|

市場調查報告書

商品編碼

1524203

無菌醫療包裝:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Sterile Medical Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

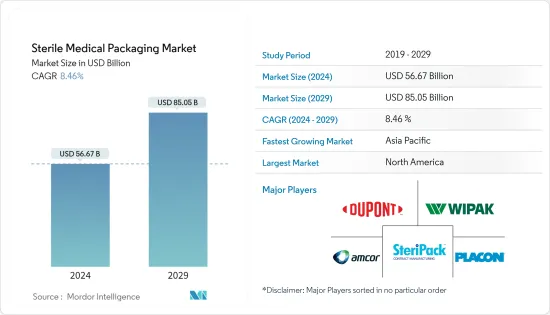

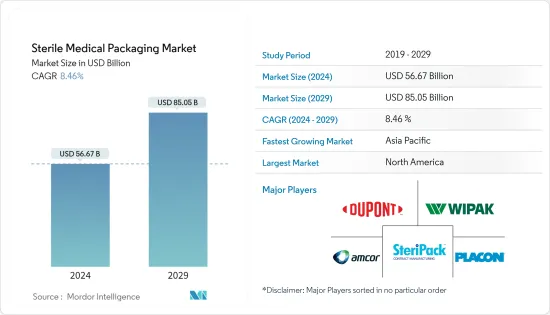

無菌醫療包裝市場規模預計到 2024 年為 566.7 億美元,預計到 2029 年將達到 850.5 億美元,在預測期內(2024-2029 年)複合年成長率為 8.46%。

滅菌是醫療產業的重要加工步驟。因此,無菌包裝產品和無菌屏障系統在業界變得越來越重要。無菌醫療包裝不可重複使用,可作為防止微生物感染的屏障。使用塑膠和紙張具有重量輕、可回收、耐用等優點。

主要亮點

- 醫療製藥業對包裝的需求不斷成長,以保護產品在運輸過程中免受環境因素(例如潮濕)的影響。此外,對包裝技術的投資增加,包括使用先進設備來提高效率,正在推動對確保醫療設備和藥品完整性和無菌性的包裝解決方案的需求。

- 塑膠材料的進步正在推動市場,塑膠被用於醫療設備和消耗品,包括個人防護設備。塑膠對於基本醫療保健的生產、包裝和分配也至關重要。各種製藥和醫療設備包裝製造商正在透過引入更好的無菌包裝解決方案來不斷改進產品系列。

- 2024年1月,全球領先的微生物解決方案專家Cherwell宣布推出革命性的Redipor Beta Bag。這種具有多種用途的創新塑膠袋有可能降低與環境監測 (EM) 程序相關的風險、成本和時間,同時持續生產無菌藥品。最近推出的轉移袋經過徹底檢驗,旨在與隔離器和 RABS 系統中常見的 190mm Getinge Alpha 連接埠無縫配合。這確保了信用者電鍍介質的無污染轉移,從而實現高效生產並顯著降低風險。

- 由於處方藥成本上升和安全問題日益嚴重,非處方藥 (OTC) 變得越來越受歡迎。此外,疼痛、壓力和皮膚病等特定疾病的增加也導致成藥的消費增加。對成藥的需求可能會增加整個製藥業對無菌包裝的需求。

- 醫療無菌包裝領域不允許任何污染或感染的可能性。因此,該細分市場在全球範圍內受到嚴格監管,以確保產品安全,免受污染和篡改,並確保準確顯示劑量、製造和有效期等重要資訊。然而,在患者安全至關重要的行業中,遵循詳細的包裝標準有時可能變得過於重要。包裝法規的動態性質給該行業的製造商帶來了挑戰。

- 自 COVID-19 大流行後,全球醫療藥品支出不斷增加,導致對醫療無菌包裝的需求增加。

醫用無菌包裝的市場趨勢

醫藥產業佔主要市場佔有率

- 全球製藥業在過去幾年中經歷了顯著成長,這主要歸功於技術進步和市場創新。根據國家醫學圖書館的數據,FDA 在 2023 年核准了 55 種新藥,這正在推動市場成長。

- 根據世界衛生組織(WHO)的資料,2019年60歲以上人口10億,預計2030年將增加至14億,2050年將增加至21億人。人口老化和醫療產品使用量的增加推動了製藥業對無菌包裝的需求。癌症、糖尿病和腸道疾病等需要長期服用藥物的疾病的增加正在推動市場的成長。

- 藥品和藥品的無菌包裝可確保產品在供應鏈過程中不受污染、無塵且安全,進而推動市場成長。熱成型托盤、泡殼包裝和小袋等包裝有助於防止患者使用的有害細菌傳播。

- 主要企業努力透過無菌包裝提供最高水準的保護。杜邦德內穆爾公司等公司提供具有高強度和微生物屏障的無菌藥品包裝,以幫助在運輸和儲存過程中保持無菌。

- 此外,根據 IQVIA 2023 年 1 月發布的報告,全球醫療藥品支出不斷增加,2022 年將達到約 14,820 億美元。

亞太地區將顯著成長

- 由於對醫療保健和醫療行業的日益重視,亞太地區無菌包裝市場預計將成長。醫療產業不斷成長的需求導致醫療設備和手術器械包裝的蓬勃發展。

- 該地區無菌包裝產業的開拓得益於滅菌技術和智慧設計包裝解決方案的新興市場推動了市場成長。

- 由於人口老化、慢性病增加以及醫療技術進步,全球醫療產業持續成長,無菌醫療設備包裝的需求預計將相應增加。這種成長是由對感染控制和患者安全的日益關注進一步推動的,這導致醫療設備製造商優先考慮使用無菌包裝,以確保產品的完整性和無菌性。

- 對病人安全的日益重視和對一次性醫療產品的需求增加正在推動對高品質無菌包裝解決方案的需求。具有增強耐用性和阻隔性的無菌包裝解決方案的創新也是全部區域的趨勢。

無菌醫療包裝產業概況

由於品牌身份驗證、強力的競爭策略和透明度等影響市場的因素,無菌醫療包裝市場正在變得半固體。強大的品牌是良好業績的代名詞,因此我們預期老字型大小企業將擁有優勢。此外,大規模投資增加了現有參與企業的退出壁壘,推動產業競爭更加激烈。此外,供應商正在提高其技術力並加劇市場競爭。市場參與企業包括 Amcor Group GmbH、Dupont De Nemours Inc.、Steripack Group Limited、Wipak Group 和 Placon Corporation。

- 2024年4月,杜邦宣布推出Tyvek Protech PSU即剝即貼襯墊,這是一款全新屋頂襯墊產品。這款新產品旨在提供高性能、耐高溫和抗紫外線、防滑行走表面、易於安裝的分離式襯裡、ICC-ES 代碼報告以及著名的 FL/Miami-Dade 認證。

- 2024 年 2 月,Spectrum 宣布計劃透過擴大其哥斯達黎加工廠以納入無菌杜邦Tyvek醫療包裝能力來加強其醫療管業務。埃雷迪亞工廠從 36,000 平方英尺擴建至 52,000 平方英尺,旨在提高產能並加快服務交付。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 當前地緣政治情勢對市場的影響

第5章市場動態

- 市場促進因素

- 嚴格的感染控制法規預計將推動無菌產品的需求

- 最近產能增加

- 塑膠領域的材料進步

- 市場問題

- 法規的動態性質要求製造商應對帶來材料可用性挑戰的當地因素。

第6章 市場細分

- 依材料類型

- 塑膠

- 聚丙烯(PP)

- 聚酯纖維

- 聚苯乙烯(PS)

- 聚氯乙烯(PVC)、高密度聚苯乙烯(HDPE)等

- 紙板

- 玻璃

- 其他

- 塑膠

- 依產品類型

- 熱成型托盤

- 無菌瓶/容器

- 袋子和袋子

- 泡殼包裝

- 管瓶和安瓿

- 預填充式注射器

- 裹

- 按用途

- 藥品

- 手術/醫療設備

- 體外診斷(IVD)

- 其他

- 按滅菌類型

- 化學滅菌

- 放射線殺菌

- 壓力/溫度滅菌

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Amcor Group GmbH

- Dupont De Nemours Inc.

- Steripack Group Limited

- Wipak Group

- Placon Corporation

- Riverside Medical Packaging Company Ltd

- Tekni-Plex Inc.

- BillerudKorsnas AB

- Sonoco Products Co

- DWK Life Sciences

- Technipaq Inc.

- 3M Company

- Nelipak Healthcare Packaging

- Oliver Healthcare Packaging

- Beacon Converting Inc.

- Paxxus Inc.

- Spectrum Plastics Group

- Sterimed Holdings SaS

- Sigma Medical Supplies Corporation

- Charter Next Generation

- Berry Global Inc.

- Sealed Air Corporation

第8章市場展望

The Sterile Medical Packaging Market size is estimated at USD 56.67 billion in 2024, and is expected to reach USD 85.05 billion by 2029, growing at a CAGR of 8.46% during the forecast period (2024-2029).

Sterilization is an important processing step in the healthcare industry. Therefore, sterile packaging products or sterile barrier systems are becoming increasingly important in the industry. Sterile medical packaging is non-reusable and acts as a barrier against microbial infection. Using plastic and paper offers lightweight, recyclability, and durability advantages.

Key Highlights

- The medical and pharmaceutical industries are experiencing a growing need for packaging to safeguard products from environmental factors like moisture while in transit. Additionally, the rising investments in packaging technologies, including the use of advanced equipment to enhance efficiency, are driving up the demand for packaging solutions that guarantee the integrity and sterility of medical devices and pharmaceuticals.

- Material advancements in plastics drive the market, using plastics in medical devices and supplies, including personal protective equipment. Plastics are also crucial in essential medical production, packaging, and distribution. Various pharmaceutical and medical device packaging manufacturers are constantly improving their product portfolio by introducing better sterile packaging solutions.

- In January 2024, global microbiology solution expert Cherwell announced the launch of the groundbreaking Redipor Beta Bag. This innovative plastic bag for multiple uses has the potential to decrease risk, expenses, and time involved in environmental monitoring (EM) procedures while continuously manufacturing sterile medicinal products. The recently introduced transfer bags have been thoroughly validated and are designed to work seamlessly with 190mm Getinge Alpha Ports commonly found in isolators and RABS systems. This ensures a contamination-free transfer of creditor-plated media, allowing for efficient production and a notable decrease in risk.

- The over-the-counter (OTC) popularity is growing because of the rising prescription drug costs and increasing concerns over safety. Further, the increase in certain disorders, such as those related to pain, stress, and skin conditions, contributes to the growing consumption of OTC drugs. The demand for OTC drugs will likely increase the demand for sterile packaging across the pharmaceutical industry.

- The medical sterile packaging sector doesn't allow any room chances for contamination and infections. Therefore, the sector is strictly regulated globally to guarantee the safety of products from contamination and tampering and to ensure that vital information regarding dosage, usage, manufacturing, expiration dates, and other details is accurately presented. However, in an industry where patient safety is paramount, following detailed criteria that control the packaging sometimes becomes overly critical. The dynamic nature of packaging regulations makes it challenging for the manufacturers in the industry.

- The spending on medical and pharmaceuticals has been increasing globally since the post-COVID-19 pandemic, consequently increasing the demand for medical sterile packaging.

Sterile Medical Packaging Market Trends

Pharmaceutical Sector to Hold Major Market Share

- The global pharmaceutical industry has experienced significant growth in the past years, mainly due to technological advancements and innovations in the market. According to the National Library of Medicine, the FDA approved 55 new drugs in 2023, which drives the market's growth.

- According to data from the World Health Organization, the number of people aged 60 years and older in 2019 was 1 billion, which is likely to increase to 1.4 billion by 2030 and 2.1 billion by 2050, rspectively. The demand for sterile packaging in the pharmaceutical industry is attributable to the rising aging population with high medical product use. Growth in diseases, including cancer, diabetes, and bowel diseases, requires long-term use of medicines and drugs, thus boosting the market's growth.

- The pharmaceutical sterile packaging for drugs and medicines ensures the products are contamination, dust-free, and secure during the supply chain, propelling the market growth. Packaging such as thermoform trays, blister packs, and pouches help prevent the spread of harmful germs used by patients.

- Major players strive to provide the highest level of protection through sterile packaging. Companies such as DuPont de Nemours Inc. provide pharmaceutical sterile packaging with high strength and microbial barriers to help preserve sterility during shipping and storage.

- Furthermore, according to the IQVIA report published on January 2023, global spending on medicine and pharmaceuticals is constantly growing, with approximately USD 1.482 trillion in 2022; encouragingly, the pharmaceutical and medical expenditure is expected to increase to around 1.917 trillion by 2027.

Asia Pacific to Register Major Growth

- The sterile packaging market in Aisa pacific, is estimated to rise due to the growing emphasis on the healthcare and medical industry. The rising demand for the medical industry has resulted in a boom in the packaging of medical devices and surgical instruments.

- The development in the sterile packaging industry in the region is attributable to the rising advancements in sterilization technologies and intelligent design packaging solutions that boost the market's growth.

- As the healthcare industry continues to grow globally, driven by an aging population, increasing prevalence of chronic diseases, and advancements in medical technology, the demand for sterile medical device packaging is expected to rise correspondingly. This growth is further driven by the heightened emphasis on infection control and patient safety, prompting medical device manufacturers to prioritize the use of sterile packaging to ensure the integrity and sterility of their products.

- Increasing emphasis on patient safety and rising demand for single-use medical products has resulted in a growing demand for high-quality sterile packaging solutions. Technological innovation in sterile packaging solutions with enhanced durability and barrier properties is also trending across the region.

Sterile Medical Packaging Industry Overview

The sterile medical packaging market is semi-consolidated with various factors affecting the market, such as brand identity, powerful competitive strategy, and degree of transparency. Strong brands are synonymous with good performance, so long-standing players are expected to have the upper hand. Moreover, the involvement of large-scale investment also increases the barriers to exit for existing players, thereby pushing the industry toward improved competition. Additionally, vendors are enhancing their technological capabilities, thereby intensifying market competition. Some of the players in the market are Amcor Group GmbH, Dupont De Nemours Inc.,Steripack Group Limited, Wipak Group, Placon Corporation

- In April 2024, DuPont announced the launch of the addition of its roofing underlayment product line, the Tyvek Protec PSU peel-and-stick underlayment. The new product is designed to provide high-performance, high-temperature, and UV resistance, a slip-resistant walking surface, a split liner for easy installation, an ICC-ES code report, and prestigious FL/Miami-Dade certification.

- In February 2024, Spectrum announced plans to expand its facility in Costa Rica, incorporating sterile DuPont Tyvek medical packaging capabilities and enhancing its medical tubing operations. The expansion of the Heredia facility from 36,000 square feet to 52,000 square feet aims to increase capacity and expedite service delivery.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4 Impact of the Current Geo-political Scenarios on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stringent Regulations Toward Infection Control Expected to Aid Demand for Sterile-based Products

- 5.1.2 Recent Increase in Utilization Capacity

- 5.1.3 Material Advancements in the Field of Plastics

- 5.2 Market Challenges

- 5.2.1 Dynamic Nature of Regulations Makes it Challenging for Manufacturers to Comply with Local Factors with Issues Related to Material Availability

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.1.1 Polypropylene (PP)

- 6.1.1.2 Polyester

- 6.1.1.3 Polystyrene (PS)

- 6.1.1.4 Polyvinyl Chloride (PVC), High-density Polyethylene (HDPE), etc

- 6.1.2 Paper and Paperboard

- 6.1.3 Glass

- 6.1.4 Other Material Types

- 6.1.1 Plastic

- 6.2 By Product Type

- 6.2.1 Thermoform Trays

- 6.2.2 Sterile Bottles and Containers

- 6.2.3 Pouches and Bags

- 6.2.4 Blisters Packs

- 6.2.5 Vials and Ampoules

- 6.2.6 Pre-Filled Syringes

- 6.2.7 Wraps

- 6.3 By Application Type

- 6.3.1 Pharmaceutical

- 6.3.2 Surgical and Medical Appliances

- 6.3.3 In Vitro Diagnostics (IVD)

- 6.3.4 Other Applications

- 6.4 By Sterilization Type

- 6.4.1 Chemical Sterilization

- 6.4.2 Radiation Sterilization

- 6.4.3 Pressure/Temperature Sterilization

- 6.5 By Geography***

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Amcor Group GmbH

- 7.1.2 Dupont De Nemours Inc.

- 7.1.3 Steripack Group Limited

- 7.1.4 Wipak Group

- 7.1.5 Placon Corporation

- 7.1.6 Riverside Medical Packaging Company Ltd

- 7.1.7 Tekni-Plex Inc.

- 7.1.8 BillerudKorsnas AB

- 7.1.9 Sonoco Products Co

- 7.1.10 DWK Life Sciences

- 7.1.11 Technipaq Inc.

- 7.1.12 3M Company

- 7.1.13 Nelipak Healthcare Packaging

- 7.1.14 Oliver Healthcare Packaging

- 7.1.15 Beacon Converting Inc.

- 7.1.16 Paxxus Inc.

- 7.1.17 Spectrum Plastics Group

- 7.1.18 Sterimed Holdings SaS

- 7.1.19 Sigma Medical Supplies Corporation

- 7.1.20 Charter Next Generation

- 7.1.21 Berry Global Inc.

- 7.1.22 Sealed Air Corporation