|

市場調查報告書

商品編碼

1524089

車隊管理解決方案:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Fleet Management Solutions - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

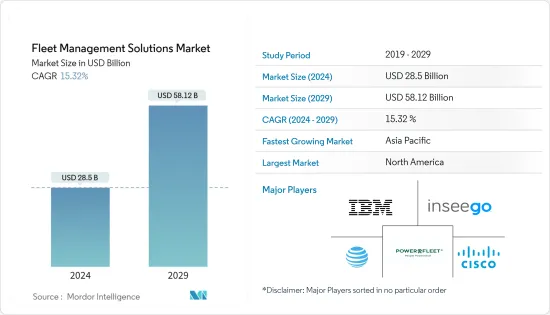

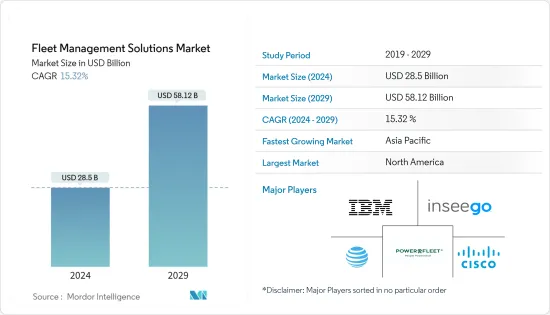

車隊管理解決方案市場規模預計到 2024 年為 285 億美元,預計到 2029 年將達到 581.2 億美元,在預測期內(2024-2029 年)複合年成長率為 15.32%。

*車隊管理軟體已成為依賴持有的企業的重要工具,透過提高生產力來改變業務。傳統方法植根於手動流程和碎片化系統,存在資料不準確、可視性差和資源浪費的問題。然而,對具有成本效益的策略和即時分析的需求正在推動對新解決方案的需求。

*企業尋求的功能包括遠端工作、生產力監控和車輛資料即時追蹤,預計這些功能將創造商機。自動駕駛汽車的引入可能會促進市場成長,因為車隊管理解決方案正在成為有效協調路線和交付時間表的關鍵要素。

*車隊管理系統市場主要由軟體、硬體、連接解決方案和網路基礎設施組成,為車隊營運商提供有效的監控和彙報。該解決方案使車隊營運商能夠降低成本和資源支出,同時確保車輛符合既定標準,從而使他們受益。市場供應商專注於透過消除非營利服務來提高車隊效率。

*貨運和物流軟體開發的第二個主要趨勢是自動化的快速採用,車隊管理解決方案正在迅速採用這種方法。該市場正在從物聯網、連網型卡車和貨櫃等新技術中獲得巨大的吸引力。將車輛連接到網路也將為高效能業務創造更多機會。

*5G的引入預計也將對車隊管理產生重大影響,因為它提高了資訊傳輸速度,使車輛能夠減少延誤並提高生產率。使用行動車隊管理應用程式的組織將能夠使用 5G。引入擴大的通訊和即時通知,使車隊經理及其工作人員能夠保持聯繫並提高生產力。

*車隊管理解決方案功能有限、初始成本較高,每月每項資產的成本會根據管理系統的功能而變動。最終,每個解決方案的確切價格取決於多種因素,包括追蹤的車輛數量、供應商提供的支援品質以及供應商許可和維護費用的價格,這些費用通常捆綁在總成本中這取決於你自己。

*COVID-19的傳播導致大量車輛閒置,而旨在管理其他類型車輛的供應商提供的車隊管理解決方案受到的打擊最為嚴重。這是由於世界各地的封鎖、旅行限制和在家工作文化所造成的。隨著公司繼續擴大在家工作政策以及人們避免使用叫車服務,這種趨勢仍在繼續。

車隊管理解決方案市場趨勢

資產管理業務預計將佔據較大佔有率

* 資產管理系統解決方案可保持與(FAST)的直接連接,消除重複的資料庫並在資產和維護管理與財務之間建立連接。由於資料的可用性和有效的研究,可以對資產對每項活動的影響進行監測,從而對成本效益分析進行審查。

*在當前製造和辦公環境快速數位化的市場場景中,資產管理和追蹤解決方案對於確保更高的業務效率變得越來越重要。物聯網技術的最新趨勢使一些最終用戶能夠購買經濟高效的資產追蹤設備。資產追蹤系統的銷售是由現代廣域和短程物聯網設備推動的,與標準的傳統資產追蹤系統相比,這些設備使用最少的電力和基礎設施。

*全球定位系統(GPS)廣泛應用於汽車,但其應用並不限於此。 GPS 可協助您在戶外追蹤您的確切位置。作為初步應用,車輛追蹤系統旨在幫助運輸和物流企業追蹤其所有資產,包括車輛和服務提供者。

* 資產車隊管理應用程式有可能收集特定車輛和駕駛員的使用資訊,並向車隊管理系統添加位置監控、影響報告、車輛訪問控制和合規檢查表等功能。物料輸送卡車不再只是堆高機。現在它被認為是管理者的資料來源,類似於駕駛員的駕駛座。傳統的基礎堆高機產品得到了廣泛的先進技術選擇的補充,例如支援駕駛員安全和生產力的功能,以及透過資料主導的、可操作的對車輛和駕駛員性能的洞察來進行設施管理。

*在工業物聯網中,資產追蹤預計在未來十年將顯著增加,位置感知將成為互連設備的關鍵要素。隨著低功耗射頻晶片技術的發展以及低功耗廣域網路(LPWAN)和藍牙LBLE信標的採用,物聯網資產監控的新解決方案已經出現。一旦使用 RFID 技術實施資產追蹤器,多個行業的需求預計將增加,包括工業自動化、供應鏈、物流、農業、建築、採礦和相關市場。

北美有望成為最大市場

- 由於製造、運輸和物流等工業部門的強大存在,北美是資產管理的重要市場。該地區的市場成長也得到了適用於各個最終用戶領域的政府措施和法規的支持。

- 隨著國內消費者越來越接受更快的運輸,聯合承運商和托運人必須維持對時間敏感的供應鏈。承運商之間在最後一英里的競爭正在推動傳統車隊和新興企業向更有效率的方式轉變,將小包裹直接送到消費者家中。此外,這個國家還有一個因素對車隊所有者的營運效率產生巨大影響:最後一個假期購物季。

- 採用車隊管理解決方案被認為是該國 5G 車隊管理的關鍵促進因素。車隊應該能夠利用 5G 的關鍵功能來減少延遲並提高生產力。隨著覆蓋範圍的擴大和生產力的提高,車隊管理應用程式的用戶可以受益於更好的 5G通訊。

- 從供應商的角度來看,汽車租賃公司開始向國內客戶提供車隊管理解決方案。這些公司中的大多數也利用協作和夥伴關係來建立其地理影響力。例如,在加拿大,HOS247 提供全面的端到端車隊管理系統,從車輛追蹤和電子記錄到車輛維護和閒置追蹤。 HOS247 的電子記錄設備旨在幫助減少違規行為並幫助企業遵守聯邦法規。該公司致力於在客戶服務方面提供一流的支援。由於公司硬體的品質和軟體的人性化設計,服務商可以毫不費力地管理他們的日誌並遠離經濟處罰和處罰。

車隊管理解決方案產業概述

車隊管理解決方案市場高度分散,既有全球參與者,也有中小企業。此外,車隊管理資料的增加正在推動企業轉向雲端技術。 iD 等幾個重要參與者主導了這個市場。 Systems、思科系統公司、IBM公司、AT&T公司、Ctrack(Inseego公司)市場參與者正在尋求聯盟和收購等策略,以加強他們的產品陣容並獲得永續的競爭優勢。

2023 年 7 月,Charles Jackson and Co. 將在其專業運輸業務中部署由 InseegoAI 支援的 AI 車隊攝影機解決方案,以提高安全性和保險性、減少碰撞並提高安全性。即時追蹤、事件警報和誘發因素的狀態監測相結合可以鼓勵負責任的駕駛並減少碰撞事故。當事故發生時,可以對駕駛因素做出反應,以確保安全並管理保險申請流程。您還可以使用影片和支援資料快速進行有效的調查。個人化或匿名的影像支援向輔導員和培訓策略提供回饋。

2023 年 3 月,Powerfleet 宣布推出一款利用其車隊智慧平台 Unity 上的安全資料的應用程式。 Unity 攝取、編譯和豐富來自任何 IoT 設備或第三方業務系統的資料。 Powerfleet 全新增強的資料科學主導解決方案使企業能夠透過一個全面、高度集中的儀表板和彙報來提高對現實世界安全事件的可見性和洞察力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章 汽車晶片短缺及下游影響

第6章 Telematics概述(車載硬體)

第7章市場動態

- 市場促進因素

- 再次強調簡化車隊營運

- 提供廣泛的彙報和分析服務

- 經濟實惠的硬體和改進的連接性

- 市場限制因素

- 小型車隊車主缺乏意識

- COVID-19 為運輸業帶來的不確定性

第8章市場區隔

- 按部署模型

- 本地

- 一經請求

- 混合

- 按解決方案

- 資產管理

- 資訊管理

- 促進要素管理

- 安全與合規管理

- 風險管理

- 營運管理

- 其他

- 按最終用戶

- 運輸

- 能源

- 建造

- 製造業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 北美洲

第9章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- AT&T Inc.

- Ctrack(Inseego Corp.)

- ID Systems

- IBM Corporation

- Astrata Group

- Mix Telematics Limited

- Omnitracs LLC

- Tomtom NV

- Trimble Navigation Limited

- Verizon Communications Inc.

- Wheels Inc.

- Tenna LLC

- Samsara Network Inc.

- KeepTrucking Inc.

- Fleet Complete Inc.

- Odoo SA

- Fleetable(Affable Web Solutions Company)

- Octo Group SpA

- Geotab Inc.

- Rarestep Inc.(FLEETIO)

- Switch Board Inc.

- Azuga holdings Inc.

- Chevin Fleet Solutions

- One Step GPS LLC

- Transflo

- Go Fleet Inc.

- Advance Tracking Technologies Inc.

- Donlen Corporation By Hertz Holdings

第10章市場展望

The Fleet Management Solutions Market size is estimated at USD 28.5 billion in 2024, and is expected to reach USD 58.12 billion by 2029, growing at a CAGR of 15.32% during the forecast period (2024-2029).

* Fleet management software has become a vital tool for businesses that depend on car fleets, transforming operations through increased productivity. Traditional methods, which originated in manual processes and fragmented systems, have drawbacks, including imprecise data, poor visibility, and wasteful resource use. However, the need for new solutions has increased due to the demand for cost-effective tactics and real-time analytics.

* Some of the features businesses are looking for, which they expect will create opportunities, include monitoring tasks and productivity in a remote environment, along with real-time tracking of fleet data. Introducing autonomous vehicles will likely contribute to market growth as fleet management solutions are becoming a key factor in effectively coordinating routes and delivery schedules.

* The Fleet Management System market mainly comprises software, hardware, connectivity solutions, and network infrastructure to provide fleet operators with effective monitoring and reporting. The solution will benefit fleet operators by reducing costs and resource expenditures while making it possible to ensure that the fleet is complying with established standards. Market vendors' primary focus has been increasing fleet efficiency by eliminating services that offer no appreciable benefit.

* The second significant trend behind software development for freight and logistics is the rapid adoption of automation, where fleet management solutions rapidly adopt this approach. The market is gaining considerable traction from new technologies such as the Internet of Things, connected trucks, and containers. Connecting vehicles to the Internet would also create further opportunities for efficient business.

* 5G deployment will also immensely affect fleet management, as it increases the speed of information transfer and allows fleets to reduce delays and gain productivity. Organizations using a mobile fleet management application will make the use of 5 G possible. The increased coverage and the introduction of immediate notifications enable fleet managers and their crews to remain in touch with each other and increase productivity.

* Fleet management solutions have high initial costs with limited functionality, and the cost per asset per month varies according to the management system's features. Ultimately, the exact price of each solution is unique and dependent on various factors, such as the number of vehicles tracked, the quality of support offered by the vendor, and the price of the vendor's licensing and maintenance fees, which are typically bundled into the total cost.

* The spread of COVID-19 resulted in high levels of idled vehicles, and fleet management solutions offered by vendors designed to manage other types of fleets have been hit hardest. This is due to a global lockdown, travel restrictions, and the culture of working from home. The trend stays in place as firms continue to expand work-from-home policies and people avoid using ride-hailing services.

Fleet Management Solutions Market Trends

Asset Management Segment Expected to Hold Significant Share

* Asset management systems and solutions allow for the creation of connections between property and maintenance management and financial by maintaining a direct connection to the (FAST), eliminating duplicate databases, and maintaining a This allows for the monitoring of an asset's effect on each activity to be carried out so that a review of cost-benefit analysis may take place, thanks to data availability and effective research.

* In the present market scenario for rapid digitalization in manufacturing and office environments, asset management and tracking solutions have become even more important to ensure a higher efficiency of operations. Several end users have benefited from recent developments in the Internet of Things technologies, enabling them to purchase economical and efficient asset-tracking equipment. The sales of asset tracker systems are driven by modern wide area and short-range Internet of Things equipment, which use minimal power and infrastructure compared with standard traditional Asset Tracker Systems.

* Global positioning systems (GPS) are widely used in vehicles, but their application is not limited. Organizations have also reported using them to monitor employees-GPS aids in tracking precise outdoor locations. As a preliminary application, the vehicle tracking system is designed to help businesses in transport or logistics keep track of all their assets, including vehicles and drivers.

* Applications for asset fleet management may gather utilization information on specific cars and drivers, assisting managers in finding ways to boost output features like position monitoring, impact reporting, vehicle access control, and compliance checklists are additional possible additions to fleet management systems. The material handling truck has evolved beyond being a simple lift truck. It is now regarded as the manager's data source as well as the operator's cockpit. Traditional base lift truck offerings can be enhanced with a wide range of advanced technological choices, such as capabilities to support operator security and productivity, as well as data-driven, actionable insight into vehicle and operator performance for facility management.

* In the Industrial Internet of Things, asset tracking is projected to increase significantly in the coming decade, and location awareness will become a key element for interconnected devices. New solutions for asset monitoring of the Internet of Things have emerged due to developments in low-power radio frequency chip technology and the adoption of Low Power Wide Area Networks, LPWAN, and Bluetooth LBLE beacons. Demand in several sectors, such as industry automation, supply chains, logistics, agriculture, construction, mining, and related markets, is anticipated to increase when asset trackers are implemented using RFID technology.

North America is Expected to Register the Largest Market

- Given the strong presence of industry sectors such as manufacturing, transportation, and logistics, North America is an important market for asset management. In addition, market growth in the region is supported by government initiatives and regulations applicable to different end-user sectors.

- Allied carriers and shippers must keep a time-definite supply chain in place, given the increasing adoption of more rapid delivery by consumers at home. The competition between carriers for the last mile has resulted in a shift to efficient methods of delivering small packages directly into consumers' homes from traditional fleets and start-ups. In addition, there is a significant factor influencing the driving efficiency of fleet owners in this country: the last holiday shopping season.

- Adopting fleet management solutions is considered a critical driving factor in this country regarding 5G fleet management. Fleets should be able to shorten delays and improve productivity using 5G's main features. Due to improved coverage and higher productivity, users of fleet management applications can benefit from better communication with 5G.

- In vendor terms, vehicle leasing companies have started offering fleet management solutions to clients in the country. In addition, most of those companies have been using cooperation and partnerships to build their geographic presence. For instance, in Canada, from vehicle tracking and electronic logging to vehicle maintenance and idle tracking, HOS247 provides a comprehensive end to end fleet management system. The electronic logging device from HOS247 is made to reduce infractions and assist companies in adhering to federal rules. The company is dedicated to offering first rate support with their customer care. Because of the quality of the company's hardware and the user-friendly design of the software, drivers can effortlessly manage their logs and stay away from funds and penalties.

Fleet Management Solutions Industry Overview

The fleet management solutions market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Furthermore, companies have become interested in cloud technologies due to growing fleet management data. Several important players, such as I.D., dominate this market. Systems, Cisco Systems Inc., IBM Corporation, AT&T Inc., Ctrack (Inseego Corp.), and others. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In July 2023, Charles Jackson and Co. expand its A.I. fleet camera solution with an InseegoAI-powered fleet dashcam solution to its specialist haulage operation to target safety and insurance improvements and to reduce collisions and improve safety, where the combination of live tracking, incident alerting, and driver status monitoring will help us encourage responsible driving and reduce crashes. If an incident does occur, we will be able to respond to ensure driver welfare and manage the insurance claims process, as well as use video and supporting data to undertake an effective investigation quickly. Individual or anonymized footage will support our targeted driver feedback and training strategy.

In March 2023, Powerfleet Inc. launched its safety and security data-powered application to Unity, its fleet intelligence platform. Unity ingests, compiles, and enriches data from any IoT device or third-party business system. Mixed fleets, over the road or in the warehouse or distribution center, now have a single source of truth to revolutionize the safety of assets, vehicles, and, most importantly, its people; with Powerfleet's new and enhanced data-science-driven solution, businesses have improved visibility and insights from real-world safety and security incidents under one comprehensive and highly focused set of dashboards and reporting.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the Impact of COVID-19 on the Industry

5 IMPACT OF CHIP SHORTAGE IN AUTOMOTIVE AND DOWNSTREAM EFFECTS

6 TELEMATICS (FLEET HARDWARE) OVERVIEW

7 MARKET DYNAMICS

- 7.1 Market Drivers

- 7.1.1 Renewed Emphasis on Streamlining Fleet Operations

- 7.1.2 Availability of a Wider Range of Reporting and Analytics Services

- 7.1.3 Affordable Hardware and Access to Greater Connectivity

- 7.2 Market Restraints

- 7.2.1 Lack of Awareness among Smaller Fleet Owners

- 7.2.2 Uncertainties in transport industry due to COVID-19

8 MARKET SEGMENTATION

- 8.1 By Deployment Model

- 8.1.1 On-Premise

- 8.1.2 On-Demand

- 8.1.3 Hybrid

- 8.2 By Solution

- 8.2.1 Asset Management

- 8.2.2 Information Management

- 8.2.3 Driver Management

- 8.2.4 Safety and Compliance Management

- 8.2.5 Risk Management

- 8.2.6 Operations Management

- 8.2.7 Other Solutions

- 8.3 By End User

- 8.3.1 Transportation

- 8.3.2 Energy

- 8.3.3 Construction

- 8.3.4 Manufacturing

- 8.3.5 Other End-Users

- 8.4 By Geography

- 8.4.1 North America

- 8.4.1.1 United States

- 8.4.1.2 Canada

- 8.4.2 Europe

- 8.4.2.1 Germany

- 8.4.2.2 United Kingdom

- 8.4.2.3 France

- 8.4.2.4 Rest of Europe

- 8.4.3 Asia Pacific

- 8.4.3.1 China

- 8.4.3.2 Japan

- 8.4.3.3 India

- 8.4.3.4 Rest of Asia Pacific

- 8.4.4 Latin America

- 8.4.4.1 Brazil

- 8.4.4.2 Argentina

- 8.4.4.3 Rest of South America

- 8.4.5 Middle East and Africa

- 8.4.5.1 United Arab Emirates

- 8.4.5.2 Saudi Arabia

- 8.4.5.3 South Africa

- 8.4.5.4 Rest of Middle East and Africa

- 8.4.1 North America

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Cisco Systems Inc.

- 9.1.2 AT&T Inc.

- 9.1.3 Ctrack (Inseego Corp. )

- 9.1.4 I.D. Systems

- 9.1.5 IBM Corporation

- 9.1.6 Astrata Group

- 9.1.7 Mix Telematics Limited

- 9.1.8 Omnitracs LLC

- 9.1.9 Tomtom NV

- 9.1.10 Trimble Navigation Limited

- 9.1.11 Verizon Communications Inc.

- 9.1.12 Wheels Inc.

- 9.1.13 Tenna LLC

- 9.1.14 Samsara Network Inc.

- 9.1.15 KeepTrucking Inc.

- 9.1.16 Fleet Complete Inc.

- 9.1.17 Odoo SA

- 9.1.18 Fleetable (Affable Web Solutions Company)

- 9.1.19 Octo Group SpA

- 9.1.20 Geotab Inc.

- 9.1.21 Rarestep Inc. (FLEETIO)

- 9.1.22 Switch Board Inc.

- 9.1.23 Azuga holdings Inc.

- 9.1.24 Chevin Fleet Solutions

- 9.1.25 One Step GPS LLC

- 9.1.26 Transflo

- 9.1.27 Go Fleet Inc.

- 9.1.28 Advance Tracking Technologies Inc.

- 9.1.29 Donlen Corporation By Hertz Holdings