|

市場調查報告書

商品編碼

1536904

鉑族金屬 -市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Platinum Group Metals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

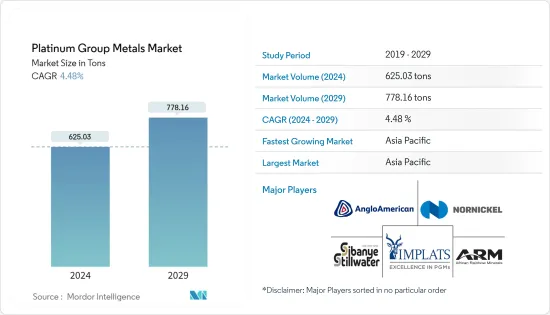

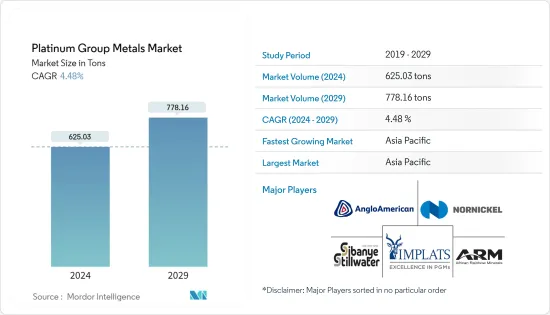

鉑族金屬市場規模預計到2024年為625.03噸,預計2029年將達到778.16噸,在預測期內(2024-2029年)複合年成長率為4.48%。

主要亮點

- COVID-19大流行對2020年的市場產生了負面影響。然而,市場預計將達到大流行前的水平,並在預測期內穩定成長。

- 短期內,市場成長預計將由汽車產業對觸媒轉換器的需求增加、電子產業對鉑、鈀和釕的需求增加以及亞太國家珠寶飾品消費的成長所推動。

- 然而,生產和維護鉑族金屬的高成本預計將阻礙市場成長。

- 然而,在預測期內,鉑金在綠色技術中的利用以及非洲國家對鉑金產業投資的增加可能會為市場創造機會。

- 預計亞太地區將在預測期內主導全球市場。預計預測期內複合年成長率將保持最高,這主要是由於汽車催化劑和珠寶飾品應用對銻的需求不斷增加。

鉑族金屬的市場趨勢

自動催化劑領域佔據市場主導地位

- 鉑族元素或鉑族金屬(PGM),包括鉑、鈀和銠,廣泛用作汽車工業的汽車催化劑。自動催化劑(觸媒轉換器)是一種內建於汽車排氣系統中的裝置,用於減少有害排放氣體。

- 這些金屬被放置在引擎和消音器之間的排氣系統中,當引擎加熱金屬時,它會中和過程中的污染物。

- 鉑金受益於 2022 年汽車產量的增加,因為經濟型汽車製造商擴大尋求用更昂貴的鈀金取代鉑金。柴油觸媒轉換器首選鉑金,瓦斯車輛首選鈀金。然而,在柴油和燃氣引擎汽車中,如果一種金屬更昂貴,通常會用另一種金屬取代它。

- 根據 OICA(國際汽車製造商協會)的數據,2022 年全球所有汽車銷量為 8,162 萬輛,而 2021 年為 8,275 萬輛。根據OICA的數據,2022年所有汽車的總產量統計為8502萬輛,而2021年為8021萬輛。

- 根據世界貿易組織(WTO)的數據,美國將在2022年超越日本成為第二大汽車出口國。中國出口增幅達30%,是前10大出口國中增幅最大的。製造業發展顯著,2023年11月中國汽車產品出口與前一年同期比較去年同期成長7%。

- 印度汽車工業的投資增加和進步預計將提振汽車催化劑市場的需求。汽車工業佔印度製造業GDP的49%,佔GDP總量的7.1%。 2022年,印度汽車市場將超越日本躍居全球第三,2023年商用車製造將躍居全球第四。

- 所有上述因素預計將推動汽車催化劑領域的發展,並在預測期內增加對鉑族金屬的需求。

亞太地區主導市場

- 亞太地區在鉑族金屬市場中佔最大佔有率,幾乎佔全球佔有率的一半。預計它將成為成長最快的市場。

- 在電子工業中,鉑、鈀、銠和銥用於塗覆電極。大多數微處理器和印刷電路基板都含有鈀金屬。該行業主要在電腦、電視和行動電話等電子元件中使用鉑金。

- 中國的智慧型手機用戶數量正在增加。到2023年,中國智慧型手機用戶將達到8.682億。

- 同樣,印度電子市場預計未來三年將達到4,000億美元。此外,預計2025年印度將成為全球第五大消費性電子產業。

- 此外,根據國際鉑金協會 (PGI) 的數據,2022 年日本鉑金銷售額將在 14 年來首次超過 1 兆日圓(100 億美元)。該國仍是人均最大的鉑金市場。

- 日本目前被認為是僅次於美國的世界第二大珠寶飾品市場。日本也是世界第二大鉑金消費國,有14.06噸鉑金用於珠寶飾品。

- 因此,所有上述因素都將增加預測期內鉑族金屬市場的需求。

鉑族金屬產業概況

鉑族金屬市場具有綜合性。主要企業(排名不分先後)包括 Anglo American Platinum Limited、Norilsk Nickel、Implats Platinum Limited、Shivani 靜水和 Africa Rainbow Minerals Limited。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 汽車產業對觸媒轉換器的需求不斷增加

- 電子業對鉑、鈀、釕的需求增加

- 亞太國家珠寶飾品消費成長

- 抑制因素

- 高成本

- 其他阻礙因素

- 價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(市場規模)

- 金屬型

- 鉑

- 鈀

- 銠

- 銥

- 釕

- 鋇

- 目的

- 汽車觸媒

- 電力/電子

- 燃料電池

- 玻璃、陶瓷、顏料

- 珠寶飾品

- 醫療(牙科和製藥)

- 工業

- 其他應用(飛機渦輪機、水處理、感測器、攝影、螢幕、法醫學失真消除)

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 東南亞國協

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- African Rainbow Minerals Limited

- ANGLO AMERICAN PLATINUM LIMITED

- GLENCORE

- Implats Platinum Limited

- Johnson Matthey

- Norilsk Nickel

- Northam Platinum Holdings Limited

- Platinum Group Metals Ltd

- Sibanye-Stillwater

- Vale

第7章 市場機會及未來趨勢

- 鉑金在綠色科技的應用

- 增加對非洲國家的投資

簡介目錄

Product Code: 61254

The Platinum Group Metals Market size is estimated at 625.03 tons in 2024, and is expected to reach 778.16 tons by 2029, growing at a CAGR of 4.48% during the forecast period (2024-2029).

Key Highlights

- The COVID-19 pandemic negatively impacted the market in 2020. However, the market is estimated to have reached pre-pandemic levels and grow steadily during the forecast period.

- Over the short term, the growing demand for catalytic converters from the automotive industry, increasing demand for platinum, palladium, and ruthenium from the electronics industry, and growing jewelry consumption in Asia-Pacific countries are expected to drive market growth.

- However, the high costs involved in production and maintaining platinum group metals are expected to hinder the market's growth.

- Nevertheless, the usage of platinum in green technology and increasing investment in the platinum industry in African countries are likely to create opportunities for the market during the forecast period.

- Asia-Pacific is expected to dominate the global market during the forecast period. It is also expected to register the highest CAGR during the forecast period due to rising demand for antimony, mainly in autocatalysts and jewelry applications.

Platinum Group Metals Market Trends

Autocatalysts Segment to Dominate the Market

- Platinum group elements or platinum group metals (PGMs), including platinum, palladium, and rhodium, are widely used as autocatalysts in the automotive industry. Autocatalysts, or catalytic converters, are devices integrated into the exhaust systems of vehicles to reduce harmful emissions.

- These metals are placed in the exhaust system between the engine and the muffler, and when the engine heats the metals, the process neutralizes the pollutants.

- Platinum profited from increased car manufacture in 2022 as economical automakers increasingly attempt to swap it for more expensive palladium. Platinum is preferred in diesel catalytic converters, while palladium is preferred in gas-powered automobiles. Nevertheless, both metals may be exchanged, one for the other, in diesel- and gas-powered vehicles, which is common when one of the metals is somewhat expensive.

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA) (International Organization of Motor Vehicle Manufacturers), global sales of all vehicles in 2022 were 81.62 million, compared to 82.75 million in 2021. According to the OICA, total production statistics for all vehicles was 85.02 million in 2022, compared to 80.21 million in 2021.

- According to the World Trade Organization, the United States overtook Japan as the second-largest automotive exporter in 2022. China increased its exports the most among the top ten exporters by 30%. One notable development in the manufacturing sector is that China increased the value of its automotive product exports by 7% year on year in November 2023.

- Increased investments and advancements in the Indian automobile industry are expected to boost demand for the automotive catalyst market. The automobile industry accounts for 49 percent of India's manufacturing GDP and 7.1 percent of its overall GDP. The Indian auto market was ranked third in the world, surpassing Japan in 2022 and fourth in commercial vehicle manufacturing in 2023.

- All the factors above are expected to drive the autocatalysts segment, enhancing the demand for platinum group metals during the forecast period.

Asia-Pacific Region to Dominate the Market

- The Asia-Pacific region accounted for the largest share in the market for platinum group metals, with almost half of the global share. It is expected to be the fastest-growing market.

- In the electronics industry, platinum, palladium, rhodium, and iridium are used to coat electrodes, the tiny components in all the electronic products that help in controlling the flow of electricity. Palladium metal is contained in most microprocessors and printed circuit boards. The industry majorly uses platinum in electronic components of computers, televisions, mobile phones, and others.

- The number of smartphone users in China is increasing. By 2023, the country's smartphone user base had risen to 868.2 million.

- Similarly, the Indian electronics market is expected to reach USD 400 billion over the next three years. Additionally, India is expected to become the world's fifth-largest consumer electronics and appliances industry by 2025.

- Additionally, according to Platinum Guild International (PGI), in 2022, the sales of platinum in Japan exceeded the mark of JPY one trillion (USD 10 billion) for the first time in 14 years. The country remains the biggest platinum market per capita.

- Japan is now considered the second largest jewelry market in the world, after only the United States. The country is also the world's second-largest consumer of platinum, with 14.06 tons of the metal used for jewelry creation.

- Thus, all the above factors will likely increase the demand for the platinum group metals market during the forecast period.

Platinum Group Metals Industry Overview

The platinum group metals market is consolidated in nature. The major players (not in any particular order) include Anglo American Platinum Limited, Norilsk Nickel, Implats Platinum Limited, Sibanye-Stillwater, and African Rainbow Minerals Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Demand for Catalytic Converters from the Automotive Industry

- 4.1.2 Increasing Demand for Platinum, Palladium, and Ruthenium from the Electronics Industry

- 4.1.3 Growing Jewelry Consumption in Asia-Pacific Countries

- 4.2 Restraints

- 4.2.1 High Costs Involved in Production and Maintenance

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Metal Type

- 5.1.1 Platinum

- 5.1.2 Palladium

- 5.1.3 Rhodium

- 5.1.4 Iridium

- 5.1.5 Ruthenium

- 5.1.6 Osmium

- 5.2 Application

- 5.2.1 Auto Catalysts

- 5.2.2 Electrical and Electronics

- 5.2.3 Fuel Cells

- 5.2.4 Glass, Ceramics, and Pigments

- 5.2.5 Jewellery

- 5.2.6 Medical (Dental and Pharmaceuticals)

- 5.2.7 Chemical Industry

- 5.2.8 Other Applications (Aircraft Turbines, Water Treatment, Sensors, Photography, Screens, and Forensic straining)

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN Countries

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 African Rainbow Minerals Limited

- 6.4.2 ANGLO AMERICAN PLATINUM LIMITED

- 6.4.3 GLENCORE

- 6.4.4 Implats Platinum Limited

- 6.4.5 Johnson Matthey

- 6.4.6 Norilsk Nickel

- 6.4.7 Northam Platinum Holdings Limited

- 6.4.8 Platinum Group Metals Ltd

- 6.4.9 Sibanye-Stillwater

- 6.4.10 Vale

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Usage of Platinum in Green Technology

- 7.2 Increasing Investment in the African Countries

02-2729-4219

+886-2-2729-4219