|

市場調查報告書

商品編碼

1536901

汽車防撞系統:市場佔有率分析、產業趨勢、成長預測(2024-2029)Automotive Collision Avoidance Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

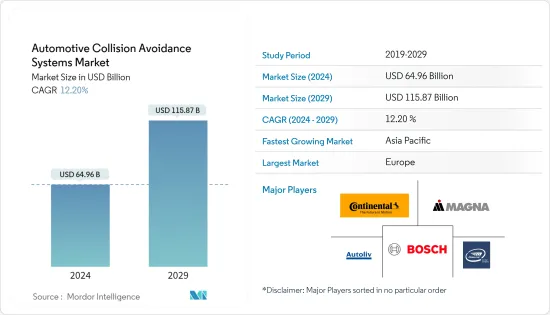

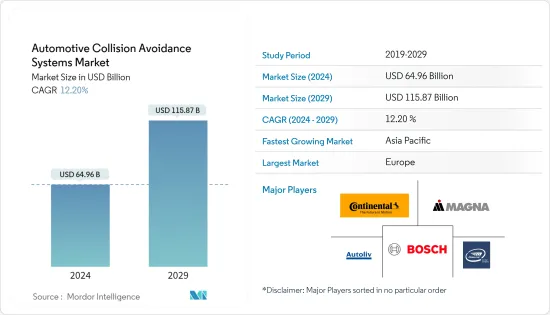

汽車防撞系統市場規模預計到2024年為649.6億美元,預計到2029年將達到1158.7億美元,在預測期內(2024-2029年)複合年成長率為12.20%。

汽車防撞系統透過接收環境輸入並進行相應調整來防止即將發生的碰撞。它在複雜的情況下為駕駛員進行控制並執行複雜的功能。它還使用感測器和攝影機來收集資料,然後由控制器單元進行處理。這些裝置會向駕駛員發送訊號,提醒他們注意自己的駕駛和其他駕駛員的駕駛,這可能會增加碰撞或受傷的風險。

政府為改善車輛安裝的安全系統而採取的各種措施被認為是主要的成長要素。例如,美國國家運輸安全委員會 (NTSB) 發布了 10 項最需要的運輸安全改進措施清單。該清單提案了可以安裝在汽車中以確保乘客安全的技術。

對自動駕駛汽車不斷成長的需求正在推動對汽車防撞系統的需求。然而,高昂的安裝成本阻礙了市場的成長。同時,人們對車輛安全標準的日益關注以及車輛電子整合的增加預計將為防撞系統市場創造進一步擴張的機會。

汽車防撞系統市場趨勢

LiDAR市場在預測期內將顯著成長

ADAS(高階駕駛輔助系統)市場預計在預測期內將出現顯著成長。各種組織和大型OEM所進行的安全宣傳活動數量不斷增加,是提高公眾車輛安全意識的一個主要因素。

客戶意識的提高導致對具有自動駕駛功能和先進安全功能的汽車的需求增加。 LiDAR 透過將雷射光束照射到目標上並用感測器測量其反射來測量距離。汽車LiDAR系統主要用於半自動或全自動駕駛輔助功能,例如碰撞警告和避免系統、盲點監控、車道維持車道維持系統、車道偏離警告和主動車距控制巡航系統。它還為自動駕駛汽車的所有駕駛模式提供完全自動化。

自動駕駛和半自動駕駛汽車行業新興市場的發展、政府對配備 ADAS 的車輛的日益關注以及對 LiDAR新興企業的投資和資金籌措激增預計將推動市場成長。

例如,2023 年 11 月,AEye Inc. 宣布推出 4Sight(TM) Flex 艙內雷射雷達系統。它擁有 120° 水平 (H) x 30° 垂直 (V) 視野、高達 0.05° x 0.05° 的超高解析度以及在 10% 反射率下長達 275m 的遠距檢測,是AEye 的第一代產品所有設計的尺寸大約是原來的一半,耗電量卻比原來的低 40%。

汽車製造商和設備供應商的這種開拓,加上現有車輛的巨大規模和擴充性潛力,預計在預測期內該細分市場將出現強勁的成長率。

亞太地區是一個快速成長的市場

對配備 ADAS 的車輛的需求不斷成長以及政府的建設性支持預計將在預測期內推動目標市場的成長。隨著客戶需求的不斷增加,汽車製造商正在加大研發投入。感測器和技術的結合從根本上改變了汽車產業。此外,創新技術正在吸引新客戶,市場可能在預測期內顯著成長。

中國是亞太地區重要的汽車製造國家之一。中國擁有大量汽車製造商,可能在預測期內為市場創造利潤豐厚的機會。根據中國工業協會統計,2022年7月中國汽車銷量快速成長至242萬輛,與前一年同期比較同期成長29.7%。 2022年7月,包括純電動車、插電式混合動力汽車、氫燃料電池車在內的新能源車與前一年同期比較同期成長120%。

中國不僅是全球最大的電動車市場之一,也是成長最快的電動車製造商之一。許多企業也隨著中國汽車產業的發展,與合作夥伴一起擁抱創新,透過創新的新產品實現雙贏。

2023年2月,吉利汽車正式宣布推出全新超緊湊型電動車「熊貓Mini」。標準配備為9.2吋彩色儀錶板、ABS(防鎖死煞車系統)、EBD(電子煞車力道分配系統)。部分車型配備8吋中央顯示器和倒車相機,可在各種駕駛情況下為駕駛員提供協助。

汽車防撞系統產業概況

幾家公司主導著汽車防撞系統市場,包括大陸集團、德爾福、電裝、奧托立夫、Mobileye、松下和海拉。然而,該市場仍然吸引著一些新參與企業,表明該市場潛力巨大。這些公司計劃合作並投資最新的 ADAS 功能。例如,2023年11月,禾賽科技宣布與長城汽車建立汽車LiDAR設計夥伴關係。長城汽車多款乘用車將搭載禾賽超高解析度遠距LiDARAT128,計畫於2024年交付。

此外,2023 年 6 月,日產宣布開發一種基於LiDAR的新型高級駕駛員輔助技術,具有十字路口防撞功能。該技術採用基於利用下一代雷射雷達的地面實況感知技術的交叉路口防撞新控制邏輯。可以從側面檢測物體的速度、位置和潛在的碰撞風險。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場促進因素

- 自動駕駛汽車需求的擴大推動市場成長

- 市場限制因素

- 高安裝成本可能阻礙市場成長

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依功能類型

- 適應性

- 自動化

- 監控

- 警告

- 依技術類型

- 雷達

- LiDAR

- 相機

- 超音波

- 按車型分類

- 客車

- 商用車

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 挪威

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 其他亞太地區

- 世界其他地區

- 南美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 供應商市場佔有率

- 公司簡介

- Continental AG

- Delphi Automotive

- Denso Corporation

- Infineon Technologies

- Panasonic Corporation

- Robert Bosch GmbH

- ZF Group

- Autoliv Inc.

- Siemens AG

- Bendix Commercial Vehicle Systems LLC

- Toyota

- WABCO Vehicle Control Services

- Fujitsu Laboratories Ltd

- Magna International

- Mobileye

- Hyundai Mobis

- Hella KGaA Hueck & Co.

- National Instruments Corp.

第7章 市場機會及未來趨勢

- 擴大研發投入

The Automotive Collision Avoidance Systems Market size is estimated at USD 64.96 billion in 2024, and is expected to reach USD 115.87 billion by 2029, growing at a CAGR of 12.20% during the forecast period (2024-2029).

Automotive collision avoidance systems prevent imminent crashes by receiving environmental inputs and adapting accordingly. It takes control and performs complicated functions for drivers in complex situations. It also uses sensors and cameras to collect data and process it through controller units. These units send signals to drivers to alert them about concerns that increase the risk of collision and injury, both regarding their driving and other's driving.

Various initiatives by governments of different countries to improve the safety systems onboard a car are considered significant growth factors. For instance, the National Transportation Safety Board (NTSB) of the United States released a list of the 10 most wanted transportation safety improvements. This list suggests incorporating technologies that can be used to equip vehicles for passenger safety.

Growing demand for autonomous vehicles drives the demand for automobile collision avoidance systems. However, market growth is hindered by a high installation cost. On the other hand, rising concerns about automotive safety norms and increased electronic integration in vehicles are anticipated to generate further opportunities for expansion in the collision avoidance systems market.

Automotive Collision Avoidance Systems Market Trends

LiDAR Segment to Grow Significantly During The Forecast Period

The advanced driver assistance system (ADAS) market is expected to grow significantly during the forecast period. Increasing safety campaigns by different organizations and large-scale OEMs are significant factors for the increased public awareness of vehicle safety.

Rising awareness among customers is leading to a growth in the demand for vehicles with autonomous and advanced safety features. LiDAR is used to measure distances by illuminating the target with laser light and measuring the reflection with a sensor. The automotive LiDAR system is used mainly in Semi or fully autonomous vehicle assistance features such as collision warning & avoidance systems, blind-spot monitors, lane-keep assistance, lane-departure warning, and adaptive cruise control. They also offer complete automation under all driving modes for self-driving cars.

Increasing developments across the autonomous and semi-autonomous vehicle industry, rising emphasis from the governments for ADAS-incorporated vehicles, and a surge in investments and funding in LiDAR startups are some of the keys that are expected to drive the market growth.

For instance, in November 2023, AEye Inc. announced the launch of 4Sight(TM) Flex, In-cabin Lidar system. It boasts a 120o horizontal (H) x 30o vertical (V) field of view, with ultra-high resolution of up to 0.05° x 0.05° and long-range detection of up to 275 meters at 10% reflectivity, all at approximately half the size and up to 40% lower power consumption compared to AEye's first-generation design.

Due to such developments from both vehicle manufacturers and equipment suppliers, combined with the immense size and potential for scalability to existing vehicles, this segment of the market is anticipated to witness a significant growth rate during the forecast period.

Asia-Pacific is the Fastest-growing Market

Growing demand for ADAS-equipped vehicles and constructive government support are expected to boost the target market growth over the forecast period. With increased customer demand, automakers invest more in research and development. The combination of sensors and technology has fundamentally transformed the automotive industry. Furthermore, innovative technologies attract new customers, which is likely to witness major growth for the market during the forecast period.

China is one of the prominent countries in terms of vehicle manufacturing in Asia-Pacific. China has a major presence of automotive manufacturers, which is likely to create lucrative opportunities for the market during the forecast period. According to the China Association of Automobile Manufacturers (CAAM), China's auto sales surged 29.7% in July 2022, standing at 2.42 million units, compared to the previous year. The sales of new energy vehicles, including pure electric vehicles, plug-in hybrids, and hydrogen fuel-cell vehicles, increased by 120% in July 2022 from the previous year.

China is not only one of the world's largest EV markets, but it is also one of the fastest-growing EV manufacturers. Many players are also expanding alongside the Chinese automobile industry, embracing reforms alongside its partners in order to achieve win-win solutions through innovative new products.

In February 2023, Geely officially announced the launch of the new Panda Mini micro-electric vehicle. In standard configuration, the vehicle features a 9.2-inch color instrument panel, ABS (Anti-lock Braking System), and EBD (Electronic Brakeforce Distribution). Some models feature an 8-inch central display and a backup camera, assisting drivers in various driving scenarios.

Automotive Collision Avoidance Systems Industry Overview

A few players, such as Continental, Delphi, Denso, Autoliv, Mobileye, Panasonic, and Hella, dominate the automotive collision avoidance systems market. However, the market still attracts several new players, which indicates the great potential this market exhibits. They are entering partnerships and planning to invest in the latest ADAS features. For instance, in November 2023, Hesai Technology announced an automotive LIDAR design partnership with Great Wall Motors. Multiple passenger vehicle models from GWM will equip Hesai's ultra-high resolution long-range lidar AT128, with plans for mass production and delivery starting in 2024.

Additionally, in June 2023, Nissan Motors announced the development of new LIDAR-based advanced driver-assistance technology, which features intersection collision avoidance. The technology features a new control logic for intersection collision avoidance based on ground-truth perception technology utilizing next-generation LIDAR. It can detect an object's speed, location, and potential risk of a collision from a lateral direction.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Growing Autonomous Vehicle Demand To Propel The Market Growth

- 4.2 Market Restraints

- 4.2.1 High Installation Cost May Hamper The Market Growth

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Function Type

- 5.1.1 Adaptive

- 5.1.2 Automated

- 5.1.3 Monitoring

- 5.1.4 Warning

- 5.2 By Technology Type

- 5.2.1 Radar

- 5.2.2 Lidar

- 5.2.3 Camera

- 5.2.4 Ultrasonic

- 5.3 By Vehicle Type

- 5.3.1 Passenger Vehicle

- 5.3.2 Commercial Vehicle

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Norway

- 5.4.2.5 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Rest of the World

- 5.4.4.1 South America

- 5.4.4.2 Middle-East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Continental AG

- 6.2.2 Delphi Automotive

- 6.2.3 Denso Corporation

- 6.2.4 Infineon Technologies

- 6.2.5 Panasonic Corporation

- 6.2.6 Robert Bosch GmbH

- 6.2.7 ZF Group

- 6.2.8 Autoliv Inc.

- 6.2.9 Siemens AG

- 6.2.10 Bendix Commercial Vehicle Systems LLC

- 6.2.11 Toyota

- 6.2.12 WABCO Vehicle Control Services

- 6.2.13 Fujitsu Laboratories Ltd

- 6.2.14 Magna International

- 6.2.15 Mobileye

- 6.2.16 Hyundai Mobis

- 6.2.17 Hella KGaA Hueck & Co.

- 6.2.18 National Instruments Corp.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Investment In Research and Development