|

市場調查報告書

商品編碼

1536833

汽車自動緊急煞車系統:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Automotive Autonomous Emergency Braking System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

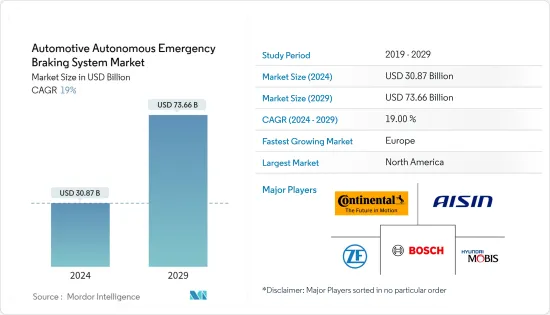

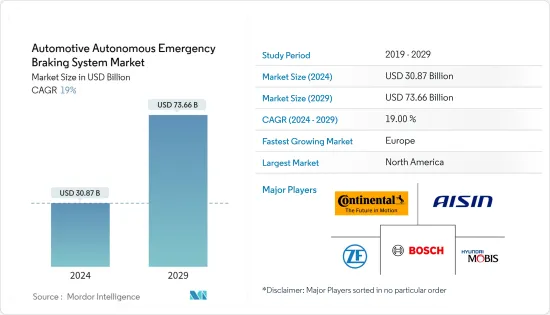

2024年全球汽車自動緊急煞車系統市場規模將達308.7億美元,2024-2029年預測期間複合年成長率為19%,預計到2029年將達到736.6億美元。

從中期來看,消費者和當局安全意識的提高將導致汽車自動緊急煞車系統的重大發展,從而提高安全性並減少道路事故。隨著技術的進一步進步,市場預計將看到更安全、更可靠的煞車系統。

汽車製造商正在將先進的煞車系統融入其車輛中,以提高煞車效率,預計產業參與者提供的各種產品將在預測期內進一步推動市場成長。

每年約有 125 萬人死於交通事故,是開發中國家死亡人數最多的國家。世界各地許多政府已開始推出嚴格的法規來遏制交通事故的增加。

各大OEM都在加大研發投入,開發先進技術。對車輛安全的日益關注、先進煞車系統的採用增加、先進人工智慧驅動系統的出現、政府車輛安全標準的提高,加上全球車輛產量的增加,自動緊急煞車系統市場預計將在預測期內得到推動。

許多目標商標產品製造商已在其大多數中檔和豪華汽車中安裝了 AEB 系統。因此,自動駕駛汽車的產量正在增加。預計此類車輛的產量在預測期內複合年成長率將超過 21%。

汽車自動緊急煞車系統的市場趨勢

乘用車佔主要市場佔有率

世界主要地區對汽車先進安全功能的需求不斷成長以及乘用車銷量的增加預計將在未來幾年推動市場的顯著成長。

自動緊急煞車是一種先進的安全技術系統,可在誘發因素未能反應的情況下自動減慢或完全停止車輛,以防止事故發生。與任何先進的駕駛輔助技術一樣,自動緊急煞車並非 100% 萬無一失。

為了滿足這種不斷成長的需求,多家汽車製造商正在推出配備這些技術的新車。特斯拉已經將 AEB 功能作為其所有車輛的標準配置,戴姆勒、寶馬和福特等其他汽車製造商也有望在其未來的所有車型中配備 AEB 功能。特斯拉汽車配備了實現完全自動駕駛所需的所有硬體。例如

*2023年11月,雷諾在法國推出了Dacia Duster SUV。這款新型 SUV 配備 4x4 地形控制變速箱,具有五種駕駛模式和自動緊急煞車系統。

*2023年11月,豐田汽車公司在北美市場推出中型跨界SUV「Crown Signia」。這款新款SUV配備了自動緊急煞車系統。

世界各地的車主對自動緊急煞車系統的興趣日益濃厚,正在推動全球市場的發展。交通事故數量的增加也推動了這種需求。世界各國政府鼓勵開發各種類型的安全功能,以避免道路事故。

可支配收入的增加以及客戶對配備安全功能的汽車的偏好的轉變也推動了市場的發展。乘用車領域預計將在預測期內引領市場。

根據 EURO NCAP 的一項研究,城市駕駛環境中 75% 的碰撞發生在時速低於 25 英里/小時的情況下,而 AEB 可以將追撞碰撞減少 38%。未來幾年,4 級和 5 級自動駕駛汽車提供的自動駕駛技術可能會成為全球的一個巨大市場。

由於上述全球發展,乘用車自動緊急煞車系統的需求預計在未來幾年將保持在較高水準。

北美預計將引領市場

在美國,51% 的OEM提供的車型系列提供自動煞車功能。特斯拉和沃爾沃 100% 的車輛都配備了 AEB 標準。

美國運輸部國家公路交通安全管理局 (NHTSA) 最近發布了擬議法規,要求客車和輕型卡車配備自動緊急煞車和行人用AEB 系統。

擬議的規則預計將大大減少與行人相關的事故和追撞事故。 NHTSA 估計,這項提議的規則如果最終確定,將每年挽救至少 360 人的生命並減少至少 24,000 人的傷害。

此外,這些 AEB 系統可以顯著減少追撞碰撞造成的財產損失。許多事故是完全可以避免的,而另一些事故的破壞性則較小。

該部門的其他道路安全措施包括制定弱勢道路使用者安全評估,以支持 2023 年國家規定的評估。評估的參數包括該州針對弱勢道路使用者的安全績效及其安全改進計劃。

隨著技術的進步,OEM必須繼續積極履行 AEB 的承諾,否則將面臨在安全進步方面落後於其他市場參與者並可能失去 Masu 品牌的風險。特別是,將 AEB 納入美國政府的安全評級可能會改變消費者的看法。

隨著上述新興市場的開拓,未來該市場可望高速成長。

汽車自動緊急煞車系統產業概況

汽車自動緊急煞車系統市場由羅伯特·博世有限公司、大陸集團、ZF Friendrichagen AG、現代摩比斯和日立汽車系統有限公司等主要企業主導。主要企業透過採取策略方法繼續在全球市場上獲得競爭優勢。煞車系統的持續進步和創新正在幫助製造商在競爭激烈的市場中獲得吸引力。例如

*2023 年 7 月,ZF Friedrichshafen AG 與 Volta Trucks 簽署了一項長期協議,為電動式Volta Zero 卡車進行零件整合。採埃孚提供先進的緊急煞車系統「OnGuardACTIVE」、包括煞車踏板盒的電子煞車系統、電子穩定控制系統「ESCsmart」以及電空手煞車「OnHand」。

*2023年6月,美國公路運輸安全管理局(NHTSA)宣布五年內要求重型卡車和巴士配備自動緊急煞車(AEB)。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 車輛安全功能的需求不斷成長

- 市場限制因素

- 與系統相關的高成本

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔(市場規模:美元)

- 按車型分類

- 客車

- 商用車

- 依技術

- LiDar

- 雷達

- 相機

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 歐洲其他地區

- 亞太地區

- 印度

- 中國

- 日本

- 韓國

- 其他亞太地區

- 其他領域

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 併購

- 公司簡介

- Robert Bosch GmbH

- WABCO Holdings Inc.

- Hyundai Mobis Co. Ltd

- Denso Corporation

- ZF Friedrichshafen AG

- Continental AG

- Autoliv Inc.

- Valeo SA

- Aisin Corporation

- Delphi Automotive PLC

第7章 市場機會及未來趨勢

The Automotive Autonomous Emergency Braking System Market size is estimated at USD 30.87 billion in 2024, and is expected to reach USD 73.66 billion by 2029, growing at a CAGR of 19% during the forecast period (2024-2029).

Over the medium term, increasing awareness about safety among consumers and authorities has led to significant developments in the automotive automated emergency brake system, resulting in improved security and reduced accidents on the road. With further technological advancements, the market is expected to see even safer and more reliable brake systems.

Factors such as individual vehicle manufacturers incorporating advanced braking systems in their vehicles to improve braking efficiency and industry players offering a wide range of products are further expected to drive market growth during the forecast period.

Annually, around 1.25 million people are killed in road accidents, with the highest numbers being registered in developing countries. Many governments worldwide have started imposing stringent regulations to curb the rising number of road accidents.

Major OEMs have started increasingly investing in R&D efforts to develop advanced technologies. Increasing concerns regarding vehicle safety, the growing adoption of advanced braking systems, the emergence of advanced AI-powered systems, and an increase in government vehicle safety norms, combined with a rise in vehicle production worldwide, are expected to propel the automotive autonomous emergency braking system market during the forecast period.

Many original equipment manufacturers are equipping AEB systems in most of their medium and luxury car ranges. This is resulting in the increasing production of autonomous vehicles. During the forecast period, the production of such vehicles is expected to record a CAGR of over 21%.

Automotive Autonomous Emergency Braking System Market Trends

Passenger Cars Hold Major Market Share

The rise in demand for advanced safety features in vehicles and the increase in passenger car sales across major regions worldwide are likely to result in major growth for the market over the coming years.

Automatic emergency braking is an advanced safety technology system that autonomously slows or completely stops a vehicle in order to prevent an accident if the driver fails to respond. As with other advanced driver assistance technologies, automatic emergency braking is not 100% foolproof.

To cater to this growing demand, several automakers are launching new vehicle models with these technologies. Tesla is already offering AEB features as standard across all its cars, while other automakers like Daimler, BMW, and Ford are expected to provide AEB in all their upcoming models. Tesla's cars are equipped with all the necessary hardware to achieve full autonomy. For instance,

* In November 2023, Renault introduced the Dacia Duster SUV in France. The new SUV offers a 4x4 Terrain Control transmission with five driving modes and an automatic emergency braking system.

* In November 2023, Toyota Motor Corporation introduced the Crown Signia mid-size crossover SUV in the North American market. The new SUV is equipped with an automatic emergency braking system.

The growing interest among vehicle owners worldwide in autonomous emergency braking systems is driving the global market. This demand has also been fueled by a rising number of road accidents. Governments worldwide are encouraging the development of several kinds of safety features in order to avoid road accidents.

Rising disposable incomes and customer preferences increasingly transitioning toward cars with fully loaded safety features are driving the market. The passenger cars segment is expected to lead the market during the forecast period.

As per research by EURO NCAP, 75% of all collisions in urban driving environments occur at speeds below 25 mph, with AEB having led to a 38% reduction in rear-end crashes. Autonomous vehicle technology offered with level 4 and 5 autonomous cars may become a large market worldwide over the coming years.

In line with the abovementioned developments globally, the demand for automatic emergency braking systems in passenger cars will be high over the coming years.

North America Expected to Lead the Market

Autonomous braking is provided with 51% of the model lines offered by OEMs across the United States. Tesla and Volvo offer AEB as a standard feature in 100% of their vehicles.

The US Department of Transportation's National Highway Traffic Safety Administration (NHTSA) recently issued a notice of proposed regulations that would require automatic emergency braking and pedestrian AEB systems for passenger vehicles and light trucks.

The proposed rule is expected to dramatically reduce pedestrian-related accidents and rear-end collisions. The NHTSA estimates that this proposed rule, if finalized, would save at least 360 lives per year and reduce the number of injuries by at least 24,000 annually.

In addition, these AEB systems would lead to a significant reduction in property damage caused by rear-end collisions. Many accidents could be avoided entirely, while others would be less destructive.

The Department's other road safety actions include the preparation of the Vulnerable Road User Safety Assessment to assist states with the required assessments for 2023. The safety performance of the state in terms of vulnerable road users and its plan to improve their safety are among the parameters assessed.

In line with growing technological advancements, OEMs must remain active in achieving their AEB commitments or face the possibility of brand erosion due to falling behind other market players in safety advances. In particular, the incorporation of AEB into the US government's safety ratings may alter consumer perception.

Based on the aforementioned developments, the market is expected to witness high growth in the upcoming period.

Automotive Autonomous Emergency Braking System Industry Overview

The automotive autonomous emergency braking system market is dominated by several key players, such as Robert Bosch GmbH, Continental AG, ZF Friendrichagen AG, Hyundai Mobis, and Hitachi Automotive System Ltd. Key players continue to gain a competitive edge in the global market by engaging in strategic approaches. Consistent advancements and innovations in braking systems have assisted manufacturers in gaining traction in the competitive market. For instance,

* In July 2023, ZF Friedrichshafen AG and Volta Trucks signed a long-term agreement for the integration of components and parts in the all-electric Volta Zero electric truck. ZF provided the OnGuardACTIVE advanced emergency braking system, the electronic braking system including the brake pedal box, the ESCsmart electronic stability control, and the OnHand electro-pneumatic handbrake.

* In June 2023, the US National Highway Transportation Safety Administration (NHTSA) announced that heavy trucks and buses must include automatic emergency braking equipment (AEB) within five years.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Demand for Safety Features in Vehicles

- 4.2 Market Restraints

- 4.2.1 High Costs Associated with the System

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Technology

- 5.2.1 LiDar

- 5.2.2 Radar

- 5.2.3 Camera

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Mergers and Acquisitions

- 6.3 Company Profiles*

- 6.3.1 Robert Bosch GmbH

- 6.3.2 WABCO Holdings Inc.

- 6.3.3 Hyundai Mobis Co. Ltd

- 6.3.4 Denso Corporation

- 6.3.5 ZF Friedrichshafen AG

- 6.3.6 Continental AG

- 6.3.7 Autoliv Inc.

- 6.3.8 Valeo SA

- 6.3.9 Aisin Corporation

- 6.3.10 Delphi Automotive PLC