|

市場調查報告書

商品編碼

1536838

食品加工機械:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Food Processing Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

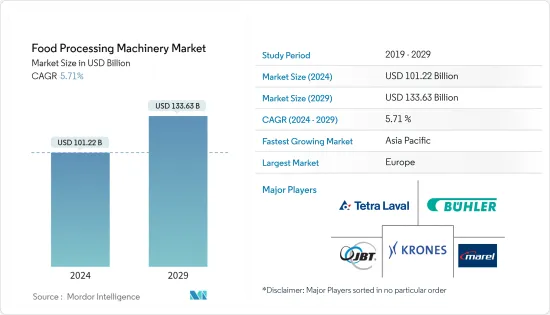

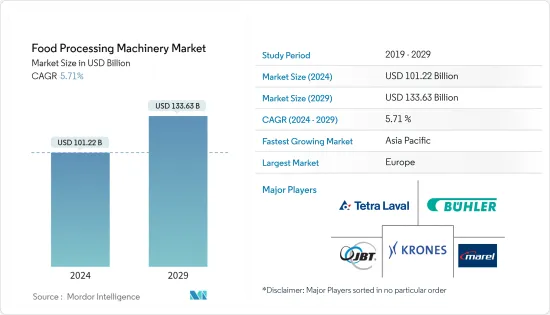

食品加工機械市場規模預計到2024年為1012.2億美元,預計到2029年將達到1336.3億美元,在預測期內(2024-2029年)複合年成長率為5.71%,預計將會成長。

消費者偏好轉向方便的即食食品,推動了對先進加工設備的需求。不斷變化的消費者生活方式的特徵是越來越依賴省時的解決方案和即食食品。這種模式轉移需要食品加工機械的發展,以滿足對簡便食品食品生產的效率、品種和品質日益成長的期望。製造商正在投資購買能夠有效加工各種簡便食品的設備。世界新興經濟體對加工食品的需求不斷成長以及設備回扣等政府激勵措施也是推動新興市場需求的因素之一。

例如,根據農業和加工食品出口發展局(APEDA)的數據,2021年印度加工食品和產品的出口額將為3909.9億美元,其中加工蔬菜為3909.9億美元,加工水果、果汁和堅果為7801.9億美元。

加工食品的需求和消費正在穩步成長,這是該行業的主要驅動力。儘管這是一種全球現象,但這種願望在低度開發國家尤其普遍。近年來,由於經濟的成功和對國際商品的市場開放程度的提高,印度和中國等國家的食品加工業發生了根本性的發展。肉類消費增加是其最重要的後果之一。肉類加工設備領域正在快速成長,特別是在開發中國家。

西歐、美國和加拿大等新興市場烘焙和飲料產業對加工和包裝設備的需求強勁。機能飲料的日益普及正在不斷增加對用於生產非酒精和乳製品飲料產品的設備的需求。

此外,食品設備製造商正在透過投資先進資料和分析、機器人技術和自動化等新功能來開發新的工作方式,以吸引更多的加工商。物聯網(IoT)技術和智慧感測器在食品加工機械中的整合是一個值得注意的趨勢。這可以實現即時監控、預測性維護和資料主導的決策,從而提高整體業務效率。主要市場參與者專注於提供高效機械,以滿足食品加工商的需求。

食品加工機械市場趨勢

提高食品和飲料加工的自動化程度

食品加工機械技術的進步正在提高效率、生產力和產品品質。自動化、機器人技術、物聯網整合、人工智慧和資料分析擴大被用來簡化營運、降低人事費用並增強食品安全和可追溯性。隨著需求和成本的不斷上升,自動化有助於減少生產時間,同時提高產量。食品加工商越來越認知到資料主導的洞察力在充分利用原料、確保可追溯性、支持持續改進以及提高食品品質和安全方面的價值。機器人屠宰機是最常見的自動化設備之一,有助於加快這一過程。這種自動化設備還透過減少處理潛在危險工具和設備的人員數量來提高設施安全性。

例如,2023 年 11 月,伯明翰大學企業公司宣布了 EvoPhase。它結合了進化人工智慧演算法和工業攪拌機等系統中的顆粒模擬,以針對混合葉片和混合容器的形狀或尺寸進行最佳化設計。 EvoPhase 提供各種製程設備,包括破碎機、乾燥機、烘烤機、塗佈機、流體化床和攪拌罐,預計將為業界帶來顯著的成本和能源節約。

市場上的肉類、烘焙和乳製品行業是採用自動化加工和包裝的重點產業,從而提高了市場的生產效率。隨著大量公司在市場上營運,自動化技術的進步預計將在未來幾年推動市場朝著正面的方向發展。

歐洲佔最大市場佔有率

歐洲是重要的區域市場之一,由於對高品質系統的需求不斷增加,預計未來幾年將出現強勁成長。法國、德國、荷蘭、英國、西班牙和丹麥是主要的歐洲市場。歐洲公司也是食品和飲料的主要出口商。法國是食品主要出口國,包括乳製品、肉類、葡萄酒和加工食品。為了滿足國際市場上對法國食品不斷成長的需求,食品加工商現在有必要擁有高效可靠的設備來擴大生產規模,以滿足出口要求,同時保持產品品質和一致性。例如,根據歐盟統計局的數據,2022 年法國起司產量將達到 665,400 噸,而 2020 年為 657,060 噸。同樣,根據聯合國商品貿易統計資料庫的數據,法國綿羊或山羊肉的新鮮、冷藏和冷凍形式出口將增加,2022年將達到3.4061億歐元,2021年將達到2.9729億歐元。

食品業越來越關注永續性和環境責任。為了實現永續性目標並減少環境足跡,食品加工商正在投資購買能夠降低能源消耗、最大限度減少廢棄物並最佳化資源利用的設備。需要具有節能技術、水回收系統和減少廢棄物措施等功能的設備來支援永續的食品生產實踐。因此,公司開始製造採用節能技術的食品加工機械。例如,OctoFrost Process Solutions 提供節能食品加工機械,特別是在冷凍和熱處理領域。該公司提供創新的解決方案,旨在最佳化能源使用,同時保持食品品質和完整性。

食品加工機械產業概況

全球食品加工機械市場擁有不同國家的主要區域和國家參與者,國內公司比市場佔有率較高的跨國公司更受青睞。全球食品加工機械市場的一些主要參與者包括 JBT Corporation、Buhler AG、Krones AG、Marel 和 Tetra Laval。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 對加工食品的需求增加

- 支持市場成長的技術進步

- 市場限制因素

- 能源和人事費用上升導致生產成本上升

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 類型

- 加工機械/設備

- 包裝器材/設備

- 公共事業

- 目的

- 乳製品和乳製品替代品

- 肉類/魚貝類和肉類/魚貝類替代品

- 麵包店和糖果零食

- 飲料

- 水果、蔬菜和堅果

- 其他用途

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 其他北美地區

- 歐洲

- 英國

- 德國

- 法國

- 俄羅斯

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 印度

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 南非

- 沙烏地阿拉伯

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 最採用的策略

- 市場佔有率分析

- 公司簡介

- Anko Food Machine

- Buhler AG

- GEA

- Krones AG

- Tetra Laval

- Atlas Pacific Engineering Co. Inc.

- Bean(John)Technologies Corp.

- Hosokawa Micron Corp.

- Nichimo Co. Ltd

- Satake Corp.

- Spx Corp.

- Tomra Systems ASA

第7章 市場機會及未來趨勢

The Food Processing Machinery Market size is estimated at USD 101.22 billion in 2024, and is expected to reach USD 133.63 billion by 2029, growing at a CAGR of 5.71% during the forecast period (2024-2029).

The shift in consumer preferences toward convenient and ready-to-eat food products is driving the need for sophisticated processing equipment. Evolving consumer lifestyles are characterized by an increasing reliance on time-saving solutions and ready-to-consume food products. This paradigm shift necessitates an evolution in food processing equipment to meet the growing expectations for efficiency, variety, and quality in the production of convenience foods. Manufacturers are investing in equipment that allows for the efficient processing of a wide variety of convenience food products. The growing demand for processed foods from developing nations worldwide and government incentives, such as reimbursement on equipment, are also among the factors driving demand from the growing markets.

For instance, according to the Agricultural & Processed Food Products Export Development Authority (APEDA), the export value of processed food and products from India in 2021 amounted to USD 390.99 billion for processed vegetables and USD 780.19 for processed fruits, juices, and nuts.

Processed food demand and consumption have been steadily increasing, which is a major driver for the industry. Despite being a global phenomenon, this desire is particularly prevalent in underdeveloped countries. The food processing industry in nations like India and China has fundamentally evolved as a result of recent economic success and increased market openness to international commodities. An increase in meat eating is one of the most significant consequences of this. One of the fastest-expanding segments, especially in developing nations, is the meat processing equipment segment.

The developed markets of Western Europe, the United States, and Canada are witnessing a strong demand for processing and packaging equipment from the bakery and beverage industries. The increasing popularity of functional beverages has escalated the demand for equipment that is utilized in the production of non-alcoholic drinks and dairy-based beverage products.

Moreover,food equipment manufacturers are developing new ways of working by investing in new capabilities, like advanced data and analytics, robotics, and automation, to attract more processors. The integration of Internet of Things (IoT) technologies and smart sensors in food processing equipment is a notable trend. This enables real-time monitoring, predictive maintenance, and data-driven decision-making, enhancing overall operational efficiency. The key market players are focused on providing machinery with high efficiency to cater to the demand from food processors.

Food Processing Machinery Market Trends

Increasing Automation in Food and Beverage Processing

Advances in food processing equipment technology have led to improved efficiency, productivity, and product quality. Automation, robotics, IoT integration, artificial intelligence, and data analytics are being increasingly adopted to streamline operations, reduce labor costs, and enhance food safety and traceability. Automation is helping reduce production time while increasing output as demand and costs continue to rise. Food processors are increasingly aware of the value of data-driven insights in maximizing the utilization of raw materials, ensuring traceability and support for constant improvement, and improving food quality and safety. The robotic butchery machine, which helps speed up the process, is among the most common types of automation gear. This automated equipment also makes facilities safer since it reduces the amount of personnel handling potentially harmful tools and apparatus.

For instance, in November 2023, the University of Birmingham Enterprise launched EvoPhase. It uses evolutionary AI algorithms, coupled with simulations of particulates in systems such as industrial mixers, to evolve an optimized design for the mixing blade and the shape or size of the blending vessel. EvoPhase offers a diverse range of process equipment, including mills, dryers, roasters, coaters, fluidized beds, and stirred tanks, and is expected to result in huge cost and energy savings for the industry.

The meat, baking, and dairy segments of the market are among the major segments adopting automation in terms of processing and packaging, resulting in increased production efficiency in the market. With a significant number of players operating in the market, technical advancements in terms of automation are expected to drive the market in a positive direction over the coming years.

Europe Holds the Largest Market Share

Europe, one of the prominent regional markets, is likely to witness significant growth over the coming years owing to the growing demand for high-quality systems. France, Germany, the Netherlands, the United Kingdom, Spain, and Denmark are the important markets in Europe. Firms belonging to Europe are also major exporters of food and beverage products. France is a major exporter of food products, including dairy, meats, wines, and processed foods. To meet the growing demand for French food products in international markets, food processors require efficient and reliable equipment that can scale production to meet export requirements while maintaining product quality and consistency. For example, according to Eurostat, the volume of cheese from France reached 665.4 thousand tons in 2022, while it was 657.06 thousand tons in 2020. Similarly, according to UN Comtrade, the export of meat from sheep or goats, in fresh, chilled, and frozen forms, in France increased and reached EUR 340.61 million in 2022, registering an increase from EUR 297.29 million in 2021.

There is a growing emphasis on sustainability and environmental responsibility in the food industry. Food processors are investing in equipment that reduces energy consumption, minimizes waste, and optimizes the use of resources to achieve sustainability goals and reduce their environmental footprint. Equipment with features such as energy-efficient technologies, water recycling systems, and waste reduction measures are in demand to support sustainable food production practices. Thus, companies have started to manufacture food processing machinery with energy-efficient technology. For example, OctoFrost Processing Solutions provides energy-efficient food processing machinery, particularly in the fields of freezing and thermal processing. The company offers innovative solutions designed to optimize energy usage while maintaining the quality and integrity of food products.

Food Processing Machinery Industry Overview

The global food processing machinery market includes the presence of large regional and domestic players across different countries, with domestic companies having gained preference over multinationals with a higher market share. Some of the major players in the global food processing machinery market include JBT Corporation, Buhler AG, Krones AG, Marel, and Tetra Laval.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing Demand for Processed Food Products

- 4.1.2 Technological Advancements Supporting Market Growth

- 4.2 Market Restraints

- 4.2.1 Increasing Cost of Production Due to Rise in Energy and Labor Cost

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Processing Machinery and Equipment

- 5.1.2 Packaging Machinery and Equipment

- 5.1.3 Utilities

- 5.2 Application

- 5.2.1 Dairy and Dairy Alternatives

- 5.2.2 Meat/Seafood and Meat/Seafood Alternatives

- 5.2.3 Bakery and Confectionery

- 5.2.4 Beverages

- 5.2.5 Fruits, Vegetables, and Nuts

- 5.2.6 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Russia

- 5.3.2.5 Italy

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 India

- 5.3.3.2 China

- 5.3.3.3 Japan

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Anko Food Machine

- 6.3.2 Buhler AG

- 6.3.3 GEA

- 6.3.4 Krones AG

- 6.3.5 Tetra Laval

- 6.3.6 Atlas Pacific Engineering Co. Inc.

- 6.3.7 Bean (John) Technologies Corp.

- 6.3.8 Hosokawa Micron Corp.

- 6.3.9 Nichimo Co. Ltd

- 6.3.10 Satake Corp.

- 6.3.11 Spx Corp.

- 6.3.12 Tomra Systems ASA