|

市場調查報告書

商品編碼

1536866

無線感測網路:市場佔有率分析、產業趨勢和成長預測(2024-2029)Wireless Sensors Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

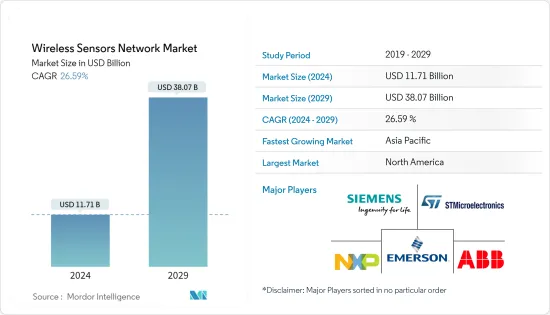

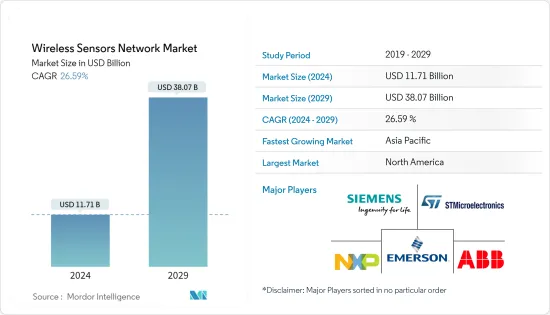

預計2024年無線感測網路市場規模為117.1億美元,2029年達到380.7億美元,在市場預測與預測期間(2024-2029年)複合年成長率為26.59%。

無線感測網路在機器人領域有許多應用,包括先進的機器人感測、多機器人協作、機器人規劃和導航以及機器人定位。無線感測網路可以幫助緊急應變機器人了解電磁場監測、森林火災偵測等情況。

主要亮點

- 自動化和機器人產業的成長、資產監控、安全和運輸領域對無線感測網路的需求不斷增加,以及通訊技術進步帶來的可靠性提高,是推動無線感測網路(WSN) 市場的主要因素。

- 隨著各國政府收緊法規以增加安全感測器的使用,在環境條件惡劣(例如非常高的壓力和溫度)的地區,對無線感測器的需求正在成長。無線感測器可以輕鬆地在安全距離內連續控制和監控您的設施。無線感測器有助於從難以存取的位置獲取資料。

- 物聯網(IoT)的日益普及也是推動市場成長的主要因素。物聯網連接設備的增加預計將推動對無線感測網路的需求。

- 感測器製造商正在大力投資技術,以支援嚴重依賴無線技術的新興垂直產業,例如智慧城市和自動駕駛汽車。智慧感測器等感測器技術的創新預計將支持無線技術在市場上的快速採用。所有這些因素預計將有助於無線感測網路市場的成長。

- 儘管實用性很高,但使用無線感測網路系統仍面臨挑戰。此類感測器網路系統的規模差異很大,感測器節點的數量從幾個到幾個不等。部署密度也需要調整。鑑於無線感測器節點必須在電源不足的情況下運行,必須最佳化軟體和硬體設計,以便有效地完成手邊的任務。

- 無線感測器網路存在電源、儲存和大量演算法等諸多限制,這些都為維護帶來了嚴峻的挑戰。與任何依賴網際網路的應用程式一樣,WSN 也存在安全性問題。為了以任何方式打擊資料竊取,必須實施適當的資料傳輸控制。

無線感測網路市場趨勢

醫療領域可望顯著成長

- 醫療保健產業面臨幾個問題,包括成本上升、醫療錯誤增加、人才短缺和人口老化。儘管面臨這些挑戰,醫療保健專業人員仍面臨採用最新技術並同時提供更好服務的壓力。提供無處不在的醫療保健可以降低長期成本並提高服務品質。無線感測網路可以為日益流行的醫療保健系統提供有效的解決方案。

- 近年來,由於低功耗感測器和網路技術的進步,用於醫療保健的無線感測器網路開始出現。無線感測網路經常成為下一代醫療保健系統的關鍵組件。 WSN 是一種基於 Zigbee 的多點跳躍系統,使用多播和廣播來傳遞關鍵訊息。訊息速度和可靠性是此類系統的基本特徵。

- 它與從各種感測器收集即時健康資訊有關。無線通訊協定、無線頻譜、資料頻寬、加密、能耗和移動性是這些網路的基本特徵。

- 穿戴式感測器的發展使用戶能夠借助醫療保健中的無線感測網路持續監測生理資料。近身網路持續監測病患住院和居住期間的健康狀況。透過將有關患者病情的資料傳輸給醫療保健提供者,該服務在緊急情況下可能很有用。它還有助於為人們提供醫療保健服務,例如改善記憶力、存取健康資料、檢測癌症、氣喘症狀和監測血糖值。

- 此外,RBSA Advisors 報告稱,將安裝新的醫療物聯網與遠端醫療,並在疾病監測和預防中發揮關鍵作用。人工智慧驅動的分析、工具和機器可以幫助醫療保健提供者為每位患者選擇正確的方法,以實現更有效、更精確和更有影響力的干涉措施。

- 在印度,新技術正在幫助開發新穎、更好的治療方法,同時降低成本。未來幾年,人工智慧 (AI)、資料和 IoMT 將從用於追蹤心搏速率和血氧水平等生命徵象的簡單設備擴展到心電圖等複雜掃描,我們預計將快速擴展到智慧智慧型手錶。血壓並預測心臟病風險的智慧紡織品。

北美佔最大市場佔有率

- 在預測期內,北美預計將成為無線感測網路的主要市場,因為該地區正處於採用智慧城市、建築和工業自動化等最尖端科技的早期階段。該地區無線感測器網路市場的成長預計也將受到醫療保健基礎設施技術進步和消費者對穿戴式裝置日益成長的興趣的推動。

- 智慧工廠、智慧製造的採用以及許多工業無線感測網路製造商的出現預計將在未來幾年推動北美市場的成長。此外,ABB Ltd.、艾默生電氣公司和霍尼韋爾國際公司等主要企業的存在預計也將推動該地區的市場成長。

- 無線感測網路用於健康應用,有助於醫院內的綜合病患監測、診斷、藥物管理、人體生理資料的遠端監測以及醫院內醫生和患者的追蹤和監控。

- 北美貨運鐵路產業也在尋求利用車載鐵路車輛感測器網路進行進階監控和警報。在鐵路環境中,貨運列車的 WSN 呈現相當長度的線性鏈狀拓樸。

- 此外,隨著穿戴式裝置在商業市場上越來越受歡迎,它們也因其許多優點而在工業應用中越來越受歡迎。例如,空中巴士公司與Accenture合作,向航太和國防工業推出穿戴式裝置。

無線感測器網路產業概況

無線感測器網路市場分散。這是一個競爭激烈的市場,沒有單一的主導者。每位參與者都專注於新產品創新、合作和聯盟以及併購的策略投資,以加強其市場地位。

- 2023 年 11 月,義法半導體宣布推出一款新型微控制器 (MCU),將公司在無線設備設計方面的專業知識與高效能、高效的 STM32架構相結合。

- 2023 年 10 月,恩智浦半導體宣布推出符合汽車標準的新型無線連接解決方案 AW693。 AW693 專為汽車應用而設計,是業界最完整的汽車無線連接產品組合的一部分,提供受恩智浦整合EdgeLock 安全連接保護的同步雙Wi-Fi 6E 和藍牙5.3,並在您的汽車中實現更安全的連接。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 拓樸結構

- 星形

- 網

- 混合

- 樹

- 感應器

- MEMS

- CMOS感測器

- LED感應器

- 網路技術(連結性)

- 無線HART

- ZigBee

- Wi-Fi

- IPv6

- 藍牙

- 破折號 7

- Z波

- 拓樸結構

- 宏觀經濟走勢對市場的影響

第5章市場動態

- 市場促進因素

- 無線技術的採用增加

- 無線感測器成本降低

- 市場挑戰

- 高安全需求和安裝成本

第6章 市場細分

- 按最終用戶

- 軍事/安全

- 醫療保健

- 運輸/物流

- 石油和天然氣

- 用水和污水

- 消費包裝產品(食品和飲料)

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 北美洲

第7章 競爭格局

- 公司簡介

- ABB Ltd

- Atmel Corporation

- Siemens AG

- ST Microelectronics

- NXP Semiconductors

- General Electric Company

- Emerson Electric Co.

- Analog Devices

- Radiocrafts AS

- Honeywell International Inc.

- Silicon Laboratories

- Yokogawa Electric Corporation

第8章投資分析

第9章 市場機會及未來趨勢

The Wireless Sensors Network Market size is estimated at USD 11.71 billion in 2024, and is expected to reach USD 38.07 billion by 2029, growing at a CAGR of 26.59% during the forecast period (2024-2029).

There are many applications of wireless sensor networks in robotics, such as advanced robotic sensing, multiple robot coordination, robot planning and navigation, and robot localization. Using wireless sensor networks helps emergency response robots to be conscious of conditions, such as electromagnetic field monitoring, forest fire detection, etc.

Key Highlights

- The growing automation and robotics industry, increasing demand for a wireless sensor network in asset monitoring, security, and transportation, and improved reliability with communication technology advancements are the significant factors driving the market for wireless sensor networks (WSN).

- Owing to the increased government regulation for the increased use of sensors for safety, the demand for wireless sensors is growing, for instance, in areas with challenging environmental conditions, such as extremely high pressure and high temperature. With the help of wireless sensors, it becomes easy to control and monitor the facility from a safe distance continually. They help acquire data from locations that are difficult to access.

- The rising adoption of IoT (Internet-of-Things) is another major factor driving the market's growth. This growth in IoT-connected devices is projected to fuel the demand for wireless sensor networks.

- Sensor manufacturers heavily invest in technology to cater to emerging verticals, such as smart cities and autonomous vehicles, which are substantially dependent on wireless technologies. Innovation in sensor technologies, such as intelligent sensors, is expected to support the rapid adoption of wireless technologies in the market. All these factors are expected to contribute to the growth of the wireless sensor network market.

- Despite their highly practical usefulness, there are some challenges in using wireless sensor network systems. There are vast differences in the scale of such sensor networking systems, as the number of sensor nodes may vary from a few to several. An adjustment also follows this in the density of deployment. The software and hardware design needs to be optimized to operate effectively for the task at hand, given that wireless sensor nodes have to function on an insufficient power supply.

- WSN has several constraints like power supply, storage, and a large number of algorithms, so there is a serious challenge in the maintenance of all these. Like all internet-dependent applications, WSN also has an insecurity scare. In order to combat data thefts in all possible ways, it is necessary to implement appropriate data transmission management.

Wireless Sensors Network Market Trends

Medical Segment is Expected to Witness Significant Growth

- There are several issues facing the healthcare industry: soaring costs, growing incidences of medical errors, staffing shortages, aging populations, etc. Despite the challenges, healthcare professionals are under pressure to deliver improved services while at the same time adopting modern technologies. Long-term costs can be decreased, and the quality of services can be improved by offering ubiquitous healthcare. Wireless sensor networks can provide efficient solutions to an increasingly widespread healthcare system.

- Due to advances in sensors and network technologies that do not use much power, WSNs for healthcare have begun to emerge in recent years. The wireless sensor network is frequently emerging as a significant component of the next-generation healthcare system. They are a multihop Zigbee-based system that uses multicasting or broadcasting to deliver vital information. The speed and reliability of messages is an essential feature of such a system.

- They relate to the collection of real-time health information from various sensors. Wireless protocols, radio spectrum, data bandwidth, encryption, energy consumption, and mobility are essential features of these networks.

- With the development of wearable sensors, users can constantly monitor physiological data aided by wireless sensor networks in healthcare. During patient hospitalization or residence, a body area network will continue to monitor their health. This service may be helpful in emergency cases when it transfers data on patients' condition to a healthcare provider. Providing healthcare services for people, including memory enhancement, health data access, cancer detection, asthma symptoms, and blood glucose monitoring, can also be helpful.

- In addition, a new Internet of Medical Things has been set up in conjunction with telemedicine and will play an important role in the monitoring and prevention of diseases, RBSA Advisors reports. Analytics, tools, and machines driven by artificial intelligence can help healthcare providers select the right approach for each patient regarding more effective, accurate, and impactful interventions.

- In India, emerging technologies are helping the development of novel and better treatments while lowering costs. Over the next few years, artificial intelligence (AI), data, and IoMT will have swiftly expanded from simple devices that are designed to track vital signs such as heart pump rate and blood oxygen levels to smartwatches that are capable of even complex scans such as ECGs and smart textiles that can track blood pressure and also predict the risk of heart attacks.

North America Holds Largest Market Share

- North America is expected to be an important market for wireless sensor networks during the forecast period, as it is at the very early stage of adopting cutting-edge technologies like smart cities and building and industry automation. In addition, the WSN market's growth in the region is expected to be driven by technological advances in healthcare infrastructure and increasing consumer interest in wearables.

- The adoption of smart factories, intelligent manufacturing, and the presence of many industrial wireless sensor network manufacturers are expected to drive the growth of the North American market in the coming years. The presence of several key players, such as ABB Ltd, Emerson Electric Co., and Honeywell International Inc., is also expected to prompt market growth in this region.

- Wireless sensor networks were used in health applications to provide impaired interfaces, integrated patient monitoring, diagnostics, and drug administration in hospitals, telemonitoring of human physiological data, and tracking and monitoring of doctors or patients within a hospital.

- The North American freight railroad industry is also trying to leverage WSN onboard railcars for advanced monitoring and alerting. In railroad environments, freight train WSNs exhibit a linear chain-like topology of significant length.

- Furthermore, with the increasing penetration of wearable devices in the commercial market, wearable devices are also becoming increasingly popular for industrial usage due to their numerous benefits. For instance, Airbus implemented wearable devices in the aerospace and defense industries in collaboration with Accenture.

Wireless Sensors Network Industry Overview

The wireless sensors network market is fragmented. It is a highly competitive market without any single dominant player present in the market. The players are focused on strategic investments to innovate new products, collaborations and partnerships, and mergers and acquisitions to strengthen the market position.

- November 2023: STMicroelectronics released a new microcontroller (MCU) that fuses the company's expertise in wireless-device design with its high-performing and efficient STM32 architecture, especially valuable in remotely deployed applications, including metering and monitoring devices and data from alarm systems, actuators, and sensors in today's smart buildings, smart factories, and smart cities.

- October 2023: NXP Semiconductors announced the launch of AW693, a new automotive-qualified wireless connectivity solution. Designed for automotive from the ground up and part of the industry's most complete automotive wireless connectivity portfolio, AW693 enables concurrent dual Wi-Fi 6E and Bluetooth 5.3 connections, protected by NXP's integrated EdgeLock secure subsystem, to deliver many secure connections in the car.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.3.1 Topology

- 4.3.1.1 Star

- 4.3.1.2 Mesh

- 4.3.1.3 Hybrid

- 4.3.1.4 Tree

- 4.3.2 Sensors

- 4.3.2.1 MEMS

- 4.3.2.2 CMOS-based Sensors

- 4.3.2.3 LED Sensors

- 4.3.3 Network Technology (Connectivity)

- 4.3.3.1 Wireless HART

- 4.3.3.2 ZigBee

- 4.3.3.3 Wi-Fi

- 4.3.3.4 IPv6

- 4.3.3.5 Bluetooth

- 4.3.3.6 Dash 7

- 4.3.3.7 Z-Wave

- 4.3.1 Topology

- 4.4 Impact of Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Wireless Technologies

- 5.1.2 Reducing Cost of Wireless Sensors

- 5.2 Market Challenges

- 5.2.1 Higher Security Needs and Installation Costs

6 MARKET SEGMENTATION

- 6.1 By End-user

- 6.1.1 Military and Security

- 6.1.2 Medical

- 6.1.3 Transportation and Logistics

- 6.1.4 Oil and Gas

- 6.1.5 Water and Wastewater

- 6.1.6 Consumer Packaged Goods (Food and Beverage)

- 6.1.7 Other End-users

- 6.2 By Geography***

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 Japan

- 6.2.3.3 India

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.5.1 Brazil

- 6.2.5.2 Mexico

- 6.2.5.3 Argentina

- 6.2.6 Middle East and Africa

- 6.2.6.1 United Arab Emirates

- 6.2.6.2 Saudi Arabia

- 6.2.6.3 South Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 ABB Ltd

- 7.1.2 Atmel Corporation

- 7.1.3 Siemens AG

- 7.1.4 ST Microelectronics

- 7.1.5 NXP Semiconductors

- 7.1.6 General Electric Company

- 7.1.7 Emerson Electric Co.

- 7.1.8 Analog Devices

- 7.1.9 Radiocrafts AS

- 7.1.10 Honeywell International Inc.

- 7.1.11 Silicon Laboratories

- 7.1.12 Yokogawa Electric Corporation