|

市場調查報告書

商品編碼

1536826

端點安全:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Endpoint Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

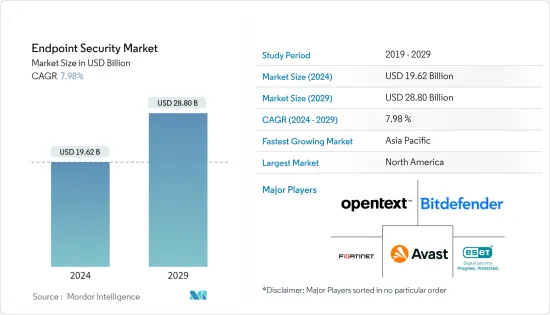

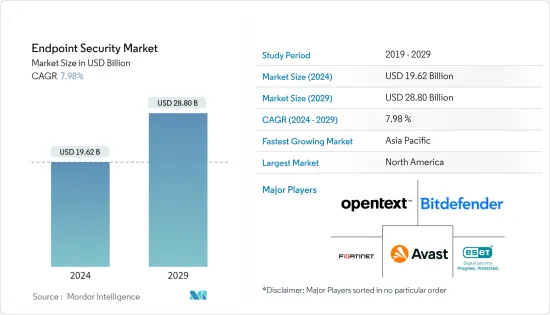

端點安全市場規模預計到 2024 年為 196.2 億美元,預計到 2029 年將達到 288 億美元,在預測期內(2024-2029 年)複合年成長率為 7.98%。

主要亮點

- 由於透過互聯連網型設備在商業生態系統中擴大採用資料集中方法和決策,因此隨著數位化的發展,全球網路攻擊的數量也在增加。全球資料外洩事件的增加正在推動企業採用更加分散和基於邊緣的安全技術,從而推動市場對端點安全解決方案的需求。

- 市場上端點設備的使用量正在強勁成長,這使得它們更容易受到端點攻擊和破壞的持續增加和複雜性的影響,並且對高安全性解決方案來應對端點攻擊的需求也在成比例地增加。 。此外,物聯網、人工智慧、機器學習和巨量資料等創新技術的出現等因素也支持了市場的成長。在日益複雜的法規環境中,快速變化的法律體制和 IT 風險的緩解預計將在預測期內支持市場成長。

- 2023 年 3 月,GSMA 報告稱,繼 2020 年以來的成長趨勢之後,全球企業的物聯網 (IoT) 連接正在顯著增加。到 2030 年,連線數量預計將達到 440 億,物聯網易受網路攻擊的脆弱性將增加企業資料外洩的風險。

- 由於缺乏對網路攻擊的認知,市場成長受到限制。然而,由於採取正確的措施幾乎所有網路攻擊都可以顯著減少,因此許多公司正計劃增加整體支出。今年預計將有超過 1 兆美元用於網路安全,並且這一數字預計會隨著時間的推移而改善。

- COVID-19 大流行增加了對端點安全解決方案的需求,主要是端點偵測和回應解決方案,以及在數位化。

- 國際付款銀行表示,在新冠肺炎 (COVID-19) 疫情期間,金融機構面臨的網路攻擊風險增加,而遠距工作條件又加劇了這種風險。大流行後,線上和資料主導的業務趨勢增加了對網路安全的需求,並刺激了世界各地的企業和政府機構採用端點安全。

端點安全市場趨勢

消費領域預計將顯著成長

- 提高消費者端點安全性的主要驅動力是網路連線的改善和網路普及率的上升。對於家庭用戶來說,網路和電子郵件是惡意軟體可能進入的區域。因此,端點安全解決方案針對消費者群體的這些攻擊點。此外,越來越多的消費者將智慧型手機、平板電腦和筆記型電腦等設備用於個人和業務目的,這使得端點安全解決方案成為保護資料的重要工具。

- 智慧建築和智慧家庭產品的出現增加了住宅中物聯網的數量,增加了全球端點安全攻擊的風險,增加了消費者領域對端點安全解決方案的需求並增加了市場佔有率。

- 愛立信表示,預計 2022 年至 2028 年全球物聯網連線數量將增加一倍。預計2022年廣域物聯網連線數將達到29億個,到2028年將達到60億個。

- 美國政府計劃於 2023 年 7 月實施措施,提高人們對智慧家庭設備的安全意識。政府推出了「美國網路信任標誌」計劃,對物聯網設備進行認證,以保護用戶免受網路攻擊。

- 智慧型手錶的普及增加了從健康和位置資訊到銀行帳戶詳細資訊等大量個人資料的儲存和傳輸,使智慧型手錶用戶容易受到網路攻擊。

- 因此,在智慧家庭的成長支持下,消費者領域中智慧型裝置、筆記型電腦和智慧型手機的使用不斷增加,以提高能源管理和生產力,從而增加了消費者領域的網路攻擊風險,預計將推動這一趨勢。

亞太地區成長強勁

- 由於智慧型手機普及率高、勒索軟體和惡意軟體攻擊增加、終端用戶行業數位化不斷提高、連接設備數量不斷增加以及網路攻擊的演變,亞太地區的端點安全市場正在經歷顯著成長。這些因素不僅推動了消費者,也推動了該地區企業對端點安全的需求。

- 隨著各行業組織的發展,該地區的端點也顯著增加。因此,組織擁有更廣泛的攻擊面,攻擊者擁有更多進入其系統的入口點,從而增加了對端點安全的需求。

- 亞太地區提供端點安全解決方案的端點安全解決方案供應商顯著擴張,顯示該地區存在成長機會。例如,2024 年 1 月,著名端點安全公司 ESET 宣佈在新加坡開設新的亞太 (APAC) 總部。透過此次擴張,該公司旨在為亞太地區的消費者和合作夥伴提供更有效的服務。

- 2023 年 11 月,網路安全解決方案供應商兼 Percept 端點偵測與回應雲端安全平台開發商 Sequretek 從 Omidyar Network India 獲得 800 萬美元資金,用於擴大其在印度的業務。

- 端點網路攻擊的增加、企業數位化趨勢的策略發展以提高業務效率、數位經濟的成長、不斷變化的網路環境以及跨行業端點設備的激增正在推動對點安全解決方案的需求不斷增加。

端點安全產業概述

由於跨國公司和中小企業的存在,全球端點安全市場高度分散。市場上的主要企業永續Open Text Corporation、Bitdefender LLC、Avast Software SRO、Fortinet Inc. 和 ESET Spol。

- 2023 年 12 月,商業軟體和服務評論提供者 G2 在 2024 年冬季報告中將 Sophos 評為端點保護、EDR、XDR、防火牆和 MDR 領域的關鍵參與者。

- 2023 年 11 月,SentinelOne 宣布與 Pax8 建立合作夥伴關係,Pax8 是一流技術解決方案的市場。此次合作將提供下一代網路安全解決方案,可端到端地保護公司最關鍵的基礎設施和資產。這種合作關係為兩家公司提供了更先進的端點、身分和雲端安全產品。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 智慧型設備的成長

- 資料外洩增加

- 市場挑戰

- 對網路攻擊缺乏認知

第6章 市場細分

- 按最終用戶

- 消費者

- 商業

- BFSI

- 政府機構

- 製造業

- 衛生保健

- 能源/電力

- 零售

- 其他業務

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Open Text Corporation

- Bitdefender LLC

- Avast Software SRO

- Fortinet Inc.

- Eset Spol. S RO

- Watchguard Technologies Inc.

- Kaspersky Lab Inc.

- Microsoft Corporation

- Sophos Ltd

- Cisco Systems Inc.

- Sentinelone Inc.

- Musarubra Us LLC(Trellix)

- Deep Instinct Ltd

- Palo Alto Networks Inc.

- Broadcom Inc.

- Trend Micro Inc.

- Crowdstrike Holdings Inc.

- Cybereason Inc.

- Blackberry Limited

第8章投資分析

第9章 市場機會及未來趨勢

The Endpoint Security Market size is estimated at USD 19.62 billion in 2024, and is expected to reach USD 28.80 billion by 2029, growing at a CAGR of 7.98% during the forecast period (2024-2029).

Key Highlights

- The increased adoption of data-intensive approaches and decisions in the business ecosystems through connected devices has raised the number of cyber-attacks globally in line with the growing digitalization. Enterprises are increasingly adopting more decentralized and edge-based security techniques due to increasing data breaches worldwide, driving the demand for endpoint security solutions in the market.

- The market has been registering significant growth in the usage of endpoint devices, which are becoming vulnerable to a continuously increasing and sophisticated nature of endpoint attacks and breaches and a proportionally increasing demand for high-security solutions to combat endpoint attacks. The growth of the market is also supported by factors such as the advent of innovative technologies like IoT, AI, ML, and big data, among others. IT risk mitigation in an increasingly complex regulatory environment with fast-changing legal frameworks is expected to support the market's growth during the forecast period.

- In March 2023, GSMA reported that Worldwide Internet of Things (IoT) connections in Enterprises are increasing significantly, following a growing trend from 2020. It is expected to reach 44 billion connection numbers by 2030, which would raise the risk of data breaches in enterprises due to the vulnerability of IoT to cyber attacks.

- The market's growth is restrained by the lack of awareness about cyberattacks. However, since almost all cyberattacks can be reduced significantly by taking appropriate actions, many companies are planning to raise their overall spending. With over a trillion dollars anticipated to be spent on cyber security this year, these figures are anticipated to improve in the future.

- The COVID-19 pandemic raised the demand for endpoint security solutions, majorly endpoint detection and response solutions and services to protect businesses and countries from malicious cyber attacks supported by increasing digitalization.

- The Bank for International Settlements stated that, during the COVID-19 pandemic, financial institutions faced an increasing risk of cyber attacks, which were accelerated by remote working conditions. The need for cyber security majors in enterprises and government entities of various countries worldwide increased after the pandemic due to the trend of online and data-driven businesses, fueling the implementation of endpoint security.

Endpoint Security Market Trends

Consumer Segment is Expected to Witness Significant Growth

- The primary driving force for increased consumer endpoint security is improved internet connectivity and growing internet penetration. For household users, the web and e-mail are potential areas for malware penetration. Thus, endpoint security solutions are aimed at these attack points for the consumer segment. Moreover, consumers are increasingly adopting devices such as smartphones, tablets, and laptops for personal and professional purposes, making endpoint security solutions an essential tool for securing data.

- The emergence of intelligent buildings and smart home products has raised the number of IoTs in residential premises, which is increasing the risk of endpoint security attacks worldwide, driving the demand for endpoint security solutions in the consumer segment and supporting the market's growth.

- According to Ericsson, the number of global IoT connections is expected to double from 2022 to 2028. The number of wide-area IoT connections in 2022 was 2.9 billion, and it is expected to be 6 billion by 2028.

- In July 2023, the US government planned to implement measures to enhance awareness of the safety of smart home devices. The administration introduced the "US Cyber Trust Mark" initiative, which seeks to authorize IoT devices to protect users from cyberattacks.

- The growth of smartwatches has raised the storage and transmission of large amounts of personal data, from health and location information to banking details, making smartwatch users vulnerable to cyberattacks.

- Therefore, the increasing usage of smart devices, laptops, and smartphones in the consumer segments, supported by the growth of smart homes for better energy management and productivity, has raised the risk of cyber attacks in the consumer segment, which is expected to fuel the growth of endpoint security solutions during the forecast period.

Asia-Pacific to Register Major Growth

- The endpoint security market in Asia-Pacific is experiencing significant growth owing to the region's high smartphone penetration, rising ransomware and malware attacks, growing digitization in end-user industries, rising number of connected devices, and evolving cyberattacks. These have necessitated the demand for endpoint security for consumers as well as businesses across the region.

- As organizations across verticals grow in the region, there is significant growth in endpoints. As a result, it expands the attack surface of an organization while offering attackers increasing entry points to a system, necessitating the demand for endpoint security.

- Asia-Pacific has been witnessing significant expansion of endpoint security solution providers to offer their endpoint security solutions, pointing toward growth opportunities in the region. For instance, in January 2024, ESET, a prominent player in endpoint security, announced the inauguration of its new Asia-Pacific (APAC) Headquarters in Singapore. With this expansion, the company aims to more effectively serve its consumers and partners in the APAC region.

- In November 2023, cybersecurity solutions provider and the developer of Percept Cloud Security Platform for Endpoint Detection & Response, Sequretek, secured USD 8 million from Omidyar Network India to expand its business in India, which shows the increasing demand for endpoint security solutions in the region.

- The growth of endpoint cyberattacks, strategic development of digitalization trends in enterprises for business efficiencies, the growing digital economy, the evolving cyber landscape, and the proliferation of endpoint devices across verticals have raised the demand for endpoint security solutions in the region.

Endpoint Security Industry Overview

The global endpoint security market is highly fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Open Text Corporation, Bitdefender LLC, Avast Software SRO, Fortinet Inc., and ESET Spol. S.R.O. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In December 2023, G2, a business software and service review provider, named Sophos a significant player for Endpoint Protection, EDR, XDR, Firewall, and MDR in their Winter 2024 Reports, which would fuel the company's brand positioning to support its market growth in the future.

- In November 2023, SentinelOne announced that the company is partnering with Pax8, which is a marketplace for best-in-class technology solutions. The partnership provides next-generation cybersecurity solutions that enable the protection of the company's most critical infrastructure and assets from end to end. This partnership will allow both companies to get more advanced endpoint, identity, and cloud security offerings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Smart Devices

- 5.1.2 Increasing Number of Data Breaches

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness about Cyberattacks

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Consumer

- 6.1.2 Business

- 6.1.2.1 BFSI

- 6.1.2.2 Government

- 6.1.2.3 Manufacturing

- 6.1.2.4 Healthcare

- 6.1.2.5 Energy and Power

- 6.1.2.6 Retail

- 6.1.2.7 Other Businesses

- 6.2 By Geography***

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Open Text Corporation

- 7.1.2 Bitdefender LLC

- 7.1.3 Avast Software SRO

- 7.1.4 Fortinet Inc.

- 7.1.5 Eset Spol. S R. O.

- 7.1.6 Watchguard Technologies Inc.

- 7.1.7 Kaspersky Lab Inc.

- 7.1.8 Microsoft Corporation

- 7.1.9 Sophos Ltd

- 7.1.10 Cisco Systems Inc.

- 7.1.11 Sentinelone Inc.

- 7.1.12 Musarubra Us LLC (Trellix)

- 7.1.13 Deep Instinct Ltd

- 7.1.14 Palo Alto Networks Inc.

- 7.1.15 Broadcom Inc.

- 7.1.16 Trend Micro Inc.

- 7.1.17 Crowdstrike Holdings Inc.

- 7.1.18 Cybereason Inc.

- 7.1.19 Blackberry Limited