|

市場調查報告書

商品編碼

1524204

夜視設備:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Night Vision Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

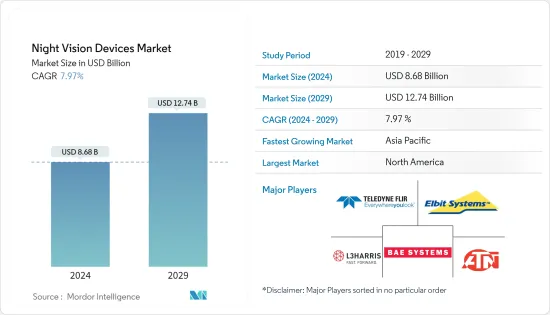

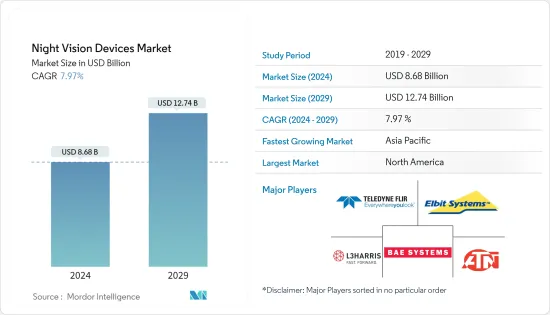

夜視設備市場規模預計到 2024 年將達到 86.8 億美元,預計到 2029 年將達到 127.4 億美元,在預測期內(2024-2029 年)複合年成長率為 7.97%。

夜視功能通常用於低照度安全或完全黑暗的夜間監視。具有夜視功能的紅外線攝影機非常適合需要監控黑暗以進行工作或業餘愛好的人。紅外線相機使用紅外線相機(照明器)而不是普通照明頻譜,可以在完全黑暗或照度條件下拍攝更好的照片。現在許多安全系統都包括日間和夜間攝影機。

*夜視設備為戰場上低照度條件下的士兵提供彩色影像。近年來,這些設備受到野火專業人士的青睞,預計對這些設備的需求將會增加。需求是由技術和應用可行性(例如頭戴式夜視設備和低成本)推動的。這些小工具可在夜間提供超過 150-200 碼的清晰視野。

*推動市場成長的主要因素是軍費開支的增加。隨著恐怖主義和非法移民等問題加劇全球安全威脅,世界各國都在增加軍事開支,為其保護部隊配備最新的技術、裝備、武器和彈藥。例如,根據SIPRI的數據,2022年全球軍費將達到2.24兆美元,而2017年為1.807兆美元。隨著軍事現代化支出預計將增加,這種趨勢預計將為市場成長創造有利的生態系統。

*然而,夜視設備的高價格和技術限制(例如穿過透明障礙物瞄準的限制)仍然是所研究的市場成長的主要挑戰。

*COVID-19 大流行對所研究市場的成長產生了重大影響。例如,在COVID-19爆發之初,各行業的全球供應鏈受到干擾,導致製造和其他工業應用中使用的原料和零件短缺。此外,體力勞動的有限使用也加劇了疫情的影響。在疫情期間,各個最終用戶行業的組織避免在不太關鍵的需求上投入高支出。因此,市場出現放緩。

*但隨著情勢逐步改善、供應鏈壓力緩解,各產業均出現成長。因此,Covid-19 後的市場成長看起來很有希望。

夜視儀市場趨勢

監控用途佔很大佔有率

- 夜視儀是軍隊中的重要道具,大多數現代軍隊都為每個士兵配備了夜視儀。夜視儀可幫助部隊保衛區域並掃描坦克或試圖傷害他們的人員等威脅。使用此設備時,隨著光線從景觀反射,一切都會呈現綠色。

- 在汽車應用中,夜視設備在民營市場中變得越來越普遍。在惡劣天氣和夜間,汽車夜視設備可以提高駕駛者的感知和能見度。通常使用紅外線或熱成像來捕獲資料,並結合主動照明將其顯示給駕駛員。夜視設備也用於飛機和直升機、照度狩獵和夜間射擊比賽。

- 如今,SWIR或短波長紅外線夜視裝置攝影機系統用於車輛導航。卡車、坦克和裝甲運兵車等軍事用陸上運輸車輛必須在完全黑暗的情況下運行,因此對具有短波紅外線 (SWIR) 照明和感測器的增強型視覺系統 (EVS) 的需求不斷增加。短波長紅外線夜視攝影機系統可讓您在危險區域謹慎操作。與中波紅外線和長波紅外線不同,短波紅外線相機可以透過擋風玻璃進行拍攝,因此可以安裝在駕駛室中,並提供前方道路的“駕駛員之眼”視圖。您也可以在堅固的外殼上安裝短波紅外線相機。

- 2024 年 1 月,雷射光源商業化公司 KYOCERA SLD Laser, Inc. (KSLD) 宣布其雷射燈的新功能,包括用於可見頻譜範圍應用的 InGaN 雷射二極體。該公司為海底、國防和安全應用開發 LiFi 創新技術。

- 基於雷射燈模組的前燈為夜視設備和感測提供高亮度白色和紅外線(IR) 雙重照明。該公司的 Laserlight LiFi 系統以 1Gbps 雙向傳輸速度發射白光和紅外線光,以支援未來的無線連線。藍色雷射驅動技術將系統的功能擴展到水下應用。此雷射模組超緊湊,外形纖薄,透鏡高度小於12.7mm。

- 根據北約預測,2023年北約成員國國防支出總合1.26兆美元,創下該時期北約成員國國防支出最高紀錄。各地區軍費開支的增加也推動了所研究市場的成長。各國政府越來越注重提升軍事能力,為夜視設備的採用提供了機會。

- 預計此類發展將在預測期內推動軍事和國防工業夜視設備市場的成長。

北美佔據主要市場佔有率

- 該地區軍事和國防支出的增加使企業能夠進行研發活動,從而實現創新並更好地管理其人民和邊境的安全。此外,夜視設備在消防行動中的使用越來越多,以增強夜間空中消防能力,從而增加了該地區夜視設備的採用。

- 技術的進步使得夜視設備能夠與機器學習和擴增實境整合,以增強其夜視能力。此外,美國最近開始使用增強型夜視鏡-雙筒望遠鏡(ENVG-B)訓練部隊。護目鏡將戰場上的資料和影像直接提供給士兵的眼睛。該系統包括高解析度顯示器、內建無線個人網路、快速目標擷取系統和擴增實境演算法,以增強陸軍士兵的夜視能力。

- 2023 年 11 月,李奧納多 DRS訂單為美國生產下一代熱感武器瞄準具的訂單。該訂單價值超過 1.34 億美元,基於單兵武器瞄準具系列 (FWS-I) IDIQ 合約。 FWS-I 是一款夾式瞄準器,可無線連接到頭盔式視覺系統,例如增強型夜視鏡雙筒望遠鏡 (ENVG-B) 或整合式視覺增強系統 (IVAS)。為士兵提供快速目標捕獲能力。利用 DRS 的非製冷熱成像技術,士兵可以在白天或晚上甚至在煙霧中定位目標。這種合作關係使 DRS 能夠繼續向美國提供這項關鍵技術。

- 2023 年 5 月,美國聯邦航空管理局 (FAA) 認證了埃里克森 S-64F 空中起重直升機可進行夜視鏡 (NVG) 操作。 Erickson 的整合 NVG 計劃為客戶提供了更高的靈活性和擴展的操作能力。我們也確保 NVG 機組人員遵守現行的 FAA 法規。該認證將使埃里克森能夠提高空中消防和民防行動期間的戰術性規劃和敏捷性。此外,Erickson 也與 Aviation Specialties Unlimited (ASU) 合作修改 S-64F 以用於 NVG 操作。

- 因此,該地區的市場旨在透過開發、整合、實驗、實驗室和平台測試以及透過與正在使用的各種系統整合進行評估來提高夜視設備的功能。

夜視儀產業概況

由於全球參與者和中小企業的存在,夜視設備市場是半固體的。該市場的主要參與者包括 Teledyne FLIR LLC、L3harris Technologies Inc.、American Technologies Network Corp.、Elbit Systems Deutschland 和 BAE Systems PLC。市場參與者正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

- 2024 年 1 月 - Exosens 宣布推出 25mm 影像增強器解決方案。基於該公司的Hi-CE MCP技術,可提供先進的Hi-QE光電陰極。

- 2023 年 12 月 - 泰雷茲與西班牙安全公司 Trablisa 成立合資企業,以完成梅利利亞國民警衛隊司令部整合監控系統的安裝,以實現智慧邊境管理。該監視系統將使國民警衛隊能夠使用高解析度的日間和夜間攝影機。夜視攝影機以及監控和控制軟體 (HORUS) 可實現感測器和致動器以及影像處理的集中管理和控制。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 評估宏觀經濟趨勢對市場的影響

第5章市場動態

- 市場促進因素

- 軍費開支增加

- 增加執法人員招募

- 市場限制因素

- 維護成本高成本

第6章 市場細分

- 按類型

- 相機

- 風鏡

- 單筒/雙筒望遠鏡

- 步槍瞄準鏡

- 其他

- 依技術

- 熱感成像

- 影像增強器

- 紅外線照明

- 其他

- 按用途

- 軍事/國防

- 野生動物觀察與保護

- 監視

- 導航

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Teledyne FLIR LLC

- L3Harris Technologies Inc.

- American Technologies Network Corp.

- Elibit Systems Ltd

- BAE Systems PLC

- Thales Group SA

- Raytheon Technologies Corporation

- Bushnell Inc.

- Satir

- Apresys International Inc.

- Luna Optics Inc.

- Opgal Optronic Industries Ltd

- EOTECH LLC

- Exosens

- Panasonic Holding Corporation

- Tak technologies private Limited

- TACTICAL NIGHT VISION COMPANY

- sharp Corporation

- nivisys LLC

- Excelitas Technologies Corp.

第8章投資分析

第9章市場的未來

The Night Vision Devices Market size is estimated at USD 8.68 billion in 2024, and is expected to reach USD 12.74 billion by 2029, growing at a CAGR of 7.97% during the forecast period (2024-2029).

Night vision is often employed in night surveillance at low-light security or completely dark conditions. Infrared cameras with night vision capabilities are excellent for anyone who needs to monitor in the dark for work or pleasure. Infrared cameras use infrared light (illuminator) rather than the usual illumination spectrum to create better photos in complete darkness or low light conditions. Many security systems now include both day and night versions of cameras.

* The night vision equipment provides soldiers with color visuals in low-light situations on the battlefield. These devices have acquired appeal among wildfire experts in recent years, which is expected to increase demand for the devices. The demand was fueled by technological and application feasibility, such as head-mounted night vision and low cost. These gadgets provide clear visibility of more than 150 to 200 yards at night.

* A major factor driving the market's growth is the growing military expenditure. As the global security threat deepens owing to issues such as terrorism, illegal migration, etc., countries across the globe are increasing their military expenditure to equip their protection forces with the latest technology devices, arms, and ammunition. For instance, according to SIPRI, the global military expenditure reached USD 2.240 trillion in 2022, compared to USD 1.807 trillion in 2017. With expenditures on military modernization anticipated to grow, such trends are anticipated to create a favorable ecosystem for the market's growth.

* However, the higher cost and technical limitations of night vision devices, such as their limitations in targeting through transparent obstacles, continue to remain among the major challenging factors for the growth of the market studied.

* The global outbreak of COVID-19 has had a notable impact on the growth of the market studied. For instance, during the initial days of COVID-19, the global supply chain of various industries was disrupted, resulting in a scarcity of raw materials and components used in manufacturing and other industrial applications. Furthermore, restrictions imposed on the use of manual workforce further intensified the pandemic's influence. During the pandemic, organizations across different end-user verticals also were averted on spending high on less crucial requirements. Hence, the market witnessed a slowdown.

* However, with the conditions gradually improving and supply chain pressure easing out, industries across different sectors reported growth, which is anticipated to be the case going forward as the influence of the pandemic on different verticals has been reducing, leading to the normalization in the market conditions both in terms of demand and supply. As a result, the market's growth in the post-COVID-19 period appears promising.

Night Vision Devices Market Trends

Surveillance Applications to Hold Significant Share

- Night vision devices are crucial gadgets of armed forces, and most modern armies equip each of their soldiers with these devices. Night vision aids military forces in defending an area or scanning for threats, such as tanks or persons wishing to harm them. Because the light reflects off the landscape, everything appears to have a greenish hue while utilizing these devices.

- In automotive, night vision has become increasingly commonly used in the civilian market. In bad weather conditions or at night, automotive night vision systems can increase a driver's perception and viewing distance. Typically, they capture data via infrared or thermal imaging, which is occasionally paired with active illumination techniques, and then show it to the driver. Night vision has also been used in aircraft and helicopters, low-light hunting, and night shooting competitions.

- Recently, SWIR or short-wavelength Infrared Night Vision Camera systems have been used for vehicle navigation. Military ground transport vehicles such as trucks, tanks, and armored personnel carriers must operate in complete darkness, increasing the demand for Enhanced Vision Systems (EVS) with short-wave Infrared (SWIR) illumination and sensors. Infinite short wave infrared night vision camera systems to maneuver discreetly through dangerous territory. SWIR cameras, unlike MWIR and LWIR, can image through the windshield, allowing them to be positioned in the driver's compartment for a "driver's eye" view of the road ahead. Ruggedized outside housings can also accommodate SWIR cameras.

- In January 2024, KYOCERA SLD Laser, Inc. (KSLD), a company in the commercialization of laser light sources, introduced its new LaserLight capabilities, including InGaN Laser Diodes for Applications in the Visible Spectral Range. The company is pioneering LiFi innovations for undersea, defense, and security applications.

- The laserlight module-based headlight offers high-brightness white and infrared (IR) dual illumination for night vision and sensing. The company's laserlight LiFi system offers white and IR illumination with a 1 Gbps bi-directional transmission rate to support the future of wireless connectivity. The blue laser-powered technology expands the system's capability into underwater applications. The laserlight Modules are ultra-compact and have a slim profile with less than a 12.7 mm lens height.

- According to NATO, in 2023, the combined defense expenditure for members of NATO was approximately USD 1.26 trillion, the highest NATO members have collectively spent on defense during the provided period. The growing military expenditure in the various regions also results in the growth of the market under study. Governments are increasingly focusing on improving their military capabilities, thereby providing opportunities for the adoption of night vision devices.

- Such developments are anticipated to propel the growth of the night vision devices market in the military and defense industry during the forecast period.

North America to Hold Significant Market Share

- The increased spending on military and defense in the region has allowed companies to conduct R&D activities, resulting in innovations, enabling them to manage better the safety and security of their people and the borders. Further, increased night vision use in firefighting activities to enhance night-time aerial firefighting capabilities increases the adoption of night vision devices in the region.

- Technological advancements have enabled night vision devices to be integrated with machine learning and Augmented reality to enhance the night vision capabilities of the devices. Further, the US Army recently started training its forces using Enhanced Night Vision Goggle-Binocular (ENVG-B). These goggles provide data and imagery from the battlefield directly to the soldier's eye. The system includes a high-resolution display, an embedded wireless personal network, a rapid target acquisition system, and Augmented reality algorithms that enhance the night vision capabilities of army personnel.

- In November 2023, Leonardo DRS, Inc. received an order for the production of its next-generation thermal weapon sights for the US Army. The production order for more than USD 134 million was made under the Family of Weapon Sights - Individual (FWS-I) IDIQ contract. FWS-I, a clip-on weapon sight, connects wirelessly to helmet-mounted vision systems, including the enhanced night vision goggle binoculars (ENVG-B) and the integrated visual augmentation system (IVAS). It offers rapid target acquisition capabilities to the soldier. It leverages DRS' uncooled thermal imaging technology, enabling soldiers to acquire targets day or night and in smoke or fog. The partnership will help the company to continue to deliver this vital technology to the US Army.

- In May 2023, the Federal Aviation Administration (FAA) certified the Erickson Incorporated S-64F Air-Crane helicopter for night vision goggles (NVG) operation. Erickson's integrated NVG program offers customers increased flexibility and expanded operational capabilities. It ensures that the NVG flight crew maintains accordance with current FAA regulations. The certification will allow the company to increase tactical planning and agility in aerial firefighting and civil protection operations. Further, Erickson also collaborated with Aviation Specialties Unlimited (ASU) to modify S-64F to perform NVG operations.

- Therefore, as the regional governments aim to evolve their night vision capabilities through development, integration, experimentation, laboratory and platform tests, and evaluation with integration with various systems in use, the market in the region is likely to grow.

Night Vision Devices Industry Overview

The night vision devices market is semi-consolidated due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Teledyne FLIR LLC, L3harris Technologies Inc., American Technologies Network Corp., Elbit Systems Deutschland, and BAE Systems PLC. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024 - Exosens announced the introduction of the 25 mm Image Intensifier solution. It is based on the company's Hi-CE MCP technology and is available with advanced Hi-QE photocathodes.

- December 2023 - Thales and the Spanish security company Trablisa formed a joint venture to complete the installation of the integrated surveillance system in the Melilla Command of the Civil Guard for intelligent border control. The surveillance system will enable the Civil Guard with high-resolution day and night cameras. The night vision cameras and the monitoring and control software (HORUS) allow the centralized management and control of sensors and actuators as well as the processing of images.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Military Expenditure

- 5.1.2 Increasing Adoption from Law Enforcement

- 5.2 Market Restraints

- 5.2.1 High Costs Associated with Maintenance

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Camera

- 6.1.2 Goggles

- 6.1.3 Monoculars and Binoculars

- 6.1.4 Rifle Scope

- 6.1.5 Other Types

- 6.2 By Technology

- 6.2.1 Thermal Imaging

- 6.2.2 Image Intensifier

- 6.2.3 Infrared Illumination

- 6.2.4 Other Technologies

- 6.3 By Application

- 6.3.1 Military and Defense

- 6.3.2 Wildlife Spotting and Conservation

- 6.3.3 Surveillance

- 6.3.4 Navigation

- 6.3.5 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Teledyne FLIR LLC

- 7.1.2 L3Harris Technologies Inc.

- 7.1.3 American Technologies Network Corp.

- 7.1.4 Elibit Systems Ltd

- 7.1.5 BAE Systems PLC

- 7.1.6 Thales Group SA

- 7.1.7 Raytheon Technologies Corporation

- 7.1.8 Bushnell Inc.

- 7.1.9 Satir

- 7.1.10 Apresys International Inc.

- 7.1.11 Luna Optics Inc.

- 7.1.12 Opgal Optronic Industries Ltd

- 7.1.13 EOTECH LLC

- 7.1.14 Exosens

- 7.1.15 Panasonic Holding Corporation

- 7.1.16 Tak technologies private Limited

- 7.1.17 TACTICAL NIGHT VISION COMPANY

- 7.1.18 sharp Corporation

- 7.1.19 nivisys LLC

- 7.1.20 Excelitas Technologies Corp.