|

市場調查報告書

商品編碼

1686546

超快雷射:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)Ultrafast Lasers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

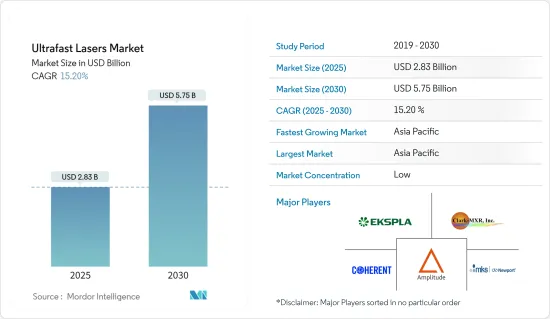

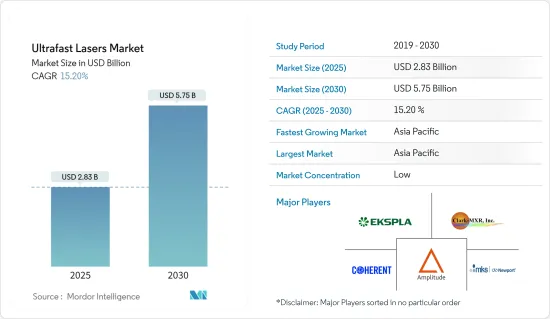

超快雷射器市場規模預計在 2025 年為 28.3 億美元,預計到 2030 年將達到 57.5 億美元,預測期內(2025-2030 年)的複合年成長率為 15.2%。

超快雷射是一種發射一系列脈衝的雷射,每個脈衝持續時間不到 1 奈秒。它們以超短脈衝持續時間和高峰值強度而聞名,可以實現精確且可控的材料處理。它用於切割、鑽孔、燒蝕和構造各種各樣的材料。

超快雷射在材料加工中具有高精度,可實現極其精確和複雜的材料加工和改質。這些雷射器能夠處理幾乎任何類型的材料,使其成為適用於廣泛應用的多功能工具。

超快雷射的市場成長主要受到材料加工和半導體行業不斷成長的需求的推動,並且在汽車、家用電器、通訊技術和醫療保健等終端用戶領域得到廣泛應用。超快雷射和微加工實現的高尺寸精度是推動超快雷射需求的關鍵因素。這些雷射用於半導體工業的光掩模修復。它也可用於切片和切塊。

對更小、更複雜的組件的需求要求更高水平的尺寸精度,而超快雷射器以其超短脈衝持續時間和最小的熱效應錐來滿足這一需求。此功能可提高產品品質並減少製造時間和成本。隨著技術的進步,超快雷射市場預計將進一步擴大,以滿足對卓越尺寸精度日益成長的需求。

由於製造超快雷射需要先進的技術和極高的精度,因此其生產過程十分複雜。為了了解製造的複雜性,我們需要深入研究製造這些高性能設備的複雜過程。

新冠肺炎疫情對全球經濟造成了擾亂。此外,電子和半導體市場的生產設施也停止了生產。製造能力下降、勞動力和原料短缺、旅行禁令和工廠關閉導致市場成長放緩。隨著自動化的廣泛應用和精密製造需求的不斷成長,疫情過後,雷射的應用和需求正在更高。

超快雷射市場趨勢

消費性電子產品成長強勁

- 大多數家用電子電器應用需要高度可重複的脈衝和聚焦雷射光束,以實現最高的生產力和精度。光纖雷射器出色的光束品質、靈活性和穩定性使其成為微加工應用的理想選擇。近年來,IPG 已大幅擴展產品系列,從傳統的紅外線擴展到綠光和紫外線,並開發了皮秒和高飛秒脈衝功能。

- 此外,家用電子電器產業對 IPG 光纖雷射和整合自動化系統青睞有加,因為它們將可靠性、靈活性、效率、高功率、光束品質、緊湊性和成本效益完美地融為一體。

- 研究領域的主要推動因素是家用電子電器領域不斷成長的需求以及快速的技術發展,這迫使OEM持續向市場推出獨特的產品。消費性電子產品供應商主要依賴電子產品製造商為市場帶來好處,例如降低成本、縮短時間、提高品質、縮短時間和靈活性。

- 據消費科技協會稱,美國消費科技零售收益預計將在 2022 年至 2024美國間小幅成長,到 2024 年底將達到 5,000 億美元以上。大部分收益將來自硬體,到 2024 年將達到約 3,450 億美元。

- 如今,市場上大多數的電子設備都在小型化,對設備尺寸公差的要求越來越嚴格,以適應越來越小的尺寸,從而推動了超快雷射的成熟。電子製造製程需要提高對較小元件特徵的偵測精度。

- 超快雷射器對於某些智慧型手機零件(例如微處理器和半導體)的生產至關重要。智慧型手機的日益普及將極大地促進研究市場的成長。

亞太地區可望佔據主要市場佔有率

- 亞太地區是世界最大製造業經濟體的所在地,包括中國、日本、韓國和台灣。汽車、電子、航太和醫療設備等領域製造業的持續擴張,對工業雷射的需求龐大,以支援各種加工、切割、焊接和標記應用。

- 亞太地區在這個市場上有一些關鍵參與者,例如大族雷射科技產業集團。該地區以其在汽車和醫療行業的能力而聞名,預計將推動市場成長。此外,預計亞太地區將呈現最高的市場成長率,各類參與者將進行投資以推動成長和發展。

- 此外,該地區的汽車工業正朝著電氣化和小型化的方向發展,同時要求高剛性、設計靈活性和可製造性。藍色雷射具有較高的光吸收效率,在汽車引擎和電池的銅加工方面需求強勁。生產性加工需要高功率和高光束品質的雷射光束源。

- 由於台灣半導體製造公司等公司的存在,該地區是最大的半導體和電子產品製造商。台灣生產了全球60%以上的半導體,以及90%以上的先進半導體。半導體大部分都是由台積電生產的。

超快雷射市場概覽

超快雷射市場較為分散,且有多家參與者,競爭十分激烈。市場似乎相當集中。市場供應商紛紛參與新產品的發布,並投入大量研發資金和夥伴關係,這大大促進了市場的成長。此外,各公司正在將收購作為一種成長策略。市場由 Amplitude Laser Group Coherent Inc.、Ekspla(EKSMA 集團)、MKS Instruments Inc.(Newport Corporation)和 Clark-MXR Inc. 等雷射/光子巨頭組成。

2024 年 1 月 - IPG Photonics Corporation 在舊金山的光電 West 上展示了全新創新的光纖雷射解決方案。 2,000 平方英尺的展位展示了各種雷射源、整合系統和特定產業解決方案以及大量應用樣品。

2023 年 6 月-相干公司推出其新一代超低成本奈秒脈衝紫外線雷射器,用於工業電子、消費品、設備、包裝等領域的高對比度標記應用。新型陣列雷射的輸出功率為 5 W 和 10 W,脈衝重複率為 50 kHz 至 300 kHz。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第 1 章 簡介

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 新冠肺炎疫情及其他宏觀經濟因素對市場的影響

第5章 市場動態

- 市場促進因素

- 需要提高尺寸精度

- 政府要求推動超快雷射的採用

- 市場限制

- 製造業的複雜性挑戰市場成長

第6章 市場細分

- 依雷射類型

- 固體雷射

- 光纖雷射

- 脈衝時間

- 皮秒

- 飛秒

- 按應用

- 材料加工與微加工

- 醫學和生物成像

- 研究

- 按最終用戶

- 消費性電子產品

- 醫療

- 車

- 航太和國防

- 研究

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

第7章 競爭格局

- Vendor Positioning Analysis

- 公司簡介

- Amplitude Laser Group

- Coherent Inc.

- Ekspla(EKSMA group)

- MKS Instruments Inc.(Newport Corporation)

- Clark-MXR Inc.

- TRUMPF Group

- Novanta(Laser Quantum Ltd)

- Lumentum Holdings

- Aisin Seiki(IMRA America Inc.)

- IPG Photonics

- NKT Photonics

- Light Conversion Ltd

第8章投資分析

第9章:市場的未來

The Ultrafast Lasers Market size is estimated at USD 2.83 billion in 2025, and is expected to reach USD 5.75 billion by 2030, at a CAGR of 15.2% during the forecast period (2025-2030).

Ultrafast lasers are a variety of lasers that emits a series or train of pulses, each lasting less than a nanosecond. They are known for their ultra-short pulse duration and high peak intensity, allowing precise and controlled material processing. They are used for cutting, drilling, ablating, and structuring various materials.

Ultrafast lasers offer high precision in material processing, allowing for extremely accurate and intricate fabrication and modification of materials. These lasers can process almost every type of material, making them versatile tools for various applications.

The market growth for ultrafast lasers is primarily driven by the increasing demand in the materials processing and semiconductor industries, finding applications in several end users like automotive, consumer electronics, communications technology, and healthcare. The high dimensional accuracy enabled by ultrafast lasers and micromachining are significant factors boosting the demand for ultrafast lasers. These lasers are used for photomask repairs in the semiconductor industry. They are also employed for slicing and dicing activities

The demand for smaller, more complex components necessitates a higher level of dimensional accuracy, which ultrafast lasers deliver with their ultrashort pulse durations and minimal heat-affected cones. This capability improves product quality and reduces production time and costs. As technology advances, the market for ultrafast lasers is expected to expand further to meet the growing need for superior dimensional accuracy.

Manufacturing ultrafast lasers involves many complexities stemming from the advanced technology and precision required to produce these devices. Understanding the manufacturing complexities requires delving into the intricate process of creating these high-performance devices.

The COVID-19 pandemic caused disruptions in the global economy. It also halted the production facilities of the electronics and semiconductors markets. The slowdown in manufacturing capacity, unavailability of workers and raw materials, travel bans, and facility closures led to a slowdown in the market's growth. With the proliferation of automation and a growth in the demand for precision manufacturing, lasers are witnessing higher application and demand after the pandemic effect.

Ultrafast Lasers Market Trends

Consumer Electronics to Witness Significant Growth

- Most consumer electronics applications require a focused laser beam delivered in highly repeatable pulses at a rapid repetition rate for maximum productivity and precision. Fiber lasers' outstanding beam quality, flexibility, and stability are ideal for micromachining applications. Recently, IPG significantly expanded its product portfolio from the traditional infrared into the green and ultraviolet wavelengths and developed picosecond and high femtosecond pulse capabilities, which greatly broaden the scope of consumer electronics applications able to benefit from fiber laser technology.

- In addition, the consumer electronics industry covets IPG fiber lasers and integrated automated systems for their unique combination of reliability, flexibility, efficiency, high power, beam quality, compactness, and cost-effectiveness.

- The studied sector is driven primarily by the increasese in demand from the consumer electronics sector and fast-paced technological developments, which force OEMs to introduce unique products continuously in the market. Consumer electronics providers primarily rely on electronic manufacturers who offer benefits like cost savings, reduced time-to-volume, quality, decreased time-to-market, and flexibility to provide their products in the market.

- According to the Consumer Technology Association, in the United States, consumer technology retail revenue is forecast to increase slightly between 2022 and 2024, reaching over USD 500 billion at the end of the period. Hardware accounts for most of the revenue, bringing in around USD 345 billion in 2024.

- Most of the electronic appliances in the market nowadays are downsized and demand tighter dimensional tolerances so that the elements can fit inside ever-smaller form factors, driving the maturation of the ultrafast laser. The electronic manufacturing process needs to inspect the tinier component features and improve accuracy.

- Ultrafast lasers are crucial in manufacturing specific smartphone components, such as microprocessors and semiconductors. The increasing adoption of smartphones is going to to aid the studied market's growth significantly.

Asia-Pacific is Expected to Hold Major Market Share

- The Asia-Pacific is home to some of the world's largest manufacturing economies, including China, Japan, South Korea, and Taiwan. The ongoing expansion of manufacturing industries in sectors such as automotive, electronics, aerospace, and medical devices creates a significant demand for industrial lasers to support various machining, cutting, welding, and marking applications.

- The Asia-Pacific houses some important players in the market, such as Han's Laser Technology Industry Group, among others. The region is known for its capabilities in the automotive and medical industries, which are expected to drive its market growth. Also, various players have invested in driving their growth and development, as the Asia-Pacific is expected to witness the highest growth rate in the market.

- Moreover, the automotive industry in the region is moving toward electrification and miniaturization while requiring high rigidity, design flexibility, and productivity. Blue lasers with high optical absorption efficiency are in high demand in copper fabrication for automotive motors and batteries. The highly productive processing requires a laser beam source with high output power and beam quality.

- The region is the biggest manufacturer of semiconductor and electronics products owing to the presence of companies like Taiwan Semiconductor Manufacturing Company. Taiwan produces more than 60% of the global semiconductors and over 90% of the advanced ones. Most of the semiconductors are manufactured by TSMC.

Ultrafast Lasers Market Overview

The Ultrafast laser market is fragmented and highly competitive due to multiple players. The market appears to be moderately concentrated. Vendors in the market are taking part in new product rollouts with crucial R&D investments and partnerships that significantly boost market growth. Additionally, companies have acquisitions as their growth strategy. The market consists of laser/photonic giants, like Amplitude Laser Group Coherent Inc., Ekspla (EKSMA group), MKS Instruments Inc. (Newport Corporation), and Clark-MXR Inc.

January 2024 -The IPG Photonics Corporation highlighted new and innovative fiber laser solutions at Photonics West January 30 - February 01, 2024, in San Francisco. The 2,000-square-foot booth displays include a wide range of laser sources, integrated systems, and industry-specific solutions, along with numerous showcases of application samples.

June 2023 - Coherent Corporation introduced an ultra-low-cost, next-generation nanosecond pulsed UV laser for high-contrast marking applications in industrial electronics, consumer goods, equipment, and packaging. The new array lasers are available with 5W and 10W output power and operate at pulse repetition rates between 50kHz and 300kHz.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Need for Enhanced Dimensional Accuracy

- 5.1.2 Government Mandates Promoting Adoption of Ultrafast Lasers

- 5.2 Market Restraints

- 5.2.1 Manufacturing Complexities Challenge the Market Growth

6 MARKET SEGMENTATION

- 6.1 By Laser Type

- 6.1.1 Solid State Laser

- 6.1.2 Fiber Laser

- 6.2 By Pulse Duration

- 6.2.1 Picosecond

- 6.2.2 Femtosecond

- 6.3 By Application

- 6.3.1 Material Processing And Micromachining

- 6.3.2 Medical And Bioimaging

- 6.3.3 Research

- 6.4 By End User

- 6.4.1 Consumer Electronics

- 6.4.2 Medical

- 6.4.3 Automotive

- 6.4.4 Aerospace and Defense

- 6.4.5 Research

- 6.4.6 Other End Users

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia-Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles

- 7.2.1 Amplitude Laser Group

- 7.2.2 Coherent Inc.

- 7.2.3 Ekspla (EKSMA group)

- 7.2.4 MKS Instruments Inc. (Newport Corporation)

- 7.2.5 Clark-MXR Inc.

- 7.2.6 TRUMPF Group

- 7.2.7 Novanta (Laser Quantum Ltd)

- 7.2.8 Lumentum Holdings

- 7.2.9 Aisin Seiki (IMRA America Inc.)

- 7.2.10 IPG Photonics

- 7.2.11 NKT Photonics

- 7.2.12 Light Conversion Ltd