|

市場調查報告書

商品編碼

1536859

多因素認證 -市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Multi-factor Authentication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

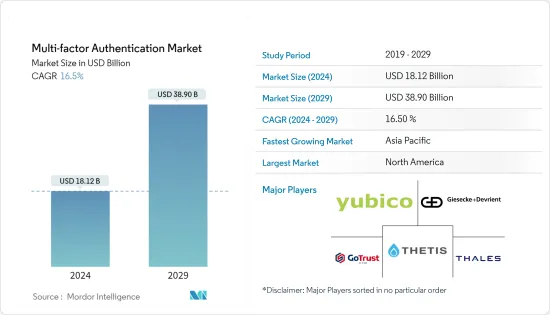

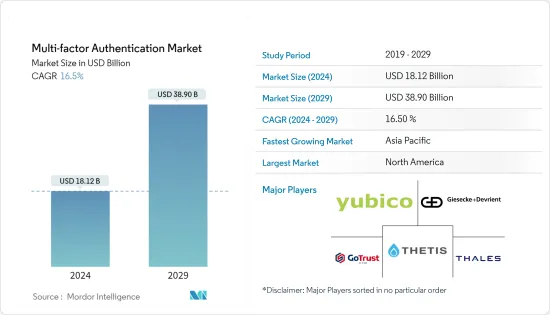

多因素身份驗證市場規模預計到 2024 年為 181.2 億美元,預計到 2029 年將達到 389 億美元,在預測期內(2024-2029 年)複合年成長率為 16.5%。

網路釣魚攻擊和資料外洩等網路威脅的頻率和複雜性不斷增加,迫使組織實施多因素身份驗證等強大的安全措施,以保護敏感資訊並防止未授權存取。嚴格的資料保護法律和合課責標準,包括《通用資料保護條例》、《健康保險互通性和責任法案》以及 PCI 安全標準,正在推動 MFA 的採用。

*監管合規對於推動多因素身份驗證解決方案的需求至關重要。世界各地的政府和行業監管機構制定了嚴格的安全標準來保護敏感資料,包括通用資料保護條例、HIPAA 和 PCI DSS。為了滿足這些要求,組織越來越依賴 MFA 作為增強身分驗證安全性的可靠手段。不遵守這些法規可能會導致重大製裁和訴訟,這使得 MFA 成為企業關鍵的風險緩解要素。

* 由於擴大使用網際網路實現業務數位化,BFSI、醫療保健、IT 和電信等各個最終用戶行業的網路攻擊案例不斷增加。

*工業自動化的出現以及使用雲端基礎的軟體來實現企業業務功能自動化正在增加工業物聯網的數量以及每個業務環境中電腦的使用。這可能會增加網路攻擊和不道德存取公司業務營運和資料的風險,而 MFA 解決方案適用於在使用公司設備之前提供安全存取和身份驗證的應用程式,預計將推動需求並推動市場成長。 。

*MFA 的最大挑戰之一是管理員和最終用戶的管理複雜性增加。在大多數情況下,MFA 並不方便用戶使用,因為它很複雜並且需要最終用戶執行額外的步驟。隨著組織進行數位轉型,實施和使用多因素身份驗證帶來了複雜性的挑戰。以過時的硬體、通訊協定和協定為特徵的傳統基礎設施限制了實施現代網路安全實踐的能力。將這些過時的系統與現代技術相結合通常會造成一個更難以實施和維護強大的網路安全框架的環境。

*由於全球地緣政治地位加強的趨勢,世界許多國家的國防支出不斷增加,隨著數位化。此外,破壞國家安全的網路攻擊的增加表明在私人和政府組織中實施網路安全解決方案的重要性,這可能會加速未來對 MFA 的需求。

多因素身份驗證市場趨勢

醫療保健行業作為最終用戶正在快速成長

- 醫療保健 MFA 市場正在迅速發展,醫療保健組織擴大尋求保護病患資料、確保合規性並防範快速變化的威脅。近年來,人工智慧、機器學習和物聯網等尖端技術在醫療保健領域的使用不斷擴大,網路犯罪分子的攻擊面也隨之擴大。為此,全球醫療保健組織正在增加對網路安全的投資,以防止和減輕網路攻擊,從而推動市場成長。

- 網路犯罪分子對醫療保健產業非常感興趣,因為它從電子健康記錄(HER)、電子病歷 (EMR)、穿戴式裝置、各種感測器、物聯網平台等產生有價值的資料。市場上的供應商都致力於合作活動,以促進醫療保健產業的網路安全,從而顯著擴大市場成長。

- 根據世界經濟論壇的數據,醫療保健產業在 2023 年連續 13 年報告了最昂貴的資料外洩事件,平均成本為1,093 萬美元,幾乎是排名第二的金融業的兩倍,平均成本為1,093 萬美元。必須保護這些數位資產,以維護病患資訊的完整性、機密性和可用性。

- 據分析,亞太地區佔了很大的市場佔有率。例如,2024年4月,聯邦衛生署推出了iOS應用程式“myCGHS”,使中央政府衛生系統的受益人更容易獲得醫療服務。該應用程式由 NIC Himachal Pradesh 和 NIC Health Team 開發,允許存取預約和健康記錄、測試報告、用藥史和報銷申請狀態。雙因素認證和 MPIN 是我們安全措施的一部分。該應用程式的推出是數位醫療保健領域的一個里程碑,並增強了 CGHS 的服務。在 App Store 和 Google Play 上免費提供。衛生部長強調了政府致力於利用科技讓醫療保健離家更近。

- 總體而言,醫療保健領域先進技術的不斷採用以及連網型設備的增加將要求這些最終用戶產業加強其網路安全。

北美佔據主要市場佔有率

- 由於數位科技比其他國家更廣泛地滲透到最終用戶產業,美國已成為網路犯罪的中心。美國企業面臨更多網路攻擊,造成重大損失。由於組織和個人面臨的網路威脅和攻擊數量不斷增加,網路安全已成為美國日益重要的領域。

- 根據身分盜竊資源中心(ITRC)2024年2月發布的報告,2023年美國記錄了3,205起資料外洩事件,比2022年增加了78%,比2021年增加了72%。這些備受矚目的資料外洩和網路安全事件提高了企業和消費者對實施強力的安全措施來保護個人和敏感資訊的重要性的認知。因此,企業擴大採用多因素身分驗證解決方案來降低帳戶盜用和身分相關詐騙的風險。

- 在美國,網路攻擊頻率的增加正在推動多因素身份驗證解決方案的採用。由於監管要求不斷提高,並且許多行業受到 GDPR、HIPPA 和 PCI DSS 等法規的約束,該地區的許多組織正在採用和投資網路安全解決方案。這要求組織實施網路安全解決方案並增加對多因素身份驗證解決方案的投資。

- 隨著加拿大線上威脅和網路攻擊的增加,加拿大政府認知到保護其公民和移民的敏感資訊和個人資料的重要性。因此,加拿大政府於 2023 年 7 月強制要求使用者透過 GCKey 存取移民、難民和公民服務時進行多重身分驗證。這項新政策適用於使用 GCKey 建立新帳戶並登入現有帳戶的個人。這種採用推動了對 MFA 解決方案的需求。

- 此外,加拿大對資料安全解決方案的需求持續成長。加拿大有嚴格的資料保護條例,包括《個人資訊保護和電子文件法》(PIPEDA)。組織必須實施強大的資料安全措施,例如 MFA 解決方案,以確保遵守這些法規,從而推動對資料安全解決方案的需求。隨著組織進行數位轉型,他們越來越依賴數位資料。在敏感資訊的整個生命週期(從創建到儲存到傳輸)中保護敏感資訊已成為數位計劃的關鍵方面。

- 因此,加拿大的網路犯罪和資料安全漏洞數量不斷增加,刺激了多因素身份驗證的採用。由於各行業身份盜竊事件的增加,預計將擴大採用多因素身份驗證來確保數位身分的安全,從而支持市場成長。

多因素身份驗證產業概述

由於跨國公司和中小企業的存在,多因素身份驗證市場變得分散。該市場的主要企業包括 Yubico AB、Giesecke+Devrient GmbH、Thetis、GoTrustid Inc. 和 Thales。市場上的公司正在採取聯盟和收購等策略來增強其產品供應並獲得永續的競爭優勢。

*2024年2月,Giesecke+Devrient 透過增持軟體公司 Netcetera 的股份擴大了其在金融平台業務的數位產品組合,並擴大了其在數位付款和數位銀行領域的產品系列。

*2023 年 11 月,Okta Inc. 與行動裝置管理 (MDM) 解決方案 Trio 合作,使 Trio 能夠提供全面的解決方案,用於管理和保護各種規模職場的設備。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 宏觀經濟情境分析

- 洞察網路安全的監管格局

第5章市場動態

- 市場促進因素

- 網路犯罪增加、數位破壞和合規要求提高

- 互聯設備的採用增加

- 身份盜竊和詐騙行為增加

- 市場挑戰

- 缺乏技術專長

- 實施和使用多重身份驗證的複雜性

- 市場機會

- 身份驗證解決方案標準/規範(ACE、FBA、FIDO 等)

- MFA工具價格分析(硬體和軟體)

第6章 市場細分

- 按報價類型

- 硬體

- 代幣

- 生物識別裝置

- 其他設備

- 軟體

- 認證解決方案

- 行動應用程式

- 按服務

- 硬體

- 按認證類型

- 雙因素認證

- 三因素認證

- 四因素認證

- 其他身份驗證類型

- 按最終用戶產業

- 銀行/金融機構

- 加密貨幣

- 科技公司(SaaS 和 IT 服務供應商)

- 政府 - 聯邦、州和地方政府(包括系統整合)

- 醫療保健和製藥

- 零售與電子商務

- 基於流程的應用 - 能源、製造

- 其他最終使用者產業-教育、移民等。

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- Vendor Positioning Analysis

- 公司簡介

- Yubico AB

- Giesecke+Devrient GmbH

- Thetis

- GoTrustid Inc.

- Thales

- Duo(Cisco Systems Inc.)

- RSA SECURITY LLC

- Okta Inc.

- Google LLC(ALPHABET INC.)

- Ping Identity Corporation

- ManageEngine(Zoho Corporation Pvt. Ltd)

- Microsoft Corporation

- Telesign Corporation(Proximus Group)

第8章 市場未來展望

The Multi-factor Authentication Market size is estimated at USD 18.12 billion in 2024, and is expected to reach USD 38.90 billion by 2029, growing at a CAGR of 16.5% during the forecast period (2024-2029).

With the increasing frequency and sophistication of cyber threats, including phishing attacks and data breaches, organizations are pressured to implement strong security measures such as multi-factor authentication to protect confidential information and prevent unauthorized access. Strict data protection legislation and compliance standards, including the General Data Protection Regulation, Health Insurance Portability and Accountability Act, and PCI Security Standards, drive MFA adoption.

*To drive demand for multi-factor authentication solutions, regulatory compliance is crucial. Governments and industry regulators worldwide, such as the General Data Protection Regulation, HIPAA, or PCI DSS, have set strict security standards to protect sensitive data. Organizations increasingly rely on MFA as a reliable means of enhancing authentication security to comply with these requirements. The failure to comply with these regulations may lead to significant sanctions and possible judicial consequences, making the implementation of MFA a key element in risk mitigation for companies.

*The rising instances of cyber-attacks in various end-user industries, including BFSI, Healthcare, and IT & Telecom, supported by their increasing usage of the internet to have digitalized operational processes, are fueling the demand for multi-factor authentications (MFA) solutions in the market due to their application in adding a layer of protection to the users' access control, endpoint systems or company's data, which effectively helps prevent stolen passwords, malware, phishing, and ransomware attacks, driving the growth of the market.

*The emergence of industrial automation and the usage of cloud-based software for automating business functionalities in enterprises are raising the number of IIoTs and the usage of computers in any business environment. This can raise the risk of cyber-attacks and unethical access to the company's business operations and data, fueling the demand for MFA solutions due to their application in providing secure access and authentications before using the devices of the enterprises, which is expected to drive the market's growth during the forecast period.

*One of the biggest challenges for MFA is the increase in management complexity for administrators and end users. In most cases, MFA is complex and not user-friendly as it requires additional steps for end users. As organizations undergo digital transformation, there are challenges associated with complexities in implementing and using multi-factor authentication. Legacy infrastructure, characterized by outdated hardware, software, and protocols, poses limitations to implementing modern cybersecurity measures. Combining these outdated systems with modern technology frequently results in an environment that makes it more challenging to implement and maintain strong cybersecurity frameworks.

*Defense spending in many countries worldwide is increasing due to the strategies to strengthen their geopolitical positions at a global scale, which is driving the demand for cybersecurity solutions as, in the trend of digitalization, cyber wars are becoming more prevalent. Furthermore, the number of cyber-attacks has increased to weaken national security, which shows the importance of adopting cybersecurity solutions in private and government organizations, which could accelerate the demand for MFA in the future.

Multi-factor Authentication Market Trends

Healthcare Sector to be the Fastest Growing End User

- The MFA market in the healthcare sector is evolving rapidly, with healthcare organizations increasingly seeking to protect patient data, ensure compliance, and protect against a rapidly changing threat landscape. In the past few years, the growing use of advanced technologies such as AI, ML, and IoT in healthcare has enlarged the attack surface for cybercriminals. In response, healthcare organizations globally are analyzed to increase their investments in cybersecurity to prevent and mitigate cyberattacks, thus driving the market's growth.

- The healthcare sector has become a target of significant interest among cybercriminals due to its generation of valuable data from electronic health records (HER), electronic medical records (EMRs), wearable devices, a range of sensors, IoT platforms, etc. Market vendors are indulging in partnership activities to foster cybersecurity in the healthcare sector, thus significantly expanding the market's growth.

- According to the World Economic Forum, in 2023, for the 13th year in a row, the healthcare industry reported the most expensive data breaches, at an average cost of USD 10.93 million, which is almost double that of the financial sector, which came second with an average cost of USD 5.9 million. To maintain the integrity, confidentiality, and availability of patient information, it is necessary to protect such digital assets.

- Asia-Pacific is analyzed to hold a significant share of the market. For instance, in April 2024, to make it easier for beneficiaries of the Central Government Health Scheme to access healthcare services, the Union Ministry of Health launched the myCGHS iOS app. Developed by NIC Himachal Pradesh and the NIC Health Team, the app enables appointment booking and accessing health records, lab reports, medicine history, and reimbursement claim status. Two-factor authentication and MPIN are part of the security measures. The launch is a milestone in digital healthcare and will enhance CGHS services. It is available on the App Store and Google Play at no charge. The Union Health Minister emphasized the commitment of the Government to leverage technology to make healthcare accessible.

- Overall, the growing adoption of advanced technologies in the healthcare sector, with further growth in connected devices, will require these end-user industries to strengthen their cybersecurity landscape.

North America Holds Significant Market Share

- The United States is at the epicenter of cybercrime due to the growing penetration of digital technologies in end-user industries compared to other countries. Businesses in the US face a higher volume of cyberattacks, which incur costly consequences. Cybersecurity has become an increasingly important area of focus in the United States, owing to the rising number of cyber threats and attacks that organizations and individuals face.

- As per the Identity Theft Resource Center (ITRC) report published in February 2024, in 2023, the United States recorded 3,205 data breaches, which is a 78% increase in 2022 and a 72% increase since 2021. Such high-profile data breaches and cybersecurity incidents have raised awareness among businesses and consumers about the importance of implementing robust security measures to safeguard personal and sensitive information. Hence, companies are increasingly adopting multi-factor authentication solutions to help organizations mitigate the risk of account takeover and identity-related fraud.

- The increasing frequency of cyber-attacks drives the adoption of multi-factor authentication solutions in the United States. Many organizations in the region are adopting and investing in cybersecurity solutions owing to the growing regulatory requirement and many industries subject to regulations such as GDPR, HIPPA, and PCI DSS. This requires organizations to implement cybersecurity solutions and increase their investments in multi-factor authentication solutions.

- As online threats and cyberattacks increase in Canada, the Canadian Government has recognized the importance of safeguarding citizens' and immigrants' sensitive information and personal data. Hence, in July 2023, the Canadian Government made multi-factor authentication mandatory for users accessing immigration, refugees, and citizenship services through GCKey. The new policy applies to individuals creating a new account using GCKey and those signing into their existing accounts. Such adoptions are driving the demand for MFA solutions.

- In addition, Canada's demand for data security solutions is continuously growing. Canada has stringent data protection regulations, including the Personal Information Protection and Electronic Documents Act (PIPEDA). Organizations must implement robust data security measures such as MFA solutions to ensure compliance with these regulations, driving the demand for data security solutions. As organizations undergo digital transformation, there is a greater reliance on digital data. Protecting sensitive information throughout its lifecycle, from creation to storage and transmission, becomes a critical aspect of digital initiatives.

- Therefore, the increasing number of cybercrimes and data and security breaches in Canada fuel the adoption of multi-factor authentication, which is expected to increase for securing digital identities, owing to the increasing number of identity theft cases across the industries, supporting the market's growth.

Multi-factor Authentication Industry Overview

The multi-factor authentication market is fragmented due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are Yubico AB, Giesecke+Devrient GmbH, Thetis, GoTrustid Inc., and Thales. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

*In February 2024, Giesecke+Devrient expanded its digital portfolio in the financial platforms business by increasing its stake in the software company Netcetera to broaden its product portfolio in the areas of digital payment and digital banking, which would create an opportunity for the company to offer MFA-based solutions to the financial industries in the market, which would support the growth of the company's market presence in the future.

*In November 2023 - Okta Inc. partnered with Trio, a Mobile Device Management (MDM) solution, enabling Trio to provide a comprehensive solution for managing and securing devices in workplaces of any size, which would fuel the growth of the company's market presence in the MFA market supported by the company's strategic focus on developing solutions in the identity access management solutions in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Analysis of Macro Eeconomic Scenarios

- 4.3 Insights on the Regulatory Landscape Related to Cyber Security

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Cybercrime, Digital Disruption, and Increased Compliance Demands

- 5.1.2 Rising Adoption of Interconnected Devices

- 5.1.3 Increased Instances of Identity Theft and Fraud

- 5.2 Market Challenges

- 5.2.1 Lack of Technical Expertise

- 5.2.2 Complexities in Implementing and Using Multi-factor Authentication

- 5.3 Market Opportunities

- 5.3.1 Standards/Specifications for Authentication Solutions (ACE, FBA, FIDO, etc.)

- 5.3.2 Pricing Analysis for MFA Tools (Hardware and Software)

6 MARKET SEGMENTATION

- 6.1 By Offering Type

- 6.1.1 Hardware

- 6.1.1.1 Token

- 6.1.1.2 Biometric Devices

- 6.1.1.3 Other Devices

- 6.1.2 Software

- 6.1.2.1 Authenticator Solutions

- 6.1.2.2 Mobile Apps

- 6.1.3 Services

- 6.1.1 Hardware

- 6.2 By Authentication Type

- 6.2.1 Two-factor Authentication

- 6.2.2 Three-factor Authentication

- 6.2.3 Four-factor Authentication

- 6.2.4 Other Types of Authentication

- 6.3 By End-user Industry

- 6.3.1 Banking and Financial Institutions

- 6.3.2 Cryptocurrency

- 6.3.3 Technology-based Companies (SaaS & IT Service Vendors)

- 6.3.4 Government - Federal, State, and Local Entities (Including System Integrators)

- 6.3.5 Healthcare and Pharmaceutical

- 6.3.6 Retail and E-commerce

- 6.3.7 Process-based Applications - Energy and Manufacturing

- 6.3.8 Other End-user Verticals - Education, Immigration, Etc.

- 6.4 By Geography***

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Positioning Analysis

- 7.2 Company Profiles*

- 7.2.1 Yubico AB

- 7.2.2 Giesecke+Devrient GmbH

- 7.2.3 Thetis

- 7.2.4 GoTrustid Inc.

- 7.2.5 Thales

- 7.2.6 Duo (Cisco Systems Inc.)

- 7.2.7 RSA SECURITY LLC

- 7.2.8 Okta Inc.

- 7.2.9 Google LLC (ALPHABET INC.)

- 7.2.10 Ping Identity Corporation

- 7.2.11 ManageEngine (Zoho Corporation Pvt. Ltd)

- 7.2.12 Microsoft Corporation

- 7.2.13 Telesign Corporation (Proximus Group)