|

市場調查報告書

商品編碼

1523386

全球無損檢測(NDT)軟體市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Non-Destructive Testing (NDT) Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

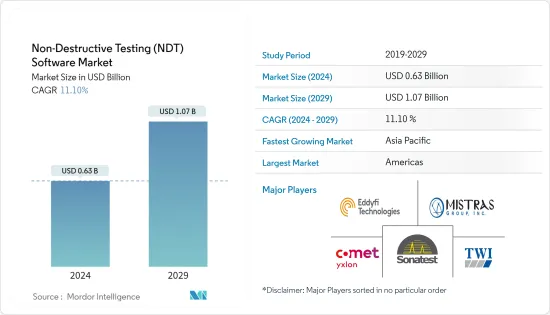

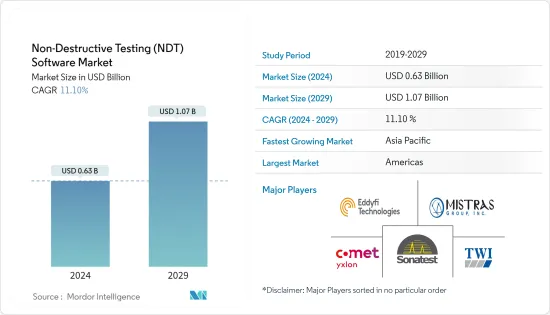

預計2024年全球無損檢測(NDT)軟體市場規模將達6.3億美元,2024年至2029年複合年成長率為11.10%,2029年將達10.7億美元。

主要亮點

- NDT 軟體在測試中發揮關鍵作用,具有眾多優勢,包括簡化測試程序、提高準確性和提高整體效率。 NDT 軟體的主要優點之一是能夠自動化和標準化測試程序。透過利用先進的演算法和資料分析技術,NDT 軟體可以準確、一致地執行複雜的測試。這種自動化減少了人為錯誤的可能性,並確保檢查程序符合既定的標準和規範。此外,測試程序的標準化可以與品管系統無縫整合,並確保符合行業法規和標準。

- NDT軟體有助於即時收集和分析,從而實現即時回饋和決策。此功能對於對時間敏感的檢查至關重要的行業(例如航太和製造)尤其有價值。即時資料分析使技術人員能夠快速識別缺陷和異常情況,從而及時干預並防止安全隱患和生產延誤。

- 使用 NDT 軟體還有助於增強資料管理和文件記錄。 NDT 軟體可以透過數位記錄管理和雲端基礎的儲存來檢索偵測資料、歷史記錄和偵測報告。這簡化了文件流程,並為合規性和品質保證目的提供了全面的審核追蹤。此外,建立詳細且可自訂的檢查報告可以改善組織內部以及與外部相關人員的溝通和透明度。

- 此外,NDT 軟體支援先進成像和分析技術的整合,例如電腦斷層掃描 (CT) 掃描和數位放射線攝影。這些技術可提供詳細的 3D 視覺化以及內部結構和缺陷的分析,從而有效洞察材料的完整性和品質。透過利用這些先進的影像處理功能,NST 軟體使技術人員能夠檢測傳統檢測方法無法檢測到的微小缺陷,從而提高整體檢測精度和可靠性。

- 隨著多個國家政府採取各種遏制措施,COVID-19 大流行對市場產生了顯著影響。實施封鎖等措施對半導體、電子和汽車等產業的供應鏈產生了重大影響。結果,我們看到市場放緩,尤其是在早期階段。

- 然而,由於世界各國政府已經認知到半導體產業的重要性及其在經濟復甦中的作用,並正在獎勵在地採購和支持,半導體產業預計將在預測期內復甦。

無損檢測(NDT)軟體市場趨勢

石油和天然氣產業將經歷顯著成長

- 石油和天然氣產業分為三個部門:上游、中游和下游。上游部門負責探勘和生產活動,涉及陸地和海上鑽機的工作。

- 上游產業的 CUI 測試主要在海上設施進行。世界上大多數正常運作的石油鑽井平台都位於海上。這對用於檢查 CUI 的 NDT 軟體產生了巨大的需求。

- 石油和天然氣行業的無損檢測對於煉油和開採作業的設備精製和安全性至關重要。為了安全地容納管道和壓力容器內的潛在危險化學品和液體,必須使用超音波和渦流無損檢測解決方案仔細檢查焊接和金屬是否有缺陷和腐蝕。

- 在石油和天然氣行業,NDT 軟體在缺陷檢測、材料表徵、完整性評估和安全保證方面發揮重要作用。例如,根據歐佩克的說法,全球石油需求預計將轉向汽油和乙烷等輕質產品。到 2045 年,汽油需求預計將增至每天 2,760 萬桶。

亞太地區預計將錄得最快成長

- 由於所研究市場中的所有主要最終用戶產業都在經歷快速成長,預計亞太地區無損檢測 (NDT) 軟體市場將出現強勁成長。隨著市場上主要供應商擴大其全球足跡,先進製造和產品測試解決方案的滲透也不斷成長。品質和產品安全對於與國際企業競爭至關重要。

- 石化、紙漿和造紙、石油和天然氣、汽車、航太和國防等製造業最終用戶產業的成長預計將推動該地區的市場成長率。該地區對可再生能源的需求不斷成長可能為所研究市場的成長帶來有利的成長優勢。

- 此外,該地區汽車工業的成長也支持了預測期內的市場成長。根據日本工業協會公佈的2023年統計數據,日本新車註冊量達到約399萬輛,其中普通汽車約176萬輛。輕型車(又稱輕型車和小型車)的新車註冊數量也超過了去年。日本新車註冊量約478萬輛,其中乘用車佔多數。

- 根據國土交通省的數據,截至 2023 年 5 月,電動車 (EV) 約佔韓國汽車市場的 1.8%。此外,韓國政府也制定了2030年將電動車和氫動力車在新車銷售中的比例提高到33%的目標,進一步支持市場成長。

無損檢測 (NDT) 軟體產業概述

無損偵測 (NDT) 軟體市場較為分散,由 Yxlon International Gmbh (Comet Holding Ag)、TWI Limited、Sonatest Ltd、Mistras Group 和 Eddyfi Technologies 等領先廠商組成。這些參與者擁有重要的市場佔有率,並致力於擴大基本客群。這些公司正在透過策略合作提高市場佔有率和盈利。

- 2023 年 8 月 - 貝克休斯宣布推出 Krautkramer RotoArray compAct,這是一種可攜式滾輪探頭,用於大型複合材料的手動相位陣列(PA)超音波檢查。這項新技術補充了 Krautkramer RotoArray 用於航空、航太和風力發電產業的產品線。 Krautkramer RotoArray compAct 採用全新 Baker Hughes 專利緊湊技術,可實現更輕、更簡單且更具成本效益的超音波(UT)相位陣列應用。

- 2023年5月,子公司Previan收購Sensor Networks Inc.(SNI),一時成為熱門話題。 SNI 專注於感測工具和技術,可增強對安全關鍵組件的檢查和遠端監控並提高生產力。收購後,SNI 加入了 Previan 集團,NDT 解決方案現在由 Eddyfi Technologies 部門提供支援。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19副作用和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 各行業檢查及安全改善需求

- 新科技的興起(AI、IIOT、EVS等)

- 市場挑戰

- 缺乏熟練人員和培訓設施

- 軟體和設備高成本以及半導體短缺

第6章 市場細分

- 按類型

- 標準軟體

- 整合軟體

- 按最終用戶產業

- 油和氣

- 電力/能源

- 航太/國防

- 汽車與運輸

- 電子產品

- 其他最終用戶產業

- 按地區

- 美洲

- 歐洲

- 亞太地區

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Yxlon International GmbH(Comet Holding AG)

- TWI Limited

- Sonatest Ltd

- Mistras Group

- Eddyfi Technologies

- Spinnsol

- Evident Corporation(Bain Capital LP)

- Baker Hughes

- Eclipse Scientific(Acuren)

- Durr NDT GmbH & Co. KG

- Carl Zeiss AG

- Volume Graphics(Hexagon AB)

第8章消費行為分析

- 目前的痛點和機遇

- 按行業分類的競爭因素/消費者偏好

第9章 廠商排名分析

第10章市場的未來

The Non-Destructive Testing Software Market size is estimated at USD 0.63 billion in 2024, and is expected to reach USD 1.07 billion by 2029, growing at a CAGR of 11.10% during the forecast period (2024-2029).

Key Highlights

- NDT software plays a crucial role in testing, offering numerous advantages that streamline testing procedures, improve accuracy, and enhance overall efficiency. One of the primary advantages of the NDT software is its ability to automate and standardize testing procedures. By utilizing advanced algorithms and data analysis techniques, NDT software can perform complex inspections with precision and consistency. This automation reduces the potential for human error and ensures that testing procedures adhere to established standards and specifications. Additionally, the standardization of testing procedures enables seamless integration with quality control systems, ensuring compliance with industry regulations and standards.

- NDT software facilitates real-time collection and analysis, allowing immediate feedback and decision-making. This capability is especially valuable in industries where time-sensitive inspections are critical, such as aerospace and manufacturing. Real-time data analysis enables technicians to identify defects or anomalies promptly, leading to timely interventions and preventing potential safety hazards or production delays.

- The use of NDT software also contributes to enhanced data management and documentation. NDT software enables the organization to retrieve inspection data, historical records, and testing reports through digital record-keeping and cloud-based storage. This streamlines the documentation process and provides a comprehensive audit trail for regulatory compliance and quality assurance purposes. Additionally, generating detailed and customizable inspection reports enhances communication and transparency within the organization and with external stakeholders.

- Moreover, NDT software supports the integration of advanced imaging and analysis techniques, such as computed tomography (CT) scanning and digital radiography. These techniques provide detailed 3D visualization and analysis of internal structures and defects, offering efficient insights into material integrity and quality. By harnessing these advanced imaging capabilities, NST software empowers technicians to detect subtle defects that may be undetectable through traditional testing methods, thereby improving overall inspection accuracy and reliability.

- A notable impact of the global outbreak of COVID-19 was observed in the market as governments across multiple countries took various containment measures. Measures like implementing lockdowns significantly impacted the supply chain of industries like semiconductors, electronics, automotive, etc. As a result, a slowdown was witnessed in the market studied, especially during the initial phase.

- However, with several governments worldwide recognizing the importance of the semiconductor industry and its role in economic recovery and incentivizing local sourcing and support, the industry is anticipated to recover during the forecast period.

Non-Destructive Testing (NDT) Software Market Trends

Oil and Gas Sector to Witness Major Growth

- The oil and gas industry operates in three sectors: upstream, midstream, and downstream. The upstream sector is responsible for exploration and production activities that involve working in onshore and offshore rigs.

- CUI testing in the upstream industry mainly happens in offshore establishments. Most of the functional oil rigs in the world are offshore. This creates a massive demand for NDT software to confirm CUI.

- NDT in the oil and gas industry is critical for equipment integrity and the safety of petroleum refining and extraction operations. Safely containing potentially hazardous chemicals and fluids within pipes and pressure vessels requires careful inspection of welds and metals for flaws and corrosion using ultrasonic and eddy current NDT testing solutions.

- In the oil and gas industry, the NDT software plays an essential role in flaw detection, material characterization, integrity assessment, and safety assurance. For instance, according to OPEC, the global demand for crude oil is expected to be aimed toward light products, such as gasoline and ethane. In 2045, gasoline demand is forecasted to climb to 27.6 million barrels per day.

Asia-Pacific is Expected to Register the Fastest Growth

- The Asia-Pacific region is expected to grow significantly in the non-destructive testing software market as all the major end-user industries of the market studied are witnessing rapid growth. The penetration of advanced manufacturing and product testing solutions is also growing as significant vendors operating in the market are expanding their global footprint. Quality and product safety are crucial for them to compete with international players.

- The growing manufacturing end-user industries such as petrochemical, paper and pulp, oil and gas, automotive, aerospace, defense, and others are set to boost the market growth rate in the region. The growing demand for renewable energy in the region will add a lucrative growth advantage to the growth of the studied market.

- Moreover, the region's growing automotive industry also supports the market growth during the projected timeline. According to the statistics published by the Japan Automobile Manufacturers Association in 2023, the total number of new car registrations in Japan reached about 3.99 million units, of which about 1.76 million were standard-size vehicles. The number of newly registered mini cars called kei cars and compact cars also increased compared to the previous year. Japan's total number of new motor vehicle registrations reached roughly 4.78 million units, with passenger vehicles representing the vast majority.

- According to the Ministry of Land, Infrastructure, and Transport, electric vehicles (EVs) accounted for about 1.8% of South Korea's automobile market as of May 2023. In addition, the South Korean government has set a goal of increasing the share of electric and hydrogen vehicles in new car sales to 33 by 2030, further supporting the market growth.

Non-Destructive Testing (NDT) Software Industry Overview

The non-destructive testing (NDT) software market is fragmented and consists of some influential players like Yxlon International Gmbh (Comet Holding Ag), TWI Limited, Sonatest Ltd, Mistras Group, and Eddyfi Technologies. These players have a noticeable market share and are concentrating on expanding their customer base across foreign countries. These businesses leverage strategic collaborative actions to improve their market percentage and enhance profitability.

- August 2023: Baker Hughes announced the launch of Krautkramer RotoArray comPAct, a portable roller probe for manual phased array (PA) ultrasonic inspection of large-scale composite materials. The new technology complements the Krautkramer RotoArray product line for the aviation, space exploration, and wind energy industries. Krautkramer RotoArray comPAct is equipped with new Baker Hughes patented compact technology, enabling lighter, simpler, and more cost-effective ultrasound (UT) phased array applications.

- May 2023: Previan, a business under the company's umbrella, made headlines with its acquisition of Sensor Networks Inc. (SNI). SNI specializes in sensing tools and technologies that enhance the inspection and remote monitoring of safety-critical components, boosting productivity. SNI joined the Previan Group following the acquisition, with its NDT solutions now bolstered by the Eddyfi Technologies business unit.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Improved Inspection and Safety Across Industries

- 5.1.2 Rise of Emerging Technologies (AI, IIOT, EVS Etc.)

- 5.2 Market Challenges

- 5.2.1 Lack of Skilled Personnel and Training Facilities

- 5.2.2 High Cost of the Software and Equipment Combined With Semiconductor Shortages

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Standard Software

- 6.1.2 Integrated Software

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Power and Energy

- 6.2.3 Aerospace and Defense

- 6.2.4 Automotive and Transportation

- 6.2.5 Electronics

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 Americas

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Yxlon International GmbH (Comet Holding AG)

- 7.1.2 TWI Limited

- 7.1.3 Sonatest Ltd

- 7.1.4 Mistras Group

- 7.1.5 Eddyfi Technologies

- 7.1.6 Spinnsol

- 7.1.7 Evident Corporation (Bain Capital LP)

- 7.1.8 Baker Hughes

- 7.1.9 Eclipse Scientific (Acuren)

- 7.1.10 Du?rr NDT GmbH & Co. KG

- 7.1.11 Carl Zeiss AG

- 7.1.12 Volume Graphics (Hexagon AB)

8 CONSUMER BEHAVIOR ANALYSIS

- 8.1 Current Pain Points and Opportunities

- 8.2 Competitive Factors/Consumer Preferences by Industries