|

市場調查報告書

商品編碼

1536860

防火布料:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Fire-resistant Fabrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

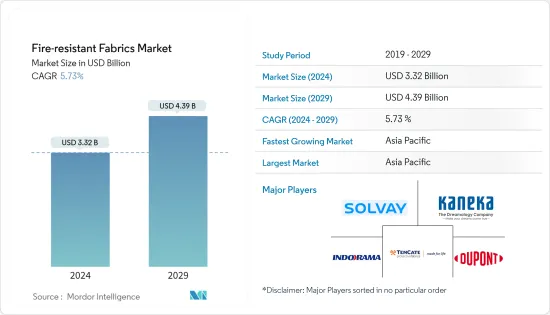

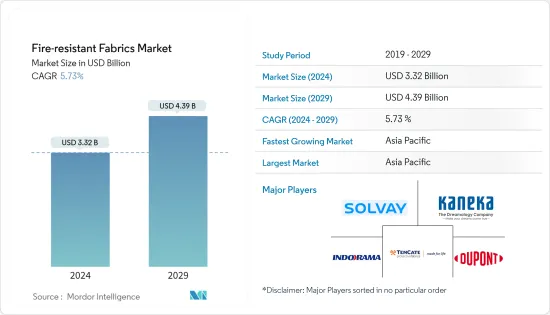

2024年防火織物市場規模預計為33.2億美元,預計2029年將達到43.9億美元,預計在預測期內(2024-2029年)複合年成長率為5.73%。

市場受到 COVID-19 大流行的負面影響。受此次疫情影響,世界多個國家紛紛採取封鎖措施,以遏止病毒傳播。這完全擾亂了供需鏈,對市場產生了負面影響。市場已從 COVID-19 大流行中恢復過來,並正在經歷顯著成長。

主要亮點

- 短期內,嚴格的織物工業標準、家用和商用家具對防火織物的需求不斷增加以及南美洲採礦業需求的增加正在推動市場成長。

- 另一方面,用於製造防火織物的原料成本高昂和缺乏安全標準預計將阻礙市場成長。

- 儘管如此,金磚國家(巴西、俄羅斯、印度、中國和南非)的快速工業化預計在預測期內將是一個好兆頭。

- 由於中國和印度等國家的消費量不斷增加,預計亞太地區在預測期內將佔最大佔有率。

防火布料市場趨勢

交通運輸領域佔市場主導地位

- 阻燃織物用於鐵路、汽車、飛機、海洋建築等交通運輸業。隨著外國投資建設更好的鐵路、地鐵和鐵路網路,全球交通運輸業預計將出現健康成長。

- 根據OICA(國際汽車構造組織)預測,全球汽車產業汽車及商用車產量將成長,2022年將達到8,484萬輛,2023年將達9,355萬輛。因此,2022年和2023年,該產業對阻燃布料的需求將會增加。

- 2022年美國、巴西、印度、中國等全球主要市場汽車銷售量與前一年同期比較分別成長10%、5%、24%、3%。

- 然而,由於各種環境問題,隨著政府計劃推動擺脫石化燃料,電動車的發展預計將繼續獲得動力,特別是在歐洲和中國,所有汽車行業的設計師都在尋求創造新的可能性。

- 在汽車領域,印度等亞太國家對電動車的需求不斷成長也推動了市場成長。

- 根據國際能源協會(IEA)預測,新政策情境下,2030年全球電動車銷售量預計將達到1.25億輛(不包括摩托車/三輪車)。在EV30@30情境中,預計到2030年,中國約70%的汽車銷售將是電動車。在歐洲,電動車佔銷售量的一半,日本佔 37%,印度佔 29%,加拿大和美國30%。

- 全球鐵路建設的擴大預計將推動防火織物的需求。印度政府正計劃在印度30多個城市開發地鐵計劃。

- 航空業也是一種正在經歷顯著成長的交通途徑。飛機被認為是長途通勤最快的方式。選擇正確的織物材料與飛機製造中的任何其他組件一樣重要。飛機事故中很大一部分的死亡是由火災、吸入煙霧以及火災釋放的有毒氣體窒息造成。

- 由於乘客數量的增加和飛機退役的增加,預計未來 20 年對新型噴射機的需求將會增加。根據波音2023-2042年商用飛機市場展望,預計2023年至2042年間將交付42,000架新飛機。

- 根據波音公司預測,到2028年民航機市場規模預計將達到3.1兆美元。營運商預計將以更省油的機型替換舊式噴射機,並擴大持有,以適應新興和成熟市場航空旅行的穩定成長。因此,隨著新型噴射機的生產,航太業對阻燃織物的需求預計在預測期內也會增加。

- 所有上述因素預計將在預測期內推動防火布料市場。

中國主導亞太市場

- 中國對防火織物的需求主要是由航太業製造活動的擴展所推動的。

- 這一成長主要是由於消費者消費能力的提高和航空旅行便利性的改善而導致的客運量增加。客運量的增加對飛機的需求更加強勁。

- 中國的航太政策是進入航太研發生產頂級水準的最全面的嘗試之一。預計未來20年中國將成為全球最大的民航機銷售單一國家市場。根據「中國製造2025」計劃,預計到2025年中國將有10%以上的國產民航機供應國內市場。預計這將為預測期內的航太防火織物市場提供商機。

- 汽車工業是防火織物的主要消費者之一。中國是汽車生產大國,2022年總產量將超過2,700萬輛,與前一年同期比較去年同期成長約3%,這將對阻燃織物的市場需求產生正面影響。

- 此外,政府對電動車生產的重視預計也將在預測期內增加對防火織物市場的需求。

- 中國政府計畫在2025年引進至少5,000輛燃料電池電動車,到2030年引進100萬輛。政府對電動、混合動力汽車和燃料電池汽車的推廣預計將在預測期內推動市場研究。

- 所有上述因素預計將在預測期內推動此國防火織物的需求。

防火布料產業概況

防火織物市場較為分散。主要企業(排名不分先後)包括杜邦公司、Indrama Corporation、Solvay、 KANEKA Corporation 和 Tencate Protective Fabrics。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 嚴格的布料工業標準

- 家用和商用家具對防火織物的需求增加

- 南美洲採礦需求增加

- 抑制因素

- 防火布料原料價格上漲

- 缺乏安全合規性

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 按類型

- 服飾

- 非服裝

- 按用途

- 工業防護衣/採礦防護衣

- 運輸

- 鐵路

- 飛機

- 汽車(公路)

- 海洋

- 國防/消防

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 泰國

- 馬來西亞

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 俄羅斯

- 北歐的

- 土耳其

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 卡達

- 阿拉伯聯合大公國

- 埃及

- 奈及利亞

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)/排名分析

- 主要企業策略

- 公司簡介

- DuPont

- Glen Raven Inc.

- Indorama Corporation

- KANEKA CORPORATION

- LENZING AG

- Newtex Industries Inc.

- PBI Fibers International

- Solvay

- Teijin Carbon Europe GmbH

- TenCate Protective Fabrics

- WL Gore & Associates Inc.

- Westex:A Milliken Brand

第7章 市場機會及未來趨勢

- 金磚國家快速工業化

- 其他機會

The Fire-resistant Fabrics Market size is estimated at USD 3.32 billion in 2024, and is expected to reach USD 4.39 billion by 2029, growing at a CAGR of 5.73% during the forecast period (2024-2029).

The market was negatively impacted due to the COVID-19 pandemic. Owing to the pandemic, several countries worldwide went into lockdown to curb the spread of the virus. This completely disrupted the supply and demand chain, negatively affecting the market. The market has recovered from the COVID-19 pandemic and has grown at a significant rate.

Key Highlights

- Over the short term, stringent industrial standards for fabrics, the increasing demand for fire-resistant fabrics in home and commercial furnishing, and growing demand from the mining industry in South America are driving the market's growth.

- On the flip side, the high price of raw materials that are used to make fire-resistant fabric and the lack of safety compliances are expected to hinder the market's growth.

- Nevertheless, rapid industrialization in BRICS countries (Brazil, Russia, India, China, and South Africa) is expected to be an opportunity during the forecast period.

- Asia-Pacific is expected to account for the largest share during the forecast period, owing to increasing consumption from countries such as China and India.

Fire-resistant Fabrics Market Trends

Transport Segment to Dominate the Market

- Fire-resistant fabrics are used in the transport industry during railways, automotive, aircraft, and marine construction. The global transport sector is expected to grow healthy in response to foreign investments in constructing better railways, metro, and rail networks.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the global automobile industry witnessed an increase in the production of cars and commercial vehicles, reaching 84.84 million units in 2022 and 93.55 million units in 2023. This, in turn, increased the demand for fire-resistant fabrics from this sector in 2022 and 2023.

- The car sales for 2022 in major global markets of the United States, Brazil, India, and China were up by 10%, 5%, 24%, and 3%, respectively, compared to the previous year.

- However, the development of electric vehicles is expected to continue to gain momentum in the future, especially in Europe and China, owing to government programs promoting the shift away from fossil fuels due to various environmental concerns, where designers in all the automotive segments are discovering new possibilities.

- In the automotive sector, the growing demand for electric vehicles in Asia-Pacific countries, like India, has also fueled the market's growth.

- According to the IEA (International Energy Association), in 2030, global electric vehicle sales are expected to reach 125 million as per the New Policies Scenario (excluding two/three-wheelers). In the EV30@30 Scenario, in 2030, in China, around 70% of vehicle sales are expected to be EVs. Half of the vehicles sold in Europe are EVs, with 37% in Japan, 29% in India, and 30% in Canada and the United States.

- Growing railway construction worldwide is expected to drive the demand for fire-resistant fabrics. The Indian government plans to develop metro rail projects in more than 30 Indian cities.

- The aviation industry is another popular mode of transportation that has been growing notably. It is known to be the fastest means of commuting to distant places. Selecting the right fabric material in aircraft production is as important as any other component. A substantial percentage of aircraft accident deaths are caused by fire and smoke inhalation and asphyxiation from toxic gases released during a fire.

- The growing passenger volumes and increasing aircraft retirements are expected to drive the need for new jets over the next two decades. According to Boeing Commercial Market Outlook 2023-2042, 42,000 new aircraft are expected to be delivered during 2023-2042.

- According to Boeing, the market value for commercial aircraft is expected to reach USD 3.1 trillion by 2028, as operators are expected to replace older jets with more fuel-efficient models and expand their fleets to cater to the steady rise in air travel in emerging and established markets. Hence, with the production of new jets, the demand for fire-resistant fabrics from the aerospace industry is also expected to increase during the forecast period.

- All the factors above are expected to drive the fire-resistant fabrics market during the forecast period.

China to Dominate the Asia-Pacific Market

- The growing manufacturing activities of the aerospace industry in the country mainly drive the demand for fire-resistant fabrics in China.

- This growth primarily depends on the rising passenger traffic due to the high consumer spending power and better air connectivity. The increasing passenger traffic is further creating a robust demand for aircraft.

- The Chinese aerospace policy represents one of the most comprehensive attempts to enter the top aerospace development and production levels. China is expected to be the world's largest single-country market for civil aircraft sales in the next 20 years. Under the plan 'Made in China 2025,' it is expected that China will supply over 10% of homemade commercial aircraft to the domestic market by 2025. This is expected to provide opportunities for the fire-resistant fabrics market in the aerospace sector during the forecast period.

- The automotive industry is one of the major consumers of fire-resistant fabrics. China is the leading producer of vehicles, with a total production volume of over 27 million vehicles in 2022, registering a growth rate of about 3% compared to the previous year, thus positively impacting the market demand for fire-resistant fabrics.

- Moreover, the government's focus on producing electric vehicles is expected to drive the demand for the fire-resistant fabrics market during the forecast period.

- The Chinese government plans to have at least 5,000 fuel-cell electric vehicles by 2025 and 1 million by 2030. The government's promotion of electric, hybrid, and fuel-cell electric vehicles is expected to drive the market studied during the forecast period.

- All the abovementioned factors are expected to drive the demand for fire-resistant fabrics in the country over the forecast period.

Fire-resistant Fabrics Industry Overview

The fire-resistant fabrics market is fragmented in nature. The major companies (not in any particular order) include DuPont, Indorama Corporation, Solvay, KANEKA CORPORATION, and TenCate Protective Fabrics.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Stringent Industrial Standards for Fabrics

- 4.1.2 Increasing Demand for Fire-resistant Fabrics in Home and Commercial Furnishing

- 4.1.3 Growing Demand from the Mining Industry in South America

- 4.2 Restraints

- 4.2.1 High Price of Raw Materials Used to Make Fire-resistant Fabrics

- 4.2.2 Lack of Safety Compliance

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 By Type

- 5.1.1 Apparel

- 5.1.2 Non-apparel

- 5.2 By Application

- 5.2.1 Industrial Protective and Mining Clothing

- 5.2.2 Transport

- 5.2.2.1 Railway

- 5.2.2.2 Aircraft

- 5.2.2.3 Automotive (Roadway)

- 5.2.2.4 Marine

- 5.2.3 Defense and Firefighting Service

- 5.2.4 Other Applications

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Thailand

- 5.3.1.6 Malaysia

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 Russia

- 5.3.3.7 NORDIC

- 5.3.3.8 Turkey

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Qatar

- 5.3.5.4 United Arab Emirates

- 5.3.5.5 Egypt

- 5.3.5.6 Nigeria

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%) **/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 DuPont

- 6.4.2 Glen Raven Inc.

- 6.4.3 Indorama Corporation

- 6.4.4 KANEKA CORPORATION

- 6.4.5 LENZING AG

- 6.4.6 Newtex Industries Inc.

- 6.4.7 PBI Fibers International

- 6.4.8 Solvay

- 6.4.9 Teijin Carbon Europe GmbH

- 6.4.10 TenCate Protective Fabrics

- 6.4.11 W. L. Gore & Associates Inc.

- 6.4.12 Westex: A Milliken Brand

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Rapid Industrialization in BRICS Countries

- 7.2 Other Opportunities