|

市場調查報告書

商品編碼

1536788

顏料:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Pigments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

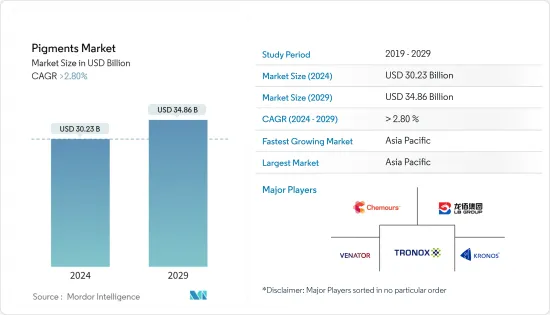

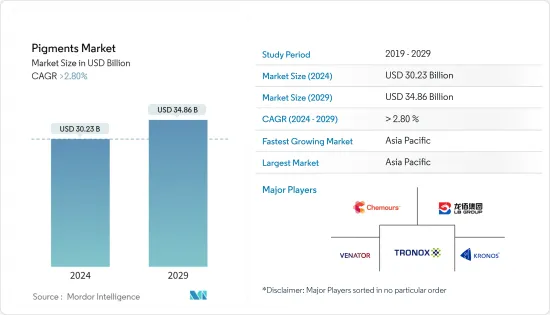

預計2024年全球顏料市場規模將達302.3億美元,2024年至2029年複合年成長率將超過2.80%,2029年將達到348.6億美元。

主要亮點

- COVID-19 對 2020 年市場產生了負面影響。全球供應鏈的中斷,加上油漆和塗料、塑膠和紡織品等許多最終用戶行業的需求減少,抑制了顏料需求。

- 然而,隨著消費者花更多的時間在家裡,專注於住宅裝修計劃,以及住宅建築業的復甦,市場開始復甦。由於人們對清潔和衛生的日益關注,防護和消毒塗料的需求量很大。

- 從中期來看,新興市場油漆和塗料行業需求的增加以及複雜無機顏料在各種應用中的廣泛使用將是推動市場的關鍵因素。

- 另一方面,嚴格的政府法規和顏料反傾銷稅等因素正在阻礙市場成長。此外,轉向環保產品和對 3D 列印材料的需求不斷成長等因素也為所研究的市場帶來了機會。

- 亞太地區主導全球市場,消費量最高的國家為中國、印度和日本。

顏料市場趨勢

塗料產業需求增加

- 顏料是不溶性顆粒物質,可為油漆和塗料提供顏色、不透明度、光澤控制、流變控制和其他特定性能(例如腐蝕抑制)。

- 顏料被認為是油漆和塗料中的重要成分,因為它們不僅提供顏色,而且還可以透過充當體積填料來幫助降低油漆成本。

- 根據世界油漆和塗料工業協會(WPCIA)的數據,2022年油漆和塗料行業銷售額排名前五的公司是宣偉公司、PPG工業公司、阿克蘇諾貝爾公司、立邦塗料和RPM國際公司。

- 據德國聯邦統計局稱,到2024年,德國油漆、清漆和類似塗料、印刷油墨和膠粘劑生產的工業營業額預計將達到約129.4億美元,從而增加油漆和塗料行業可能會增加顏料的消耗。

- 此外,2022 年 11 月,宣偉公司在北卡羅來納州斯泰茨維爾舉行了擴建現有製造工廠的奠基儀式。此次擴建旨在大幅提高公司建築油漆和塗料產品的年生產能力。預計 2024年終完工,導致油漆和塗料中使用的顏料需求增加。

- 所有上述因素預計將對未來幾年的市場成長產生重大影響。

亞太地區主導市場

- 考慮到中國、印度等國家各種應用的巨大需求,亞太地區主導了市場成長。

- 中國佔全球塗料市場四分之一以上。根據中國塗料工業協會統計,近年來該產業成長約7%。根據歐洲塗料協會統計,中國有近萬家塗料生產公司。

- 2022年7月,BASF塗料擴大了位於中國南方廣東省江門市的塗料基地的汽車修補漆產能。此次擴建完成後,BASF汽車修補漆年產能增加至3萬噸。

- 2023會計年度印度染料和顏料產量為39.8萬噸,較2022會計年度成長近22%。

- 據印度工商聯合會稱,到 2022 年,印度印刷業的價值預計約為 2,500 億印度盧比(30 億美元)。該國對墨水的需求不斷增加,導致了多個擴建計劃。例如

- 2022 年 3 月,領先的印刷油墨製造商 DIC Corporation 在古吉拉突邦魯奇區 Saykha 開設了一家新的無甲苯工廠 Optima,用於生產液體油墨。工廠用地面積92500平方公尺,第一期具備兩班制生產10000餘噸TF、KF/NTNK(無甲苯/無酮)液體墨水的能力。製造設施的這種擴張預計將在預測期內推動市場成長。

- 因此,所有此類擴張活動和適當的政府措施預計將促進該地區的建設活動,並進一步擴大對油漆和塗料的需求,從而增加對顏料的需求。

顏料產業概況

顏料市場得到部分完整。主要企業(排名不分先後)包括科慕公司、Venator Materials PLC、Kronos Worldwide Inc.、LB Group 和 Tronox Holdings Plc。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 開發中國家油漆和塗料行業的需求不斷成長

- 擴大複合無機彩色顏料 (CICP) 在各種應用中的使用

- 紡織業需求穩定

- 抑制因素

- 嚴格的政府法規

- 對顏料徵收反傾銷稅

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模:以金額為準)

- 產品類型

- 無機的

- 氧化鈦

- 氧化鋅

- 其他產品類型

- 有機的

- 特殊顏料/其他產品類型

- 無機的

- 目的

- 油漆/塗料

- 紡織品

- 印刷油墨

- 塑膠

- 皮革

- 其他用途

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)分析

- 主要企業策略

- 公司簡介

- ALTANA AG

- DIC Corporation

- Heubach Gmbh

- Kronos Worldwide, Inc.

- LANXESS

- LB Group

- Pidilite Industries Ltd.

- Sudarshan Chemical Industries Limited

- The Chemours Company

- Tronox Holdings Plc.

- Venator Materials PLC.

第7章 市場機會及未來趨勢

- 轉向環保產品

- 3D列印材料需求不斷成長

簡介目錄

Product Code: 46248

The Pigments Market size is estimated at USD 30.23 billion in 2024, and is expected to reach USD 34.86 billion by 2029, growing at a CAGR of greater than 2.80% during the forecast period (2024-2029).

Key Highlights

- COVID-19 had a negative impact on the market in 2020. The disruption in the worldwide supply chain, combined with lower demand from numerous end-user industries such as paints and coatings, plastics, textiles, and others, hampered pigment demand.

- However, the market recovered as consumers spent more time at home and focused on home remodeling projects, and the residential construction sector recovered. Protective and sanitizing coatings are in high demand due to growing concerns about cleanliness and hygiene.

- In the medium term, the significant factors driving the market studied are rising demand from the paints and coatings industry from developing nations and rising applications of complex inorganic color pigments in various applications.

- On the flip side, factors such as stringent government regulations and anti-dumping duties on pigments are hampering the market growth. Moreover, factors such as shifting focus towards eco-friendly products and rising demand for 3D printing materials are acting as an opportunity for the studied market.

- Asia-Pacific dominated the market worldwide, with the most significant consumption from countries such as China, India, and Japan.

Pigments Market Trends

Increasing Demand from the Paints and Coatings Industry

- Pigments are insoluble particulate materials that are responsible for providing color, opacity, gloss control, rheological control, and certain other properties, such as corrosion inhibition to the paints and coatings.

- Pigments are considered an important constituent in paints and coatings as they impart color and also help in reducing the cost of coatings by acting as a volume filler.

- According to the World Paint and Coatings Industry Association (WPCIA), in the year 2022, with respect to revenue, the top 5 companies in the paints and coatings industry were The Sherwin-Williams Company, PPG Industries, AkzoNobel N.V., Nippon Paint and RPM International.

- According to the Statistisches Bundesamt, the industry revenue of the manufacture of paints, varnishes, and similar coatings, printing ink, and mastics in Germany is projected to reach around USD 12.94 billion by the year 2024, thereby likely to increase the consumption of pigments used in the paints and coatings sector.

- Moreover, in November 2022, The Sherwin-Williams Company held a ceremonial groundbreaking that marked the start of construction of an extension of its existing manufacturing facility in Statesville, North Carolina. This expansion is intended to significantly expand the annual manufacturing capacity for the company's architectural paint and coatings products. It is expected to be finished by the end of 2024, thus increasing the demand for pigments used in paints and coatings.

- All the above factors are expected to impact market growth in the coming years significantly.

Asia-Pacific to Dominate the Market

- Asia-Pacific dominated the market growth, considering the huge demand from various applications in countries like China, India, and others.

- China accounts for more than one-fourth of the global coatings market. According to the China National Coatings Industry Association, the industry has registered a growth of around 7% in recent years. According to European Coatings, nearly 10,000 coatings manufacturers are located in China.

- In July 2022, BASF Coatings expanded the production capacity of automotive refinish coatings at its coatings site in Jiangmen, Guangdong Province, in South China. With the completion of the expansion, BASF's annual production capacity of automotive refinish coatings increased to 30,000 metric tons.

- India's production volume of dyes and pigments in India in the financial year of 2023 stood at 398,000 metric tons, almost a 22% increase from 2022's production.

- According to the Federation of Indian Chambers of Commerce and Industry, the value of the print industry across India was estimated at around INR 250 billion (USD 3 Billion) in 2022. The demand for ink has been increasing in the country, which has led to several expansion projects. For instance -

- One of the leading manufacturers of printing inks DIC Corporation, in March 2022, inaugurated its new toluene-free plant Optima for liquid ink manufacturing at Saykha in Bharuch district, Gujarat. The plant covers 92,500 sq m, and in phase one, the plant has the capacity to manufacture over 10,000 tons of TF, KF/NTNK (toluene-free/ketone-free) liquid inks in two shifts. Such manufacturing facility expansions are anticipated to boost the market's growth during the forecast period.

- Thus, all such expansion activities and suitable government measures are expected to boost the construction activities in the region, which is further projected to grow the demand for paint and coating, thereby increasing the demand for pigments.

Pigments Industry Overview

The pigment market is partially consolidated in nature. The major companies (not in any particular order) include The Chemours Company, Venator Materials PLC, Kronos Worldwide Inc., LB Group, and Tronox Holdings Plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand From the Paints and Coatings Industry in Developing Nations

- 4.1.2 Rising Applications of Complex Inorganic Color Pigment (CICP) in Various Applications

- 4.1.3 Consistent Demand from the Textile Industry

- 4.2 Restraints

- 4.2.1 Stringent Government Regulations

- 4.2.2 Anti-Dumping Duty on Pigments

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Inorganic

- 5.1.1.1 Titanium Dioxide

- 5.1.1.2 Zinc Oxide

- 5.1.1.3 Other Product Types (Carbon Pigments, Dry Earth, Ultramarine Pigments, Cadmium, Lead Chromate, and Others)

- 5.1.2 Organic

- 5.1.3 Specialty Pigments and Other Product Types (Functional Pigments, Magnetic Pigments, and Others)

- 5.1.1 Inorganic

- 5.2 Application

- 5.2.1 Paints and Coatings

- 5.2.2 Textiles

- 5.2.3 Printing Inks

- 5.2.4 Plastics

- 5.2.5 Leather

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ALTANA AG

- 6.4.2 DIC Corporation

- 6.4.3 Heubach Gmbh

- 6.4.4 Kronos Worldwide, Inc.

- 6.4.5 LANXESS

- 6.4.6 LB Group

- 6.4.7 Pidilite Industries Ltd.

- 6.4.8 Sudarshan Chemical Industries Limited

- 6.4.9 The Chemours Company

- 6.4.10 Tronox Holdings Plc.

- 6.4.11 Venator Materials PLC.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Shifting Focus Towards Eco-friendly Products

- 7.2 Rising Demand for 3D Printing Material

02-2729-4219

+886-2-2729-4219