|

市場調查報告書

商品編碼

1524092

天然纖維增強複合材料:市場佔有率分析、產業趨勢、成長預測(2024-2029)Natural Fiber Reinforced Composites - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

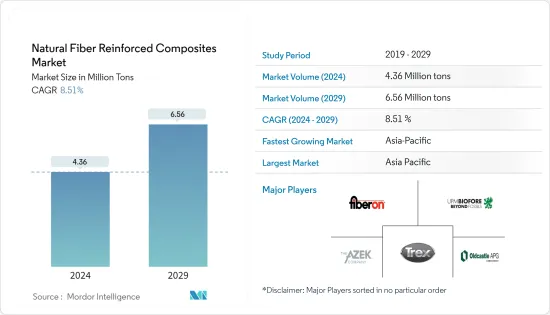

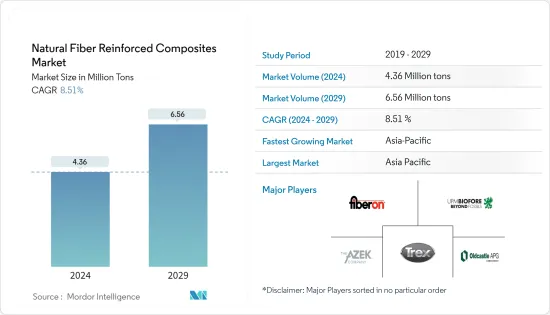

天然纖維增強複合材料的市場規模預計到2024年為436萬噸,預計2029年將達到656萬噸,在預測期內(2024-2029年)複合年成長率為8.51%。

從中期來看,生物基複合材料需求的增加和全球汽車產業的成長等因素預計將推動 2024 年至 2029 年天然纖維增強複合材料市場的發展。

主要亮點

- 然而,諸如吸濕性、有限的加工溫度、與大多數聚合物基質不相容以及由於暴露於外部環境而導致的劣化等問題可能是市場的限制因素。

- 然而,它在建設產業的日益普及預計將為市場帶來新的機會。

- 亞太地區佔據市場主導地位,預計 2024 年至 2029 年複合年成長率最高。

天然纖維增強複合材料的市場趨勢

建設產業預計將主導市場

- 建材業始終需要環保材料。基於天然纖維增強聚合物的複合材料由於其眾多優點,擴大應用於土木工程和建築應用。

- 複合材料在建設產業中發揮著至關重要的作用。工業柱、儲槽、大跨距屋頂結構、高層建築、輕質門窗、家具、輕質建築、橋樑構件、成套橋樑系統等均採用複合材料。複合材料在建設產業中變得越來越重要,以實現長期永續性。

- 近年來,建築業得到了大量投資。根據牛津經濟研究院預測,2020年至2030年間,全球建築業預計將成長4.5兆美元(42%),達到15.2兆美元。此外,2020年至2030年,中國、印度、美國和印尼預計將佔全球建築業成長的58.3%。

- 此外,建築業為中國經濟的持續發展和對天然纖維增強複合材料產品的需求做出了重大貢獻。中國正在經歷建設熱潮。此外,根據住宅部的預測,到2025年,中國建築業預計將維持GDP的6%。

- 建築業是中國經濟持續發展的關鍵力量。根據中國國家統計局的數據,建築業產值將從2021年的29.3兆元(4.2兆美元)增加至2022年的31.2兆元(4.5兆美元)。預計到 2030 年,中國將在建築上花費近 13 兆美元,對天然纖維增強複合材料來說前景樂觀。

- 在北美,美國在建設產業中佔有很大佔有率。除美國外,加拿大和墨西哥也是建築業投資的主要貢獻者。美國人口普查局資料顯示,2022年美國公共住宅年金額為91.5億美元,較2017年的67.4億美元成長35.7%。

- 同樣,根據歐盟統計局的數據,與 2022 年相比,2023 年建設業的平均年產值在歐元區成長了 0.2%,在歐盟成長了 0.1%。建設業產量年度增幅最大的是羅馬尼亞(成長 30.7%)、波蘭(成長 18.9%)和比利時(成長 10.7%)。

- 因此,預計上述趨勢將影響 2024-2029 年建築領域天然纖維增強複合材料的成長。

亞太地區預計將主導市場

- 預計亞太地區將主導全球市場。中國、印度和日本等國家建設活動的增加正在增加該地區天然纖維增強複合材料的使用。

- 據住宅部預測,到2025年,中國建築業預計將維持GDP的6%。為了回應這項預測,2022 年 1 月,中國政府宣布了一項五年計劃,旨在使建築業更加永續和品質主導。

- 同樣,天然纖維增強複合材料在電子產業的應用正在迅速增加,並可能支持該國的工業成長。根據印度品牌股權基金會(IBEF)預測,到2025年,印度電子製造業的產值預計將達到5,200億美元。

- 此外,汽車是天然纖維增強複合材料的主要消費者之一。印度汽車工業在技術進步和宏觀經濟擴張中發揮關鍵作用,使其成為印度經濟表現的重要指標。

- 此外,印度政府還宣布了「更快採用和製造(混合動力汽車和)電動車」計劃,目標是到 2030 年實現 30% 的電動車 (EV) 普及率。該計劃將為電動車創造需求獎勵,並支持在城市中心部署充電技術和充電站。政府設定的目標是,2030年,印度銷售的70%商用車、30%私家車、40%公車以及80%兩輪和三輪車為電動車。

- 因此,預計各國政府的新政策和投資將在2024-2029年期間提振亞太地區其他天然纖維增強複合材料市場的需求。

天然纖維增強複合材料產業概況

天然纖維增強複合材料市場分散。主要參與者(排名不分先後)包括 Trex Company Inc.、The AZEK Company Inc.、Oldcastle APG Inc.、UPM 和 Amorim Cork Composites SA。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 對生物基複合材料的需求增加

- 全球汽車工業的成長

- 抑制因素

- 吸濕性、加工溫度限制、與大多數聚合物基質的不相容性

- 由於暴露於外部環境而導致的劣化問題

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔:市場規模(基於數量)

- 纖維

- 木纖維複合材料

- 非木纖維複合材料

- 棉布

- 亞麻

- 紅麻

- 麻

- 其他非木纖維複合材料(黃麻、劍麻、蕉麻、相思木、鳳梨、香蕉)

- 聚合物

- 熱固性樹脂

- 熱塑性塑膠

- 聚乙烯

- 聚丙烯

- 聚氯乙烯

- 其他熱塑性塑膠(聚碳酸酯、聚醯胺、聚丁烯對苯二甲酸酯(PBT))

- 最終用戶產業

- 航太

- 車

- 海洋

- 建築/施工

- 電力/電子

- 運動的

- 其他最終用戶產業(電力產業(風力發電機)、醫療保健等)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- Amorim Cork Composites SA

- Beologic

- BPREG Composites

- Fiberon

- FKuR

- Flexform Technologies

- Green Dot Bioplastics

- GreenGran BN

- JELU-WERK J. Ehrler GmbH & Co. KG

- Oldcastle APG

- TECNARO GmbH

- The AZEK Company Inc.

- Trex Company Inc.

- UFP Technologies Inc.

- UPM

- Wuhu Haoxuan Wood Plastic Composite Co. Ltd

第7章 市場機會及未來趨勢

- 在建設產業中越來越受歡迎

The Natural Fiber Reinforced Composites Market size is estimated at 4.36 Million tons in 2024, and is expected to reach 6.56 Million tons by 2029, growing at a CAGR of 8.51% during the forecast period (2024-2029).

In the medium term, factors such as the increasing demand for bio-based composites and the growth of the global automotive industry are likely to drive the natural fiber-reinforced composites market between 2024 and 2029.

Key Highlights

- However, moisture adsorption, restricted processing temperature, incompatibility with most polymer matrices, and degradation issues due to exposure to the external environment are likely to act as restraints for the market.

- Nevertheless, increasing popularity in the building and construction industry is expected to provide new opportunities for the market.

- Asia-Pacific is expected to dominate the market and is likely to witness the highest CAGR from 2024 to 2029.

Natural Fiber Reinforced Composites Market Trends

The Construction Industry is Expected to Dominate the Market

- There is always a continuous requirement for eco-friendly materials in the building materials industry. Natural fiber-reinforced polymer-based composites are increasingly used in civil engineering construction applications due to their numerous advantages.

- In the building and construction industry, composite materials are extremely significant. Industrial supports, tanks, long-span roof structures, high-rise buildings and lightweight doors, windows, furnishings, lightweight buildings, bridge components, and complete bridge systems have all employed composite materials. Composite materials are becoming increasingly essential in the construction industry to achieve long-term sustainability.

- The construction sector has witnessed major investments in recent years. According to Oxford Economics, the global construction industry is expected to grow by USD 4.5 trillion, or 42%, between 2020 and 2030 to reach USD 15.2 trillion. Also, China, India, the United States, and Indonesia are expected to account for 58.3% of global growth in construction between 2020 and 2030.

- Additionally, the construction sector is a key contributor to China's continued economic development and demand for natural fiber-reinforced composite products. China is amid a construction mega-boom. Moreover, as per the forecast given by the Ministry of Housing and Urban-Rural Development, the Chinese construction sector is expected to maintain a 6% share of the country's GDP going into 2025.

- The construction sector is a key player in China's continued economic development. According to the National Bureau of Statistics of China, the value of construction output accounted for CNY 31.2 trillion (USD 4.5 trillion) in 2022, up from CNY 29.3 trillion (USD 4.2 trillion) in 2021. China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for natural fiber-reinforced composites.

- In North America, the United States has a major share in the construction industry. Besides the United States, Canada and Mexico contribute significantly to investments in the construction sector. According to the United States Census Bureau Data, the annual value of public residential construction in the United States was valued at USD 9.15 billion in 2022, an increase of 35.7% compared to USD 6.74 billion in 2017.

- Similarly, as per the Eurostat, the annual average production in construction for 2023, compared to 2022, increased by 0.2% in the euro area and by 0.1% in the European Union. The highest annual increases in construction production were recorded in Romania (+30.7%), Poland (+18.9%), and Belgium (+10.7%).

- Hence, the aforementioned trends are projected to influence the growth of natural fiber-reinforced composites in the construction sector between 2024 and 2029.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is expected to dominate the global market. With growing construction activities in countries such as China, India, and Japan, the usage of natural fiber-reinforced composites is increasing in the region.

- As per the Ministry of Housing and Urban-Rural Development, the Chinese construction sector is expected to maintain a 6% share of the country's GDP going into 2025. With the given forecasts, the Chinese government unveiled a five-year plan in January 2022 to make the construction sector more sustainable and quality-driven.

- Similarly, the surging application of natural fiber-reinforced composites in the electronics industry is likely to support the country's industry growth. According to the India Brand Equity Foundation (IBEF), the Indian electronics manufacturing industry is expected to reach USD 520 billion by 2025.

- Furthermore, automotive is among the major consumers of natural fiber-reinforced composites. The automotive industry in India is an important indicator of the Indian economic performance, as this sector plays a vital role in both technological advancements and macroeconomic expansion.

- Additionally, the Indian government has created momentum through its Faster Adoption and Manufacturing of (Hybrid and) Electric Vehicles schemes that encourage, and in some segments, mandate the adoption of electric vehicles (EV), intending to reach 30% EV penetration by 2030. The scheme creates demand incentives for EVs and supports the deployment of charging technologies and stations in urban centers. The government has set a target of 70% of all commercial cars, 30% of private cars, 40% of buses, and 80% of two-wheelers and three-wheelers sold in India by 2030 to be electric.

- Hence, the new policies and investments made by different governments are expected to boost the demand for the natural fiber-reinforced composites market in the rest of Asia-Pacific between 2024 and 2029.

Natural Fiber Reinforced Composites Industry Overview

The natural fiber reinforced composites market is fragmented in nature. Major players (not in any particular order) include Trex Company Inc., The AZEK Company Inc., Oldcastle APG Inc., UPM, and Amorim Cork Composites SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Demand for Bio-based Composites

- 4.1.2 Growth in the Automotive Industry Worldwide

- 4.2 Restraints

- 4.2.1 Moisture Adsorption, Restricted Processing Temperature, and Incompatibility with Most of the Polymer Matrices

- 4.2.2 Degradation Issue Due to Exposure to the External Environment

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Fiber

- 5.1.1 Wood Fiber Composites

- 5.1.2 Non-wood Fiber Composites

- 5.1.2.1 Cotton

- 5.1.2.2 Flax

- 5.1.2.3 Kenaf

- 5.1.2.4 Hemp

- 5.1.2.5 Other Non-wood Fiber Composites (Jute, Sisal, Abaca, Coir, Pineapple, and Banana)

- 5.2 Polymer

- 5.2.1 Thermosets

- 5.2.2 Thermoplastics

- 5.2.2.1 Polyethylene

- 5.2.2.2 Polypropylene

- 5.2.2.3 Poly Vinyl Chloride

- 5.2.2.4 Other Thermoplastics (Polycarbonate, Polyamide, and Polybutylene Terephthalate (PBT))

- 5.3 End-user Industry

- 5.3.1 Aerospace

- 5.3.2 Automotive

- 5.3.3 Marine

- 5.3.4 Building and Construction

- 5.3.5 Electrical and Electronics

- 5.3.6 Sports

- 5.3.7 Other End-user Industries (Power Industry (Wind Turbines), Medical, etc.)

- 5.4 Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordic Countries

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle East and Africa

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Amorim Cork Composites SA

- 6.4.2 Beologic

- 6.4.3 BPREG Composites

- 6.4.4 Fiberon

- 6.4.5 FKuR

- 6.4.6 Flexform Technologies

- 6.4.7 Green Dot Bioplastics

- 6.4.8 GreenGran BN

- 6.4.9 JELU-WERK J. Ehrler GmbH & Co. KG

- 6.4.10 Oldcastle APG

- 6.4.11 TECNARO GmbH

- 6.4.12 The AZEK Company Inc.

- 6.4.13 Trex Company Inc.

- 6.4.14 UFP Technologies Inc.

- 6.4.15 UPM

- 6.4.16 Wuhu Haoxuan Wood Plastic Composite Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Popularity in the Building and Construction Industry