|

市場調查報告書

商品編碼

1536867

汽車開關:市場佔有率分析、產業趨勢、成長預測(2024-2029)Automotive Switch - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

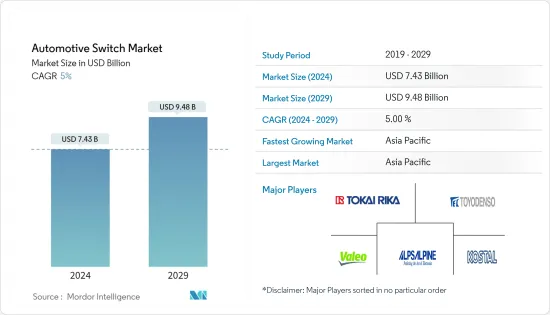

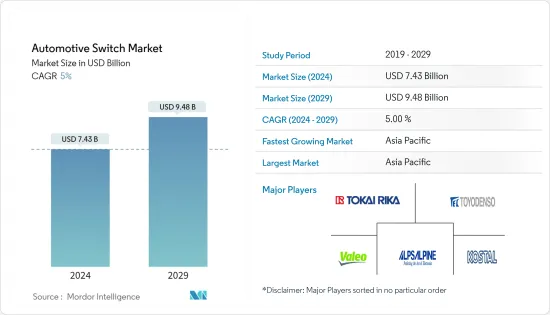

預計2024年汽車開關市場規模為74.3億美元,2029年達94.8億美元,在市場預測期間(2024-2029年)複合年成長率為5%。

從中期來看,汽車產量和電子設備使用量的增加可能會增加對開關的需求。此外,人們日益渴望使汽車變得更輕也將支持市場成長。

由於汽車中安裝的電子元件數量的增加以及燃油效率和廢氣法規的收緊,汽車開關的需求預計將增加。然而,由於虛擬助理的普及以及語音辨識技術整合到汽車中,未來市場可能會面臨障礙。

全球汽車服務中心的快速擴張推動了對汽車開關的需求。隨著汽車維修服務的持續成長,預計在預測期內對開關的需求也會增加。

由於汽車行業的成長以及對安全功能、資訊娛樂系統和暖通空調系統等技術先進車輛的需求不斷成長,亞太地區將繼續主導市場並在預測期內實現最高成長率。

汽車開關市場趨勢

電子系統開關正在經歷顯著成長

汽車產業正在經歷從硬體定義汽車到軟體定義汽車的重大轉變,每輛車的軟體和電子產品的平均數量不斷增加。這一轉變是由政府法規和消費者對系統控制更加自動化的願望所推動的,從而導致電子產品在汽車中的廣泛使用。

由於疫情和供應鏈中斷而導致的汽車產銷激增以及晶片短缺,預計將為預測期內的市場帶來積極前景。

人們越來越希望透過允許汽車與其他車輛和基礎設施通訊來使汽車變得更加智慧和方便,從而導致對新車電子系統的需求可能會迅速增加。

由於中檔和入門級汽車中的技術的可用性以及消費者購買基於該技術的售後市場產品,對汽車電子的需求正在增加。

動力傳動系統電氣化,特別是全電動汽車,可提供高能源效率和零廢氣排放。因此,純電動車市場將出現各種各樣的微控制器、功率半導體、開關和感測器,預計將推動汽車開關市場的擴張。

亞太地區佔主要市場佔有率

亞太地區引領汽車開關市場,其次是歐洲和北美。中國在亞太地區汽車開關市場佔據主導地位。該地區作為汽車市場佔有重要地位。此外,車輛電氣化程度的不斷提高以及電子穩定控制(ESC)和高級駕駛輔助系統(ADAS)等先進安全技術的興起正在主導亞太地區的汽車產業。

該國對乘用車的需求正在增加,未來幾年對開關的需求可能會增加。國家推出了安全法規,並實施了新車評估計畫(C-NCAP),其標準與歐洲標準相當。自從實施該規定以來,中國發生了重大的法律和社會變化。

汽車電氣化趨勢是推動汽車開關市場的關鍵因素。因此,汽車製造商擴大與電子製造商合作,以滿足消費者的需求。較低的系統價格也支持先進功能和半導體產品在中國的快速採用,這將對目標市場的成長產生積極影響。

由於政府的參與和消費者對系統更加自動控制的需求,電子產品在汽車中的使用正在增加。電子產品為提高能源效率和減少排放氣體提供了新的機會。汽車電子在所有車型中的高滲透率受到三個主要方面的影響:生產力、品質和創新。

多家中國汽車製造商正在轉型,以實現 2030 年碳峰值目標。東風計畫到 2024 年,其新乘用車 100% 實現電動化。據該公司稱,從2022年4月起,比亞迪將只生產純電動車和插電式混合動力車。

隨著全部區域的發展,汽車開關的需求預計在未來幾年將會成長。

汽車開關產業概況

汽車開關市場由多家主要企業主導,例如:東海理化(Tokai Rika)、奧托立夫(Autoliv Inc.)、大陸集團(Continental AG)、阿爾卑斯電氣(Alps Electric Co.)、松下電器(Panasonic Corporation)、海拉(Hella KGaA Hueck & Co.)、德昌電機(Johnson Electric Holdings Limited) 和法雷奧(Valeo) 等汽車零件製造商在全球範圍內的快速擴張可能會為汽車零件製造商創造機會。

- 2024年2月,卡莫尼產業宣布計畫在2026年投資3,400萬美元,在慶尚北道慶州市興建電氣元件工廠。新工廠將生產座椅電源模組開關和其他零件。

- 2024 年 2 月,隨著印度電動輕型商用車和公車前景的增強,Ashok Leyland 向 Optare PLC/Switch 投資了 8,000 萬美元。

- 2022 年 5 月,Marvell 發布了第三代 Marvell Brightlane 乙太網路交換器。這是汽車業最先進的安全託管交換器。此交換器具有雙核臂處理冗餘和鎖步功能,可確保支援車輛安全和性能的關鍵任務應用的高可靠性。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 汽車電氣化進展

- 市場限制因素

- 開關製造所用原料成本較高

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按開關類型

- 旋鈕

- 按鈕

- 墊片

- 按用途

- 指示系統開關

- 電子系統開關

- 空調

- EMS開關

- 按車型

- 客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Alps Alpine Co. Ltd

- Robert Bosch GmbH

- Continental AG

- Hella KGaA Hueck & Co.

- Omron Corporation

- Panasonic Corporation

- Tokai Rika Co. Ltd

- Minda Corporation Limited

- ZF Friedrichshafen AG

- Leopold Kostal GmbH & Co. KG

- Valeo SA

- Toyodenso Co. Ltd

第7章 市場機會及未來趨勢

第8章 主要供應商訊息

The Automotive Switch Market size is estimated at USD 7.43 billion in 2024, and is expected to reach USD 9.48 billion by 2029, growing at a CAGR of 5% during the forecast period (2024-2029).

Over the medium term, the production of vehicles and their use of electronics may increase, thus boosting the demand for switches. The growing preference for lightweight vehicles will also drive the market's growth.

The demand for automotive switches is expected to increase due to the rising electronic content in vehicles and the enactment of stricter fuel economy and emission regulations. However, the market may face obstacles in the future due to the growing popularity of virtual assistants and the integration of voice recognition technology in vehicles.

Demand for automotive switches accompanies the rapid expansion of vehicle service centers worldwide. As vehicle maintenance services continue to grow, the demand for switches will also rise during the forecast period.

Asia-Pacific is expected to continue to dominate the market studied and witness the highest growth rate during the forecast period, owing to the growing automotive industry and rising demand for technologically advanced vehicles, which include safety features, infotainment systems, and HVAC systems.

Automotive Switch Market Trends

Electronic System Switches Witnessing Major Growth

The automotive industry is undergoing a significant shift from hardware-defined to software-defined vehicles, leading to an increase in the average software and electronics content per vehicle. This shift is driven by government regulations and consumer demand for greater automatic control of systems, resulting in the widespread use of electronics in vehicles.

A surge in automotive production and sales following the pandemic and supply chain disruptions, along with chip shortages, is expected to create a positive outlook for the market during the forecast period.

There is a growing trend toward making cars more intelligent by allowing them to communicate with other vehicles and infrastructure through electronic systems, ensuring convenience for consumers, which may result in a rapid increase in the demand for electronic systems in new cars.

The demand for automotive electronics has increased due to technology availability in mid-range and entry-level cars and consumer purchase of technology-based aftermarket products.

The electrification of drivetrains, particularly in fully electric vehicles, offers high energy efficiency and zero tailpipe emissions. As a result, the emergence of a wide range of microcontrollers, power semiconductors, switches, and sensors for the pure electric vehicle market is expected to fuel the expansion of the automotive switch market.

Asia-Pacific Holds the Major Market Share

Asia-Pacific leads the automotive switch market, followed by Europe and North America. China dominates the Asia-Pacific automotive switch market. The country is a significant vehicle market in the region. It also dominates the Asia-Pacific automotive industry due to increased vehicle electrification and a rise in advanced technology for safety, such as ESC and advanced driver assistance systems (ADAS).

Rising demand for passenger cars across the country will likely increase the demand for switches in the coming years. The country has introduced safety regulations to run a new car assessment program (C-NCAP) with standards that will match Europe's standards. There have been significant legal and social changes in China since the implementation of these regulations.

The growing trend of vehicle electrification is a significant factor driving the automotive switch market. As a result, automotive manufacturers are increasingly collaborating with electrical component manufacturers to suit the needs of their consumers. Lower system prices have also aided in the rapid adoption of advanced features and semiconductor products in China, which will positively impact the target market's growth.

The usage of electronics in vehicles has increased due to government involvement and consumers' demand for greater automatic control of systems. Electronics provide new opportunities to improve energy efficiency and reduce emissions, as several functions can be consolidated into fewer and smaller electronic control superunits, reducing weight. The high penetration rate of automobile electronics across all vehicle classes is influenced by three major aspects: productivity, quality, and innovation.

Several automakers in China are making changes to match the 2030 carbon peaking aim. By 2024, Dongfeng intends to electrify 100% of its new passenger car models. According to the company, from April 2022 onwards, BYD will only produce BEVs and PHEVs.

With such development across the region, the demand for automotive switches is likely to grow in the coming years.

Automotive Switch Industry Overview

The automotive switch market is dominated by several key players such as Tokai Rika Co. Ltd, Autoliv Inc., Continental AG, Alps Electric Co., Panasonic Corporation, Hella KGaA Hueck & Co., Johnson Electric Holdings Limited, and Valeo. The rapid expansion of automotive component manufacturers across the world is likely to create an opportunity for the market in the coming years. For instance,

- In February 2024, Duck Il Industry Co. Ltd announced its plan to invest USD 34 million by 2026 to construct an electrical component factory in Gyeongju, Gyeongsangbuk-do. The new facility will manufacture seat power module switches and other components.

- In February 2024, Ashok Leyland invested USD 80 million in Optare PLC/Switch as prospects of e-LCVs and buses strengthened in India.

- In May 2022, Marvell introduced its third-generation Marvell Brightlane Ethernet Switch, the most advanced secure managed switch in the automotive industry. The switch features dual-core arm processing redundancy with lockstep to ensure high reliability for mission-critical applications that support vehicle safety and performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Rise in Vehicle Electrification

- 4.2 Market Restraints

- 4.2.1 The Cost of Raw Materials Used in the Manufacturing of Switches is High

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value - USD)

- 5.1 By Switch Type

- 5.1.1 Knob

- 5.1.2 Button

- 5.1.3 Touchpad

- 5.2 By Application

- 5.2.1 Indicator System Switches

- 5.2.2 Electronic System Switches

- 5.2.3 HVAC

- 5.2.4 EMS Switches

- 5.3 By Vehicle Type

- 5.3.1 Passenger Cars

- 5.3.2 Commercial Vehicles

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Alps Alpine Co. Ltd

- 6.2.2 Robert Bosch GmbH

- 6.2.3 Continental AG

- 6.2.4 Hella KGaA Hueck & Co.

- 6.2.5 Omron Corporation

- 6.2.6 Panasonic Corporation

- 6.2.7 Tokai Rika Co. Ltd

- 6.2.8 Minda Corporation Limited

- 6.2.9 ZF Friedrichshafen AG

- 6.2.10 Leopold Kostal GmbH & Co. KG

- 6.2.11 Valeo SA

- 6.2.12 Toyodenso Co. Ltd