|

市場調查報告書

商品編碼

1523398

全球汽車產業測試、檢驗和認證市場:市場佔有率分析、行業趨勢和統計、成長預測(2024-2029)Testing, Inspection, And Certification For The Automotive Industry - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

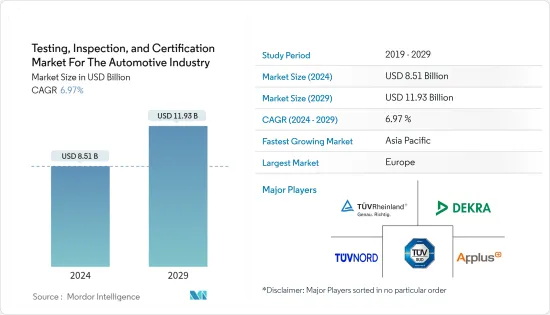

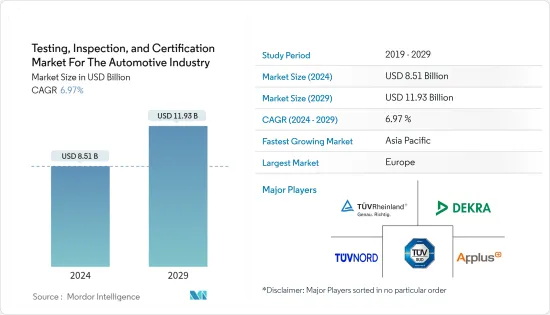

預計2024年全球汽車產業測試、檢驗和認證市場將達到85.1億美元,2024年至2029年複合年成長率為6.97%,預計2029年將達到119.3億美元。

透過檢驗和測試服務,TIC公司旨在減少汽車零件和設備製造商的問題,並為最終用戶提供良好的體驗。 TIC 透過確保產品性能符合製造商聲明或指定要求,協助保護品牌聲譽並促進消費者信任和信心。

向電動車的過渡正在加速,從 2022 年初開始,汽車製造商將專注於生產具有更先進功能的電動車。電動車預計將在歐洲、美國和中國獲得較高的市場佔有率,並且銷售量將超過內燃機汽車。

美國是電動車市場及其銷售的關鍵地區之一。 COX Enterprises 的數據顯示,2023 年第一季美國純電動車銷量達到約 258,900 輛。與2022年同期銷量相比,年比大幅成長約44.9%。此外,2023 年第一季超過 2022 年第四季度,使其成為過去兩年中純電動車銷售最強勁的季度。

此外,以電動車(EV)為中心的汽車產業是最突出的產業,導致對電氣產品和零件的需求增加。此外,感測器的採用正在顯著增加,特別是在汽車行業。在其他市場的支持下,這種需求激增預計在未來幾年將保持在較高水準。補貼和實現碳排放目標等政府舉措預計將增加對該地區電動車產業的投資,從而擴大市場的成長前景。

此外,人們越來越認知到 ADAS 在減少車輛事故方面的重要性,這是近年來推動這些系統需求的主要因素之一。歐洲、北美和亞洲的許多國家都推出了法規,強制在乘用車領域使用各種類型的 ADAS。例如,從 2018 年開始,在加拿大銷售的新車必須配備倒車相機和 ADAS 功能。

由於不同的要求、缺乏正確的理解以及缺乏適當的基礎設施,該行業面臨標準、監管和認證方面的挑戰。

由於需求疲軟,尤其是已開發國家的需求疲軟,預計 2024 年汽車產量成長將放緩。然而,電動車在全球市場上的日益普及以及人們對電動車在開發階段相關風險的日益擔憂,在抑制汽車市場的 TIC 需求方面發揮著重要作用。

汽車產業 TIC 市場趨勢

電動車實現顯著成長

- 由於日益成長的擔憂以及傳統汽車對環境的負面影響,市場正在向電動車等替代品開放。

- 隨著電動車變得越來越流行,嚴格的安全和合法令遵循已經到位,以確保這些車輛的可靠性、性能和安全性。 TIC 市場在檢驗電動車是否符合這些監管標準(包括電池安全、電磁相容性和碰撞測試要求)方面發揮關鍵作用。嚴格的測試和認證有助於增強消費者對電動車車型安全和品質的信心。

- 電池組和電動動力傳動系統等核心電動車組件需要進行廣泛的測試和檢驗,以確保最佳的性能、耐用性和使用壽命。確保電動車電池安全、高效和可靠性的測試和認證規則對於電動車的廣泛採用至關重要。測試和認證程序檢驗電動車電池符合嚴格的安全和性能標準。這些流程可向製造商、監管機構和消費者保證電池符合所需規格並可在各種條件下使用。

- 此外,現代電動車越來越依賴複雜的軟體和連接功能,例如 ADAS(高級駕駛員輔助系統)和 OTA(無線)更新。 TIC 市場有助於確保這些軟體主導的電動車系統的網路安全、資料隱私和功能安全,這對於維持客戶信任和監管合規性至關重要。

- 此外,總部位於德國的 TUV SUD TIC 專業公司表示有興趣在印度建立電動車電池實驗室,作為計劃的第二階段。這些舉措預計將推動市場成長。

歐洲實現巨大成長

- 汽車製造業的復甦以及電動車和自動駕駛汽車等趨勢是推動德國汽車產業 TIC 需求的關鍵因素。此外,ADAS(高級駕駛輔助系統)和使用感測器、攝影機和雷射掃描儀的車輛等安全技術的成長預計將在未來幾年為研究市場中的供應商提供顯著的成長機會。

- 德國是全球主要汽車中心,擁有羅伯特·博世有限公司、大眾汽車公司和戴姆勒公司等主要汽車製造商和OEM設備製造商。車輛對車輛、車輛對車輛基礎設施和車上娛樂系統技術的持續開拓預計將在預測期內推動市場發展。

- 西班牙是歐洲第二大、世界第九大汽車製造國。西班牙汽車工業約佔該國GDP的10%,約佔出口的18%。西班牙的汽車工業對於外國投資者來說是一個有吸引力的投資目的地。根據FDI提供的見解,近年來西班牙已成為跨國公司在歐洲新建待開發區計劃的第二大首選投資目的地。

- 波蘭汽車工業佔總產值的11.1%,是波蘭僅次於食品工業的最重要的製造業之一。近年來,波蘭汽車製造業吸引了大量外國直接投資,已成為中東歐主要的汽車及汽車零件製造地。

汽車產業 TIC 市場概覽

汽車產業的測試、檢驗和認證市場分散且參與者眾多。隨著汽車需求的增加,新的參與者也進入市場,加劇了市場競爭。現有的市場參與者正致力於進一步擴大其市場佔有率和服務組合、建立合作夥伴關係以及進行收購以進一步加強其市場佔有率。市場上的一些主要企業包括 DEKRA SE、TUV Rheinland、TUV SUD、Applus Services SA 和 TUV Nord。

2024 年 2 月,DEKRA 成為 SERMI 計畫的官方合格評定機構 (CAB)。 SERMI 為獨立品牌的汽車相關企業提供與車輛安全相關的維修和保養資訊 (RMI) 的存取權限。作為 SERMI 認證的合格評定機構 (CAB),DEKRA 執行核准和認可測試。

2023 年 12 月,TUV SUD 在印度班加羅爾揭幕了一座最先進的設施,稱為 TUV SUD 班加羅爾園區。該機構專門根據國家和國際標準對電氣電子產品和醫療設備進行測試和認證。 TUV SUD班加羅爾校區佔地3英畝,初期總面積為70,000平方英尺(約8,000平方公尺)。這個最先進的校園經過精心設計,採用最新技術和永續建材,確保能源效率和環境永續性。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- COVID-19對市場的影響/後果以及其他宏觀趨勢對產業的影響

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- TIC產業產品週期

- 預計未來需求的標準、認證和服務類型

- 充電站基礎設施分析(世界情境)

第5章市場動態

- 市場驅動力

- 智慧汽車的演變

- 由於環境標準的日益重要和道路安全的迅速提高,車輛排放氣體測試和認證的增加

- 市場限制因素

- 缺乏國際標準

第6章 市場細分

- 按服務類型

- 測試

- 檢查

- 認證

- 按地區

- 美洲

- 美國

- 墨西哥

- 巴西

- 歐洲

- 德國

- 西班牙

- 法國

- 亞洲

- 中國

- 日本

- 韓國

- 印度

- 澳洲/紐西蘭

- 中東/非洲

- 美洲

第7章 競爭格局

- 公司簡介

- DEKRA SE

- TUV Rheinland

- TUV SUD

- Applus Services SA

- TUV Nord

- Bureau Veritas

- Intertek Group PLC

- SGS SA

- UL Solutions Inc.

- National Technical Systems(NTS)

- Eurofins Scientific

- Element Materials Technology

- KIWA NV

- ATIC(Guangzhou)Co. Ltd

第8章供應商市場佔有率分析

第9章市場的未來

The Testing, Inspection, And Certification Market For The Automotive Industry is expected to grow from USD 8.51 billion in 2024 to USD 11.93 billion by 2029, at a CAGR of 6.97% during the forecast period (2024-2029).

Through inspection/testing services, TIC companies aim to help automotive component and device manufacturers reduce problems and provide a positive end-user experience. They help protect brand reputation and drive consumer confidence and trust by confirming that products perform according to a manufacturer's claims or specified requirements.

* The migration toward EVs is accelerating, and from the start of 2022, car manufacturers have been focused on producing even more electric cars fitted with more advanced capabilities. EVs will gain higher market shares in Europe, the United States, and China and outpace ICE vehicle sales.

* The United States is one of the significant regions in the EV market and its sales. COX Enterprise reported that sales of battery electric vehicles in the United States reached nearly 258,900 units in the first quarter of 2023. This marked a significant year-over-year growth of approximately 44.9% compared to the sales figures from the same period in 2022. Furthermore, the first quarter of 2023 also outperformed the fourth quarter of 2022, establishing itself as the country's most successful quarter for BEV sales over the past two years.

* Moreover, the automotive industry, primarily focused on electric vehicles (EVs), is the most prominent sector, leading to a rise in demand for electrical products and components. Moreover, sensor adoption is significantly increasing, particularly in the automotive industry. This surge in demand is expected to persist at elevated levels in the coming years, supported by other markets as well. Government initiatives, such as subsidies and efforts to meet carbon emission targets, are anticipated to boost investments in the region's EV sector, consequently expanding growth prospects for the market.

* Furthermore, the rising awareness about the importance of ADAS in reducing car accidents is one of the primary factors driving the demand for these systems in recent years. Many countries in Europe, North America, and Asia have introduced regulations to mandate the use of different types of ADAS in the passenger car segment. For instance, since 2018, new vehicles sold in Canada must be equipped with a backup camera and an ADAS feature.

* There are challenges faced by the industry related to standards, regulations, and certification due to varying requirements, lack of proper understanding, absence of suitable infrastructure, etc.

* The production growth of automotive is expected to slow down in 2024 as weaker demand takes hold of the industry, particularly in advanced economies. However, the growing popularity of EVs in the global market and surging concerns related to dangers associated with them during their evolution phase have played a vital role in rolling back the TIC demand in the automotive market.

TIC Market For The Automotive Industry Trends

Electric Vehicles to Witness Significant Growth

- Due to the increasing environmental concerns and adverse effects of traditional vehicles, the market is opening up for alternatives such as electric vehicles.

- As the adoption of EVs continues to rise, stringent safety and compliance regulations have been put in place to ensure these vehicles' reliability, performance, and safety. The TIC market plays a crucial role in verifying that EVs meet these regulatory standards, such as battery safety, electromagnetic compatibility, and crash-test requirements. Rigorous testing and certification help build consumer confidence in the safety and quality of EV models.

- The core components of an EV, such as the battery pack and electric powertrain, require extensive testing and validation to ensure optimal performance, durability, and longevity. For the widespread adoption of electric vehicles, the rules for testing and homologation of EV batteries are essential to ensure their safety, efficiency, and reliability. The compliance of EV batteries with strict safety and performance standards is verified by testing and homologation procedures. These processes assure manufacturers, regulators, and consumers that the batteries comply with the necessary specifications and can be used in various conditions.

- Moreover, modern EVs increasingly rely on complex software and connectivity features, such as advanced driver assistance systems (ADAS) and over-the-air (OTA) updates. The TIC market helps ensure these software-driven EV systems' cybersecurity, data privacy, and functional safety, which are crucial for maintaining customer trust and regulatory compliance.

- Furthermore, Germany-based TUV SUD TIC giant expressed interest in setting up an EV battery lab in India in the second phase of its project. These initiatives are expected to drive the market's growth.

Europe to Witness Major Growth

- The recovery in automotive manufacturing and trends like electric vehicles and autonomous cars are some of the significant factors driving the demand for TIC in the German automotive industry. Moreover, growth in safety technologies such as advanced driver-assistance systems (ADAS) and vehicles using sensors, cameras, and laser scanners, among others, is expected to create massive growth opportunities for the vendors of the market studied in the coming years.

- Germany is a major automotive hub globally due to the presence of major automotive and OEM manufacturing companies such as Robert Bosch GmbH, Volkswagen AG, and Daimler AG. Consistent development of vehicle-to-vehicle, vehicle-to-infrastructure, and in-vehicle entertainment technologies is expected to drive the market studied during the forecast period.

- Spain is the second largest automaker in Europe and also the 9th largest in the world. The automotive industry in Spain contributes approximately 10% to the country's GDP and represents approximately 18% of the exports. The Spanish automotive industry is an attractive destination for foreign investors. Based on insights provided by FDI, it has been the second preferred destination in Europe for new Greenfield Projects by multinational companies in the last few years.

- Poland's automotive industry stands as one of the country's most significant manufacturing sectors, accounting for 11.1% of the total production value, second only to the food industry. In recent years, Poland has attracted substantial foreign direct investment in automotive manufacturing, emerging as a major manufacturing hub for cars, car parts, and components in Central and Eastern Europe.

TIC Market For The Automotive Industry Overview

The automotive industry testing, inspection, and certification market is fragmented and has several players. With the growing demand for automobiles, an increasing number of new players are also entering the market, driving the market competition. Established market players focus on further expanding their market presence and service portfolio, establishing partnerships, and making acquisitions to consolidate their market presence further. Some major players operating in the market include DEKRA SE, TUV Rheinland, TUV SUD, Applus Services SA, and TUV Nord, among others.

* In February 2024, DEKRA became an official conformity assessment body (CAB) for the SERMI scheme. SERMI offers brand-independent automotive businesses access to vehicle safety-related repair and maintenance information (RMI). As an accredited Conformity Assessment Body (CAB) for SERMI certification, DEKRA conducts approval and authorization inspections.

* In December 2023, TUV SUD unveiled its cutting-edge establishment, known as the 'TUV SUD Bengaluru Campus,' in Bengaluru, India. This facility is dedicated to the testing and certifying of electrical and electronic products and medical devices, adhering to national and international standards. Spanning over an impressive 3 acres, the 'TUV SUD Bengaluru Campus' encompasses a total area of 70,000 square feet in its initial phase. This state-of-the-art campus has been meticulously designed to incorporate the latest technology and sustainable building materials, ensuring energy efficiency and environmental sustainability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Impact/After-effects of COVID-19 on the Market and Other Macro Trends on the Industry

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Degree of Competition

- 4.4 Product Cycle of TIC Industry

- 4.5 Standards/Certifications and Types of Services that Might Be in Demand in the Future

- 4.6 Analysis of Charging Stations Infrastructure (Global Scenario)

5 MARKET DYNAMICS

- 5.1 Market Drives

- 5.1.1 Increasing Evolution of Smart Vehicles

- 5.1.2 Rising Automotive Emission Testing and Certification with Surging Importance of Environmental Standards as well as Surge Road Safety

- 5.2 Market Restraints

- 5.2.1 Lack of International Accepted Standards

6 MARKET SEGMENTATION

- 6.1 By Service Type

- 6.1.1 Testing

- 6.1.2 Inspection

- 6.1.3 Certification

- 6.2 By Geography***

- 6.2.1 Americas

- 6.2.1.1 United States

- 6.2.1.2 Mexico

- 6.2.1.3 Brazil

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 Spain

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 South Korea

- 6.2.3.4 India

- 6.2.3.5 Australia and New zealand

- 6.2.4 Middle East and Africa

- 6.2.1 Americas

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 DEKRA SE

- 7.1.2 TUV Rheinland

- 7.1.3 TUV SUD

- 7.1.4 Applus Services SA

- 7.1.5 TUV Nord

- 7.1.6 Bureau Veritas

- 7.1.7 Intertek Group PLC

- 7.1.8 SGS SA

- 7.1.9 UL Solutions Inc.

- 7.1.10 National Technical Systems (NTS)

- 7.1.11 Eurofins Scientific

- 7.1.12 Element Materials Technology

- 7.1.13 KIWA NV

- 7.1.14 ATIC (Guangzhou) Co. Ltd