|

市場調查報告書

商品編碼

1524123

全球軟包裝市場:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Flexible Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

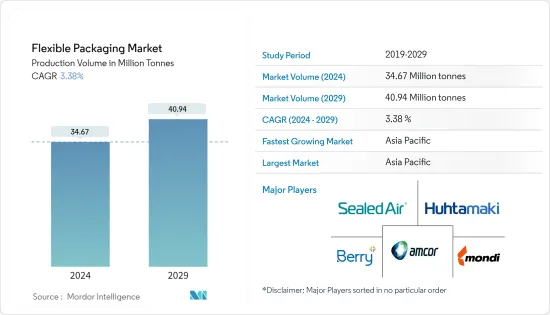

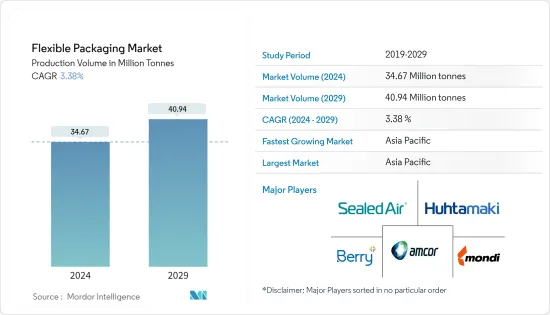

全球軟包裝市場的生產規模預計將從2024年的3,467萬噸擴大到2029年的4,094萬噸,預測期間(2024-2029年)複合年成長率為3.38%。

軟包裝市場受到許多相互交織的因素的推動,包括對方便、輕質包裝解決方案的需求不斷成長、消費者對永續性的意識不斷增強,以及提高保存期限和產品保護的包裝技術的進步。

主要亮點

- 此外,軟包裝的多功能性、成本效益和運輸便利性也是其成長的推動因素。隨著產業優先考慮環保解決方案以及消費者要求便利性和功能性,軟包裝市場可望擴大。

- 零售收益的增加往往會導致市場擴張,使新產品進入市場,並使現有產品接觸更多消費者。軟包裝可適應多種產品類型,使其適用於多種行業,包括食品和飲料、藥品和個人護理品。因此,零售的擴張可能會推動軟包裝市場多個細分領域的成長。

- 聚乙烯主要用於塑膠袋、塑膠薄膜、地工止水膜等包裝。聚乙烯是一種輕質、部分結晶質、低吸濕性熱塑性塑膠,具有高耐化學性和隔音性能。低密度聚乙烯(LDPE)主要用於生產塑膠袋。 LDPE 聚乙烯袋在低溫下柔軟且富有彈性,也有自然色可供選擇。

- 在包裝方面,回收和環保至關重要。海洋和垃圾掩埋場的塑膠污染受到包裝廢棄物的影響。塑膠包裝導致環境中的塑膠污染。塑膠需要數百年才能分解,並會影響海洋生物和生態系統。

- 預計這一趨勢將持續下去。 COVID-19 之後,對牛皮紙廠的投資可能會增加。紙包裝的使用不斷增加,很大程度上是由於電子商務領域的擴張以及消費者對環保解決方案的興趣。

軟包裝市場趨勢

烘焙點心和零嘴零食領域成長

- 軟包裝為烘焙點心和零嘴零食的消費者和生產商提供了便利。消費者重視軟包裝的易用性和可重新密封性,特別是經常食用多次的產品,例如餅乾和麵包。

- 此外,根據美國農業部的數據,隨著經濟成長、富裕程度的提高以及海灣各州年輕人和移民的擴張,零嘴零食食品,特別是巧克力、鹹味零嘴零食、甜餅乾和砂糖,繼續增加。

- 根據加拿大農業和食品部統計,到2026年,美國冷凍烘焙食品的規模預計將達到25.76億美元,較2022年大幅成長。對糖果零食和烘焙產品的需求增加催生了軟包裝選擇,如小袋、袋子、包裝紙和薄膜,因為軟包裝可以提供廣泛的印刷選擇,以改善糖果零食包裝設計,這預計將推動需求。

- 過去十年,忙碌的生活方式、勞動力中女性人數的增加以及工業化的不斷發展等方面迅速增加了該地區對即時包裝食品和零食的需求。此外,雙收入專業家庭正在推動零食市場的發展,作為忙碌一天後的代餐或獎勵。

- 人口稠密且富裕的阿拉伯聯合大公國和沙烏地阿拉伯佔零食和糖果零食支出的 75% 以上。卡達和巴林等其他小國也正在經歷穩定成長,預計到 2025 年將成為大型市場。

亞太地區正在經歷顯著成長

- 在中國,泡殼包裝主要應用於製藥業,因為它具有增強產品保護、簡化分銷、單位劑量包裝和改進產品標識等眾多優點。因此,我國泡殼包裝產業的範圍顯著擴大。

- 在人口老化的日本,日本袋裝食品以及預先切割的單份蔬菜和肉類變得越來越容易買到,以適應零售商不斷變化的偏好。值得注意的是,由層壓塑膠和鋁製成的殺菌袋在日本越來越受歡迎,尤其是醬汁和咖哩。這些袋子正在取代傳統罐頭,因為它們在熱滅菌過程中更耐用。此外,小袋包裝比罐頭食品更具成本效益,特別是在罐頭食品依賴金屬進口的國家,這進一步支持了其在日本的採用。

- 根據日本罐頭食品協會統計,2022年日本蒸餾食品產量約157,540噸咖哩,而殺菌袋農產品僅佔780噸。預計這些趨勢將持續下去並推動市場成長。

- 印度擁有14億人口,是世界上人口最多的國家,也是世界第五大經濟體。該國強勁的製藥業,加上投資的增加、人口的成長、健康意識的提高和預期壽命的延長,預計將推動對軟性藥品包裝解決方案的需求。

- 澳洲包裝市場在亞太地區表現突出,成長迅速。特別是加工食品、生鮮食品和肉類產業正在經歷快速成長。健康意識的趨勢和對消費者道德的日益關注正在推動對本地生產的生鮮食品的需求。

- 馬來西亞、菲律賓、泰國、越南、紐西蘭、韓國和亞太其他地區佔據了亞太地區軟包裝產業的主要市場佔有率。

軟包裝產業概況

由於少數供應商擁有相當大的市場佔有率佔有率,軟包裝市場呈現分散化狀態。市場較為集中,領導企業採取產品創新、併購等策略來維持競爭力。該行業的主要企業包括 Amcor Group GmbH、Mondi Group、Berry Global Inc.、Sealed Air Corporation 和 Huhtamaki Oyj。

- 2024 年 3 月 Berry Global Group, Inc. 的軟性部門最近提高了三個歐洲回收設施的回收能力,這是擴大該公司 Sustane 系列回收聚合物生產的歐洲範圍計劃的一部分。該擴建計劃預計將利用全球獲得高價值再生塑膠的機會,滿足對再生材料製成的高性能薄膜不斷成長的需求。

- 2024 年 2 月,Amkor 與有機優格製造商 Stonyfield Organic 和吸嘴袋包裝製造商 Cheer Pack North America 合作,為 Stonyfield Organic 的冷藏 Yo Baby 優格創造一種更永續的替代品,以替代傳統的多層結構。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力:波特五力分析

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 對便捷包裝的需求不斷成長

- 長期儲存的需求和生活方式的改變

- 市場挑戰

- 對環境和回收的擔憂

第6章 市場細分

- 依材料類型

- 塑膠

- 聚乙烯(PE)

- 雙軸延伸聚丙烯(BOPP)

- 流延聚丙烯 (CPP)

- 聚氯乙烯(PVC)

- 乙烯 - 乙烯醇(EVOH)

- 其他塑膠(PA、生質塑膠)

- 紙

- 鋁箔

- 塑膠

- 依產品類型

- 小袋

- 包包

- 薄膜和包裝

- 其他產品類型(小袋、套袋、泡殼包裝、襯裡、層壓板等)

- 按最終用途行業

- 食品

- 冷凍/冷藏食品

- 乳製品

- 水果和蔬菜

- 肉/雞肉/魚貝類

- 烘焙點心/零嘴零食

- 糖果/糖果零食

- 其他食品

- 飲料

- 藥品和醫療用品

- 家居用品/個人護理

- 其他最終用途行業(煙草、化學品、農業等)

- 食品

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 土耳其

- 波蘭

- 俄羅斯

- 亞洲

- 中國

- 日本

- 印度

- 澳洲

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 伊朗

- 奈及利亞

- 北美洲

第7章 競爭格局

- 公司簡介

- Amcor Group Gmbh

- Berry Global Inc.

- Mondi PLC

- Sealed Air Corporation

- Huhtamaki Oyj

- Uflex Limited

- Coveris Management Gmbh

- ProAmpac LLC

- Wipf AG

- Flexpak Services Llc

- Sigma Plastics Group Inc.

- KM Packaging Services Ltd

- Sonoco Products Company

- Arabian Flexible Packaging LLC

- Gulf East Paper and Plastic Industries LLC

第8章投資分析

第9章市場的未來

The Flexible Packaging Market size in terms of production volume is expected to grow from 34.67 Million tonnes in 2024 to 40.94 Million tonnes by 2029, at a CAGR of 3.38% during the forecast period (2024-2029).

The flexible packaging market is driven by a combination of factors, including increasing demand for convenient and lightweight packaging solutions, rising consumer awareness toward sustainability, and advancements in packaging technology for improved shelf life and product protection.

Key Highlights

- Additionally, the versatility of flexible packaging in accommodating various shapes and sizes, its cost-effectiveness, and ease of transportation further contribute to its growth. As industries prioritize eco-friendly solutions and consumers seek convenience and functionality, the flexible packaging market is poised to expand.

- Higher retail sales often lead to market expansion, with new products entering the market and existing ones reaching broader audiences. Flexible packaging is adaptable to different product categories, making it suitable for various industries, including food and beverage, pharmaceuticals, personal care, and more. Thus, expanding retail sales could drive growth in multiple segments of the flexible packaging market.

- Polyethylene is primarily used for packaging plastic bags, plastic films, geomembranes, etc. It is a lightweight, partially crystalline, low moisture absorbent, thermoplastic resin that has high resistance to chemicals and sound-insulating properties. Low-density polyethylene (LDPE) is mainly used to manufacture plastic bags. LDPE polyethylene bags are soft and flexible, even at low temperatures, and are available in natural colors.

- Recycling and environmental considerations are essential when it comes to packaging. Plastic contamination in oceans and landfills are impacted by packaging trash. Plastic packaging affects the environment's plastic pollution. Plastic can affect marine life and ecosystems since it takes hundreds of years to disintegrate.

- It is expected that this trend will continue. Investments in the kraft paper mills will rise post-COVID-19. The increased use of paper packaging is largely due to the growing e-commerce sector and consumer interest in eco-friendly solutions.

Flexible Packaging Market Trends

Baked Goods and Snack Foods Segment to Witness Growth

- Flexible packaging offers convenience to both consumers and producers of baked goods and snack foods. Consumers appreciate the ease of use and resealability of flexible packaging, especially for items like cookies and bread, which are often consumed multiple times.

- Moreover, according to USDA, the snacks and confectionery, especially chocolates, salty snacks, sweet biscuits, and sugar confectionery, continue to rise along with the growing economy, rising affluence, and expanding young and migrant residents in the Gulf states.

- According to Agriculture and Agri-Food Canada, the value of frozen bakery food in the United States is expected to witness a bolstered growth amounting to USD 2.576 billion by 2026, significantly up from 2022. Since flexible packaging can provide a wide range of printing options to improve the packaging design of confectionery products, a rise in demand for confectionery and baked products would consequently drive the demand for flexible packaging options like pouches, bags, wraps, and films.

- Aspects such as busy lifestyles, more women in the workforce, and growing industrialization have strengthened the need for ready-to-eat packaged foods and snacks in the region over the last decade. Dual-income professional households have also spurred the market for snacks between meals as a meal replacement and a reward after a busy workday.

- With their extensive and affluent populations, the United Arab Emirates and Saudi Arabia account for more than 75% of snacks and sweets consumption by value. Other smaller countries like Qatar and Bahrain are witnessing steady growth and are predicted to become larger markets by 2025.

Asia Pacific to Witness Significant Growth

- China predominantly employs blister packaging in its pharmaceutical sector, owing to its numerous advantages, such as enhanced product protection, streamlined distribution, unit dosage packaging, and improved product identification. This has significantly expanded the scope of the country's blister packaging industry.

- With Japan's aging population, there's a rising availability of Japanese pouch meals and pre-cut, single-serving portions of vegetables and meats, all catering to the evolving retail preferences. Notably, retort pouches, made from laminated plastic and aluminum, are gaining traction in Japan, particularly for sauces and curries. These pouches are replacing traditional cans due to their durability during thermal sterilization. Moreover, pouch packaging proves more cost-effective than cans, especially in countries reliant on metal imports for canning, further bolstering its adoption in Japan.

- According to the Japan Canners Association, in 2022, curry emerged as the dominant retort food pouch product in Japan, with a production volume of about 157.54 thousand tons, overshadowing agricultural products in retort pouches, which accounted for a mere 780 tons. These trends are expected to persist, driving market growth in the coming years.

- With a population of 1.4 billion, India stands as the world's most populous nation and the fifth-largest economy. The country's robust pharmaceutical industry, coupled with growing investments, a rising population, heightened health awareness, and increasing life expectancy, is set to bolster the demand for flexible pharmaceutical packaging solutions.

- The Australian packaging market has been a standout in the Asia-Pacific region, boasting rapid growth. Notably, the country is witnessing a surge in its processed food, fresh produce, and meat sectors. Health-conscious trends and a heightened focus on consumer ethics are propelling the demand for locally-grown fresh food.

- The Rest of Asia-Pacific, encompassing Malaysia, the Philippines, Thailand, Vietnam, New Zealand, South Korea, and other countries in the region, commands a significant market share in the Asia-Pacific flexible packaging sector.

Flexible Packaging Industry Overview

The flexible packaging market is fragmented owing to the presence of a few vendors with significant market share. The market is slightly concentrated, with the major players adopting strategies like product innovation, mergers, and acquisitions to remain competitive. The key players in the industry are Amcor Group GmbH, Mondi Group, Berry Global Inc., Sealed Air Corporation, and Huhtamaki Oyj, among others.

- In March 2024, Berry Global Group, Inc.'s Flexibles division recently increased recycling capacity at three European recycling facilities as part of a Europe-wide project to scale up production of the company's Sustane line of recycled polymers. The expansion project is expected to meet the increasing demand for high-performing films created with recycled content by leveraging the company's global access to high-value recycled plastic.

- In February 2024, Amcor partnered with Stonyfield Organic, the organic yogurt maker, and Cheer Pack North America, a spouted pouch packaging manufacturer, to introduce an all-polyethylene (PE)-based spouted pouch that replaces Stonyfield Organic's previous multilayered structure with a more sustainable pouch design for their Yo Baby refrigerated yogurt.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of Substitutes

- 4.2.4 Threat of New Entrants

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Demand for Convenient Packaging

- 5.1.2 Demand for Longer Shelf Life and Changing Lifestyles

- 5.2 Market Challenges

- 5.2.1 Concerns Regarding the Environment and Recycling

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.1.1 Polyethene (PE)

- 6.1.1.2 Bi-orientated Polypropylene (BOPP)

- 6.1.1.3 Cast polypropylene (CPP)

- 6.1.1.4 Polyvinyl Chloride (PVC)

- 6.1.1.5 Ethylene Vinyl Alcohol (EVOH)

- 6.1.1.6 Other Plastic Types (PA, Bioplastics)

- 6.1.2 Paper

- 6.1.3 Aluminum Foil

- 6.1.1 Plastic

- 6.2 By Product Type

- 6.2.1 Pouches

- 6.2.2 Bags

- 6.2.3 Films & Wraps

- 6.2.4 Other Product Types (Sachets, Sleeves, Blister Packs, Liners, Laminates, etc.)

- 6.3 By End-user Industry

- 6.3.1 Food

- 6.3.1.1 Frozen and Chilled Food

- 6.3.1.2 Dairy Products

- 6.3.1.3 Fruits and Vegetables

- 6.3.1.4 Meat, Poultry, and Seafood

- 6.3.1.5 Baked Goods and Snack Foods

- 6.3.1.6 Candy and Confections

- 6.3.1.7 Other Food Products

- 6.3.2 Beverage

- 6.3.3 Pharmaceutical and Medical

- 6.3.4 Household and Personal Care

- 6.3.5 Other End-user Industries (Tobacco, Chemical, and Agriculture, Among Others)

- 6.3.1 Food

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.2.5 Spain

- 6.4.2.6 Turkey

- 6.4.2.7 Poland

- 6.4.2.8 Russia

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.4.3 Mexico

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.5.4 Egypt

- 6.4.5.5 Iran

- 6.4.5.6 Nigeria

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Amcor Group Gmbh

- 7.1.2 Berry Global Inc.

- 7.1.3 Mondi PLC

- 7.1.4 Sealed Air Corporation

- 7.1.5 Huhtamaki Oyj

- 7.1.6 Uflex Limited

- 7.1.7 Coveris Management Gmbh

- 7.1.8 ProAmpac LLC

- 7.1.9 Wipf AG

- 7.1.10 Flexpak Services Llc

- 7.1.11 Sigma Plastics Group Inc.

- 7.1.12 KM Packaging Services Ltd

- 7.1.13 Sonoco Products Company

- 7.1.14 Arabian Flexible Packaging LLC

- 7.1.15 Gulf East Paper and Plastic Industries LLC