|

市場調查報告書

商品編碼

1687188

無塵室技術:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)Cleanroom Technology - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

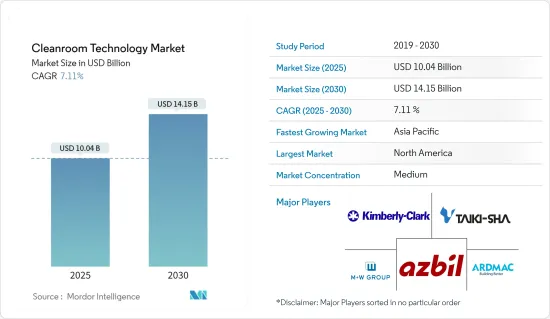

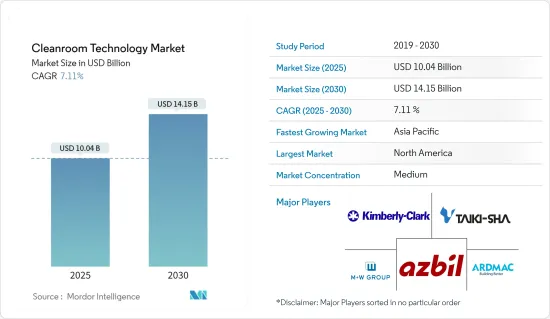

無塵室技術市場規模預計在 2025 年為 100.4 億美元,預計到 2030 年將達到 141.5 億美元,預測期內(2025-2030 年)的複合年成長率為 7.11%。

關鍵亮點

- 隨著品質和安全標準不斷發展且愈加嚴格,對無塵室技術的需求也日益增加。潔淨室是指空氣品質、粒狀物水平、溫度和濕度受到精確調節的受控環境。潔淨室最大限度地降低了空氣中的顆粒物、微生物和其他污染物對產品完整性產生不利影響的風險。製藥、生物技術和電子等行業使用無塵室來滿足監管機構規定的嚴格品質和安全要求。對品質和安全標準的日益關注推動了潔淨室技術的採用,以維護和確保關鍵產品的品質和安全標準。

- 現代無塵室的發展始於第二次世界大戰期間,旨在提高用於生產坦克、槍支和飛機的測量設備的品質和可靠性。在此期間,HEPA 過濾器也被開發用於容納核分裂實驗和化學和生物戰爭研究產生的危險放射性物質、微生物和化學污染物。潔淨室的演變受到美國國家航空暨太空總署 (NASA) 在 1950 年代和 1960 年代的太空旅行計劃的推動。在此期間,「層流」概念被引入,標誌著潔淨室技術的一個轉折點。

- 隨著電子產品需求的成長,無塵室技術供應商的業務也不斷成長。因此,已開發國家和開發中國家的政府都在做出巨大努力,確保擁有足夠的無塵室來滿足其國家所有稀缺情況。例如,美國政府去年正式通過了《CHIPS法案》。該法案要求美國公司在美國境內建造半導體製造無塵室,而不是外包給海外的無塵室。隨著法案訂定,海外半導體廠商也紛紛計畫在美國新建無塵室,以獲得美國政府的資助。

- 2024 年 4 月,拜登總統宣布根據《晶片與科學法案》與美光公司達成高達 61 億美元的初步協議。這項投資將支持在紐約州克萊和愛達荷州建造兩座晶圓廠,到 2030 年將釋放 500 億美元的私人投資,也是美光公司首次在兩個州建造尖端記憶體製造生態系統的投資,未來 20 年總投資將達到 1,250 億美元。資金籌措將用於支持計劃中的四座晶圓廠「Megafun」工廠的前兩座的建設,該工廠致力於生產尖端 DRAM 晶片。每個晶圓廠將擁有 60 萬平方英尺的無塵室空間,四個工廠的總合。這是美國有史以來公佈的最大的無塵室空間,相當於40個足球場的面積。

- 醫療設備需求的不斷成長以及製藥業研發支出的不斷增加進一步推動了市場的成長。根據IQVIA統計,近年來全球醫藥市場經歷了顯著成長。到2023年,全球醫藥市場規模預計將達到約1.6兆美元。這比前一年增加了1000多億美元。

- 隨著品質和安全標準不斷發展且愈加嚴格,對無塵室技術的需求也日益增加。潔淨室是指空氣品質、粒狀物水平、溫度和濕度受到精確調節的受控環境。潔淨室最大限度地降低了空氣中的顆粒物、微生物和其他污染物對產品完整性產生不利影響的風險。製藥、生物技術和電子等行業使用無塵室來滿足監管機構規定的嚴格品質和安全要求。對品質和安全標準的日益關注推動了潔淨室技術的採用,以維護和確保關鍵產品的品質和安全標準。

- 例如,2023年8月,博世宣布計劃在馬來西亞建立一個最先進的晶片和感測器半導體測試中心。該設施佔地超過 18,000平方公尺,包括無塵室、辦公空間和專門的研究和開發實驗室,可容納多達 400 名員工。

- 由於需要受控環境來維持高品質的產品,潔淨室在各種最終用戶市場中越來越受歡迎。然而潔淨室的成本不僅需要大量的建設投資,還取決於空氣交換次數和過濾效率,這些都需要營運成本。

- 為了保持足夠的空氣質量,潔淨室必須始終處於運作,這使得營運成本非常高。節能運作和持續遵守無塵室標準使無塵室成為製造技術和實驗室最關鍵的基礎設施之一。預計這將對市場成長構成挑戰。

潔淨室技術市場趨勢

半導體製造終端用戶正在推動市場成長

- 潔淨室對於半導體製造至關重要,該產業嚴重依賴無塵室環境來生產精密的微電子產品。半導體晶片存在於每一種電腦化設備中,從行動電話等家用物品到汽車、國防技術和太空船等複雜機器。半導體晶片採用敏感材料製造,形成必須小心處理的精密層。因此,半導體晶片的製造、封裝和測試等操作必須在受控的無塵室環境中進行。

- 半導體無塵室是要求最嚴格的無塵室之一。由於光刻線寬度低於 0.1 微米,這些無塵室通常屬於 10 級或 100 級無塵室分類(ISO-4 或 ISO-5)。此外,半導體無塵室對溫度和濕度有嚴格的要求。這些潔淨室的面積從 500 平方英尺到 50 萬平方英尺不等。半導體潔淨室通常使用 ULPA 過濾器而不是 HEPA 過濾器來防止最小的亞微米顆粒進入無塵室。 HEPA 過濾器可以捕捉 0.3u 的 99.97% 的顆粒,而 ULPA 過濾器可以捕捉 0.12u 的 99.999% 的顆粒。

- 例如,2023年6月,全球領先的半導體公司美光科技公司宣布計劃在印度古吉拉突邦建立自己的組裝和測試工廠。美光公司的新工廠將實現 DRAM 和 NAND 產品的組裝和測試製造,以滿足國內和國際市場的需求。

- 全球半導體產業投資的增加是市場的主要成長動力。例如,Analog Devices Inc. 於 2023 年 7 月宣布,其打算增強無塵室能力以最佳化製造流程。作為最新投資的一部分,該公司將推出半導體維修培訓計畫。這項 10 億美元的重大投資有望推動比佛頓半導體工廠的成長和效率。最值得注意的是,此次擴建將增加 25,000 平方英尺,使無塵室容量達到令人印象深刻的 118,000 平方英尺。

- 摩根州立大學最近獲得了額外的 680 萬美元州政府資助,用於推出兩個尖端研究中心,以創造和推動半導體設計和製造領域的創新,並解決公共教育面臨的挑戰。

- 隨著 5G 網路擴展、物聯網 (IoT) 設備激增以及人工智慧 (AI) 和機器學習 (ML) 應用成長等趨勢推動半導體需求成長,半導體製造商需要提高生產能力。這種產能的增加需要建造或擴建配備最新無塵室技術的無塵室設施,以滿足半導體製造所需的嚴格清潔標準。根據WSTS預測,2024年全球半導體銷售額預計將達5,883.6億美元,較上年大幅成長。

- 總體而言,不斷成長的半導體需求將推動對無塵室技術的投資,以支持半導體製造能力的擴大,並確保為各個行業和應用生產高品質的晶片。

預計北美將佔據較大的市場佔有率

- 預計北美在預測期內將出現顯著成長,這主要歸因於無塵室技術的進步、該地區醫療保健行業的成長以及產品認證的嚴格監管規範等推動該市場發展的因素。根據CMS的數據,美國全國醫療保健總支出預計將在2024年達到4.8兆美元,並在2031年達到7.1兆美元。

- 售後市場銷售的成長以及從定長切割採伐技術的轉變也促進了市場的成長。這種成長主要歸功於生技產業的成長,該產業還很年輕,尤其是與汽車、化學和鋼鐵業相比。生技產業的發展是一個獨特的故事,但它建立在美國其他產業通用的基礎上。據美國國立衛生研究院(NIH)稱,2023財政年度NIH對生物技術的資助約為89億美元。預計到 2024 年將達到 91 億美元。

- 多年來,政府和私人資助的研究繼續提供世界上無與倫比的知識庫。透過生物製造,美國的永續生質能被轉化為新產品,為基於石油的化學品、藥品、燃料、材料等的生產提供替代品。

- 例如,《金融時報》美國製藥和生物技術展將於2024年5月在紐約舉辦,並首次與Endpoints News合作。這項活動匯集了生物製藥行業的領導者、監管機構、投資者和科學家,共用對未來一年的獨特見解,並討論影響該行業和國家的最重要趨勢。這些努力可能會進一步刺激該地區的市場需求。

- 2024 年 4 月,安進在俄亥俄州新奧爾巴尼開設了一家新的人工智慧生物製造工廠。預計將僱用約400名員工。該投資 3.65 億美元的工廠將採用自動化、人工智慧和資料驅動的製造流程,以最佳化即時效能。該設施按照環境永續性標準建造,並支持安進的碳中和目標。

- 該地區的國家主要希望提高晶片製造水平,並有望協助美國發展人工智慧、5G 和量子運算等未來戰略技術,這些技術將決定未來幾十年的全球經濟和軍事領導地位。美國半導體產業協會(SIA)最新報告指出,美國政府面臨戰略機遇,可以扭轉美國晶片製造業數十年來的衰退軌跡,加強國家安全,增強供應鏈的韌性,使美國成為全球最具吸引力的半導體製造業國家機會。隨著各公司宣布未來幾年重點發展北美地區業務的計劃,預計這一成長將為北美無塵室技術市場帶來巨大推動力。

潔淨室技術市場概覽

由於潔淨室設備產業的分散性,無塵室技術市場的特點是競爭對手之間的競爭非常激烈,許多供應商都在爭奪市場佔有率。特別是在耗材領域,供應商之間的競爭非常激烈,都爭相搶佔大量市場佔有率。該領域的主要企業包括 M+W Group GmbH、Azbil Corporation、Taikisha Global Limited、Kimberly Clark Corporation 和 Ardmac Ltd.。

2024 年 4 月,AES Clean Technology 宣佈於 2024 年 4 月 16 日在 INTERPHEX 2024 上推出 CleanLock 模組。無塵室氣閘解決方案旨在透過整合 AES 獨有的無塵室飾面、取得專利的照明、可預測的氣流模式和先進的門控來最大限度地降低污染風險。這些功能可以立即融入任何設施。 CleanLock 模組可使人員和材料安全進入現有的無塵室。

2024年2月,ADI公司宣布與全球領先的專用半導體代工廠台積電達成特別協議,透過位於熊本縣的台積電控股製造子公司日本先進半導體製造公司(JASM)提供長期晶圓生產能力。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 主要宏觀經濟趨勢將如何影響市場

第5章市場動態

- 市場促進因素

- 主要市場生物技術和醫療保健支出整體成長

- 嚴格的政府法規和對優質產品的需求

- 市場問題

- 安裝維護成本高,缺乏技術純熟勞工

第6章市場區隔

- 按組件

- 設備類型

- 無塵室空氣浴塵室

- HVAC 系統

- 層流系統

- 高效過濾器

- 乾燥櫃

- 風機過濾機組

- 耗材類型

- 衣服

- 手套

- 擦拭巾

- 真空系統

- 消毒劑

- 其他耗材

- 設備類型

- 按最終用戶

- 製藥

- 生物技術

- 醫療設備

- 醫院

- 半導體製造

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- M+W Group

- Azbil Corporation

- Taikisha Global Limited

- Kimberly Clark Corporation

- Ardmac Ltd

- Ansell Limited

- Clean Air Products

- Labconco Corporation

第8章投資分析

第9章:市場的未來

The Cleanroom Technology Market size is estimated at USD 10.04 billion in 2025, and is expected to reach USD 14.15 billion by 2030, at a CAGR of 7.11% during the forecast period (2025-2030).

Key Highlights

- The demand for cleanroom technology grows as quality and safety standards evolve and become more stringent. Cleanrooms offer controlled environments with precise regulation of air quality, particulate levels, temperature, and humidity. They minimize the risk of contamination from airborne particles, microorganisms, and other contaminants that can adversely affect product integrity. Industries such as pharmaceuticals, biotechnology, and electronics rely on cleanrooms to meet the strict quality and safety requirements imposed by regulatory bodies. The increasing focus on quality and safety standards drives the adoption of cleanroom technology to maintain and ensure significant product quality and safety standards.

- The modern, clean room development began during the Second World War to enhance the quality and reliability of instrumentation used in manufacturing tanks, guns, and aircraft. During this time, HEPA filters were also developed to contain the dangerous radioactive, microbial, or chemical contaminants that resulted from experiments into nuclear fission and research into chemical and biological warfare. The evolution of clean rooms gained momentum due to NASA's space travel program in the 1950s and 1960s. During this time, the 'laminar flow' concept was introduced, marking a turning point in clean room technology.

- With the growing demand for electronics, cleanroom technology providers are witnessing increased business. As a result of this, governments from developed and developing nations are significantly working toward securing ample cleanrooms to handle any scarce situation domestically. For instance, the US government officially passed the CHIPS Act in the previous year. Under this act, the US government wanted US companies to build cleanrooms in the United States for semiconductor manufacturing instead of outsourcing to cleanrooms in foreign countries. After introducing this act, foreign semiconductor manufacturers have also been planning new US-based cleanrooms to get US government funding.

- In April 2024, President Biden announced up to USD 6.1 billion preliminary agreement with Micron under the CHIPS and Science Act. This investment will support the construction of two fabs in Clay, New York, and one fab in Idaho, releasing USD 50 billion in private investment by 2030 as the first step toward Micron's investment of up to USD 125 billion across both states over the next two decades to create a leading-edge memory manufacturing ecosystem. Funding will support the construction of the first two fabs of a planned four-fab "megafan" focused on leading-edge DRAM chip production. Each fab will have 600,000 square feet of cleanrooms, totaling 2.4 million square feet of cleanroom space across the four facilities, the most extensive cleanroom space ever announced in the United States and the size of nearly 40 football fields.

- Growing demand for medical instruments and increasing R&D spending in the pharmaceutical industry further propel the market growth. According to IQVIA, the global pharmaceutical market has experienced significant growth in recent years. In 2023, the total global pharmaceutical market was around USD 1.6 trillion. This is an increase of over USD 100 billion compared to the previous year.

- The demand for cleanroom technology grows as quality and safety standards evolve and become more stringent. Cleanrooms offer controlled environments with precise regulation of air quality, particulate levels, temperature, and humidity. They minimize the risk of contamination from airborne particles, microorganisms, and other contaminants that can adversely affect product integrity. Industries such as pharmaceuticals, biotechnology, and electronics rely on cleanrooms to meet the strict quality and safety requirements imposed by regulatory bodies. The increasing focus on quality and safety standards drives the adoption of cleanroom technology to maintain and ensure significant product quality and safety standards.

- For instance, in August 2023, Bosch announced plans to establish a state-of-the-art semiconductor test center for chips and sensors in Malaysia. The facility boasts an expansive area of over 18,000 square meters, housing clean rooms, office spaces, and dedicated R&D laboratories to accommodate up to 400 associates.

- Cleanrooms are gaining popularity in various end-user markets as a controlled environment is necessary for maintaining high-quality products. However, the cost of a cleanroom is not only highly investment-intensive to build, but operational costs can also rely on the number of required air exchanges and filtration efficiency.

- The operation can be extremely costly, as holding the appropriate air quality means the room has to be in constant operation. Energy-efficient operation and continuous adherence to cleanroom standards make a cleanroom one of the most critical infrastructures for manufacturing technology and laboratories. This is anticipated to challenge the market's growth.

Cleanroom Technology Market Trends

Semiconductor Manufacturing End User Significantly Driving the Market Growth

- Cleanrooms are necessary for semiconductor manufacturing as this industry relies heavily on cleanroom environments to manufacture sensitive microelectronics. Semiconductor chips are utilized in every computerized device, from household objects like cell phones to complex machines such as vehicles, defense technology, or spacecraft. They are produced using susceptible materials to create delicate layers that must be worked on carefully. Thus, tasks like semiconductor chip manufacturing, packaging, and testing must be carried out in a controlled cleanroom environment.

- Semiconductor cleanrooms are among the most demanding cleanrooms. As photolithography linewidths go below 0.1 microns, these cleanrooms are usually class 10 or 100 cleanroom classification (ISO-4 or ISO-5). Additionally, semiconductor cleanrooms have tight temperature and humidity requirements. Such cleanrooms can vary in size from 500 SF to 500,000 SF; usually, semiconductor cleanrooms use ULPA filters instead of HEPA filters to prevent even the smallest submicron particles from entering the cleanroom. While HEPA filters can catch 99.97% of particles at 0.3u, ULPA filters can catch 99.999% at 0.12u.

- For instance, in June 2023, Micron Technology Inc., one of the world's significant semiconductor companies, announced plans to build a unique assembly and test facility in Gujarat, India. Micron's new facility will allow assembly and test manufacturing for DRAM and NAND products and address demand from domestic and international markets.

- The growing investments in the semiconductor industry worldwide are a key growth driver for the market. For instance, in July 2023, Analog Devices Inc. announced its intention to enhance its cleanroom capabilities to optimize manufacturing. The company will introduce a semiconductor maintenance training program as part of its latest investment. This substantial investment of USD 1 billion is poised to foster the growth and efficiency of the semiconductor facility in Beaverton. Notably, the expansion will result in an additional 25,000 square feet, boosting the cleanroom capacity to an impressive 118,000 square feet.

- Recently, Morgan State University secured an additional USD 6.8 million in state funding to support the launch of two latest research centers that will create and drive innovation in the design and fabrication of semiconductors and handle the challenges facing public school education.

- As the demand for semiconductors rises, driven by trends such as the expansion of 5G networks, the proliferation of Internet of Things (IoT) devices, and the growth of artificial intelligence (AI) and machine learning (ML) applications, semiconductor manufacturers need to ramp up production capacity. This increased production capacity requires constructing or expanding cleanroom facilities equipped with the latest cleanroom technology to meet the stringent cleanliness standards necessary for semiconductor fabrication. According to WSTS, 2024 semiconductor sales were expected to reach USD 588.36 billion worldwide, significantly more than the previous year.

- Overall, the growing demand for semiconductors drives investment in cleanroom technology to support the expansion of semiconductor manufacturing capacity and ensure the production of high-quality chips for various industries and applications.

North America is Expected to Hold Significant Market Share

- It is anticipated that North America will experience significant growth during the forecast period, primarily due to the technological advancements in cleanrooms, the growth of the healthcare sector in the region, and stringent regulatory standards for product approvals are the factors propelling the development of this market. According to CMS, the total US national health expenditure recorded was USD 4.8 trillion in FY 2024, and it is projected to reach USD 7.1 trillion by 2031.

- Rising aftermarket sales and the shift toward modified cut-to-length logging techniques also contribute to the market growth. This growth is primarily attributed to the growing biotechnology industry, which is still young, especially compared with the automotive, chemical, and steel industries. The development of the biotechnology industry is a unique story, and yet it rests on foundations common to other segments of American industry. According to NIH, biotechnology funding by the NIH was around USD 8.9 billion during the fiscal year 2023. Further, it is estimated to reach USD 9.1 billion by FY 2024.

- Years of research, both government-funded and privately funded, continue to provide a knowledge base unequaled in the world. Through biomanufacturing, sustainable biomass across the United States has been converted into new products and provides an alternative to petroleum-based production for chemicals, medicines, fuels, materials, and more.

- For instance, the Financial Times US Pharma and Biotech Summit returned to New York in May 2024, partnering with Endpoints News for the first time. The event gathered biopharma leaders, regulators, investors, and scientists to share unique insights about the year ahead and discuss the most critical trends affecting the industry and the country. Such initiatives may further propel the market demand in the region.

- In April 2024, Amgen opened a new AI-enabled biomanufacturing facility in New Albany, Ohio. It will employ roughly 400 people. The USD 365 million investment features automation, AI, and data-driven manufacturing processes, optimizing real-time performance. The facility was built with environmental sustainability standards, supporting Amgen's carbon neutrality goals.

- The regional countries are mainly looking forward to strengthening chip manufacturing, which is expected to help America with the strategic technologies of the future, including AI, 5G, and quantum computing, that will determine global economic and military leadership for decades to come. According to a new report by the Semiconductor Industry Association, the US government has a strategic opportunity to reverse the decades-long trajectory of declining chip manufacturing in America, strengthen national security, make supply chains more resilient, and make the country one of the most attractive places in the world to produce semiconductors. This growth is expected to provide a vast share of traction to the North American cleanroom technology market as the companies have announced their plans to majorize the region in the upcoming few years.

Cleanroom Technology Market Overview

In the cleanroom technology market, intense competitive rivalry prevails due to the fragmentation of the cleanroom equipment industry, with numerous vendors vying for market share. Fierce competition is evident among these vendors, especially in the consumable segments, as they seek to capture a larger portion of the market. Key players in this sector include M+W Group GmbH, Azbil Corporation, Taikisha Global Limited, Kimberly Clark Corporation, and Ardmac Ltd.

April 2024: AES Clean Technology announced the launch of its CleanLock Module at INTERPHEX 2024 on April 16, 2024. The airlock solution for cleanrooms is engineered to minimize the risk of contamination by integrating AES' proprietary cleanroom finishes, patented lighting, predictable airflow patterns, and advanced door controls. These features can be incorporated into any facility without delay. The CleanLock Module allows for a secure transition of people and materials entering existing cleanrooms.

February 2024: Analog Devices Inc. announced that the company made a special arrangement with TSMC, the world's significant dedicated semiconductor foundry, to supply long-term wafer capacity through Japan Advanced Semiconductor Manufacturing Inc. ("JASM"), TSMC's majority-owned manufacturing subsidiary in Kumamoto Prefecture, Japan.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

- 4.3 Impact of Key Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Overall Growth in Biotechnology and Healthcare Spending in Major Markets

- 5.1.2 Stringent Government Regulations and Demand for Quality Products

- 5.2 Market Challenges

- 5.2.1 High Installation, Maintenance Costs, and Lack of Skilled Workforce

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Type of Equipment

- 6.1.1.1 Cleanroom Air Showers

- 6.1.1.2 HVAC Systems

- 6.1.1.3 Laminar Air Flow Systems

- 6.1.1.4 High Efficiency Filters

- 6.1.1.5 Desiccator Cabinets

- 6.1.1.6 Fan Filter Units

- 6.1.2 Type of Consumable

- 6.1.2.1 Apparels

- 6.1.2.2 Gloves

- 6.1.2.3 Wipes

- 6.1.2.4 Vacuum Systems

- 6.1.2.5 Disinfectants

- 6.1.2.6 Other Types of Consumables

- 6.1.1 Type of Equipment

- 6.2 By End User

- 6.2.1 Pharmaceutical

- 6.2.2 Biotechnology

- 6.2.3 Medical Devices

- 6.2.4 Hospitals

- 6.2.5 Semiconductor Manufacturing

- 6.2.6 Other End Users

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 M+W Group

- 7.1.2 Azbil Corporation

- 7.1.3 Taikisha Global Limited

- 7.1.4 Kimberly Clark Corporation

- 7.1.5 Ardmac Ltd

- 7.1.6 Ansell Limited

- 7.1.7 Clean Air Products

- 7.1.8 Labconco Corporation