|

市場調查報告書

商品編碼

1536861

電池回收:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Battery Recycling - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

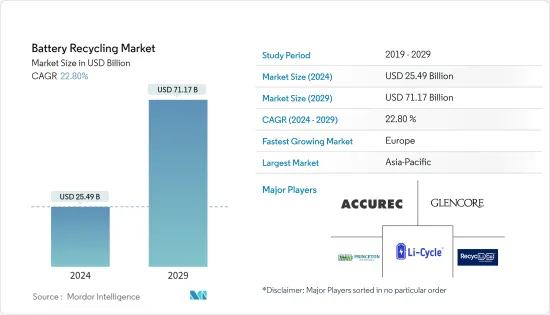

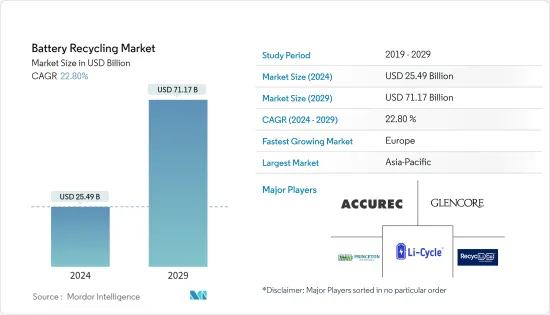

電池回收市場規模預計到 2024 年將達到 254.9 億美元,在預測期內(2024-2029 年)複合年成長率為 22.80%,預計到 2029 年將達到 711.7 億美元。

電動車普及率的提高、對電池廢棄物處理的日益擔憂以及嚴格的政府政策等因素預計將在預測期內推動電池回收市場的發展。

另一方面,高成本、缺乏強大的供應鏈以及與電池回收相關的低產量比率預計將阻礙未來幾年的市場成長。

然而,電池回收策略的技術創新為市場開拓提供了重大機會。

由於電池應用的增加,預計歐洲將成為預測期內成長最快的市場。這一成長歸因於電動車 (EV) 中電池使用的增加。

電池回收市場趨勢

鋰離子電池領域可望大幅成長

- 鋰離子電池技術在汽車 (EV) 和可再生能源產業特別受歡迎。低廉的價格和有利的化學成分正在推動對該技術的需求。鋰電池的使用壽命為3-4年,之後可回收更換新電池。

- 根據國際能源總署(IEA)電動車展望報告,2023年全球電動車(BEV和PHEV)銷量將超過1,330萬輛,預計到2024年將進一步成長35%至1700萬輛。電動車在整個汽車市場的佔有率從2020年的約4%上升到2023年的18%。在預測期內,由於需要回收鋰離子電池,因此電動車的成長預計將為電池回收市場帶來動力。

- 世界各地的公司正在推出各種計劃來加強電池回收。例如,2023 年 6 月,美國能源局尖端材料和製造技術 (AMMTO) 部門宣布了一項由阿貢國家實驗室 (ANL) ReCell 中心營運的鋰離子電池回收、再循環和再利用計劃)宣布將撥款200萬美元。

- 此外,2023 年 12 月,根據阿拉伯聯合大公國能源和基礎設施部、中東創新和永續解決方案提供商 BEEAH 與印度領先的電池回收公司 Lohum Cleantech Pvt. 之間的共同開發契約條款, Lohum 將建立一個佔地80,000 平方英尺的設施來回收和再生鋰電池。該設施預計每年回收3,000噸鋰離子電池,並將15MWh電池容量轉化為永續能源儲存系統(ESS)。

- 此外,為了降低成本並提高回收過程的效率,Umicore、Glencore PLC、Cirba Solutions 和 Raw Materials Company Inc. 預計這將導致未來電池回收量的增加。

- 因此,政府推動電池回收活動以及鋰離子電池在電動車和能源儲存系統中的利用的舉措預計將在預測期內推動全球鋰離子電池回收市場的發展。

預計歐洲將進一步成長

- 在歐洲,由於新興企業的崛起,電池回收市場不斷成長。電池回收的其他主要推動力是該地區不斷成長的電動車市場和能源儲存計劃。

- 根據國際能源總署(IEA)的數據,2023年純電動車銷量為220萬輛,比2019年成長4.95倍。隨著世界各國關注淨零碳排放目標並以清潔燃料能源來源取代碳氫化合物,這一數字正在顯著增加。

- 根據世界能源資料統計回顧,在歐洲,由於全部區域多個太陽能和風電通道的發展,2022年發電量較2021年下降了3.5%。大部分發電來自可再生能源發電。多年來,發電和消費量之間的差距不斷擴大,預計將增加預測期內電池回收的需求。

- 由於多種因素,法國鋰離子電池回收市場正在經歷顯著成長。成長的主要驅動力之一是該國對永續能源和交通實踐的關注。例如,2023年3月,Li-Cycle宣布計劃在法國哈內斯建造一座1萬噸/年的鋰離子電池回收設施。該設施計劃於 2024 年完工,隔年產能將增加至多 25,000 噸。

- 同樣,2023年3月,Altium Metals宣布計畫加速開發該國最大的鋰離子回收廠,年產能近3萬噸。 2022年英國蓄電池產能將達2.3GW。作為國家電池儲存目標的一部分,到 2030 年將安裝約 20GW。這為各種公共和私人開發人員投資電池能源儲存計劃提供了機會。

- 西班牙設定了2023年攜帶式電池回收率達到45%、2027年達到63%、2030年達到73%、2028年輕型交通電池回收率達到51%、2031年達到61%的目標。增加電池收集是正確回收電池的必要步驟。

- 隨著歐洲能源儲存市場的持續成長,電池回收市場也將產生重大影響。隨著越來越多的家庭和企業投資能源儲存解決方案來儲存太陽能的剩餘能源或在高峰時段使用,對電池的需求不斷增加,需要回收的電池數量也會增加。

- 由於這些發展,歐洲預計在未來幾年將顯著成長。

電池回收業概況

電池回收市場適度分散。市場主要企業包括(排名不分先後)Accurec Recycling GmbH、Glencore PLC、Princeton NuEnergy Inc.、Li-Cycle Holdings Corp. 和 Recyclo Battery Materials Inc.。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2029年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 電動車的擴張

- 人們對電池廢棄物處理的興趣日益濃厚,政府政策也越來越嚴格

- 抑制因素

- 回收作業高成本

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依電池類型

- 鉛酸電池

- 鎳電池

- 鋰離子電池

- 其他電池類型

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 卡達

- 埃及

- 奈及利亞

- 其他中東和非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Accurec Recycling GmbH

- Aqua Metals Inc.

- Battery Recycling Made Easy

- Battery Solutions Inc.

- Call2Recycle Inc.

- Eco-Bat Technologies Ltd

- Exide Technologies

- Neometals Ltd

- Raw Materials Company

- Recupyl SAS

- 市場排名分析

第7章 市場機會及未來趨勢

- 電池回收的創新

The Battery Recycling Market size is estimated at USD 25.49 billion in 2024, and is expected to reach USD 71.17 billion by 2029, growing at a CAGR of 22.80% during the forecast period (2024-2029).

Factors such as the increasing adoption of electric vehicles, rising concerns over battery waste disposal, and stringent government policies are likely to drive the battery recycling market in the forecast period.

On the other hand, higher costs, lack of a strong supply chain, and low yield related to battery recycling are expected to hinder market growth in the coming years.

Nevertheless, technological innovations in battery recycling strategies create tremendous opportunities for market development.

Europe is expected to be the fastest-growing market during the forecast period due to the rising number of battery applications. This growth is due to the growing battery usage in electric vehicles (EVs).

Battery Recycling Market Trends

The Lithium-ion Battery Segment is Expected to Witness Significant Growth

- Lithium-ion battery technology has gained prominence, particularly in the automobile (EV) and renewable energy industries. Low pricing and favorable chemistry enhanced technology demand. A lithium battery has a lifetime of three to four years, after which it can be recycled and replaced with a new one.

- According to the International Energy Agency Electric Vehicle Outlook Report, more than 13.3 million electric cars (BEV and PHEV) were sold worldwide in 2023, and sales are expected to grow by another 35% in 2024 to reach 17 million. This significant growth in electric cars' share of the overall car market rose from around 4% in 2020 to 18% in 2023. The rise in electric vehicles is likely to give impetus to the battery recycling market, as there is a need for Li-ion batteries to be recycled during the forecast period.

- The companies across the world are launching various projects to enhance battery recycling. For instance, in June 2023, the Advanced Materials and Manufacturing Technologies (AMMTO) branch of the US Department of Energy announced that USD 2 million would be allocated to programs for the rejuvenation, recycling, and reuse of lithium-ion batteries run by the ReCell Center at Argonne National Laboratory (ANL).

- Additionally, in December 2023, the UAE's Ministry of Energy & Infrastructure, BEEAH, the Middle East's provider of innovative and sustainable solutions, and Lohum Cleantech Pvt. Ltd (Lohum), India's top battery recycling company, inked a deal to construct the country's first electric vehicle (EV) battery recycling facility. According to the terms of the joint development agreement, Lohum will establish an 80,000-square-foot facility for recycling and refurbishing lithium batteries. This facility is anticipated to recycle 3000 tons of lithium-ion batteries annually and convert 15 MWh of battery capacity into sustainable energy storage systems (ESS).

- Furthermore, to cut costs and boost efficiency in the recycling processes, leading industry participants like Umicore, Glencore PLC, Cirba Solutions, Raw Materials Company Inc. (RMC), and RecycLiCo Battery Materials Inc. are employing various technological advancements. This is expected to lead to an increase in battery recycling in the future.

- Therefore, government initiatives to boost battery recycling activities and lithium-ion battery utilization for electric vehicles and energy storage systems are anticipated to drive the global lithium-ion battery recycling market during the forecast period.

Europe Expected to Witness Faster Growth

- The battery recycling market has been witnessing continuous growth in Europe due to the blooming start-ups in the field. Other big drivers for battery recycling are the growing electric vehicle market and energy storage projects in the region.

- According to the International Energy Agency (IEA), in 2023, battery electric vehicle sales were recorded at 2.2 million, an increase of 4.95 times compared to 2019. The number has risen significantly as countries worldwide focus on NET zero carbon emission targets and replace hydrocarbons with clean fuel energy sources.

- According to the Statistical Review of World Energy Data, in Europe, electricity generation reduced by 3.5% in 2022, compared to 2021, due to the maintenance of several solar and wind channels across the region. The majority of electricity generation comes from renewable sources of energy. The difference between generations and consumption is increasing every year, and this is likely to increase the demand for battery recycling during the forecast period.

- The lithium-ion battery recycling market in France is experiencing significant growth due to several factors. One of the primary drivers of growth is the country's strong focus on sustainable energy and transportation practices. For instance, in March 2023, Li-Cycle announced its plans to build a 10,000 mt/year lithium-ion battery recycling facility in Harnes, France. The facility is expected to be completed by 2024 and will boost capacity by up to 25,000 mt/year in the following years.

- Similarly, in March 2023, Altilium Metals announced plans to accelerate the development of the country's largest lithium-ion recycling plant, with a capacity of nearly 30,000 tonnes per year. The battery storage capacity in the United Kingdom was 2.3 GW as of 2022. As a part of the national battery storage target, about 20 GW of power will be installed by 2030. This signifies an opportunity for various public and private developers to invest in battery energy storage projects.

- Spain has set a target of portable battery collection for recycling to 45% in 2023, 63% in 2027, and 73% in 2030, and for batteries from light means of transport, the target is set at 51% in 2028 and 61% in 2031. An increase in battery collection is a necessary step for the proper recycling of batteries.

- As the energy storage market continues to grow in Europe, there will be a significant impact on the battery recycling market. With more and more households and businesses investing in energy storage solutions to store excess solar energy or to use during peak hours, the demand for batteries will increase, leading to an increase in the volume of batteries that need to be recycled.

- Owing to such developments, Europe is expected to witness significant growth in the coming years.

Battery Recycling Industry Overview

The battery recycling market is moderately fragmented. Some of the major players in the market (in no particular order) include Accurec Recycling GmbH, Glencore PLC, Princeton NuEnergy Inc., Li-Cycle Holdings Corp., and Recyclico Battery Materials Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Adoption Of Electric Vehicles

- 4.5.1.2 Growing Concern for Battery Waste Disposal and Stringent Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High Cost of Recycling Operations

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lead-Acid Battery

- 5.1.2 Nickel Battery

- 5.1.3 Lithium-ion battery

- 5.1.4 Other Battery Types

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Australia

- 5.2.3.5 Malaysia

- 5.2.3.6 Thailand

- 5.2.3.7 Indonesia

- 5.2.3.8 Vietnam

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Colombia

- 5.2.4.5 Rest of South America

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 United Arab Emirates

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Egypt

- 5.2.5.6 Nigeria

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Accurec Recycling GmbH

- 6.3.2 Aqua Metals Inc.

- 6.3.3 Battery Recycling Made Easy

- 6.3.4 Battery Solutions Inc.

- 6.3.5 Call2Recycle Inc.

- 6.3.6 Eco-Bat Technologies Ltd

- 6.3.7 Exide Technologies

- 6.3.8 Neometals Ltd

- 6.3.9 Raw Materials Company

- 6.3.10 Recupyl SAS

- 6.4 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Innovations in the Battery Recycling