|

市場調查報告書

商品編碼

1523382

全球特種玻璃市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Specialty Glass - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

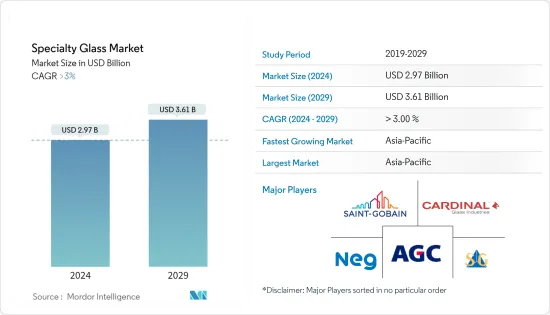

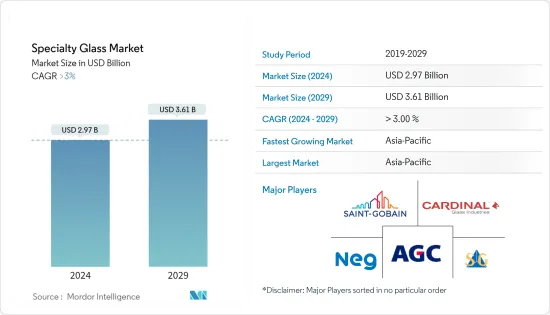

預計2024年全球特種玻璃市場規模將達到29.7億美元,並在2024-2029年預測期內以超過3%的複合年成長率成長,到2029年將達到36.1億美元。

由於 COVID-19 對全球製造和開發部門的影響,特種玻璃市場某些領域的需求受到了打擊。然而,藥品和醫療設備的需求強勁,很大程度上抑制了其他玻璃類別消費的下降。由於新冠肺炎 (COVID-19) 疫情爆發後,全球可再生能源和製藥產業持續實施發展舉措,預計預測期內對特種玻璃的需求將保持強勁。

主要亮點

- 可再生能源和建築領域對太陽能玻璃的需求不斷增加,以及醫療保健領域市場的不斷開拓預計將推動市場的發展。

- 有關空氣和水污染標準的嚴格環境法規預計將阻礙市場成長。

- 可再生能源領域活性化的研發活動預計將在預測期內為市場創造機會。

- 預計亞太地區將主導市場。由於通訊、架構、醫療設備和可再生能源產業對特種玻璃的需求不斷增加,預計在預測期內複合年成長率將達到最高。

特種玻璃市場趨勢

越來越重視太陽能玻璃在建築應用上的使用

- 特種玻璃因其高效性能而成為各國住宅和建築計劃中太陽能玻璃的主要材料。這些玻璃反射最大的光線並保持室內涼爽。透過在建築應用中使用太陽能玻璃,各國的目標是保持最佳環境溫度,同時降低整體能源消耗。

- 太陽能玻璃是一種高性能特殊玻璃,由於其高透光性能,為太陽能電池板提供高效率。由於這些理想的特性,太陽能玻璃被認為是建築物太陽能技術的重要組成部分。此外,太陽能玻璃可以保護太陽能電池板免受各種環境條件的影響。

- 特殊玻璃具有隔熱、透明、耐候等優異性能,使其成為滿足各種建築要求的理想選擇。建築和開發行業的成長預計將直接影響未來幾年對功能玻璃的需求。

- 建設活動的增加預計將推動特種玻璃市場。亞太地區和北美是全球住宅最繁忙的地區。在北美,美國和加拿大等國家的住宅不斷增加,這推動了特種玻璃市場的發展。根據美國人口普查局的數據,2022 年美國建築業年產值為 1,790 億美元,而 2021 年為 16,260 億美元。

- 同樣,歐洲的住宅建設也在增加。德國是該地區最大的住宅市場。在新住宅建設活動增加的推動下,該國的建設產業持續成長。例如,根據歐盟統計局的數據,2022 年建築施工收入為 1,140 億美元,預計 2024 年將達到 1,254 億美元。

- 由於這些因素,特種玻璃市場預計在預測期內將在全球範圍內成長。

亞太地區主導市場

- 預計亞太地區將在預測期內主導特種玻璃市場。照明、眼鏡鏡片、顯示器、通訊、架構和醫療設備等應用對特種玻璃的需求正在增加。

- 中國是世界領先的玻璃生產國和出口國之一,玻璃在建築應用中的使用越來越多。根據中國國家統計局的數據,2022年中國建築業產值將達到4.34兆美元,2021年為4.84兆美元。

- 同樣,印度的建設活動也在增加。 2023-2024年預算每年向二線和三線城市分配12.18億美元的城市基礎設施發展資金。這將增加對建築應用中使用的特種玻璃的需求。

- 印度作為主要新興經濟體之一,在全球市場玻璃需求中佔有很大比例。政府推動可再生能源產業發展的意願不斷增強,推動了印度市場對特種太陽能玻璃和麵板的需求。

- 印度政府最近啟動了國家太陽能任務,作為應對氣候變遷挑戰的關鍵任務之一。任務的目標是到2022年安裝100吉瓦併網太陽能發電廠。這代表了排放的INDC(累積自主貢獻石化燃料)。

- 印度政府啟動了新能源和可再生能源部(MNRE)屋頂太陽能併網發電計畫的第二階段。根據該計劃,泰米爾南都能源發展局於 2022 年 4 月進行競標,在泰米爾南都州安裝 12 兆瓦併網住宅屋頂太陽能光電系統。同樣,特倫甘納邦可再生能源委員會已競標指定承包商建造 50 兆瓦併網住宅屋頂太陽能發電工程。

- 就就業和收益而言,醫療保健是印度經濟中最大的部門之一。據 IBEF 稱,印度醫療保健產業預計將成長兩倍,2016 年至 2022 年複合年成長率為 22%,從 2016 年的 1,100 億美元增至 2022 年超過 3,720 億美元。此外,到2025年,印度醫療設備市場預計將成長至500億美元。該國醫療設施數量的增加將增加對醫療設備的需求並帶動特種玻璃市場。

- 由於這些因素,該地區的特種玻璃市場預計在預測期內將成長。

特種玻璃產業概況

特種玻璃市場得到部分完整。市場主要企業包括(排名不分先後)AGC Inc.、Cardinal Glass Industries, Inc.、CSG HOLDING、Nippon Electric Glass 和 Saint-Gobain。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 可再生能源和建築領域對太陽能玻璃的需求不斷增加

- 醫療保健領域的需求不斷成長

- 其他司機

- 抑制因素

- 有關空氣和水污染標準的嚴格環境法規

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:金額)

- 類型

- 硼矽酸玻璃

- 鈉鈣玻璃

- 其他類型

- 目的

- 用於照明

- 光學鏡片

- 顯示螢幕

- 通訊玻璃

- 架構

- 醫療設備

- 可再生能源

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- AGC Inc.

- AGI Glaspec

- Cardinal Glass Industries, Inc.

- Corning Incorporated

- CSG HOLDING CO., LTD.

- DWK Life Sciences

- Fuyao Glass Industry

- Gerresheimer AG

- Kanger Enterprise

- Lino

- Nippon Electric Glass Co.,Ltd.

- Saint-Gobain

- SCHOTT AG

- Sichuan Shubo(Group)Co., Ltd.

- Ta Hsiang

第7章 市場機會及未來趨勢

- 活性化可再生能源領域的研發活動

- 其他機會

The Specialty Glass Market size is estimated at USD 2.97 billion in 2024, and is expected to reach USD 3.61 billion by 2029, growing at a CAGR of greater than 3% during the forecast period (2024-2029).

Demand in some of the segments in the specialty glass market was hit due to the repercussions of COVID-19 on the manufacturing and development sector across the globe. However, appreciable demand for pharmaceuticals and medical equipment largely restrained the severe fall in its consumption concerning other categories of glass. Post-COVID pandemic, with the consistent development initiatives in the renewable energy and pharmaceutical industry being undertaken across the globe, the demand for specialty glass is projected to remain robust during the forecast period.

Key Highlights

- The rising demand for solar glass in the renewable energy and construction sector and the increasing developments in the healthcare sector are expected to drive the market.

- The stringent environmental regulation regarding air and water pollution standards is expected to hinder the market's growth.

- The increasing R&D activities in the renewable energy sector are expected to create opportunities for the market during the forecast period.

- The Asia-Pacific region is expected to dominate the market. It is also expected to register the highest CAGR during the forecast period due to rising demand for specialty glass in telecommunication, architecture, medical equipment, and renewable energy industries.

Specialty Glass Market Trends

Increasing Emphasis on Utilizing Solar Glass Architecture Construction Application

- Specialty glass is a majorly preferred material in solar glass for housing and building projects in various countries due to its efficient properties. These formulated glasses are perceived to reflect maximum light, thereby keeping the interiors cool. With the use of solar glass in architectural applications, various countries aim to reduce overall energy consumption while maintaining an optimum temperature for the surroundings.

- Solar Glass is a high-performance specialty glass that provides high efficiency to solar panels due to their high light transmittance performance. Owing to these ideal properties, solar glass is also regarded as an integral part of the building's integrated photovoltaic technology. Solar glass can also guard the solar panel from various environmental conditions.

- The superior properties of specialty glass, like insulation, transparency, and weather resistance, make it an ideal choice for various architectural requirements. Growth in the construction and development sector is expected to directly impact the demand for Specialty Glass in the coming years.

- The increasing construction activities are expected to drive the market for specialty glass. The Asia-Pacific and North America are the most significant regions for residential construction globally. In North America, residential construction activities are increasing in countries like the United States and Canada, which are driving the market for specialty glass. According to the United States Census Bureau, the annual value of construction output in the United States was valued at USD 1792 billion in 2022, compared to USD 1626 billion in 2021.

- Similarly, in Europe, residential construction activities are increasing. Germany is the largest market for residential construction in the region. The country's construction industry has been growing, driven by an increase in new residential construction activities. For instance, according to Eurostat, the building construction revenue is registered at USD 114 billion in 2022 and is expected to reach USD 125.4 billion by 2024.

- Owing to all these factors, the specialty glass market will likely grow globally during the forecast period.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific region is expected to dominate the market for specialty glass during the forecast period. There is a rising demand for specialty glass from lighting, ophthalmic lenses, display screens, telecommunication, architecture, and medical equipment applications.

- China is the world's leading producer and exporter of glass, in line with the increasing utilization of glass in architectural construction applications. According to the National Bureau of Statistics of China, the output value of construction works in the country accounted for USD 4.34 trillion in 2022, as compared to USD 4.084 trillion in 2021.

- Similarly, in India, construction activities are increasing. As per the 2023-2024 budget, a dedicated amount of USD 1,218 million per annum has been allocated through urban infra-development funds for Tier II and Tier III cities. This will create a buoyant demand for specialty glass used in construction applications.

- India, one of the major developing economies, constitutes a large share of glass demand in the global market. The increasing inclination of the government to promote the development of the renewable energy sector has been driving the demand for specialty solar glass and panels in the Indian market.

- The Indian government has recently started the National Solar Mission as one of the critical Missions to meet the challenges of climate change. The Mission targets installing 100 GW grid-connected solar power plants by the year 2022. This is in line with India's Intended Nationally Determined Contributions (INDCs) target to achieve about 40 percent cumulative electric power installed capacity from non-fossil fuel-based energy resources and to reduce the emission intensity of its GDP by 33 to 35 percent from the 2005 level by 2030.

- The Government of India initiated phase II of the Ministry of New and Renewable Energy's (MNRE) grid-connected rooftop solar program. Under this program, in April 2022, the Tamil Nandu Energy Development Agency issued a tender to install 12 MW of grid-connected residential rooftop solar systems in Tamil Nandu. Similarly, Telangana state's Renewable Energy Department Corporation invited bids to appoint suppliers to build 50 MW of grid-connected residential rooftop solar projects.Thus the growth in the renewable energy sector is expected to drive the demand for specialty glass in the region.

- Healthcare is one of the largest sectors of the Indian economy in terms of both employment and revenue. According to IBEF (India Brand Equity Foundation), the Indian healthcare sector recorded a three-fold rise, growing at a CAGR of 22% between 2016-22 to reach over USD 372 billion in 2022 from USD 110 billion in 2016. Furthermore, it is anticipated that India's market for medical equipment will grow to USD 50 billion by 2025. The increasing number of medical facilities in the country will boost the demand for medical devices, thereby driving the market for specialty glass.

- Due to all such factors, the market for specialty glass in the region is expected to grow during the forecast period.

Specialty Glass Industry Overview

The specialty glass market is partially consolidated in nature. Some of the major players in the market include (not in any particular order) AGC Inc., Cardinal Glass Industries, Inc.,CSG HOLDING CO., LTD., Nippon Electric Glass Co., Ltd., and Saint-Gobain, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand for Solar Glass in the Renewable Energy and Construction Sector

- 4.1.2 Increasing Developments in Healthcare Sector

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Stringent environmental regulation regarding air and water pollution standards

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Type

- 5.1.1 Borosilicate Glass

- 5.1.2 Soda-Lime Glass

- 5.1.3 Other Types (Insulated Glass, Decorative Glass, etc.)

- 5.2 Applications

- 5.2.1 Lighting

- 5.2.2 Ophthamalic Lenses

- 5.2.3 Display Screens

- 5.2.4 Telecommunication

- 5.2.5 Architecture

- 5.2.6 Medical Equipments

- 5.2.7 Renewable Energy

- 5.2.8 Other Applications (Beam Splitters, Semiconductor Assemblies, etc.)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 UAE

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGC Inc.

- 6.4.2 AGI Glaspec

- 6.4.3 Cardinal Glass Industries, Inc.

- 6.4.4 Corning Incorporated

- 6.4.5 CSG HOLDING CO., LTD.

- 6.4.6 DWK Life Sciences

- 6.4.7 Fuyao Glass Industry

- 6.4.8 Gerresheimer AG

- 6.4.9 Kanger Enterprise

- 6.4.10 Lino

- 6.4.11 Nippon Electric Glass Co.,Ltd.

- 6.4.12 Saint-Gobain

- 6.4.13 SCHOTT AG

- 6.4.14 Sichuan Shubo (Group) Co., Ltd.

- 6.4.15 Ta Hsiang

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing R&D activities in the Renewable Energy Sector

- 7.2 Other Opportunities