|

市場調查報告書

商品編碼

1685919

陀螺儀:市場佔有率分析、行業趨勢和統計數據、成長預測(2025-2030 年)Gyroscopes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

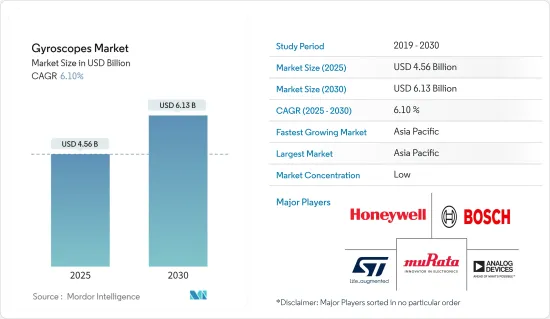

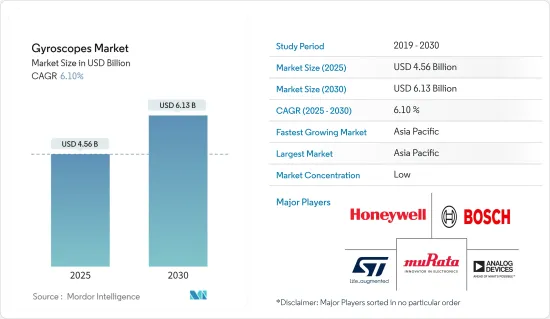

陀螺儀市場規模預計在 2025 年為 45.6 億美元,預計到 2030 年將達到 61.3 億美元,預測期內(2025-2030 年)的複合年成長率為 6.1%。

隨著基於 MEMS 的陀螺儀的推出,陀螺儀技術在過去十年中經歷了許多創新。陀螺儀的精度和效率也得到了提高,多軸陀螺儀現在採用數位整合以提高精度。近年來,陀螺儀的應用領域也不斷擴大,該技術在家用電子電器和工業應用領域具有重要意義。

主要亮點

- 預計國防和商業領域對無人機和無人駕駛飛行器(UAV)的快速應用將成為市場的主要驅動力。無人駕駛飛行器(UAV)是一種空中系統或飛行器,由人類操作員遠端操作或由機載電腦自主操作,用於戰爭或監視目的。不斷增加的研究和開發正在推動無人機的採用率。

- 根據商業和技術雜誌《國防》報道,無人機研究、開發和採購成本預計將從 2020 年的 111 億美元增加到 2029 年的 143 億美元。此外,研發費用預計將從 2020 年的 32 億美元增加到 2029 年的 40 億美元。到 2020 年,資金將從 2020 年的 79 億美元成長到約 103 億美元。由於無人機和無人駕駛飛機的使用日益增多,市場也不斷成長。

- 此外,對工業自動化和小型化消費性設備(如穿戴式裝置和物聯網連接設備)的需求是推動各地區受調查市場對 MEMS 陀螺儀需求的主要因素。

- 然而,高昂的前期成本和營運問題是預測期內限制市場成長的主要因素。此外,高品質的原料對製造商來說至關重要,因為它們對於生產優質的感測器至關重要。製造業使用的金屬和合金包括鉑、銅、矽、鎢、鎳等,合金進一步分為K型、M型、E型、J型等。此外,原物料價格和供應的波動也是阻礙市場成長的因素。

陀螺儀市場趨勢

汽車是一個快速成長的終端用戶市場

- 陀螺儀在汽車工業有多種應用。陀螺儀,尤其是 MEMS,用於汽車防翻滾和安全氣囊展開系統。陀螺儀也用於車載影像防手震系統,例如行車記錄器和其他車載攝影機中的機內影像防手震。它還用於車載導航系統以提高性能和準確性。陀螺儀可以與其他感測器配合使用,提供精確的位置和方向。

- 陀螺儀也用於車輛控制系統,以協助穩定性和控制。它提供有關車輛角運動的資訊,有助於最佳化車輛動力學並提高安全性。陀螺儀是汽車慣性導引系統的一部分。這些系統使用陀螺儀測量和維持車輛的方向和角速度,以提供準確的導航和引導資訊。此外,它也是汽車電子穩定程式 (ESP) 系統的重要組成部分,有助於檢測和測量汽車的轉速。這些資訊有助於在機動過程中保持車輛的穩定性和控制力。

- 乘用車產量的增加正在推動所研究的市場的發展。例如,根據OICA預測,2022年全球汽車產量將超過8,500萬輛。乘用車產量約佔汽車總產量的 73%,達到近 6,159 萬輛。 2021年全球汽車產量約5,705萬輛。

- 陀螺儀對於汽車 ADAS(高級駕駛輔助系統)至關重要。陀螺儀用於穩定控制系統,以檢測和糾正車輛偏離預定路徑的偏差,提高駕駛時的安全性和穩定性。提高自動駕駛能力、強度和安全性。 GPS輔助陀螺儀系統是為汽車領域的車輛動力學和駕駛輔助參數測量而開發的。這些系統提供高度精確的測量以協助 ADAS 測試和開發。根據國家安全委員會的數據,到 2026 年,大約 71% 的註冊車輛將配備後視攝影機,60% 的註冊車輛將配備後停車感應器。 ADAS 的日益普及可能會促進所研究市場的成長。

- 此外,自動駕駛和自動駕駛汽車的日益普及也是 ADAS 市場的主要成長要素。例如,根據英特爾預測,2030年全球汽車銷量將達到1.014億輛以上,而自動駕駛汽車預計將佔2030年汽車註冊量的約12%。

亞太地區預計將經歷強勁成長

- 由於龐大的消費性電子市場、不斷成長的5G設備需求以及政府積極發展經濟以保持全球領先地位,陀螺儀有望成為中國的領先產品。

- 中國正積極致力於將5G技術融入消費性電子產品。根據GSMA統計,中國當地是全球最大的5G技術市場,預計2022年底將佔全球5G連線數的60%以上。根據GSMA的《移動經濟報告》,到2024年,5G將超越4G,成為中國主導的行動技術。隨著5G的發展,網路連線更加先進,智慧型手機和平板裝置上的GPS應用也越來越普及,進而帶動陀螺儀的需求。

- 日本的汽車、半導體和家電產業是世界上最大的產業之一。日本有豐田、日產、本田、鈴木、三菱、大發、馬自達、Subaru、日野、五十鈴、川崎、Yamaha等主要汽車製造商。汽車行業技術的不斷進步、電動汽車銷量的不斷成長以及自動駕駛和聯網汽車中智慧控制系統的整合,對用於精確定位和導航的陀螺儀的需求不斷增加。

- 5G 在印度的快速推廣勢頭強勁,該國將在不久的將來獲得顯著的技術和經濟效益。例如,根據愛立信的報告,印度的5G行動用戶數將從2022年的666萬增加到2028年的6.9984億。 5G的引入預計將徹底改變各行業的工業和經濟表現,並增加就業機會。 5G 手機在該國越來越受歡迎,這有助於推動市場成長。

- 亞太其他地區包括韓國、台灣、泰國、馬來西亞、新加坡和印尼等東南亞國家。領先的智慧型手機製造商三星電子的存在以及韓國對開發 5G 市場的投資不斷增加正在推動智慧型手機市場的發展,從而對該地區對陀螺儀的需求產生積極影響。

陀螺儀市場概況

陀螺儀市場高度分散,既有全球性企業,也有中小型企業。市場的主要企業包括村田製作所、意法半導體公司、霍尼韋爾國際公司、ADI公司和博世感測器技術有限公司(羅伯特博世有限公司)。該市場的競爭對手正在採取聯盟和收購等策略來加強其產品供應並獲得永續的競爭優勢。

- 2024 年 1 月-村田製作所推出了結合陀螺儀和加速計的「下一代」感測器 SCH16T-K01。 SCH16T-K01 是多設備 SCH16T 系列六自由度 (6DoF) 感測器之一,基於村田製作所的新一代 3D電子機械系統 (MEMS) 感測器技術。

- 2023 年 11 月-意法半導體推出支援 AI 的汽車慣性測量單元,適用於高達 125°C 的始終開啟感知應用。意法半導體用於汽車應用的 ASM330LHXG1 慣性測量單元 (IMU) 結合了感測器內建 AI、增強低功耗操作和 125°C動作溫度範圍,可在惡劣環境下實現可靠性。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 產業價值鏈分析

- 宏觀經濟趨勢對產業的影響

第5章市場動態

- 市場促進因素

- 國防和民用無人駕駛車輛的普及

- 技術進步使組件更小、更輕、更有效率

- 市場限制

- 複雜性顯著增加,挑戰市場需求

第6章市場區隔

- 依技術

- MEMS陀螺儀

- 光纖陀螺儀(FOG)

- 環形雷射陀螺儀(RLG)

- 半球諧振陀螺儀(HRG)

- 動態調諧陀螺儀(DTG)

- 其他技術

- 按行業

- 消費性電子產品

- 車

- 航太與國防

- 工業的

- 海洋

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

- 北美洲

第7章競爭格局

- 公司簡介

- Murata Manufacturing Co. Ltd

- STMicroelectronics NV

- Honeywell International Inc.

- Analog Devices Inc.

- Robert Bosch GmbH

- MEMSIC Inc.

- EMCORE Corporation

- InnaLabs

- MicroStrain Inc.

- Vectornav Technologies LLC

- Dynalabs

第8章投資分析

第9章 市場機會與未來趨勢

The Gyroscopes Market size is estimated at USD 4.56 billion in 2025, and is expected to reach USD 6.13 billion by 2030, at a CAGR of 6.1% during the forecast period (2025-2030).

Gyroscope technology has witnessed many innovations in the past decade with the introduction of MEMS-based gyroscopes. The accuracy and efficiency of the gyroscopes have also improved, as multi-axis gyroscopes are more accurate due to digital integration. The applications of gyroscopes have also expanded over the past few years, with the consumer electronics and industrial segments finding significant implications for the technology.

Key Highlights

- The rapidly growing adoption of drones and unmanned aerial vehicles (UAVs) in the defense and commercial sectors has been expected to be a significant driver in the market. An Unmanned Aerial Vehicle (UAV) is an airborne system or an aircraft operated remotely by a human operator or autonomously by an onboard computer for warfare and surveillance. Due to the increase in research and development, the adoption rate of UAVs is rising.

- According to National Defense, a business technology magazine, the cost of research, development, and procurement for UAVs is expected to increase from USD 11.1 billion in 2020 to USD 14.3 billion by 2029. Additionally, it is anticipated that R&D spending will increase from USD 3.2 billion in 2020 to USD 4 billion in 2029. Procurement funding will rise from USD 7.9 billion in 2020 to approximately USD 10.3 billion by the decade's end. The market is expanding due to the increasing use of drones and UAVs.

- Further, industrial automation and demand for miniaturized consumer devices, such as wearables and IoT-connected devices, among others, across regions are among the significant factors driving the MEMS Gyroscope demand in the studied market.

- However, high initial costs and operational concerns are the major factors anticipated to restrain the growth of the studied market over the forecast period. Further, as an essential part of producing superior sensors, high-quality raw materials are vital for manufacturers. Metals and alloys used in manufacturing include Platinum, Copper, Silicon, Tungsten, and Nickel, and alloys, which are further categorized into type-K, type-M, type-E, type-J, and so on. Fluctuations in prices and supply of raw materials could also cause hindrances in the growth of the studied market.

Gyroscopes Market Trends

Automotive to be the Fastest Growing End-user Vertical

- Gyroscopes have several applications in the automotive industry. Gyroscopes, particularly MEMS, are used in vehicle roll-over prevention and airbag deployment systems. Gyroscopes are used in vehicle image stabilization systems, such as in-camera stabilization systems for dashcams or other onboard cameras. They are also utilized in-vehicle navigation systems to improve performance and accuracy. They can be used with other sensors to provide precise positioning and orientation.

- Gyroscopes can also be used in vehicle control systems to assist with stability and control. They can provide information about the vehicle's angular motion, which can be used to optimize vehicle dynamics and improve safety. They are utilized as a part of inertial guidance systems in cars. These systems use gyroscopes to measure and maintain a vehicle's orientation and angular velocity, providing accurate navigation and guidance information. Further, they form a crucial part of the electronic stability program (ESP) systems of vehicles that aid in the detection and measurement of the rate of rotation of the car. This information assists in maintaining vehicle stability and control during maneuvers.

- The increased production of passenger vehicles drives the market studied. For instance, according to OICA, worldwide motor vehicle production in 2022 amounted to more than 85 million units. The passenger cars segment generated approximately 73 percent of the motor vehicle production, almost 61.59 million units. In 2021, the worldwide motor vehicle production totaled about 57.05 million.

- Gyroscopes are essential in the automotive advanced driver assistance systems (ADAS). They are used in stability control systems to detect and correct deviations from the vehicle's intended path, improving safety and stability during driving. They enhance autonomous driving capabilities, strength, and safety. GPS-aided gyro systems have been developed to measure vehicle dynamics and driver assistance parameters in the automotive sector. These systems provide high-precision measurements to aid in ADAS testing and development. According to the National Safety Council, by 2026, approximately 71% of registered vehicles will be equipped with rear cameras, while 60% will have rear parking sensors. Such increasing adoption of ADAS would aid the growth of the market studied.

- Moreover, the increasing adoption of self-driving or autonomous vehicles is a primary growth factor for the ADAS market. For instance, according to Intel, global car sales are expected to reach over 101.4 million units in 2030, and autonomous vehicles will account for about 12% of car registrations by 2030.

Asia Pacific Expected to Witness Significant Growth

- Gyroscopes are expected to gain traction in China owing to the huge consumer electronics market, growing demand for 5G devices, and active efforts by the government to develop the economy to stay at the leading position in the world.

- China is actively focusing on the integration of 5G technology in consumer electronics. According to GSMA, Mainland China is the largest 5G technology market in the world, and at the end of 2022, it accounted for over 60% of global 5G connections. According to the Mobile Economy Report by GSMA, in 2024, 5G will surpass 4G to become the central mobile technology in China. With the advancement in network connectivity with the 5G development, the proliferation of GPS applications in smartphones and tablets increased, which created demand for gyroscopes.

- The automotive, semiconductor, and consumer electronics industries in Japan are some of the most prominent and largest industries in the world. The country is home to several leading automakers such as Toyota, Nissan, Honda, Suzuki, Mitsubishi, Daihatsu, Mazda, Subaru, Hino, Isuzu, Kawasaki, and Yamaha. The growing technological advancement in the automotive industry, the rise in sales of electric vehicles, and the integration of smart control systems in autonomous and connected vehicles create demand for gyroscopes for accurate positioning and navigation.

- In India, the rapid expansion of 5G is gaining momentum and will soon allow the country to reap significant technological and economic benefits. For instance, according to Ericsson's report, 5G mobile subscriptions in India will increase from 6.66 million in 2022 to 699.84 million in 2028. The introduction of 5G is expected to revolutionize industrial and economic performance in various sectors, as well as enhance access to employment opportunities. 5G mobile smartphones are gaining traction in the country which encourages market growth.

- The rest of the Asia Pacific segment comprises countries such as South Korea and Taiwan and Southeast Asian countries such as Thailand, Malaysia, Singapore, Indonesia, and others. The presence of leading smartphone manufacturer Samsung Electronics and growing investment in 5G development in South Korea drives the smartphone market, which positively impacts the gyroscope demand in the region.

Gyroscopes Market Overview

The gyroscope market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Murata Manufacturing Co. Ltd, STMicroelectronics NV, Honeywell International Inc., Analog Devices Inc., and Bosch Sensortec Gmbh (Robert Bosch GmbH). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- January 2024 - Murata Manufacturing has launched a "next-generation" combined gyroscope and accelerometer sensor, offering the company's "high-precision" sensing for machine control and more: the SCH16T-K01. The multi-device SCH16T family of six degrees of freedom (6DoF) sensors, the SCH16T-K01, is based on a new generation of Murata's 3D micro-electromechanical systems (MEMS) sensor technology.

- November 2023 - STMicroelectronics introduced an AI-enabled automotive inertial measurement unit for always-aware applications up to 125°C. STMicroelectronics' ASM330LHHXG1 inertial measurement unit (IMU) for automotive applications combines in-sensor AI with enhanced low-power operation and a 125°C operating temperature range for reliability in harsh environments.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Rise of Unmanned Vehicle in Both Defense and Civilian Applications

- 5.1.2 Technological Advancements Enabling More Effective Components at a Smaller and Lighter Size

- 5.2 Market Restraints

- 5.2.1 Substantial Increase in Complexity Challenging the Market Demand

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 MEMS Gyroscope

- 6.1.2 Fiber Optic Gyroscope (FOG)

- 6.1.3 Ring Laser Gyroscope (RLG)

- 6.1.4 Hemispherical Resonating Gyroscope (HRG)

- 6.1.5 Dynamically Tuned Gyroscopes (DTG)

- 6.1.6 Other Technologies

- 6.2 By End-user Vertical

- 6.2.1 Consumer Electronics

- 6.2.2 Automotive

- 6.2.3 Aerospace and Defense

- 6.2.4 Industrial

- 6.2.5 Marine

- 6.2.6 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 United Kingdom

- 6.3.2.3 France

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Murata Manufacturing Co. Ltd

- 7.1.2 STMicroelectronics NV

- 7.1.3 Honeywell International Inc.

- 7.1.4 Analog Devices Inc.

- 7.1.5 Robert Bosch GmbH

- 7.1.6 MEMSIC Inc.

- 7.1.7 EMCORE Corporation

- 7.1.8 InnaLabs

- 7.1.9 MicroStrain Inc.

- 7.1.10 Vectornav Technologies LLC

- 7.1.11 Dynalabs