|

市場調查報告書

商品編碼

1536880

全球塑膠包裝:市場佔有率分析、產業趨勢與統計、成長趨勢預測(2024-2029)Global Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

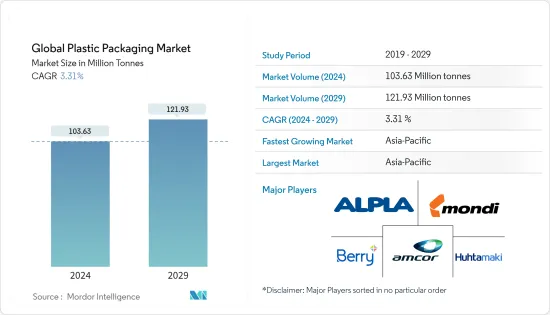

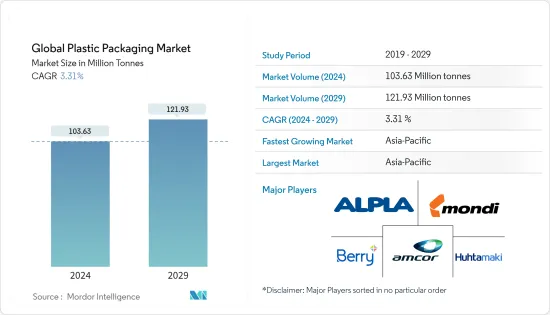

預計2024年全球塑膠包裝市場規模為1,0363萬噸,預估2029年將達1,2,193萬噸,預測期間(2024-2029年)複合年成長率為3.31%

主要亮點

- 塑膠包裝因其耐用性、靈活性和成本效益而成為消費者的熱門選擇。這種包裝形式利用塑膠薄膜、容器或其他聚合物材料來形成針對外部元素的屏障,為包裝各種產品提供了多功能且輕巧的解決方案。塑膠容器在食品和飲料、化妝品和製藥行業中變得至關重要。

- 新的填充技術和耐熱包裝材料的出現為市場帶來了新的可能性和選擇。化妝品、衛生用品和清潔劑主要以聚乙烯 (PE) 瓶出售,儘管寶特瓶在多個行業中已作為標準瓶使用。

- 根據經合組織的報告,已有120多個國家對一次性塑膠製品實施了禁令或課稅,但這些措施往往無法有效減少整體污染。許多法規都針對塑膠購物袋等物品,這些物品僅佔塑膠廢棄物的一小部分,並且在減少亂丟垃圾方面比解決更廣泛的塑膠消耗問題更成功。此外,只有少數國家引入了掩埋或焚燒稅來獎勵回收,這凸顯出需要更全面的策略來解決全球塑膠污染問題。

- 多家跨國公司越來越認知到將 PET 回收用於飲料容器等食品級產品的迫切性。這一趨勢可能會推動全球對 PET 的需求。例如,可口可樂計劃在 2030 年之前在其容器中使用 50% 的回收 PET。聯合利華也致力於到 2025 年使其塑膠包裝 100% 可重複使用或可回收。

- 電子商務行業的快速擴張預計將為市場擴張創造新的機會。為了降低運輸成本,電子商務公司更喜歡輕且靈活的包裝選擇。隨著越來越多的人每天在網路上購買生鮮食品、快速消費品、電子產品、服飾等,該行業預計將蓬勃發展。

- 此外,隨著活性包裝、改性環保包裝、可食用包裝和生質塑膠包裝等創新包裝解決方案的持續推出,預計未來幾年塑膠包裝將迎來更大的商機。然而,永續性意識的增強以及為減少塑膠污染而嚴格禁止一次性塑膠的做法預計將對該行業的生存構成挑戰。

塑膠包裝市場趨勢

食品領域在市場研究中佔據主要佔有率

- 食品包裝產業是塑膠的最大用戶之一。食品業對硬質塑膠包裝的需求不斷成長,由於其重量輕和節省成本等有益特性,取代了紙板、金屬和玻璃等傳統材料。

- 烘焙產品消費的增加進一步推動了軟性塑膠包裝解決方案的採用,以延長保存期限並避免麵包淤積。市場正在對需求做出反應,大約80% 的烘焙產品以軟包裝形式出售,麵包店生產的麵包、小圓麵包和麵包卷的種類比以往任何時候都多,包括特色產品和無麩質產品。正在開發先進的解決方案。

- 供應商正在策略合作,以增強該細分市場的軟包裝。例如,2023年10月,專門從事可堆肥包裝解決方案的製造商Pakka Limited(原Yash Pakka Limited)宣布與以棗類保健食品聞名的營養品公司Brawny Bear合作,推出印度首款可堆肥軟包裝。

- 硬質塑膠包裝被納入塑膠瓶和容器中,在食品包裝應用行業中很受歡迎。由 HDPE 和 LDPE 材料製成的容器用於包裝醬料和其他消費品。此外,塑膠瓶和容器由於能夠延長包裝食品的保存期限而在食品工業中變得越來越重要。

- 目前的市場狀況顯示了全球對糖果零食產品軟包裝解決方案的需求。小袋、袋子和包裝紙等軟包裝形式因其多功能性、成本效益和延長保存期限的能力而廣泛應用於糖果零食行業。這些包裝解決方案提供便利性、便攜性和有吸引力的品牌機會,以增強產品吸引力和消費者體驗。此外,軟包裝可以結合可重新密封的功能,提高產品新鮮度並減少廢棄物。

- 根據經濟合作暨發展組織(OECD)統計,LLDPE和LDPE預計將佔包裝產品30%以上的佔有率。 HDPE 和 LDPE 因其優異的阻隔性、耐用性和安全性而常用於食品業的包裝。 HDPE 和 LDPE 通常用於瓶子、袋子和容器。此外,PE 薄膜擴大用於食品應用,因為它們提供靈活的保護屏障,可保持新鮮度、延長保存期限並增強產品的視覺吸引力。

亞太地區佔最大市場佔有率

- 亞太地區的包裝產業受到人均收入成長、社會氛圍變化和人口趨勢的強烈影響。因此,需要新的包裝材料、工藝和形式。

- 中國是塑膠包裝使用量最大的國家。午餐盒的增加趨勢、餐廳和超級市場數量的增加以及瓶裝水和飲料消費量的增加是推動市場成長的主要因素。

- 根據中國國家統計局統計,2023年,中國塑膠製品產量約7,489萬噸。中國塑膠製品的高產量預計將帶動各種硬質塑膠包裝產品的市場需求。

- 此外,市場供應商提供的產品強調了他們對永續性的承諾。例如,總部位於印度的層壓塑膠管製造商 Essel Propack 生產了可回收的 HDPE 阻隔管,作為其永續性承諾的一部分。 Platina 250 和 Green Maple Leaf (GML) 300 層壓管是為希望改用可回收且環保的阻隔包裝形式的品牌而設計的。

- 2023 年 7 月,百事印度公司宣布計劃在碳酸飲料類別中推出一款新的 100% 再生聚對苯二甲酸乙二醇酯 (rPET) 瓶。該公司推出這些瓶子是其在印度建立「PepsiCo Positive」(pep+)價值鏈努力的一部分,為循環經濟體係做出貢獻。

- 此外,瑪氏中國於2023年12月推出了採用單一材料軟質包裝的黑巧克力穀物士力架。新產品提供低碳水化合物和低血糖指數 (GI) 選項,並採用單一 PP 材料進行獨立包裝,秉承「回收設計」的理念,可透過指定路線輕鬆回收。

塑膠包裝行業概況

由於許多在國內和國際範圍內營運的參與者,全球塑膠包裝市場競爭非常激烈。該市場由 Alpra Group、Amcor PLC、Berry Global Inc. 和 Mondi PLC 等主要參與者組成。

- 2023 年 11 月,Amcor PLC 推出了新一代醫用層壓板解決方案。 Amcor 的最新創新推動了可在聚乙烯流中回收的全薄膜包裝的開發。這種新的包裝解決方案由單一材料聚乙烯 (PE) 層壓板組成,可用於多種包裝形式。可回收的蓋子可以替代用於手術單、導管、保護器以及注射和管道系統的 3D 熱成型包裝上的不可回收的蓋子。層壓材料也應用於手套和創傷護理材料等產品的2D袋中。

- 2023 年 7 月,總部位於印第安納州的 Berry World Inc. 將為具有道德和環保意識的清潔公司 Bio-D 生產由消費後回收塑膠 (PCR) 製成的可重複使用的瓶子。新型PCR瓶可在全國300多家加註店多次加註。與原生塑膠相比,使用 100% PCR 瓶每年可減少 14.3 噸二氧化碳排放。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 市場動態

- 市場促進因素

- 老年人口增加和疾病傳播

- 產品創新,例如相對低成本的小型化

- 市場挑戰

- 法規的動態性和缺乏處理重負載的能力

- 市場促進因素

第5章市場區隔

- 硬質塑膠包裝

- 材料

- 聚乙烯(PE)

- 聚對苯二甲酸乙二酯 (PET)

- 聚丙烯(PP)

- 聚苯乙烯 (PS) 和發泡聚苯乙烯 (EPS)

- 聚氯乙烯(PVC)

- 產品

- 瓶子和罐子

- 托盤和容器

- 最終用戶產業

- 食品

- 飲料

- 衛生保健

- 化妝品/個人護理

- 地區

- 北美洲

- 國家名稱

- 美國

- 加拿大

- 國家名稱

- 歐洲

- 國家名稱

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 國家名稱

- 亞洲

- 國家名稱

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 印尼

- 澳洲/紐西蘭

- 國家名稱

- 拉丁美洲

- 國家名稱

- 巴西

- 阿根廷

- 墨西哥

- 國家名稱

- 中東/非洲

- 國家名稱

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 國家名稱

- 北美洲

- 材料

- 軟塑膠包裝

- 材料類型

- 聚乙烯(PE)

- 雙軸延伸聚丙烯(BOPP)

- 流延聚丙烯 (CPP)

- 聚氯乙烯(PVC)

- 乙烯 - 乙烯醇(EVOH)

- 產品類型

- 小袋

- 包包

- 薄膜包裝

- 最終用戶產業

- 食品

- 烘焙產品

- 小吃

- 肉/雞肉/海鮮

- 糖果/糖果零食

- 寵物食品

- 飲料

- 化妝品/個人護理

- 衛生保健

- 地區

- 北美洲

- 國家名稱

- 美國

- 加拿大

- 國家名稱

- 歐洲

- 國家名稱

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 國家名稱

- 亞洲

- 國家名稱

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 國家名稱

- 拉丁美洲

- 國家名稱

- 巴西

- 阿根廷

- 墨西哥

- 國家名稱

- 中東/非洲

- 國家名稱

- 阿拉伯聯合大公國 (UAE)

- 南非

- 沙烏地阿拉伯

- 埃及

- 國家名稱

- 北美洲

- 材料類型

第6章 競爭狀況

- 公司簡介

- DS Smith PLC

- ES-Plastic GmbH

- Pact Group

- Liquibox(Olympus Partners)

- UFlex Limited

- Anchor Packaging LLC

- Plastipak Holdings Inc.

- Dart Container Corporation

- ALPLA Group

- Amcor PLC

- American Packaging Corporation

- Berry Global Inc.

- Constantia Flexibles Group GmbH

- Mondi PLC

- Novolex

- Printpack Inc.

- Reynolds Consumer Products Inc.

- Quadpack Industries SA

- Sealed Air Corporation

- Sigma Plastics Group

- Sonoco Products Company

- Tetra Pak International SA(Tetra Laval Group)

- Toppan Inc.

- Transcontinental Inc.

- Winpak Ltd

- Huhtamaki Oyj

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 55138

The Global Plastic Packaging Market size is estimated at 103.63 Million tonnes in 2024, and is expected to reach 121.93 Million tonnes by 2029, growing at a CAGR of 3.31% during the forecast period (2024-2029).

Key Highlights

- Plastic packaging has become a popular choice among consumers due to its durability, flexibility, and cost-effectiveness. This packaging form utilizes plastic films, containers, or other polymer-based materials to create a barrier against external elements, providing a versatile and lightweight solution for packaging a wide range of goods. Plastic containers are becoming essential in the beverage, food, cosmetics, and pharmaceutical industries.

- New filling technologies and the emergence of heat-resistant packaging material opened up new possibilities and options in the market. While PET bottles are standard in multiple segments, cosmetics, sanitary products, and detergents are predominantly sold in polyethylene (PE) bottles.

- As per the OECD report, while over 120 countries have implemented bans and taxes on single-use plastics, these measures often fall short of effectively reducing overall pollution. Many regulations primarily target items like plastic bags, which constitute a small fraction of plastic waste, proving more successful in lowering littering than addressing the broader issue of plastic consumption. Furthermore, only a minority of countries have implemented landfill and incineration taxes that provide incentives for recycling, highlighting a global need for more comprehensive strategies to tackle plastic pollution.

- Several global companies increasingly recognize the urgency of recycling PET into food-grade products, such as beverage containers. This trend can drive the demand for PET across the world. For instance, the Coca-Cola Company intends to use 50% recycled PET in its containers by 2030. Also, Unilever is committed to making 100% of its plastic packaging reusable or recyclable by 2025.

- The e-commerce industry's rapid expansion is expected to create new opportunities for market expansion. To cut the cost of transportation, e-commerce enterprises favor lightweight and flexible packaging options. The industry is anticipated to flourish as more people shop online for fresh foods, FMCG products, electrical devices, and clothing every day.

- Additionally, more significant opportunities for plastic packaging are anticipated in the upcoming years due to the growing introduction of innovative packaging solutions, including active packaging, modified environment packaging, edible packaging, and bioplastic packaging. However, the industry's existence is expected to be challenged by growing sustainability awareness and a strict prohibition on single-use plastic to reduce plastic pollution.

Plastic Packaging Market Trends

The Food Segment to Occupy Major Share in the Market Studied

- The food packaging industry is one of the largest users of plastics. The demand for rigid plastic packaging for the food industry is witnessing growth, as it is increasingly replacing traditional materials such as paperboard, metals, and glass owing to its beneficial properties, such as being lightweight and having reduced cost.

- The increasing consumption of bakery products is further driving the adoption of flexible plastic packaging solutions to increase shelf life and avoid chalky bread conditions. With roughly 80% of baked goods being sold in flexible packaging and bakeries now producing a more comprehensive range of bread, buns, and rolls than ever before, including specialty and gluten-free, market players are developing advanced solutions catering to the demand.

- Vendors are strategically partnering to enhance flexible packaging for the segment. For instance, in October 2023, Pakka Limited, formerly known as Yash Pakka Limited, a manufacturer specializing in compostable packaging solutions, introduced India's first-ever compostable flexible packaging through a collaboration with Brawny Bear, a nutrition company renowned for its date-based healthy food products.

- Rigid plastic packaging is incorporated in plastic bottles and containers, and it is popular in industries for food packaging applications. Containers made of HDPE and LDPE materials are used to pack sauces and other consumer goods. Moreover, plastic bottles and containers have gained importance in the food industry due to their ability to provide extended shelf life to packaged food items.

- The current market scenario indicates a global demand for flexible packaging solutions for sweets and confectionery products. Flexible packaging formats, such as pouches, bags, and wrappers, are widely used in the confectionery industry due to their versatility, cost-effectiveness, and ability to extend shelf life. These packaging solutions offer convenience, portability, and attractive branding opportunities, enhancing product appeal and consumer experience. In addition, flexible packaging can incorporate resealable features, improving product freshness and reducing waste.

- According to the Organisation for Economic Co-operation and Development (OECD), LLDPE and LDPE are anticipated to account for more than 30% share of the packaging products. HDPE and LDPE are commonly used in the food industry for packaging due to their excellent barrier properties, durability, and safety. HDPE and LDPE are often used for bottles, bags, and containers. Moreover, PE films are also increasingly used in food applications to provide a flexible, protective barrier that maintains freshness, extends shelf life, and enhances the visual appeal of products.

Asia-Pacific to Hold the Largest Market Share

- The Asia-Pacific packaging industry is heavily influenced by rising per capita income, changing social atmosphere, and demographics. As a result of the shift, new packaging materials, processes, and forms are required.

- China is the largest country contributing to plastic packaging usage. The growing trend of packed meals, the increasing number of restaurants and supermarkets, and increasing bottled water and beverage consumption are significant factors driving the market growth.

- According to the National Bureau of Statistics of China, in 2023, China produced about 74.89 million metric tons of plastic products. Such high production of plastic product use in China is expected to drive the market demand for various rigid plastic packaging products.

- Moreover, market vendors are offering products that focus on sustainability commitments. For instance, as part of its commitment to sustainability, Essel Propack, a manufacturer of laminated plastic tubes based in India, produced recyclable HDPE barrier tubes. Platina 250 and Green Maple Leaf (GML) 300 Lamitubes were created for brands looking to switch to recyclable, environmentally friendly barrier packaging formats.

- In July 2023, PepsiCo India announced its plans to launch new 100% recycled polyethylene terephthalate (rPET) bottles for its Carbonated Beverage category. The company is introducing these bottles as part of its efforts to build a 'PepsiCo positive' (pep+) value chain that contributes to a circular economy system in the country.

- Furthermore, in December 2023, Mars China launched a Snickers bar featuring dark chocolate cereal in mono-material flexible packaging. This new product offers low-sugar and low-glycemic index (GI) options and individual packaging made from mono PP material, adhering to the concept of 'Designed for Recycling' that can be easily recycled in designated channels.

Plastic Packaging Industry Overview

The global plastic packaging market is highly competitive because of the presence of many players running their businesses within national and international boundaries. The market is fragmented with the presence of major players like Alpla Group, Amcor PLC, Berry Global Inc., and Mondi PLC.

- In November 2023, Amcor PLC launched the next generation of its medical laminate solutions. Amcor's latest innovation enables the development of all-film packaging that is recyclable in the polyethylene stream. The new packaging solution consists of a mono-material polyethylene (PE) laminate that can be employed for a wide range of packaging formats. It can replace non-recyclable with recycle-ready lidding for 3D thermoformed packages that are used for drapes, catheters, protective materials, and injection and tubing systems. Laminates also find application in 2D pouches for products such as gloves and wound care materials.

- In July 2023, Indiana-based Berry Global launched a range of reusable bottles made from post-consumer recycled plastic (PCR) for The Bio-D Co., a cleaning company with an ethical and environmental focus. The new PCR bottles can be refilled multiple times at more than 300 refill stores across the country. The CO2 emissions saved by using 100% PCR bottles compared with virgin plastic amount to 14.3 tons annually.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Dynamics

- 4.4.1 Market Drivers

- 4.4.1.1 Growing Geriatric Population and Prevalence of Diseases

- 4.4.1.2 Product Innovations such as Downsizing Coupled with Relatively Low Costs

- 4.4.2 Market Challenges

- 4.4.2.1 Dynamic Nature of Regulations and Inability to Support Heavy Goods

- 4.4.1 Market Drivers

5 MARKET SEGMENTATION

- 5.1 RIGID PLASTIC PACKAGING

- 5.1.1 Material

- 5.1.1.1 Polyethylene (PE)

- 5.1.1.2 Polyethylene Terephthalate (PET)

- 5.1.1.3 Polypropylene (PP)

- 5.1.1.4 Polystyrene (PS) and Expanded Polystyrene (EPS)

- 5.1.1.5 Polyvinyl Chloride (PVC)

- 5.1.2 Product

- 5.1.2.1 Bottles and Jars

- 5.1.2.2 Trays and containers

- 5.1.3 End-user Industry

- 5.1.3.1 Food

- 5.1.3.2 Beverage

- 5.1.3.3 Healthcare

- 5.1.3.4 Cosmetics and Personal Care

- 5.1.4 Geography

- 5.1.4.1 North America

- 5.1.4.1.1 Material

- 5.1.4.1.2 End-user Industry

- 5.1.4.1.3 Country

- 5.1.4.1.3.1 United States

- 5.1.4.1.3.2 Canada

- 5.1.4.2 Europe

- 5.1.4.2.1 Material

- 5.1.4.2.2 End-user Industry

- 5.1.4.2.3 Country

- 5.1.4.2.3.1 United Kingdom

- 5.1.4.2.3.2 Germany

- 5.1.4.2.3.3 France

- 5.1.4.2.3.4 Italy

- 5.1.4.2.3.5 Spain

- 5.1.4.3 Asia

- 5.1.4.3.1 Material

- 5.1.4.3.2 End-user Industry

- 5.1.4.3.3 Country

- 5.1.4.3.3.1 China

- 5.1.4.3.3.2 India

- 5.1.4.3.3.3 Japan

- 5.1.4.3.3.4 Australia

- 5.1.4.3.3.5 South Korea

- 5.1.4.3.3.6 Indonesia

- 5.1.4.3.3.7 Australia and New Zealand

- 5.1.4.4 Latin America

- 5.1.4.4.1 Material

- 5.1.4.4.2 End-user Industry

- 5.1.4.4.3 Country

- 5.1.4.4.3.1 Brazil

- 5.1.4.4.3.2 Argentina

- 5.1.4.4.3.3 Mexico

- 5.1.4.5 Middle East and Africa

- 5.1.4.5.1 Material

- 5.1.4.5.2 End-user Industry

- 5.1.4.5.3 Country

- 5.1.4.5.3.1 United Arab Emirates (UAE)

- 5.1.4.5.3.2 Saudi Arabia

- 5.1.4.5.3.3 South Africa

- 5.1.4.5.3.4 Egypt

- 5.1.4.1 North America

- 5.1.1 Material

- 5.2 FLEXIBLE PLASTIC PACKAGING

- 5.2.1 Material Type

- 5.2.1.1 Polyethene (PE)

- 5.2.1.2 Bi-orientated Polypropylene (BOPP)

- 5.2.1.3 Cast Polypropylene (CPP)

- 5.2.1.4 Polyvinyl Chloride (PVC)

- 5.2.1.5 Ethylene Vinyl Alcohol (EVOH)

- 5.2.2 Product Type

- 5.2.2.1 Pouches

- 5.2.2.2 Bags

- 5.2.2.3 Films and Wraps

- 5.2.3 End-user Industry

- 5.2.3.1 Food

- 5.2.3.1.1 Baked Food

- 5.2.3.1.2 Snacked Food

- 5.2.3.1.3 Meat, Poultry and Sea Food

- 5.2.3.1.4 Candy/Confections

- 5.2.3.1.5 Pet Food

- 5.2.3.2 Beverage

- 5.2.3.3 Cosmetics and Personal Care

- 5.2.3.4 Healthcare

- 5.2.4 Geography

- 5.2.4.1 North America

- 5.2.4.1.1 Material Type

- 5.2.4.1.2 End-user Industry

- 5.2.4.1.3 Country

- 5.2.4.1.3.1 United States

- 5.2.4.1.3.2 Canada

- 5.2.4.2 Europe

- 5.2.4.2.1 Material Type

- 5.2.4.2.2 End-user Industry

- 5.2.4.2.3 Country

- 5.2.4.2.3.1 United Kingdom

- 5.2.4.2.3.2 Germany

- 5.2.4.2.3.3 France

- 5.2.4.2.3.4 Italy

- 5.2.4.2.3.5 Spain

- 5.2.4.3 Asia

- 5.2.4.3.1 Material Type

- 5.2.4.3.2 End-user Industry

- 5.2.4.3.3 Country

- 5.2.4.3.3.1 China

- 5.2.4.3.3.2 India

- 5.2.4.3.3.3 Japan

- 5.2.4.3.3.4 Australia and New Zealand

- 5.2.4.4 Latin America

- 5.2.4.4.1 Material Type

- 5.2.4.4.2 End-user Industry

- 5.2.4.4.3 Country

- 5.2.4.4.3.1 Brazil

- 5.2.4.4.3.2 Argentina

- 5.2.4.4.3.3 Mexico

- 5.2.4.5 Middle East and Africa

- 5.2.4.5.1 Material Type

- 5.2.4.5.2 End-user Industry

- 5.2.4.5.3 Country

- 5.2.4.5.3.1 United Arab Emirates (UAE)

- 5.2.4.5.3.2 South Africa

- 5.2.4.5.3.3 Saudi Arabia

- 5.2.4.5.3.4 Egypt

- 5.2.4.1 North America

- 5.2.1 Material Type

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 DS Smith PLC

- 6.1.2 ES-Plastic GmbH

- 6.1.3 Pact Group

- 6.1.4 Liquibox (Olympus Partners)

- 6.1.5 UFlex Limited

- 6.1.6 Anchor Packaging LLC

- 6.1.7 Plastipak Holdings Inc.

- 6.1.8 Dart Container Corporation

- 6.1.9 ALPLA Group

- 6.1.10 Amcor PLC

- 6.1.11 American Packaging Corporation

- 6.1.12 Berry Global Inc.

- 6.1.13 Constantia Flexibles Group GmbH

- 6.1.14 Mondi PLC

- 6.1.15 Novolex

- 6.1.16 Printpack Inc.

- 6.1.17 Reynolds Consumer Products Inc.

- 6.1.18 Quadpack Industries SA

- 6.1.19 Sealed Air Corporation

- 6.1.20 Sigma Plastics Group

- 6.1.21 Sonoco Products Company

- 6.1.22 Tetra Pak International SA (Tetra Laval Group)

- 6.1.23 Toppan Inc.

- 6.1.24 Transcontinental Inc.

- 6.1.25 Winpak Ltd

- 6.1.26 Huhtamaki Oyj

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219