|

市場調查報告書

商品編碼

1524207

鼠李醣脂:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Rhamnolipids - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

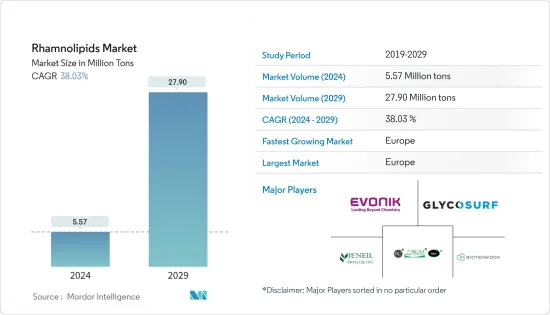

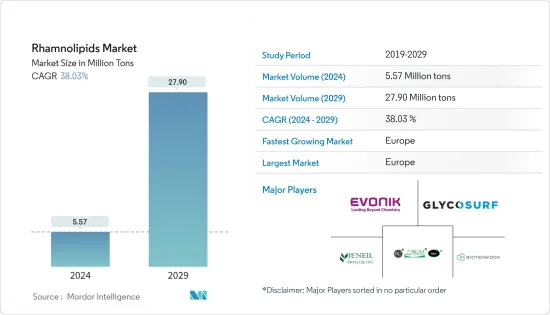

鼠李醣脂市場規模預計到2024年為557萬噸,預計到2029年將達到2790萬噸,在預測期內(2024-2029年)複合年成長率為38.03%。

主要亮點

- COVID-19 的爆發導致全球封鎖、供應鏈和製造活動中斷以及生產停頓,所有這些都對 2020 年的市場產生了負面影響。然而,情況在 2021 年開始改善,市場能夠在預測期內的剩餘時間內恢復上升趨勢。

- 推動市場的關鍵因素是鼠李醣脂的需求不斷成長,因為鼠李醣脂是環保的界面活性劑。此外,個人保健產品需求的增加預計也將推動市場需求。

- 另一方面,鼠李醣脂的工業規模生產受到限制,阻礙了市場成長。

- 鼠李醣脂應用的未來研究預計將為預測期內的市場成長提供各種機會。

- 歐洲地區是最大的市場,由於德國、英國和法國等國家的消費增加,預計在預測期內將成為成長最快的市場。

鼠李醣脂市場趨勢

界面活性劑對鼠李醣脂的需求不斷成長

- 鼠李醣脂生物界面活性劑在自然界中比合成界面活性劑更容易被殺死。它被認為是合成表面活性劑的絕佳替代品,因為它對皮膚溫和、易於沖洗且環保。

- 表面活性劑被稱為清潔劑和家庭清洗產品的主要成分。清潔劑和其他清洗行業始終需要環保表面活性劑。

- 鼠李醣脂生物界面活性劑用於洗衣精、地板清潔劑、餐具清潔劑和其他清洗產品。許多公司正在將生物表面活性劑清洗和清潔劑產品推向市場。

- 鼠李醣脂界面活性劑含有一或兩分子鼠李糖作為親水性水,並連接一或兩分子B-羥基化脂肪酸鏈作為疏水區域。

- 鼠李醣脂會自然分解,無論是有氧或厭氧,並成為100%天然物質。這些醣脂是用途廣泛的生物表面活性劑,可用於多種應用,包括清洗劑。

- 此外,總部位於比利時的生態清洗公司 Ecover 也提供含有鼠李醣脂的玻璃和表面清洗。該公司提供的產品被歸類為生物分解性的,對水生生物的影響最小。

- 根據加拿大統計局數據,2023年1月至3月加拿大肥皂和清洗產品月銷售額為3.9558億加元(約3.04億美元),比去年同期銷售額成長約2000萬日元。

- 因此,由於上述因素,界面活性劑的鼠李醣脂應用可能在預測期內佔據主導地位。

歐洲地區主導市場

- 目前,在工業和最終用途需求的推動下,歐洲在界面活性劑、化妝品和藥品的全球市場中佔有最高佔有率。

- 在歐洲,德國是鼠李醣脂的重要市場。 Fraunhofer IGB、Cognis Care Chemicals、Evonik Industries AG 和 Biotensidon GmbH 生產鼠李醣脂和生物界面活性劑。

- Biotensidon GmbH 已具備經濟高效地大量生產鼠李醣脂的能力,有助於改善多個工業領域許多產品的健康和環境特性。為了提高鼠李醣脂產能,Biotensidon GmbH 正在建造新的鼠李醣脂-超分子複合物,將其鼠李醣脂產能提高到每年 5,000 噸。

- 在英國,該公司正在投資開發鼠李醣脂和生物界面活性劑活性劑的高效生產技術。

- TeeGene Biotech Limited是一家國內專業生產和開發生物表面活性劑的生物科技公司。該公司開發了最先進的環保生物技術工藝,利用微生物、植物和海洋生物等自然資源來生產生物表面活性劑。

- 在義大利,鼠李醣脂和生物界面活性劑市場仍處於研發階段。鼠李醣脂市場預計未來幾年將在該國擴大。

- 法國是全球最大的化妝品市場。因此,大多數公司正在開發用於個人護理應用的特定生物界面活性劑。例如,化妝品和個人護理公司奇華頓開發了生物界面活性劑。這種生物界面活性劑用於除臭劑、洗面乳、沐浴凝膠、卸妝等。

- 因此,由於上述因素,歐洲很可能在預測期內主導鼠李醣脂市場。

鼠李醣脂產業概況

全球鼠李醣脂市場部分整合,只有少數大型企業主導市場。主要企業包括(排名不分先後)Evonik Industries AG、Jeneil Biotech、Stepan Company、AGAE Technologies LLC 和 Biotensiodn GmbH。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行概述

第4章市場動態

- 促進因素

- 環保表面活性劑的出現

- 個人保健產品需求增加

- 抑制因素

- 鼠李醣脂工業規模生產的限制

- 價值鏈分析

- 波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模(基於數量))

- 種類

- 單鼠李醣脂

- 二鼠李醣脂

- 目的

- 界面活性劑

- 化妝品

- 農業

- 食品

- 藥品

- 其他

- 地區

- 亞太地區

- 北美洲

- 歐洲

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- AGAE Technologies, LLC

- Stepan Company

- Biotensidon GmbH

- Evonik Industries AG

- GlycoSurf

- Jeneil Biotech

- DEGUAN Biosurfactant Supplier

- TensioGreen

第7章 市場機會及未來趨勢

- 鼠李醣脂應用的未來研究

簡介目錄

Product Code: 70585

The Rhamnolipids Market size is estimated at 5.57 Million tons in 2024, and is expected to reach 27.90 Million tons by 2029, growing at a CAGR of 38.03% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 outbreak resulted in a global lockdown, a breakdown in supply chains and manufacturing activities, and production halts, all of which had a detrimental effect on the market in 2020. However, things started to get better in 2021, which allowed the market to resume its upward trend for the remainder of the projected period.

- The major factor driving the market studied is the growing demand for rhamnolipids from eco-friendly surfactants. Moreover, the increasing demand for personal care products is also expected to fuel the market demand.

- On the flip side, limitations in the production of rhamnolipids on an industrial scale have hindered the growth of the market.

- The upcoming research in the applications of rhamnolipids is forecasted to offer various opportunities for the growth of the market over the forecast period.

- Europe region represents the largest market and is also expected to be the fastest-growing market over the forecast period owing to the increasing consumption from countries such as Germany, the United Kingdom, and France.

Rhamnolipids Market Trends

Growing Demand of Rhamnolipids from Surfactants

- Rhamnolipid bio-surfactants have the property of getting dreaded easily in nature as compared to synthetic surfactants. They are believed to be a better alternative to synthetic surfactants due to their being skin-friendly, rinse-active, and very environmentally friendly.

- Surfactants are known to be the major ingredients of detergents and household cleaning agents. There is a constant need for environmentally sound surfactants to be used in the industry for detergents and other cleaning products.

- Rhamnolipid bio-surfactants are used in laundry detergents, floor cleaners, dishwashing liquids, and other cleaning products. Many companies have been introducing bio-surfactant cleaning and detergent products in the market.

- Rhamnolipids surfactants contain either one or two molecules of rhamnose as the hydrophilic moisture, linked to one or two B-hydroxylated fatty acid chains as the hydrophobic region.

- Rhamnolipids decompose naturally, whether aerobically or anaerobically, to 100% natural substances. These glycolipids are versatile biosurfactants with a wide range of possible applications ranging from cleansing agents.

- Moreover, Ecover, a Belgium-based manufacturer of ecologically sound cleaning products, offers a glass and surface cleaner containing rhamnolipid. The product provided by the company is classified as biodegradable and shows minimal impact on aquatic life.

- According to Statcan, the Canadian Statistics Agency, the monthly manufacturer sales of soap and cleaning compounds in Canada in the first three months of 2023 accounted for CAD 395.58 million (~USD 304 million), approximately 20% more than the previous year's sales for the same period.

- Hence, owing to the factors mentioned above, the application of rhamnolipids from surfactant is likely to dominate during the forecast period.

Europe Region to Dominate the Market

- Currently, Europe accounts for the highest share of surfactants, cosmetics, and pharmaceuticals in the global market, owing to the demand from the industries and end-use applications.

- In Europe, Germany has a significant market for rhamnolipids. Fraunhofer IGB, Cognis Care Chemicals, Evonik Industries AG, and Biotensidon GmbH manufacture rhamnolipids and biosurfactants.

- Biotensidon GmbH has developed the capability for cost-effective mass-production of rhamnolipids, which will be instrumental in improving the health and eco characteristics of many products in several industry sectors. In order to increase the production capacity of rhamnolipids, Biotensidon GmbH has built a new rhamnolipid-supra molecular complex to increase the production capacity of rhamnolipids up to 5,000 tons per year.

- In the United Kingdom, companies are investing in the development of efficient production technologies for rhamnolipids and biosurfactants.

- TeeGene Biotech Limited is a biotechnology company that specializes in the production and development of biosurfactants in the country. The company developed environmentally friendly cutting-edge biotechnological processes to manufacture biosurfactants from natural sources such as microorganisms, plants, and marine organisms.

- In Italy, the market for rhamnolipids and biosurfactants is still in the research and development phase. In the coming years, the market for rhamnolipids is expected to grow in the country.

- France has the largest market for cosmetics in the world. Thus, most of the companies are developing specific biosurfactants which are used in personal care applications. For instance, Givaudan, a cosmetics and personal care company, developed a biosurfactant belonging to the sophorolipids family. The biosurfactant is used in deodorants, face cleansers, shower gels, and make-up removers.

- Hence, owing to the factors mentioned above, Europe is likely to dominate the rhamnolipids market during the forecast period.

Rhamnolipids Industry Overview

The global rhamnolipids market is partially consolidated in nature with only a few major players dominating the market. Some of the major companies are (not in any particular order) Evonik Industries AG, Jeneil Biotech, Stepan Company, AGAE Technologies LLC, and Biotensiodn GmbH, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Emergence of Eco-friendly Surfactant

- 4.1.2 Increasing Demand For Personal Care Products

- 4.2 Restraints

- 4.2.1 Limitation in the Production of Rhamnolipids on an Industrial Scale

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Type

- 5.1.1 Mono-Rhamnolipids

- 5.1.2 Di-Rhamnolipids

- 5.2 Application

- 5.2.1 Surfactants

- 5.2.2 Cosmetics

- 5.2.3 Agriculture

- 5.2.4 Food

- 5.2.5 Pharmaceutical

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.2 North America

- 5.3.3 Europe

- 5.3.4 South America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 AGAE Technologies, LLC

- 6.4.2 Stepan Company

- 6.4.3 Biotensidon GmbH

- 6.4.4 Evonik Industries AG

- 6.4.5 GlycoSurf

- 6.4.6 Jeneil Biotech

- 6.4.7 DEGUAN Biosurfactant Supplier

- 6.4.8 TensioGreen

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Upcoming Research in the Applications of Rhamnolipids

02-2729-4219

+886-2-2729-4219