|

市場調查報告書

商品編碼

1536906

陸上石油和天然氣管道:市場佔有率分析、產業趨勢、成長預測(2024-2029)Onshore Oil And Gas Pipeline - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

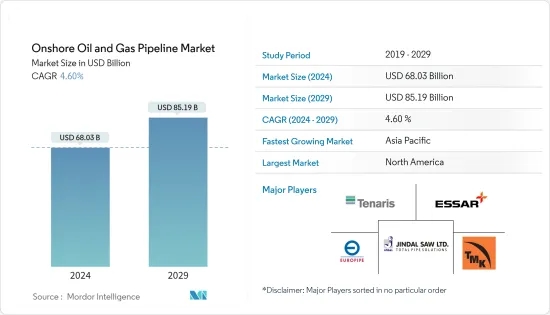

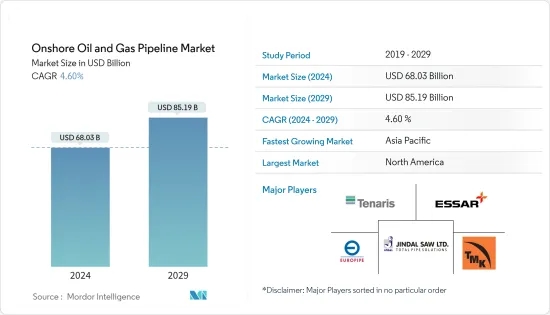

陸上油氣管道市場規模預計到2024年為680.3億美元,預計到2029年將達到851.9億美元,在預測期內(2024-2029年)複合年成長率為4.60%。

主要亮點

- 與其他石化燃料相比,豐富的天然氣蘊藏量和較低的成本預計將抵消多個最終用戶(包括發電)對天然氣的需求。預計這將在預測期內推動天然氣管道產業的發展。

- 然而,全球轉向再生能源來源發電對石油和天然氣需求構成重大威脅,這可能成為預測期內陸上石油和天然氣管道設施成長的重大挑戰。

- 儘管如此,越來越多的陸上探勘和生產計劃預計將在未來幾年為市場相關人員提供巨大的機會,因為它為管道行業的進一步成長鋪平了道路。

- 在預測期內,亞太地區預計將顯著成長,其中大部分需求來自中國、印度等國家。

陸上油氣管道市場趨勢

主導市場的天然氣管道類型

*陸上管道敷設於國內內陸地區及地區。陸地管道有多種類型,包括主管、交叉管道、支線、輸送管道、支線、地上管道和地下管道。

*各國正在擴大現有陸上管道計劃,以滿足不斷成長的需求。根據美國能源資訊管理局 (EIA) 的數據,到 2023 年,美國內天然氣管道容量將增加約 52 億立方英尺/天 (Bcf/d)。大部分管道擴建位於德克薩斯州和路易斯安那州,以滿足美國墨西哥灣沿岸市場的天然氣需求。

*此外,近年來燃氣發行系統的主要里程增加。根據美國運輸部的數據,2023 年發行行駛里程將為 1,367,244 英里,與前一年同期比較增加 1%。鑑於終端消費者對天然氣的使用量不斷增加,天然氣發行系統的主要里程可能很快就會繼續逐步成長。

*同樣,到2030年,由於環境效益和中東、非洲和亞太等地區對能源安全的追求等因素,天然氣的需求將成為所有燃料類型中最大的,預計將成長。

*2024年7月,伊朗開始開發全長1,200公里的管線“伊朗天然氣幹線-IGAT XI”,以滿足布希爾、法爾斯、亞茲德和伊斯法罕省的天然氣需求。該計劃由伊朗國家天然氣公司擁有,預計將於 2027 年完工。在預測期內,此類新興市場的開拓可能會促進石油和天然氣管道市場的成長。

*頁岩礦床等新天然氣資源的開發以及相關的價格壓力正在增加天然氣的國際貿易。因此,預計這些發展將增加預測期內管網擴建的需求。

預計亞太地區需求旺盛

*到 2050 年,亞太地區的能源消費量預計將增加 48%。根據國際能源總署(IEA)預測,到2025年,中國預計將貢獻全球能源成長的30%。近年來,該地區原油和天然氣消費量顯著成長,主要得益於印度和中國等新興經濟體的需求增加。

*從 2024 年 1 月起,澳洲石油和天然氣巨頭桑托斯公司將開始建造一個價值約 43 億美元的天然氣管道計劃,將巴羅莎天然氣田與澳洲北部城市達爾文的一個加工廠連接起來。該計劃預計未來將增加澳洲天然氣的供應。

*印度也在發展天然氣管道基礎設施,以滿足不斷成長的需求。該國的目標是將天然氣在其能源籃子中的佔有率提高到15%。到2030年,我們預計投資660億美元用於天然氣基礎設施建設,包括陸上天然氣管道、CGD和液化天然氣再氣化終端。此外,2020年12月,印度政府宣布將投資600億美元建造天然氣管道基礎設施,主要是在陸地上。其目標是到2024年在全國232個地區擴展壓縮天然氣管網(CGD)。

*近年來,亞太地區的石油消費量一直在增加。根據世界能源統計,2022年石油消費量為16.15億噸,比上年增加0.5%。預計預測期內石油消費量將進一步增加。

*因此,原油和天然氣需求上升以及亞太地區新建管道基礎設施等關鍵因素預計將推動全球陸上油氣管道市場的成長。

陸上油氣管線產業概況

陸上油氣管道市場較為分散。該市場的主要企業包括(排名不分先後)Tenaris SA、Essar Group、Jindal SAW Ltd、Europipe GmbH 和 TMK Group。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029 年之前的市場規模與需求預測

- 到2029年管道的歷史裝置容量和預測(單位:公里)

- 2029 年之前區域間管線進口能力 (BSCM)

- 區域間管線出口能力(BSCM):至2029年

- 2029 年之前布蘭特原油與亨利港現貨價格展望

- 2029 年之前陸上資本支出預測

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 天然氣蘊藏量豐富,與其他石化燃料相比成本低廉

- 增加生產投資以滿足全球需求

- 抑制因素

- 世界向可再生能源的轉變

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場區隔

- 類型

- 石油管線

- 瓦斯管道

- 地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 挪威

- 英國

- 法國

- 西班牙

- 北歐的

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 印尼

- 馬來西亞

- 越南

- 泰國

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南非其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 埃及

- 奈及利亞

- 卡達

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Essar Group

- Jindal SAW Ltd

- Tenaris SA

- Europipe GmbH

- CPW America Co.

- TMK Group

- Baoshan Iron & Steel Co. Ltd

- TC Energy Corporation

- WorleyParsons Limited

- Mastec Inc.

- 市場排名分析

第7章 市場機會及未來趨勢

The Onshore Oil And Gas Pipeline Market size is estimated at USD 68.03 billion in 2024, and is expected to reach USD 85.19 billion by 2029, growing at a CAGR of 4.60% during the forecast period (2024-2029).

Key Highlights

- Factors such as the availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types are expected to supplement the demand for natural gas from multiple end-users, including power generation. This, in turn, is expected to boost the gas pipeline segment during the forecast period.

- However, the global shift toward renewable sources for electricity generation poses a huge threat to the oil and gas demand, which is likely to be a major challenge for the growth of onshore oil and gas pipeline installations during the forecast period.

- Nevertheless, the rise in onshore exploration and production projects is expected to create excellent opportunities for the market players in the years to come, as these projects are paving the way for the pipeline industry to grow more.

- Asia-Pacific is expected to witness significant growth during the forecast period, with the majority of the demand coming from countries like China, India, etc.

Onshore Oil & Gas Pipeline Market Trends

Natural Gas Pipeline Type to Dominate the Market

* Onshore pipelines are laid in the country's inland areas or a region. Onshore pipelines are of different types: mains, crossings, feeder lines, transmissions, spur lines, and above-ground and underground pipelines.

* The expansion of existing onshore pipeline projects is being done in countries to cater to growing demand. As per the US Energy Information Administration (EIA), about 5.2 billion cubic feet per day (Bcf/d) of natural gas intrastate pipeline capacity was added in the United States of America in 2023. Most of the intrastate pipeline additions were made in Texas and Louisiana to fulfill natural gas demand in the United States Gulf Coast Markets.

* Moreover, the main mileage of gas distribution systems has grown in recent years. As per the United States of Transportation, in 2023, the distribution main mileage stood at 1,367,244 miles, an increase of 1% from the previous year. Considering the increase in the utilization of gas from end-consumers, the gradual growth of main mileage for gas distribution systems is likely to persist soon.

* Likewise, By 2030, owing to factors such as environmental benefits and the quest for energy security in regions such as the Middle East, Africa, and Asia-Pacific, the demand for natural gas is expected to witness significant growth among all fuel types.

* In July 2024, Iran commenced the development of the Iranian Gas Trunk Line-IGAT XI pipeline of 1200 kilometers to fulfill the natural gas demand of its provinces, such as Bushehr, Fars, Yazd, and Isfahan. The project owned by National Iranian Gas Co. is likely to be completed by 2027. Such developments are likely to help the oil and gas pipeline market grow in the forecast period.

* The development of new natural gas sources, such as shale gas deposits, and the resulting price pressure are increasing the international trade of natural gas. Hence, these developments are expected to increase the demand for pipeline network expansion during the forecast period.

Asia-Pacific Expected to Witness Significant Demand

* The energy consumption in Asia-Pacific is expected to increase by up to 48% by 2050. According to the International Energy Agency (IEA), China is expected to contribute 30% of the world's energy increase until 2025. Crude oil and natural gas consumption has witnessed significant growth in the region in recent years, mainly due to increasing demand from emerging economies like India and China.

* As of January 2024, Santos - Australia's oil & gas major, decided to commence the construction of a gas pipeline project worth about USD 4.3 billion that would connect the Barossa gas field to a processing plant in the northern Australian city of Darwin. The project will likely increase natural gas availability in Australia in the future.

* India is also modifying its gas pipeline infrastructure to meet the growing demand. The nation aims to increase the natural gas share to 15% in the energy basket. It expects USD 66 billion investment in building the gas infrastructure, including onshore gas pipeline, CGD, and LNG regasification terminals by 2030. Moreover, in December 2020, the Indian government announced a USD 60 billion investment for creating gas pipeline infrastructure, primarily onshore, which covers expanding Compressed Natural Gas pipeline networks (CGD) in 232 geographical areas across the country by 2024.

* Oil consumption in the Asia-Pacific has witnessed an increasing trend in recent years. As per the Statistical Review of World Energy, oil consumption stood at 1615 million tonnes in 2022, an increase of 0.5 % from the previous year. It is likely to grow more in the forecast period.

* Therefore, significant factors like the increasing demand for crude oil and natural gas and new pipeline infrastructure in the Asia-Pacific are expected to drive growth in the global onshore oil and gas pipeline market.

Onshore Oil And Gas Pipeline Industry Overview

The onshore oil and gas pipeline market is fragmented. Some of the key players in this market include (in no particular order) Tenaris SA, Essar Group, Jindal SAW Ltd, Europipe GmbH, and TMK Group.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2029

- 4.3 Installed Pipeline Historic Capacity and Forecast in Kilometers, till 2029

- 4.4 Inter-Regional Pipeline Import Capacity in BSCM, till 2029

- 4.5 Inter-Regional Pipeline Export Capacity in BSCM, till 2029

- 4.6 Brent Crude Oil and Henry Hub Spot Prices Forecast, till 2029

- 4.7 Onshore CAPEX Forecast in USD billion, till 2029

- 4.8 Recent Trends and Developments

- 4.9 Government Policies and Regulations

- 4.10 Market Dynamics

- 4.10.1 Drivers

- 4.10.1.1 Availability of abundant natural gas reserves and the lower cost compared to other fossil fuel types

- 4.10.1.2 Growing investments to increase production to fulfill global demand

- 4.10.2 Restraints

- 4.10.2.1 The global shift toward renewable sources for electricity generation

- 4.10.1 Drivers

- 4.11 Supply Chain Analysis

- 4.12 Porter's Five Forces Analysis

- 4.12.1 Bargaining Power of Suppliers

- 4.12.2 Bargaining Power of Consumers

- 4.12.3 Threat of New Entrants

- 4.12.4 Threat of Substitutes Products and Services

- 4.12.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Oil Pipeline

- 5.1.2 Gas Pipeline

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Norway

- 5.2.2.2 United Kingdom

- 5.2.2.3 France

- 5.2.2.4 Spain

- 5.2.2.5 NORDIC

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Asia Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Indonesia

- 5.2.3.4 Malaysia

- 5.2.3.5 Vietnam

- 5.2.3.6 Thailand

- 5.2.3.7 Rest of Asia Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Colombia

- 5.2.4.4 Rest of South Africa

- 5.2.5 Middle East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Egypt

- 5.2.5.5 Nigeria

- 5.2.5.6 Qatar

- 5.2.5.7 Rest of Middle East and Africa

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Essar Group

- 6.3.2 Jindal SAW Ltd

- 6.3.3 Tenaris SA

- 6.3.4 Europipe GmbH

- 6.3.5 CPW America Co.

- 6.3.6 TMK Group

- 6.3.7 Baoshan Iron & Steel Co. Ltd

- 6.3.8 TC Energy Corporation

- 6.3.9 WorleyParsons Limited

- 6.3.10 Mastec Inc.

- 6.4 Market Ranking Analysis