|

市場調查報告書

商品編碼

1536797

汽車防鎖死煞車系統與電子穩定性控制:市場佔有率分析、產業趨勢與成長預測(2024-2029)Automotive Anti Lock Braking System And Electronic Stability Control - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

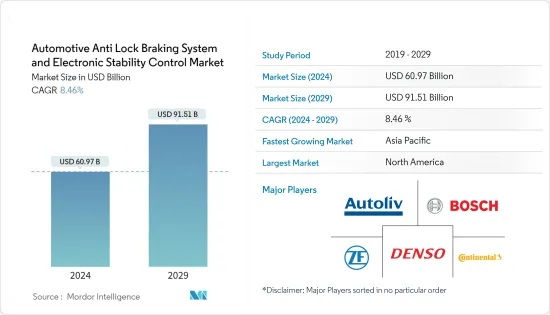

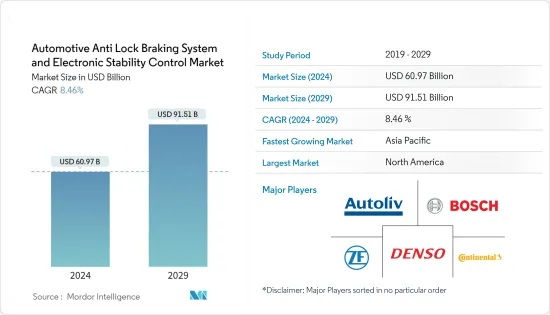

汽車防鎖死煞車系統和電子穩定控制市場規模預計到 2024 年為 609.7 億美元,到 2029 年達到 915.1 億美元,在預測期內(2024-2029 年)預計複合年成長率為 8.46 %。

2022 年,全球汽車產量約 8,500 萬輛。 2022年,中國乘用車產量將達到約2,384萬輛,商用車產量將達319萬輛,成為全球乘用車產量第一大國。

從長遠來看,由於安全問題的增加和減少道路死亡人數的潛力,ABS 系統正在獲得認可。每天有近 3,300 人死於道路交通事故,其中約十分之九發生在汽車持有不到全球一半的低收入和中等收入國家。

隨著汽車防鎖死煞車系統開始廣泛應用於入門級二輪車,預計汽車防鎖死煞車系統市場將呈現高速成長。新興市場的大多數摩托車都是具有標準安全功能的豪華車。然而,在新興市場,二輪車是最便宜的入門車輛。乘用車擴大採用此類安全系統預計將在預測期內提振市場。

然而,亞太地區預計將成為汽車防鎖死煞車系統的主要市場。日本、印度和中國是預測期間的主要汽車製造中心。

汽車防鎖死煞車系統市場趨勢

政府法規可望促進乘用車採用 ABS

由於世界範圍內汽車數量的增加,全球範圍內的交通事故顯著增加。例如

- 2023 年 7 月,Itelma LLC 位於科斯特羅馬的工廠開始生產乘用車防鎖死煞車系統 (ABS) 和電子穩定控制系統 (ESP),成為俄羅斯第一家此類工廠。地方政府新聞部門向國際文傳電訊社通報了此事。

為了促進這個計劃,建造了一個擁有全自動生產線的新車間。 Itelma LLC 還擁有 ABS 和 ESP 系統的本地製造許可證。值得注意的是,整個計劃是商業性驅動的,不依賴補貼或政府資助。國產ABS和ESP系統的產能目標為每年85萬套,並可能擴大到120萬套。

汽車防鎖死煞車系統市場主要是由對汽車安全和控制系統(例如防鎖死系統(ABS))日益成長的需求所推動的。制定安全標準的嚴格法規以及強調車輛安全重要性的各種計劃的啟動也支持了市場的擴張。

在歐洲,自2004年起,所有新乘用車都必須配備ABS。在美國,花了近十年的時間才要求所有新乘用車都配備 ABS。美國運輸部國家公路交通安全管理局 (NHTSA) 於 2007 年 3 月根據聯邦機動車輛安全標準 (FMVSS) 第 126 號的規定,強制要求將 ABS 與 ESC(電子穩定控制)一起使用。

全球汽車產業不斷提高的安全標準正在推動開發中國家,新乘用車銷售時均標配ABS。印度道路運輸和公路部 (MoRTH) 已通知,所有新乘用車和二輪車將強制安裝 ABS。 2022年,日本、巴西等國家將強制安裝ABS,因此近92%的已售乘用車將配備ABS。

考慮到幾乎所有國家政府實施的嚴格規則和規定,未來市場可能會變得活躍。

世界各地的政府法規正在推動 ABS 市場的發展

不斷增加的事故率和世界各國政府為減少傷亡人數而不斷努力是防鎖死煞車系統市場的關鍵促進因素。

亞太地區是全球成長最快的市場之一。由於道路安全法規要求所有新車均配備 ABS,該地區對防鎖死煞車系統 (ABS) 的需求不斷成長。例如,

- 印度政府強制所有轎車和小客車配備防鎖死煞車系統(ABS)。根據道路運輸和旅遊部的規定,從 2018 年 4 月起,所有新車都必須符合這項標準。同樣,現有的新車型也將被要求配備ABS。此外,125cc以上的摩托車也需要配備ABS。

- 根據 (EU) 第 168/2013 號法規,L3e-A1 子類別中的二輪車輛必須由製造商自行決定配備先進的煞車系統,包括防鎖死煞車系統 (ABS) 或組合煞車系統制動系統(CBS),或兩者都必須安裝。

美國運輸安全委員會(NTSB)正在推動美國摩托車製造過程中安裝防鎖死煞車。由於NTSB沒有製定法律的權力,它的目的是說服負責制定和執行道路安全法規的組織NHTSA。根據公路安全保險美國的數據,配備防鎖死的摩托車事故率降低了 31%。

歐盟議會強制要求 2016 年生產的摩托車必須標配防鎖死煞車系統。根據公路安全保險美國的報告,2017年,8.9%的註冊摩托車被要求配備防鎖死煞車系統。自 2002 年以來,這一數字穩步成長,當時只有 0.2% 的摩托車標配了防鎖死煞車技術。

防鎖死煞車系統(ABS)市場預計在預測期內將成長。已開發國家和新興國家正在強制要求四輪車和二輪車防鎖死煞車系統(ABS),以減少傷亡人數。

汽車防鎖死煞車系統產業概況

羅伯特·博世有限公司、奧托立夫公司、大陸雷芬德國有限公司、Denso公司和採埃孚股份公司等主要公司主導著汽車防鎖死煞車系統市場。

公司正在對關鍵技術、收購和合作夥伴關係進行策略性投資。此外,幾乎所有乘用車都配備了防鎖死煞車系統,這正在推動市場成長。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 關於汽車安全的嚴格規定

- 市場限制因素

- 整合複雜度

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 車型

- 摩托車

- 客車

- 商用車

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 巴西

- 阿根廷

- 阿拉伯聯合大公國

- 南非

- 南美洲其他地區

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Continental Reifen Deutschland GmbH

- Delphi Technologies PLC

- DENSO Corporation

- Autoliv Inc.

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Haldex AB

- WABCO Holdings Inc.

- Hyundai Mobis Co. Ltd

第7章 市場機會及未來趨勢

- 感測器與AI整合

The Automotive Anti Lock Braking System And Electronic Stability Control Market size is estimated at USD 60.97 billion in 2024, and is expected to reach USD 91.51 billion by 2029, growing at a CAGR of 8.46% during the forecast period (2024-2029).

In 2022, some 85 million motor vehicles were produced worldwide. In 2022, China emerged as the global leader in passenger car production, manufacturing approximately 23.84 million vehicles alongside 3.19 million commercial vehicles, solidifying its position as the foremost producer of passenger cars worldwide.

Over the long term, the increasing acceptance of ABS systems is the growing focus on safety and the potential reduction in road-accident-related deaths. Nearly 3,300 people die every day due to road crashes, and about 9/10th of the casualties occur in middle and low-income countries that have less than half of the world's total vehicles.

The automotive anti-lock brake system market is expected to show a high growth rate as these systems are starting to be used extensively in entry-level two-wheelers. Most two-wheelers in the developed markets are high-end vehicles with safety features similar to the standard. However, in emerging markets, two-wheelers are the cheapest and entry-level vehicles. Increased adoption of such safety systems in passenger vehicles is expected to boost the market during the forecast period.

However, Asia-Pacific is projected to become the key automotive anti-lock braking system market. During the forecast period, Japan, India, and China are the major automotive manufacturing hubs.

Automotive Anti-lock Braking System Market Trends

Government Regulations Likely to Drive Adoption of ABS in Passenger Cars

Due to the rising number of motor vehicles worldwide, there has been a significant increase in road accidents globally. For instance,

- In July 2023, the production of anti-lock braking systems (ABS) and electronic stability control systems (ESP) for passenger cars commenced at the Itelma LLC facility in Kostroma, making it the first such facility in Russia. The regional administration's press service informed Interfax about this development.

A new workshop equipped with a fully automated production line has been constructed to facilitate this project. Itelma LLC is also licensed to manufacture ABS and ESP systems locally. Notably, the entire project is commercially driven, with no reliance on subsidies or government funds. The production capacity aims to achieve an annual output of 850,000 units of domestic ABS and ESP systems, with the potential for expansion to 1.2 million units.

The automotive anti-lock braking system market is primarily driven by the growing demand for vehicle safety and control systems in automobiles, such as anti-lock brakes (ABS). Also, strict regulations dictating safety standards and the launch of various programs highlighting the importance of vehicle safety have fuelled market expansion.

All new passenger cars must be equipped with ABS since 2004 in Europe. The United States took nearly a decade to mandate ABS in all new passenger cars. The National Highway Traffic Safety Administration (NHTSA) mandated ABS in conjunction with Electronic Stability Control (ESC) under the provisions of the March 2007 Federal Motor Vehicle Safety Standard (FMVSS) No. 126.

The increasing safety standards in the global automotive industry are driving developing countries to follow their developed counterparts, where new passenger cars are sold with ABS as a standard feature. The Ministry of Road Transport and Highways (MoRTH) in India notified that ABS is mandatory for all new passenger cars and two-wheelers. In 2022, nearly 92% of the passenger cars sold had been equipped with ABS, owing to the compulsory ABS rule in countries like Japan and Brazil.

Considering the strict rules and regulations implemented by the governments of almost all the countries will drive the market in the future.

Government Regulations Across the World are Driving the ABS Market

The increasing rate of accidents and the continuous efforts of governments worldwide to reduce the number of casualties is a significant driver for the anti-lock braking systems market.

Asia-Pacific is one of the fastest-growing markets globally. The increasing demand for the region's anti-lock braking system (ABS) is supported by increased road safety rules, ensuring all new vehicles are equipped with ABS. For instance,

- The Indian government has mandated that all cars and mini-buses install an anti-lock braking system (ABS). According to the Road Transport Ministry, all new vehicles must comply with the norms from April 2018 onward. Similarly, all new cars of the existing models will have to install the ABS. Moreover, ABS will be mandatory for two-wheelers with more than a 125cc engine.

- Under Regulation (EU) No. 168/2013, motorcycles in the L3e-A1 subcategory must be fitted with an advanced braking system consisting of either an anti-lock braking system (ABS) or a combined braking system (CBS) or both at the discretion of the manufacturer.

The National Transportation Safety Board (NTSB) promotes anti-lock brakes in the manufacturing process of motorcycles in the United States. The NTSB does not have the right to create laws, so it aims to persuade the NHTSA, an organization responsible for introducing and enforcing road safety rules. The Insurance Institute for Highway Safety found that motorcycles with anti-lock brakes have a 31% lower crash rate than bikes without the feature.

The European Union parliament mandated that anti-lock braking systems be the standard equipment for motorcycles built in 2016. The Insurance Institute of Highway Safety reported that 8.9% of registered motorcycles were required to have anti-lock brake systems in 2017. This number has increased steadily since 2002, when anti-lock brake technology was considered standard equipment on only 0.2% of motorcycles.

The anti-lock brake system (ABS) market is anticipated to grow during the forecast period. Developed and developing countries are making the anti-lock braking system (ABS) mandatory for four-wheelers and two-wheelers to reduce the number of casualties.

Automotive Anti-lock Braking System Industry Overview

Major players, such as Robert Bosch GmbH, Autoliv Inc., Continental Reifen Deutschland GmbH, DENSO Corporation, and ZF Friedrichshafen AG, dominate the automotive anti-lock braking system market.

The companies are strategically investing, making acquisitions, and entering into partnerships in key technologies. Also, almost all passenger vehicles have an anti-lock braking system, driving market growth.

- In March 2022, ZF announced that its new Commercial Vehicle Solutions division would introduce its entire product and technology portfolio for heavy-duty trucking applications at TMC 2022 in Orlando. ZF's show floor exhibit includes a virtual tour of the company's entire commercial vehicle product line, including chassis technology: air management; suspension solutions; air disc brakes, brake actuators, and vacuum pumps; vehicle dynamics: ADAS, anti-lock braking systems (pneumatic and hydraulic), and steering solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Strict Rules and Regulations in Vehicle Safety

- 4.2 Market Restraints

- 4.2.1 Integration Complexity

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 Motorcycles

- 5.1.2 Passenger Cars

- 5.1.3 Commercial Vehicles

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Mexico

- 5.2.1.4 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Russia

- 5.2.2.5 Spain

- 5.2.2.6 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 Japan

- 5.2.3.3 India

- 5.2.3.4 South Korea

- 5.2.3.5 Rest of Asia-Pacific

- 5.2.4 Rest of the World

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 United Arab Emirates

- 5.2.4.4 South Africa

- 5.2.4.5 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share**

- 6.2 Company Profiles*

- 6.2.1 Continental Reifen Deutschland GmbH

- 6.2.2 Delphi Technologies PLC

- 6.2.3 DENSO Corporation

- 6.2.4 Autoliv Inc.

- 6.2.5 ZF Friedrichshafen AG

- 6.2.6 Robert Bosch GmbH

- 6.2.7 Haldex AB

- 6.2.8 WABCO Holdings Inc.

- 6.2.9 Hyundai Mobis Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Integration of Sensors and AI