|

市場調查報告書

商品編碼

1524185

紅外線攝影機:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)IR Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

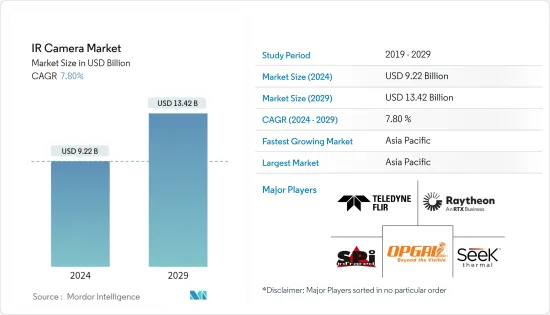

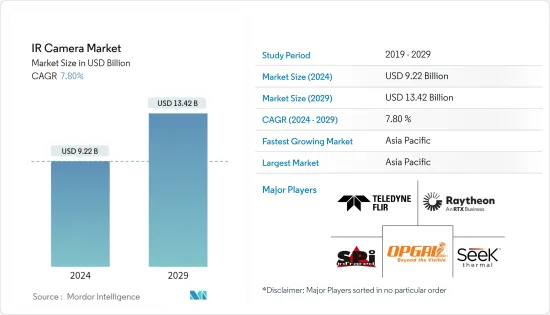

紅外線相機市場規模預計到2024年為92.2億美元,預計到2029年將達到134.2億美元,在市場估計和預測期間(2024-2029年)複合年成長率為7.80%。

紅外線攝影機廣泛用於安全和監控目的。即使在完全黑暗的情況下,它也可以檢測運動並拍攝紅外線影像。這使得它適合監控大面積區域、識別入侵者以及防止盜竊和破壞。

此外,這些攝影機可以與高級視訊分析整合,以增強威脅檢測並改善整體安全狀況。一些保全攝影機配備了智慧紅外線技術。此技術根據與物體的距離調整相機紅外線LED的亮度,避免物體變得太亮的問題。解決了當物體靠近相機時紅外線 LED 導致影像褪色的問題。

主要亮點

- 紅外線熱像儀在能源審核和效率評估中發揮重要作用。您可以識別建築物中的熱損失、隔熱材料間隙和漏氣情況。透過找出這些能源效率低下的問題,使用者可以進行有針對性的改進,從而降低能源消費量和水電費。此外,紅外線攝影機可以透過及早檢測故障或低效設備來幫助企業最佳化能源使用。

- 紅外線攝影機是預防性維護計畫的寶貴工具。透過識別電氣系統、機械設備和旋轉機械中的異常熱模式,可以提前檢測到潛在故障。這種主動方法可以及時進行維修和更換,最大限度地減少停機時間並防止代價高昂的故障。因此,公司可以降低成本並提高整體業務效率。紅外線攝影機也廣泛用於電氣檢查,因為它們可以快速識別過熱部件和潛在的火災危險。

- 紅外線攝影機已成為消防員和救援隊的必備工具。紅外線攝影機可以穿透煙霧和黑暗,在消防和搜救行動中找到熱點並識別潛在的受害者。紅外線攝影機提供即時熱成像,以提高情境察覺並實現更快、更有效的反應。

- 紅外線攝影機由於能夠捕捉熱輻射,在各行業中越來越受歡迎。紅外線攝影機廣泛應用於安全、建築檢查和醫療診斷等領域。然而,人們對其功能的準確性以及管理分銷的嚴格進出口法規表示擔憂。

- COVID-19 大流行後,隨著人們開始優先考慮個人交通並尋求大眾交通工具的替代方案,對汽車行業的需求增加。紅外線攝影機在汽車領域的主要應用之一是夜視系統。透過提高在照度下的可見度,協助者可以檢測到行人、動物和其他肉眼看不見的潛在危險。

紅外線攝影機市場趨勢

汽車產業是成長最快的最終用戶

- 隨著 ADAS(高級駕駛輔助系統)的普及,汽車產業對紅外線攝影機的需求不斷增加。世界各國政府也在推動ADAS的引進。

- 例如,美國運輸部國家公路交通安全管理局(NHTSA)發布的聯邦自動駕駛汽車政策涵蓋了多種車輛,從配備ADAS(高級駕駛輔助系統)的車輛到全自動駕駛車輛。

- 在汽車領域,紅外線攝影機可以檢測熱訊號並提高照度和惡劣天氣下的可見度。紅外線攝影機也用於夜視系統和輔助監控系統。它們還在 ADAS(高級駕駛員輔助系統)中發揮關鍵作用,提供精確的距離和物體偵測,並實現主動車距控制巡航系統和自動緊急煞車等功能。

- 自動駕駛和自動駕駛汽車的日益普及也促進了市場的成長。例如,英特爾預測,到2030年,全球汽車銷售量將達到1.014億輛,自動駕駛汽車預計將佔當年汽車註冊量的12%左右。

- 儀表板和停車攝影機市場最近的需求也激增。出於安全目的,特別是在高階和豪華汽車中,擴大使用儀表板鏡頭,推動了紅外線攝影機在汽車行業的採用。

亞太地區預計將出現顯著成長

- 亞太地區對自動化和工業 4.0 技術的投資正在迅速增加。對強大的檢查和觀察系統的需求,加上產品創新的快節奏,正在推動紅外線攝影機系統的成長。紅外線熱像儀廣泛應用於製造、石油和天然氣以及公共產業等行業,用於非接觸式溫度測量、狀態監測和預測性維護。這些攝影機能夠及早偵測設備故障、識別熱點並評估能源效率。

- 中國對紅外線攝影機的需求正在迅速成長,特別是在調查、遠端監控、邊境控制和保護關鍵基礎設施等監控業務中。對功能強大的紅外線熱感變焦相機的需求正在增加。中國紅外線攝影機的用途正在擴展到安全之外。它正在被引入水污染防治、生態系統監測和礦產資源調查等領域。

- 根據國家犯罪記錄局的數據,印度的犯罪率正在上升。因此,全國各地的安全機構都提倡安裝成像攝影機,包括紅外線 (IR) 攝影機,以提高家庭安全。

- 此外,根據印度品牌資產基金會(IBEF)的數據,印度汽車產業每年穩定成長9.5%。隨著汽車中紅外線攝影機技術的認可度提高,印度紅外線攝影機市場預計將進一步擴大。

- 日本對紅外線攝影機不斷成長的需求是由國防、軍事、監控和醫療保健應用的進步所推動的。特別是,日本2024會計年度防衛預算預計為7.95兆日圓(520億美元),大幅高於先前,反映出政府對加強國防的重視。

紅外線攝影機產業概況

紅外線攝影機市場高度分散,既有全球參與者,也有中小企業。主要參與企業包括 Teledyne FLIR LLC (Teledyne Technologies)、SPI Corp.、OPGAL Optronic Industries Ltd (Elbit Systems)、Raytheon Company 和 Seek Thermal Inc.。市場參與者正在採取聯盟和收購等策略來加強其產品陣容並獲得永續的競爭優勢。

- 2024 年 1 月 - 法雷奧與 Teledyne Technologies Incorporated 子公司 Teledyne FLIR 結盟。兩家公司的目標是將熱成像技術引入汽車產業,以提高道路安全。透過這種合作關係,我們已於 2023 年下半年與一家全球主要汽車製造商簽署了一份重要合約。根據該協議,兩家公司將提供最先進的熱熱感儀作為 ADAS(高級駕駛輔助系統)的關鍵組件。該技術有望成為車輛和道路安全的突破。

- 2024 年 1 月 - 雷神公司最近宣布已獲得一份價值 1.54 億美元的契約,為美國提供指揮官獨立檢視器 (CIV) 系統。這些系統將用於增強陸軍布拉德利戰車的能力。 CIV 系統採用了先進的光電/紅外線瞄準技術,包括第二代前視紅外線 (FLIR) 攝影機和感測器。這些尖端功能使布拉德利戰車能夠 360 度觀察戰場並提高瞄準能力。雷神公司的 FLIR 技術已被軍方使用 50 多年。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 各行業對監控的需求不斷增加

- 熱成像成本的下降

- 市場挑戰

- 相機功能不夠精確,進出口法規嚴格

第6章 市場細分

- 透過檢測器

- 冷卻

- 未冷卻的

- 按材質

- 鎗

- 矽

- 藍寶石

- 其他

- 按類型

- 近/短波長紅外線

- 中波長紅外線

- 長波紅外線

- 最終用戶產業

- 軍事/國防

- 車

- 產業

- 商業/公共

- 住宅

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 供應商定位分析

- 公司簡介

- Teledyne FLIR LLC(Teledyne Technologies)

- SPI Corp.

- OPGAL Optronic Industries Ltd(Elbit Systems)

- Raytheon Company

- Seek Thermal, Inc.

- Fluke Corporation

- Testo SE & Co. Kgaa

- Guide Sensmart Tech Co. Ltd(Guide Infrared)

- Hangzhou Hikvision Digital Technology Co., Ltd

- Leonardo DRS, Inc.

- InfraTec GmbH

第8章投資分析

第9章市場的未來

The IR Camera Market size is estimated at USD 9.22 billion in 2024, and is expected to reach USD 13.42 billion by 2029, growing at a CAGR of 7.80% during the forecast period (2024-2029).

Infrared cameras are widely used for security and surveillance purposes. They can detect movement and capture thermal images even in complete darkness. This makes them suitable for monitoring large areas, identifying intruders, and preventing theft or vandalism.

In addition, these cameras can be integrated with advanced video analytics to enhance threat detection and improve overall security measures. Some security cameras are equipped with smart IR technology. This technology modifies the brightness of the camera's infrared LEDs according to how far away an object is, avoiding the problem of the object being overly bright. It addresses the issue of images being washed out by infrared LEDs when objects are near the camera.

Key Highlights

- Infrared cameras play a crucial role in energy audits and efficiency assessments. They allow users to identify areas of heat loss, insulation gaps, and building air leakage. By pinpointing these energy inefficiencies, infrared cameras enable users to make targeted improvements, reducing energy consumption and lowering utility bills. Moreover, these cameras aid in detecting faulty or inefficient equipment early, helping businesses optimize their energy usage.

- Infrared cameras are invaluable tools for preventive maintenance programs. By identifying abnormal heat patterns in electrical systems, mechanical equipment, and rotating machinery, these cameras can help detect potential failures before they occur. This proactive approach allows for timely repairs or replacements, minimizing downtime and preventing costly breakdowns. As a result, businesses can save money and improve overall operational efficiency. Infrared cameras are also extensively used for electrical inspections, as they can quickly identify overheating components and potential fire hazards.

- Infrared cameras have become essential tools for firefighters and rescue teams. These cameras can penetrate smoke and darkness to locate hotspots and identify potential victims during firefighting and search-and-rescue operations. Infrared cameras enhance situational awareness by providing real-time thermal imaging, enabling quicker and more effective response times.

- Infrared cameras have become increasingly popular in various industries due to their ability to capture thermal radiation. These cameras have found applications in fields such as security, building inspections, and even medical diagnostics. However, there are concerns regarding the accuracy of their functionality and the stringent import/export regulations governing their distribution.

- After the COVID-19 pandemic, the automotive sector witnessed an increase in demand as people started to prioritize personal transportation and seek alternatives to public transport. One of the key applications of IR cameras in the automotive sector is in night vision systems. By providing enhanced visibility in low-light conditions, these cameras enable drivers to detect pedestrians, animals, and other potential hazards that may not be visible to the naked eye.

IR Camera Market Trends

Automotive Industry to be the Fastest Growing End User

- The automotive industry's demand for infrared cameras is rising, driven by the growing adoption of advanced driver-assistant systems (ADAS). Governments worldwide are also promoting ADAS deployment.

- For example, the Federal Automated Vehicles Policy, issued by the National Highway Traffic Safety Administration (NHTSA) of the US Department of Transportation, encompasses a spectrum of vehicles, from those equipped with advanced driver-assistance systems to entirely autonomous vehicles.

- In the automotive sector, IR cameras can detect heat signatures, enhancing vision in low-light conditions and adverse weather. IR cameras are also utilized for night vision systems and driver monitoring systems. They also play a crucial role in advanced driver assistance systems (ADAS), providing accurate distance and object detection and enabling features like adaptive cruise control and automatic emergency braking.

- The growing popularity of autonomous or self-driving vehicles also contributes to the market's growth. For instance, Intel predicts that global car sales will hit 101.4 million units by 2030, and autonomous vehicles are projected to represent approximately 12% of all car registrations that year.

- The market for dashboards and parking cameras is also experiencing a recent surge in demand. The automotive industry's adoption of infrared cameras has been driven by the increasing use of dashboard cameras, particularly in high-end and luxury vehicles, for security purposes.

Asia Pacific Expected to Register Major Growth

- The Asia-Pacific region is witnessing a surge in investments in automation and Industry 4.0 technologies. The demand for robust inspection and observation systems, coupled with a high pace of product innovation, is propelling the growth of IR camera systems. Industries such as manufacturing, oil and gas, and utilities extensively utilize infrared cameras for non-contact temperature measurement, condition monitoring, and predictive maintenance. These cameras enable early detection of equipment failures, hotspot identification, and energy efficiency assessments.

- China has witnessed a surge in demand for IR cameras, particularly for observation tasks like investigation, remote surveillance, border control, and safeguarding critical infrastructure. The need for powerful infrared and thermal zoom cameras is on the rise. China's application of infrared cameras is expanding beyond security. They are increasingly being deployed for water pollution control, ecological monitoring, and mineral resource surveys.

- According to the National Crime Records Bureau, crime rates in India have been on the rise. This has prompted security agencies nationwide to advocate for the installation of imaging cameras, including infrared (IR) cameras, to enhance household safety.

- Furthermore, the Indian automotive sector, as per the India Brand Equity Foundation (IBEF), has been witnessing a steady annual growth rate of 9.5%. With the increasing recognition of IR camera technology in automobiles, the market for these cameras in India is poised for further expansion.

- Japan's rising demand for IR cameras is driven by advancements in defense, military, surveillance, and healthcare applications. Notably, Japan's defense budget for fiscal year 2024 is estimated at JPY 7.95 trillion (USD 0.052 trillion), a significant increase from previous years, reflecting the government's focus on bolstering national defense.

IR Camera Industry Overview

The IR camera market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Teledyne FLIR LLC (Teledyne Technologies), SPI Corp., OPGAL Optronic Industries Ltd (Elbit Systems), Raytheon Company, and Seek Thermal Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024 - Valeo and Teledyne FLIR, a subsidiary of Teledyne Technologies Incorporated, have joined forces in a strategic collaboration. They aim to introduce thermal imaging technology to the automotive sector to bolster road safety. The collaboration has already yielded a major contract with a prominent global automotive OEM in late 2023. Under this contract, the companies will provide cutting-edge thermal imaging cameras as a key component of an advanced driver-assist system (ADAS). This technology promises to be a game-changer for vehicle and road safety.

- January 2024 - Raytheon has recently disclosed that they have been awarded a contract worth USD 154 million to supply the US Army with Commander's Independent Viewer (CIV) systems. These systems will be used to enhance the capabilities of the Army's Bradley Fighting Vehicles. The CIV system incorporates advanced electro-optical/infrared sight technology, including second-generation forward-looking infrared (FLIR) cameras and sensors. With these cutting-edge features, the Bradley Fighting Vehicle will gain a comprehensive 360-degree view of the battlefield and improved targeting capabilities. It is worth noting that military forces have successfully utilized Raytheon's FLIR technology for over fifty years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 Aftereffects and other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Surveillance Across Various Verticals

- 5.1.2 Gradually Decreasing Costs of Thermal Cameras

- 5.2 Market Challenges

- 5.2.1 Lack of Accuracy in Camera Functionality and Stringent Import/Export Regulations

6 MARKET SEGMENTATION

- 6.1 By Detector

- 6.1.1 Cooled

- 6.1.2 Uncooled

- 6.2 By Material

- 6.2.1 Germanium

- 6.2.2 Silicon

- 6.2.3 Sapphire

- 6.2.4 Other Materials

- 6.3 By Type

- 6.3.1 Near and Short-wavelength IR

- 6.3.2 Medium-wavelength IR

- 6.3.3 Long-wavelength IR

- 6.4 By End-user Vertical

- 6.4.1 Military and Defense

- 6.4.2 Automotive

- 6.4.3 Industrial

- 6.4.4 Commercial and Public

- 6.4.5 Residential

- 6.4.6 Other End-user Vertical

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 Germany

- 6.5.2.3 France

- 6.5.3 Asia

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 Australia and New Zealand

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles*

- 7.2.1 Teledyne FLIR LLC (Teledyne Technologies)

- 7.2.2 SPI Corp.

- 7.2.3 OPGAL Optronic Industries Ltd (Elbit Systems)

- 7.2.4 Raytheon Company

- 7.2.5 Seek Thermal, Inc.

- 7.2.6 Fluke Corporation

- 7.2.7 Testo SE & Co. Kgaa

- 7.2.8 Guide Sensmart Tech Co. Ltd (Guide Infrared)

- 7.2.9 Hangzhou Hikvision Digital Technology Co., Ltd

- 7.2.10 Leonardo DRS, Inc.

- 7.2.11 InfraTec GmbH