increase the octane rating. It is a component of automotive and aviation fuels. It also makes other chemicals, including acetophenone, cellulose acetate, diethyl-benzene, ethyl anthraquinone, ethylbenzene sulfonic acids, propylene oxide, and alpha-methylbenzyl alcohol.

- Ethylbenzene is also used as a solvent, a constituent of asphalt and naphtha, and in synthetic rubber, fuels, paints, inks, carpet glues, varnishes, tobacco products, and insecticides.

- Therefore, the demand for ethylbenzene will likely increase with the increasing usage in styrene production between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific dominated the market studied, with the largest share of the total market volume, and is estimated to be the fastest-growing region between 2024 and 2029.

- In Asia-Pacific, the growing significance of benzene and toluene in various chemical applications and the growing usage of xylene as solvents and monomers are driving the growth of the market studied.

- The region has several companies that manufacture benzene, toluene, and xylene and have various production capacities. For instance,

- In April 2023, Tangshan Risun Chemicals Limited, a subsidiary of China Risun Group Limited, successfully commenced production at the newly built Phase II crude benzene hydrogenation refinery plant, which has an annual capacity of 360,000 tonnes, and Phase I natural benzene hydrogenation refinery plant transformation project with a yearly capacity of 200,000 tonnes.

- Similarly, the crude benzene processing capacity of Tangshan Risun is likely to be boosted to 560,000 tonnes per year, making it the largest crude benzene hydrogenation refinery unit project in China. Thus, enhancing the benzene market.

- In August 2023, Mangalore Refinery and Petrochemicals Ltd (MRPL) announced they would set up a world-scale isobutylbenzene production facility in the coming days. The production of Isobutylbenzene involves toluene. Thus, the new facility will likely increase the demand for toluene between 2024 and 2029.

- Kashima Aromatics Co. Ltd, a joint venture among Japan Energy Corporation, Mitsubishi Chemical Corporation (current Mitsubishi Chemical Holdings Corporation), and Mitsubishi Corporation, has one of the largest production capacities in Japan, of approximately 520,000 tons of paraxylene and 230,000 tons of benzene a year.

- Similarly, Mitsui Chemicals has a benzene production facility in Chiba, Japan, with an annual production capacity of 145 thousand tons.

- SK Incheon Petrochem Co. Ltd's aromatics business produces and sells commodity products used as raw materials for everyday supplies, construction, home electronics, and textiles. The constant investment by the company is anticipated to expand the BTX production capacity to 3 million tons per year, the most enormous scale in the area.

- Moreover, according to Statistics Korea, in 2022, around 7.61 million metric tons of paraxylene were produced in South Korea. This represents a decrease from 8.69 million metric tons in the previous year. Paraxylene is commonly used as a building block to make other chemicals and acids, especially those used in plastic manufacturing.

- Owing to all the factors above, the market for BTX in the region is projected to grow significantly between 2024 and 2029.

Benzene-Toluene-Xylene (BTX) Industry Overview

The global benzene toluene xylene (BTX) market is partially consolidated in nature, with competition among the major players to increase their share in the studied market. Some of the major players in the market are China Petrochemical Corporation (SINOPEC), Exxon Mobil Corporation, SABIC, Reliance Industries Limited, and PetroChina Company Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Investments in Capacity Expansions is Driving the Growth of Paraxylene, Xylene, and Benzene

- 4.1.2 Increasing Demand for Toluene from Paints, Coatings, and Adhesives

- 4.2 Restraints

- 4.2.1 Hazards Associated with Benzene-toluene-xylene (BTX)

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Benzene

- 5.1.2 Toluene

- 5.1.3 Xylene

- 5.1.3.1 Ortho-xylene

- 5.1.3.2 Meta-xylene

- 5.1.3.3 Para-xylene

- 5.2 Product By Application

- 5.2.1 Benzene By Application

- 5.2.1.1 Ethylbenzene

- 5.2.1.2 Cyclohexane

- 5.2.1.3 Alkylbenzene

- 5.2.1.4 Cumene

- 5.2.1.5 Nitrobenzene

- 5.2.1.6 Other Applications

- 5.2.2 Toluene By Application

- 5.2.2.1 Paints and Coatings

- 5.2.2.2 Adhesives and Inks

- 5.2.2.3 Explosives

- 5.2.2.4 Chemical Industry

- 5.2.2.5 Other Applications

- 5.2.3 Xylene By Application

- 5.2.3.1 Solvent

- 5.2.3.2 Monomer

- 5.2.3.3 Other Applications

- 5.2.1 Benzene By Application

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Ranking Analysis

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 BP PLC

- 6.3.3 Chevron Phillips Chemical Company LLC

- 6.3.4 China National Offshore Oil Corporation (CNOOC)

- 6.3.5 Dow

- 6.3.6 Exxon Mobil Corporation

- 6.3.7 Formosa Plastics Group

- 6.3.8 GS Caltex Corporation

- 6.3.9 INEOS

- 6.3.10 IRPC Public Company Limited

- 6.3.11 JFE Chemical Corporation

- 6.3.12 JX Nippon Oil & Gas Exploration Corporation (Eneos)

- 6.3.13 MITSUBISHI GAS CHEMICAL COMPANY INC.

- 6.3.14 OCI LTD

- 6.3.15 China National Petroleum Corporation

- 6.3.16 Reliance Industries Limited

- 6.3.17 Shell PLC

- 6.3.18 China Petroleum & Chemical Corporation Limited (SINOPEC)

- 6.3.19 SABIC

- 6.3.20 S-OIL Corporation

- 6.3.21 SK Innovation Co. Ltd

- 6.3.22 Totalenergies

- 6.3.23 YEOCHUN NCC CO. LTD

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Sustainable Technologies to Develop BTX