|

市場調查報告書

商品編碼

1536899

網路自動化:市場佔有率分析、產業趨勢/統計、成長預測(2024-2029)Network Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

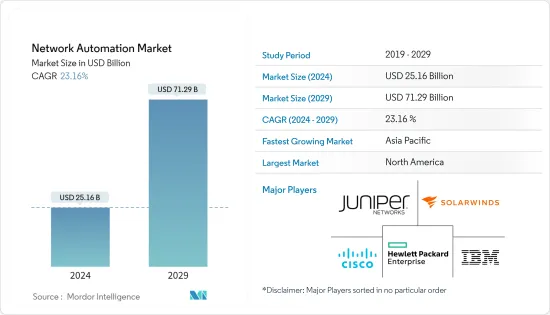

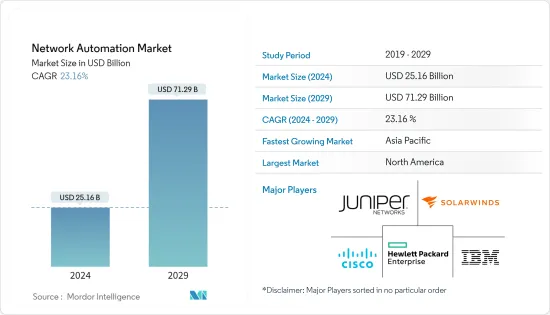

全球網路自動化市場規模預計在2024年達到251.6億美元,並在2024-2029年預測期內以23.16%的複合年成長率成長,到2029年將達到712.9億美元。

近年來,由於網路複雜性不斷增加以及對高效管理解決方案的需求,網路自動化市場顯著成長。這一成長的主要驅動力是雲端運算和虛擬技術的廣泛採用,這需要更敏捷和可擴展的網路基礎架構。

主要亮點

- 軟體定義網路 (SDN) 與網路功能虛擬(NFV) 技術整合,透過虛擬利用網路自動化,根據業務和服務目標配置和修改網路。 SDN 控制硬體設備的運作方式。管理員可以在虛擬機器之間建立虛擬軟體網路或使用網路軟體管理多個實體網路。

- 網路虛擬和網路自動化在發生意外使用高峰的環境中特別有用。自動化網路可以透過自動將網路流量重新導向到網路中受影響較小區域的伺服器來處理這些峰值。

- 物聯網設備的激增和對即時資料處理的需求進一步增加了對自動化處理大量網路流量和設備的需求。企業正在透過減少人工錯誤、提高營運效率和實現更快的服務部署來實現自動化的成本節約優勢。

- 網路自動化市場缺乏熟練的專業人員是尋求採用先進網路技術的行業的主要限制。網路自動化系統的複雜性是一項重大挑戰,需要程式設計、網路架構和網路安全方面的專業知識。

- 幾個宏觀經濟因素正在顯著影響網路自動化市場。其中包括經濟成長、全球貿易動態、利率、勞動力市場狀況、監管轉變、技術進步、地緣政治穩定性、數位轉型努力和永續性考量。總的來說,這些趨勢將影響網路自動化技術的採用和發展,使企業和政策制定者能夠做出明智的決策。

網路自動化市場趨勢

IT 和通訊最終用戶產業預計將佔據主要市場佔有率

- 智慧型手機的快速普及和連網設備數量的不斷增加正在給現有的通訊網路帶來壓力。結果,網路營運商遭受頻寬不足和擁塞的困擾,導致通話中斷和網路效能不穩定。這就是網路自動化需求出現的地方。

- IT 和通訊業研究市場的成長是由於連接設備和服務的激增而導致網路複雜性不斷增加所推動的。部署 5G 網路需要可擴展且靈活的解決方案,而自動化可以實現這一點。

- 自動化透過實現快速威脅檢測和回應來提高網路安全性。它還透過確保一致的網路效能和可靠性來提高服務質量,提高用戶體驗和客戶滿意度。

- 2024 年 2 月,戴爾科技集團宣布推出一套解決方案,協助通訊服務供應商(CSP) 簡化網路雲端和營運轉型。戴爾利用其在數位轉型方面的豐富經驗和強大的產業合作夥伴關係來建立可降低通訊服務提供者風險的通訊解決方案。這些解決方案旨在簡化部署、自動化操作、支援隔離的網路雲端基礎架構並簡化生命週期管理。

- 2024 年 5 月,全球領先的通訊技術公司塔塔通訊 (Tata Communications) 宣布推出 Tata Communications CloudLyte。這個先進的平台是完全自動化的,專注於邊緣運算,幫助企業在日益以資料為中心的環境中取得成功。 Tata Communications CloudLyte 透過提供與存取方法、雲端供應商和基礎設施無關的多功能架構而在邊緣運算領域脫穎而出,使其成為全球企業的首選。

- GSMA 預測,2021 年至 2030 年間,物聯網連線總數將翻倍,達到 374 億個。不斷擴大的物聯網生態系統正在推動這一趨勢。 2021 年至 2030 年間,優先區域的授權蜂巢式物聯網連線數量將加倍,達到 1.56 億。因此,物聯網的實施本身並不是一項技術,而是整合了與感測、自動化、軟體和雲端運算相關的各種技術。

- 隨著企業擁抱超連接以及 5G 和物聯網等技術的發展勢頭,對即時資料處理、低延遲應用和智慧決策的需求變得至關重要,從而顯著推動市場成長機會。

預計北美將佔據較大市場佔有率

- 美國擁有北美最大的市場佔有率,處於網路自動化市場的前沿。這得到了思科、IBM、SolarWinds、VMWare、Extreme Networks 和 Juniper Networks 等領先解決方案供應商的強大支持。

- 該地區預計將看到 5G 技術的採用和部署迅速激增。根據愛立信的研究,5G 用戶總數預計將從 2023 年的 2.6 億躍升至 2028 年的 4.2 億。隨著5G的日益普及,對先進網路服務的需求將會增加,對網路自動化的需求也會增加。

- 各種先進技術的興起,包括基於 SaaS 的應用程式、網路分析、DevOps 和虛擬,正在推動北美用戶和企業採用網路自動化解決方案。這包括意圖式網路、SD-WAN 和各種網路自動化工具。

- 從最終用戶產業來看,IT 和通訊產業預計將在北美網路自動化市場中實現最大的成長。這種快速成長背後的主要因素是對高效網路管理的需求不斷增加、5G技術的部署以及雲端服務的擴展。隨著資料流量和連接設備的增加,自動化解決方案對於處理複雜的網路操作和確保網路安全變得至關重要。

網路自動化產業概況

網路自動化市場高度分散,主要參與者包括思科系統公司、瞻博網路公司、IBM公司、惠普企業、Development LP和SolarWinds公司。市場競爭正在透過聯盟、收購等策略來增強產品陣容並獲得永續的競爭優勢。

- 2024 年 3 月:IBM 宣布收購著名網路和IT基礎設施自動化產品供應商 Pliant。 Pliant 的功能對於自動化網路和IT基礎設施任務以及將這些功能抽像到應用程式層至關重要。這使應用程式和開發人員可以直接在應用程式內控制簡化的配置和基礎架構管理。

- 2024 年 1 月:瞻博網路宣布推出業界首個 AI 原生網路平台。該平台經過專門設計,利用人工智慧確保通訊業者和最終用戶獲得最佳體驗。瞻博網路的平台源自於七年的知識和資料科學。經過精心設計,可在所有連接(包括裝置、使用者、應用程式和資產)中提供可靠性、可測量性和安全性。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 技術簡介

- 宏觀經濟走勢對市場的影響

第5章市場動態

- 市場促進因素

- 資料中心網路需求增加

- 連網型設備的成長趨勢

- 市場限制因素

- 各行業缺乏專業工程師

第6章 市場細分

- 依網路類型

- 身體的

- 虛擬的

- 混合

- 按成分

- 解決方案類型

- 網路自動化工具

- SD-WAN/網路虛擬

- 意圖式網路

- 服務類型

- 託管服務

- 專業服務

- 解決方案類型

- 按發展

- 雲

- 本地

- 混合

- 按最終用戶產業

- 資訊科技/通訊

- 製造業

- 能源/公共產業

- 銀行/金融服務

- 教育

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Cisco Systems Inc.

- Juniper Networks Inc.

- IBM Corporation

- Hewlett Packard Enterprise Company

- Solarwinds Corporation

- Fortra LLC

- Open Text Corporation

- NetBrain Technologies Inc.

- Arista Networks Inc.

- Extreme Networks Inc.

- BMC Software Inc.

- Fujitsu Limited

- Broadcom Inc.

- Nuage Networks(Nokia Corporation)

- Forward Networks Inc.

- AppViewX Inc.

第8章投資分析

第9章市場的未來

The Network Automation Market size is estimated at USD 25.16 billion in 2024, and is expected to reach USD 71.29 billion by 2029, growing at a CAGR of 23.16% during the forecast period (2024-2029).

The network automation market has significantly grown in recent years, driven by the increasing complexity of networks and the need for efficient management solutions. The key driver behind this growth is the rising adoption of cloud computing and virtualization technologies, which has necessitated more agile and scalable network infrastructures.

Key Highlights

- Software-defined networking (SDN) is integrated with network functions virtualization (NFV) technology to configure and change the network according to business or service goals while using network automation with virtualization. The SDN controls how the hardware devices operate. Administrators can create virtual software networks between virtual machines or manage multiple physical networks with networking software.

- Network virtualization and network automation are especially useful for environments that experience unplanned usage surges because the automated network can accommodate these surges by automatically redirecting network traffic to servers in less impacted areas of the network.

- The proliferation of IoT devices and the demand for real-time data processing have further fueled the need for automation to handle the sheer volume of network traffic and devices. Enterprises are recognizing the cost-saving benefits of automation by reducing manual errors, improving operational efficiency, and enabling faster service deployment.

- The shortage of skilled professionals in the network automation market presents a significant restraint for industries seeking to adopt advanced networking technologies. The complexity of network automation systems presents a significant challenge, necessitating expertise in programming, network architecture, and cybersecurity.

- Several macroeconomic factors significantly influence the network automation market. These include economic growth, global trade dynamics, interest rates, labor market conditions, regulatory shifts, technological advancements, geopolitical stability, digital transformation efforts, and sustainability considerations. These trends collectively shape the adoption and evolution of network automation technologies, enabling businesses and policymakers to make informed decisions.

Network Automation Market Trends

IT and Telecom End-user Industry is Expected to Hold Significant Market Share

- The surge in smartphone adoption and the expanding web-connected device count have strained existing telecom networks. Consequently, network operators grapple with bandwidth shortages and congestion, resulting in call drops and erratic network performance. It is when the demand for network automation comes into play.

- The growth of the market studied in the IT and telecom industry is driven by the increasing complexity of networks due to the proliferation of connected devices and services. The rollout of 5G networks demands scalable and flexible solutions, which automation provides.

- Automation improves network security by enabling rapid threat detection and response. It also enhances service quality by ensuring consistent network performance and reliability, improving user experiences and customer satisfaction.

- In February 2024, Dell Technologies unveiled a suite of solutions tailored to assist communications service providers (CSPs) in streamlining their network cloud and operational transformations. Leveraging its widespread experience in digital transformation and robust industry collaborations, Dell is crafting telecom solutions to mitigate risks for CSPs. These solutions are designed to streamline deployment, automate operations, and simplify support and lifecycle management for disaggregated network cloud infrastructures.

- In May 2024, Tata Communications, a prominent player in the global communication technology sector, introduced Tata Communications CloudLyte. This advanced platform is fully automated and focuses on edge computing, aiming to equip enterprises for success in an increasingly data-centric environment. Tata Communications CloudLyte stands out in edge computing, offering a versatile architecture that is agnostic to access methods, cloud providers, and infrastructure, making it a fitting choice for enterprises globally.

- GSMA estimates that the total number of IoT connections will double between 2021 and 2030, reaching 37.4 billion. The expanding IoT ecosystem assists it. Licensed cellular IoT connections in the focus regions will double between 2021 and 2030, reaching 156 million. Therefore, rather than being a technology by itself, IoT deployment integrates various technologies related to sensing, automation, software, and cloud computing.

- With businesses embracing hyperconnectivity and technologies such as 5G and IoT gaining momentum, the demand for real-time data processing, low-latency applications, and smart decision-making has become paramount, driving the market's growth opportunities significantly.

North America is Expected to Hold Significant Market Share

- With the most significant market share in North America, the United States is at the forefront of the network automation market. This is underpinned by the robust presence of major solution providers such as Cisco, IBM, SolarWinds, VMWare, Extreme Networks, and Juniper Networks.

- The region is poised for a swift surge in the adoption and implementation of 5G technology. As per Ericsson's study, the total number of 5G subscriptions is projected to soar to an estimated 420 million by 2028, up from a mere 260 million in 2023. This rise in the adoption of 5G is set to fuel a greater need for advanced network services, subsequently spurring the need for increased network automation.

- The rise of various advanced technologies, such as SaaS-based applications, network analytics, DevOps, and virtualization, has spurred users and businesses in North America to adopt network automation solutions. These include intent-based networking, SD-WAN, and various network automation tools.

- By end-user industry, the IT and telecom industry is poised for the most significant growth in the North American network automation market. This surge is mainly driven by the growing demand for efficient network management, the rollout of 5G technology, and the expansion of cloud services. As data traffic and connected devices multiply, automated solutions become essential for handling complex network operations and ensuring cybersecurity.

Network Automation Industry Overview

The network automation market is highly fragmented, with major players like Cisco Systems Inc., Juniper Networks Inc., IBM Corporation, Hewlett Packard Enterprise, Development LP, and SolarWinds Inc. Market players adopt strategies like partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- March 2024: IBM announced its acquisition of Pliant, a prominent network and IT infrastructure automation product provider. Pliant's capabilities are crucial for automating network and IT infrastructure tasks and abstracting these functions to the application layer. This gives applications and developers maximum control over simplified provisioning and infrastructure management directly within applications.

- January 2024: Juniper Networks unveiled the industry's pioneering AI-native networking platform. This platform is specifically engineered to harness AI, guaranteeing optimal experiences for operators and end-users. Juniper's platform is drawn from seven years of insights and data science. It is meticulously crafted to deliver reliability, measurability, and security across all connections, whether for devices, users, applications, or assets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Technology Snapshot

- 4.5 Impact of Macroeconomic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Data Center Network

- 5.1.2 Rising Trend of Connected Devices

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professional Across Industries

6 MARKET SEGMENTATION

- 6.1 By Network Type

- 6.1.1 Physical

- 6.1.2 Virtual

- 6.1.3 Hybrid

- 6.2 By Component

- 6.2.1 Solution Type

- 6.2.1.1 Network Automation Tools

- 6.2.1.2 SD-WAN and Network Virtualization

- 6.2.1.3 Intent-based Networking

- 6.2.2 Service Type

- 6.2.2.1 Managed Service

- 6.2.2.2 Professional Service

- 6.2.1 Solution Type

- 6.3 By Deployment

- 6.3.1 Cloud

- 6.3.2 On-premise

- 6.3.3 Hybrid

- 6.4 By End-user Industry

- 6.4.1 IT and Telecom

- 6.4.2 Manufacturing

- 6.4.3 Energy and Utility

- 6.4.4 Banking and Financial Services

- 6.4.5 Education

- 6.4.6 Other End-user Industries

- 6.5 By Geography***

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Cisco Systems Inc.

- 7.1.2 Juniper Networks Inc.

- 7.1.3 IBM Corporation

- 7.1.4 Hewlett Packard Enterprise Company

- 7.1.5 Solarwinds Corporation

- 7.1.6 Fortra LLC

- 7.1.7 Open Text Corporation

- 7.1.8 NetBrain Technologies Inc.

- 7.1.9 Arista Networks Inc.

- 7.1.10 Extreme Networks Inc.

- 7.1.11 BMC Software Inc.

- 7.1.12 Fujitsu Limited

- 7.1.13 Broadcom Inc.

- 7.1.14 Nuage Networks (Nokia Corporation)

- 7.1.15 Forward Networks Inc.

- 7.1.16 AppViewX Inc.