|

市場調查報告書

商品編碼

1524182

硬體錢包:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Hardware Wallet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

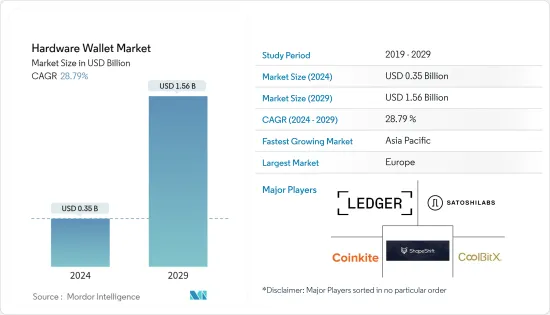

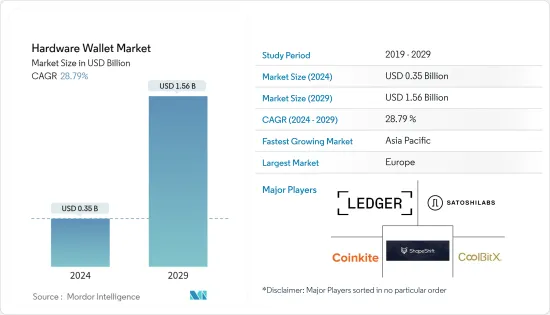

硬體錢包市場規模預計到 2024 年為 3.5 億美元,預計到 2029 年將達到 15.6 億美元,在預測期內(2024-2029 年)複合年成長率預計為 28.79%。

硬體錢包是一種專門設計的加密貨幣錢包,可將用戶的私鑰安全地儲存在加密硬體上。這些錢包允許用戶透過將私鑰儲存在微控制器內的受保護區域來保護敏感資料。

主要亮點

- 人們對加密貨幣交易的興趣日益濃厚正在推動市場發展。這些設備現已廣泛用於商業目的。此外,錢包程式內建了強大的防盜和防駭客功能,使其不易受到潛在風險的影響。此外,與軟體、紙錢包和基於網路的替代品相比,這些設備提供的增強的安全性預計將在預測期內推動市場擴張。

- 此外,硬體錢包技術的不斷進步正在改善安全功能、用戶體驗以及與各種加密貨幣的兼容性。這些進步使硬體錢包對初學者和經驗豐富的加密貨幣投資者更具吸引力。此外,機構投資者進入加密貨幣市場將進一步推動對安全儲存解決方案的需求。機構投資者通常優先考慮安全性和合規性,這使得硬體錢包成為儲存大量數位資產的有吸引力的選擇。

- 去中心化金融(DeFi)正在對全球各行各業產生重大影響。這些平台提供借貸和資產管理等金融服務,而不依賴銀行等傳統中介機構。 DeFi 用戶正在尋求安全的交易管理,而硬體錢包已成為最安全的選擇。需要物理驗證,這增加了額外的安全層。隨著 DeFi 市場的成長,我們相信對與這些平台進行安全互動的需求將繼續推動全球產業的發展。

- 政府可能會制定法規限制用於儲存加密貨幣的硬體錢包的銷售和使用。例如,他們在購買硬體錢包時可能需要廣泛的 KYC(了解您的客戶)程序,這可能會阻止存取硬體錢包。大流行減緩了硬體錢包的採用。

- 疫情導致的加密貨幣需求快速成長,對硬體錢包市場產生了正面影響。比特幣和其他加密貨幣正慢慢從不可靠的投資工具轉變為被接受的付款方式。 COVID-19 大流行增加了對付款非物質化的呼聲,並提高了人們對付款實踐和金融生命週期的認知。

硬體錢包市場趨勢

USB 細分市場佔據主要市場佔有率

- USB 硬體錢包是一種實體設備,可安全地離線儲存您的私人加密金鑰。它旨在透過將您的金鑰與網路連接的裝置隔離來防範駭客和惡意軟體等線上威脅。當用戶需要進行交易時,錢包可以連接到電腦或行動設備,但密鑰永遠不會離開設備,從而提供額外的安全性。 USB錢包是最受歡迎的加密貨幣硬體錢包。

- 該錢包使用實體螢幕和兩個按鈕進行 PIN 身份驗證、確認和更新。它採用堅固的塑膠外殼,並透過微型 USB 連接器連接。例如,Trezor 錢包是一種流行的加密貨幣硬體錢包,也是最早創建的 USB 加密貨幣硬體錢包之一。旨在儲存比特幣、Altcoin和 ERC ~20 代幣的私鑰。

- USB硬體錢包的成長主要是由市場的一些關鍵因素推動的。推動市場發展的是對安全、便捷的加密貨幣儲存解決方案不斷成長的需求。 USB 硬體錢包為用戶提供了一種可攜式且易於使用的選項,用於離線儲存數位資產,從而提高針對網路威脅和駭客攻擊的安全性。

- 加密貨幣的日益普及以及保護私鑰的需求不斷成長,增加了對 USB 硬體錢包作為可靠、安全的儲存解決方案的需求。截至 2024 年 1 月,全球共有 9,024 種加密貨幣。

- 此外,USB 連接的便利性使用戶可以從各種裝置輕鬆存取錢包,使其成為加密貨幣愛好者的熱門選擇。 USB 硬體錢包對安全性、易用性和便攜性的重視符合個人尋求強大的解決方案來保護其數位資產的不斷成長的趨勢,並且硬體錢包市場的這一領域已顯著成長。的傳播。

- 2023 年 10 月,領先的加密硬體錢包供應商 Trezor 宣布推出兩款新產品:Trezor Safe 3 和 Trezor Metal。 Trezor Safe 3 是 Trezor 的第三代旗艦硬體錢包,支援超過 1,000 種硬幣和代幣。 Trezor Safe 3 具有更大的觸控螢幕、更快的處理器、USB-C 連接埠和重新設計的介面。

亞太地區預計將出現顯著成長

- 亞太地區是硬體錢包作為安全儲存數位資產的手段出現顯著成長的市場之一。這是由於該地區擴大採用加密貨幣,以及印度、中國和韓國等新興付款付款。

- 此外,隨著分散式帳本技術和區塊鏈的整合確保安全性和透明度,市場正在擴大。網路犯罪的增加、電子商務平台的擴張以及資料漏洞的增加正在推動對硬體錢包等安全儲存解決方案的需求。市場成長是由無線硬體錢包的激增所推動的,其推動因素包括近場通訊(NFC)、長期儲存容量和直接控制等功能。

- 此外,區塊鏈技術正在徹底改變數位資產的儲存和管理方式,進一步推動硬體錢包市場的發展。特別是在印度,區塊鏈技術正在各個領域變得流行。隨著區塊鏈應用程式的增加,該領域的專家正在創建不同的方法來針對不同的使用案例修改技術。此外,區塊鏈在促進P2P交易和智慧合約方面的作用進一步強調了安全儲存解決方案的重要性,將硬體錢包定位為駕馭去中心化金融領域的重要工具。

- 2023 年 12 月,Block Inc. 在印度以及其他 94 個國家推出了自助式託管比特幣錢包 Bitkey。這使得投資者可以在遠離交易所的地方擁有、管理和儲存比特幣。 Bitkey 包括行動應用程式、硬體裝置和復原工具,以防您遺失行動電話和/或硬體。使用三個金鑰來確保您的比特幣安全,並使用兩個金鑰來移動您的比特幣或核准其他與安全性相關的操作,例如開始恢復或更改安全性設定。

- 2023年7月,中國央行推出了離線SIM卡分離的數位人民幣「硬」錢包系統,允許用戶使用行動電話使用央行數位貨幣(CBDC)進行付款。因此,擁有 2G行動電話的人即使不使用自己的設備,最終也可能能夠使用代幣。

- 總體而言,由於市場的開拓以及對加密貨幣的興趣增加、網路威脅增加和駭客攻擊等因素,預計該市場將在預測期內顯著成長和擴大。

硬體錢包產業概況

由於全球參與企業和小型參與者的存在,硬體錢包市場高度細分。市場的主要參與企業包括 Ledger SAS、Satoshi Labs SRO、ShapeShift AG、Coinkite Inc. 和 CoolbitX Ltd。市場參與企業正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 2 月 - 隨著比特幣變得越來越重要且其用戶群的需求多樣化,BitBox (Shift Crypto AG) 與 Bitsurance 建立了策略合作夥伴關係。此次合作標誌著我們持續努力增強 BitBox02 冷錢包的安全性和用戶體驗的一個重要里程碑。

- 2023 年 5 月 - SecuX 與全球網路安全供應商趨勢科技建立策略合作夥伴關係,並宣布推出預裝趨勢科技 ChainSafer 區塊鏈信譽服務的 W20 趨勢科技冷錢包。 W20提供使用者涵蓋Web2和Web3的全面保護,增強了防偽、認證和詐騙能力。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對市場的影響

- 宏觀經濟因素評估

- 案例研究分析

- 監管影響

- 硬體錢包比較(主要廠商產品比較)

第5章市場動態

- 市場促進因素

- 增加加密貨幣的投資

- 更加重視安全

- 技術進步不斷推動市場成長

- 市場限制因素

- 加密貨幣法規

- 消費者意識有限

第6章 市場細分

- 按類型

- USB

- NFC

- Bluetooth

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章 競爭格局

- 公司簡介

- Ledger SAS

- Satoshi Labs SRO

- ShapeShift AG

- Coinkite Inc.

- CoolbitX Ltd

- Shift Crypto AG

- Penta Security Inc.

- SecuX

第8章投資分析

第9章市場的未來

The Hardware Wallet Market size is estimated at USD 0.35 billion in 2024, and is expected to reach USD 1.56 billion by 2029, growing at a CAGR of 28.79% during the forecast period (2024-2029).

Hardware wallets are specially designed cryptocurrency wallets that securely store users' private keys on encrypted hardware. These wallets allow users to safeguard sensitive data by storing private keys in a protected area within a microcontroller.

Key Highlights

- The surging interest in cryptocurrency trading is driving the market. These devices are now extensively adopted for business purposes. Moreover, wallet programs incorporate robust anti-theft and anti-hacking features, rendering them less susceptible to potential risks. Moreover, it has been anticipated that the enhanced security offered by these devices, compared to software, paper wallets, and web-based alternatives, will drive market expansion during the forecast period.

- Moreover, continuous advancements in hardware wallet technology led to improved security features, user experience, and compatibility with various cryptocurrencies. These advancements make hardware wallets more appealing to both novice and experienced cryptocurrency investors. Also, the entry of institutional investors into the cryptocurrency market further boosts the demand for secure storage solutions. Institutions typically prioritize security and compliance, making hardware wallets an attractive option for storing large amounts of digital assets.

- Decentralized finance (DeFi) is significantly impacting global industry. These platforms provide financial services like lending, borrowing, and asset management without relying on traditional intermediaries such as banks. DeFi users seek secure transaction management, and hardware wallets have emerged as the safest option. Their physical confirmation requirement adds an extra layer of security. As the DeFi market grows, the demand for secure ways to interact with these platforms will continue to drive the industry globally.

- Governments may impose regulations limiting the sale or use of hardware wallets for storing cryptocurrencies. For example, they might require extensive KYC (Know Your Customer) procedures for purchasing hardware wallets, hindering their accessibility. This pandemic slowed down the adoption of hardware wallets.

- The pandemic's rapidly increasing demand for cryptocurrencies has positively impacted the hardware wallet market. Bitcoin and other cryptocurrencies are gradually moving from unreliable investment vehicles to being accepted as forms of payment. The COVID-19 pandemic has increased calls for the dematerialization of payments, which has raised awareness of payment practices and the financial life cycle.

Hardware Wallet Market Trends

USB Segment to Hold Significant Market Share

- A USB hardware wallet is a physical device that securely stores cryptocurrency private keys offline. It's designed to protect against online threats such as hacking or malware by keeping the keys isolated from internet-connected devices. The wallet can be connected to a computer or mobile device by users when they need to make transactions, but the keys never leave the device, ensuring enhanced security. A USB wallet is the most popular cryptocurrency hardware wallet.

- The wallet uses a physical screen and two buttons for PIN verification, confirmations, and updates. It is presented in a solid plastic case and is connected with a micro-USB connector. For instance, the Trezor wallet is a popular cryptocurrency hardware wallet, and it is one of the first USB cryptocurrency hardware wallets created. It has been designed to store private keys for Bitcoin, Altcoins, and ERC-20 tokens.

- Several key factors in the market are primarily driving the growth of USB hardware wallets. There is an increasing demand for secure and convenient cryptocurrency storage solutions driving the market. USB hardware wallets offer users a portable and easy-to-use option for storing their digital assets offline, providing enhanced security against cyber threats and hacking attempts.

- The rising adoption of cryptocurrencies and the need to protect private keys have fueled the demand for USB hardware wallets as a reliable and secure storage solution. As of January 2024, globally, there are 9,024 Cryptocurrencies.

- Additionally, the convenience of USB connectivity allows users to easily access their wallets on various devices, making them a popular choice among crypto enthusiasts. The emphasis on security, ease of use, and portability offered by USB hardware wallets aligns well with the growing trend of individuals seeking robust solutions to safeguard their digital assets, contributing to this segment's significant growth and adoption in the hardware wallet market.

- In October 2023, Trezor, a major provider of crypto hardware wallets, launched two new products: Trezor Safe 3 and Trezor Metal. Trezor Safe 3 is the third generation of Trezor's flagship hardware wallet, which supports over 1,000 coins and tokens. Trezor Safe 3 features a larger touchscreen, a faster processor, a USB-C port, and a redesigned interface.

Asia-Pacific Expected to Register Significant Growth

- Asia-Pacific is one of the significant growing markets for hardware wallets as a secure means to store digital assets, owing to the rising adoption of cryptocurrency in the region and the growing trend of digital and cashless payments in developing countries like India, China, and South Korea.

- Furthermore, the market is growing because of the integration of distributed ledger technology and blockchain for security and transparency. There is a rise in the need for secure storage solutions like hardware wallets due to the rising incidence of cybercrime, the expansion of e-commerce platforms, and growing data vulnerability. The market is growing because of the widespread use of wireless hardware wallets, which are motivated by features like near-field communication (NFC), long-term storage capacity, and direct control.

- Moreover, blockchain technology significantly revolutionizes how digital assets are stored and managed, further driving the hardware wallet market. Particularly in India, blockchain technology is becoming prevalent in a variety of sectors. With the increasing number of blockchain applications, professionals in the field are producing various ways to modify the technology to suit different use cases. Additionally, blockchain's role in facilitating peer-to-peer transactions and smart contracts further underscores the importance of secure storage solutions, positioning hardware wallets as essential tools for navigating the decentralized financial landscape.

- In December 2023, Block Inc. launched Bitkey, a self-custody Bitcoin wallet in India, along with 94 other countries. With this, investors would be able to own, manage, and store their Bitcoin off exchanges. Bitkey includes a mobile app, hardware device, and a set of recovery tools in case the customer loses the phone, their hardware, or both. It uses three keys to secure Bitcoin, and any two keys working together are needed to move Bitcoin or approve other security-related actions such as initiating recovery or modifying security settings.

- In July 2023, the Chinese central bank introduced a digital yuan "hard" wallet system based on offline SIM cards, enabling users to make payments in the central bank digital currency (CBDC) using powered-off phones. Hence, people with 2G phones may eventually be able to use their devices to use the token even when not in use.

- Overall, with the rise in such developments along with factors such as Increased interest in cryptocurrencies, rising cyber threats, and hacking attempts, the market is expected to grow and expand significantly during the forecast period.

Hardware Wallet Industry Overview

The hardware wallet market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Ledger SAS, Satoshi Labs SRO, ShapeShift AG, Coinkite Inc., and CoolbitX Ltd. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- February 2024 - With the growing relevance of Bitcoin and the diverse needs of its user base, BitBox (Shift Crypto AG) signed a strategic alliance with Bitsurance. This collaboration marks a significant milestone in its continuous effort to enhance the security and user experience of our BitBox02 cold wallet, especially for those new to the Bitcoin realm.

- May 2023 - SecuX signed a strategic collaboration with Trend Micro, a global cybersecurity provider, and introduced the W20 Trend Micro edition cold wallet pre-loaded with Trend Micro ChainSafer blockchain reputation service. The W20 provides users comprehensive protection covering Web2 and Web3, augmenting anti-counterfeiting, authentication, and anti-fraud capabilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of the COVID-19 Impact on the Market

- 4.5 Assessment of Macroeconomic Factors

- 4.6 Case Study Analysis

- 4.7 Regulatory Implications

- 4.8 Hardware Wallet Comparison (comparison of Key Vendors Products)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Cryptocurrency

- 5.1.2 Rising Focus on Security

- 5.1.3 Rise in Technological Advancements Bolster the Growth of the Market

- 5.2 Market Restraints

- 5.2.1 Regulations Against Cryptocurrencies

- 5.2.2 Limited Consumer Awareness

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 USB

- 6.1.2 NFC

- 6.1.3 Bluetooth

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Ledger SAS

- 7.1.2 Satoshi Labs SRO

- 7.1.3 ShapeShift AG

- 7.1.4 Coinkite Inc.

- 7.1.5 CoolbitX Ltd

- 7.1.6 Shift Crypto AG

- 7.1.7 Penta Security Inc.

- 7.1.8 SecuX