|

市場調查報告書

商品編碼

1536916

人造板市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Wood-based Panel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

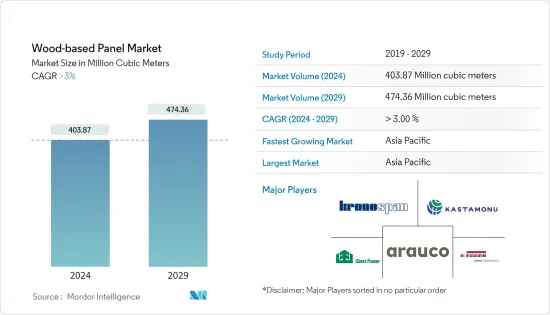

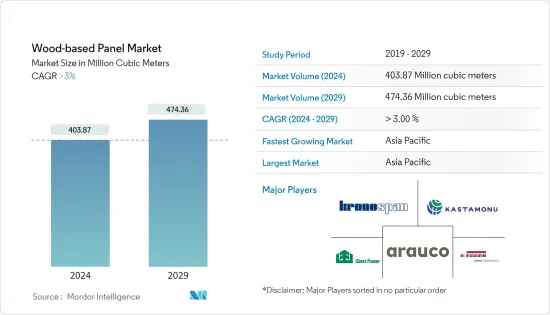

人造板市場規模預計到2024年為40387萬立方米,預計到2029年將達到47436萬立方米,在預測期內(2024-2029年)複合年成長率超過3%。

2020 年接受調查的市場受到了 COVID-19 的負面影響。一些國家對家具用某些品種的進口纖維板徵收反傾銷稅,以支持國內生產商。為了阻止病毒傳播,所有建築工程和其他活動都被停止,對市場產生了負面影響。然而,隨著建築建設活動的回暖,預計市場從 2021 年起將穩步成長。

主要亮點

- 短期來看,住宅和商業建築的看漲成長趨勢以及家具業需求的增加是市場成長的主要驅動力。

- 然而,人造板的甲醛排放是預測期內限制市場成長的主要因素。

- 然而,OSB 在結構絕緣板 (SIPS) 中的應用日益增多,預計很快就會為全球市場創造利潤豐厚的成長機會。

- 亞太地區的人造板市場預計將在評估期間成長,因為人造板因其理想的性能而被廣泛應用於家具、建築和包裝等最終用途領域。

人造板市場趨勢

家具業需求增加

- 人造板由於其多種優點,被廣泛應用於住宅家具。儘管木製家具的替代品有多種,但其需求仍處於高峰期。人造板經久耐用、經濟、易於清潔且用途廣泛。

- 全球家具市場佔家用家具的65%,其次是商業家具(包括辦公室、飯店等)。亞太地區是全球最大的家居用品生產國,其中中國、印度和日本是主要生產國。

- 宜家是世界上最大的家具製造商之一。根據該公司公佈的資料,2023年收益成長約6.73%,達到476億歐元(約502.9億美元)。

- 中國是世界領先的家俱生產國。由於都市化的趨勢,中國家具產業新品牌不斷湧現。最忠實的顧客是擁抱新潮流、擁有巨大購買力的年輕人。此外,中國日益進步的技術正在培育家具產業的新一代。

- 印度家具業最大的部分是家居用品。臥室家具在印度家居市場的佔有率最高,其次是客廳家具。然而,衣櫃和廚房是最昂貴的採購項目,顧客在廚房家具上的花費約為 7,000 美元至 10,000 美元。

- 歐洲家居產業嚴重依賴亞洲國家的進口,最近的供應鏈中斷使籌資策略變得複雜。因此,零售商從鄰國進口的商品數量多於從亞洲國家進口的商品,以降低運輸成本和縮短交貨時間。

- 2022年10月,MoKo Home+Living在由美國投資基金Talanton和瑞士投資者AlphaMundi Group共同主導的B輪股權資金籌措中籌集了65億美元。目的是增加家用家具的產量並保持良好的品質。這項措施正在推動家居用品產業的成長。

- 工作模式的變化(例如在家工作)增加了對緊湊、耐用且易於操作的家用家具的需求。從辦公空間到住宅環境的轉變增加了對功能性更強、更靈活的家用家具的需求。一些製造商已經開始提供使用木板的高效家具。無論是符合人體工學的椅子、辦公桌或學習桌,在家工作將人們的注意力重新集中在家庭室內裝飾上,並促進了家具業的成長。

- 上述因素預計將在未來幾年推動人造板市場。

亞太地區主導市場

- 亞太地區佔全球市場的很大佔有率。隨著中國、印度和日本等國家建設活動的增加和家具需求的增加,該地區對人造板的需求正在增加。

- 根據國際熱帶木材組織(ITTO)預計,2022年我國無甲醛人造板產品產量將比與前一年同期比較成長約36%,其中無甲醛膠合板(160萬立方米)、纖維板(20萬立方米),總量約為810萬立方米,其中塑合板(630萬立方米)。

- 我國木板生產集中在山東省、江蘇省及廣西壯族自治區,約佔總產量的60%。根據中國木材與木製品流通協會統計,去年中國約44%的人造板用於家具製造、裝飾和翻新。

- 中國正在經歷建設熱潮。根據中國國家統計局的數據,2023年中國建築業總產值成長1.99%,達到712,847.2億元人民幣(約108,677.8億美元)。此外,預計到2030年,中國將在建築上花費近13兆美元,為人造板創造了光明的前景。

- 據印度投資局稱,印度是世界第五大家俱生產國和第四大家具消費國。 2022年該國具有市場價值為231.2億美元。此外,印度家具市場預計 2023-28 年複合年成長率為 10.9%,到 2026 年將達到 327 億美元。

- 印度政府的「印度製造」舉措吸引了多家跨國公司在該國投資,預計將在預計時間內增加對新辦公大樓的需求,並為家俱生產提供塑合板等各種產品。 。

- 預計到2022年,印度建築業將成為世界第三大建築市場。印度政府正在實施的政策包括「智慧城市」計劃和「2022 年全民住宅」計畫。這些政策預計將為低迷的建設產業提供所需的刺激。

- 上述因素導致預測期內該地區人造板消費需求的增加。

人造板產業概況

人造板市場本質上高度分散。主要企業(排名不分先後)包括 Kronoplus Limited、West Fraser、ARAUCO、EGGER 和 Kastamonu Entegre。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章 簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 住宅和商業建築的穩定成長趨勢

- 家具業需求增加

- 其他司機

- 抑制因素

- 木質板材的甲醛排放量

- 其他阻礙因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔

- 產品類型

- 中密度纖維板(MDF)/高密度纖維板(HDF)

- 定向纖維板(OSB)

- 塑合板

- 硬板

- 合板

- 其他產品類型(腰板、軟質纖維板、塑合板、輪胎邊緣)

- 目的

- 家具

- 住宅

- 商業的

- 建築學

- 地板和屋頂

- 牆

- 門

- 其他結構(裝飾用途、木框、配件)

- 包裝

- 其他用途(藝術品、工業原型、玩具等)

- 家具

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 奈及利亞

- 卡達

- 埃及

- 阿拉伯聯合大公國

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場排名分析

- 主要企業策略

- 公司簡介

- ARAUCO

- CenturyPly

- VRG Dongwha MDF

- DEXCO

- EGGER

- Georgia-Pacific Wood Products LLC

- GREENPANEL INDUSTRIES LIMITED

- Kastamonu Entegre

- Kronoplus Limited

- Langboard Inc.

- Louisiana-Pacific Corporation

- Pfleiderer

- Roseburg Forest Products

- SWISS KRONO Group

- West Fraser

- Weyerhaeuser Company

第7章 市場機會及未來趨勢

- 擴大 OSB 在結構絕緣板 (SIPS) 中的使用

- 其他機會

The Wood-based Panel Market size is estimated at 403.87 Million cubic meters in 2024, and is expected to reach 474.36 Million cubic meters by 2029, growing at a CAGR of greater than 3% during the forecast period (2024-2029).

The market studied was negatively impacted by COVID-19 in 2020. Several countries imposed anti-dumping duty on the import of a certain variety of fiberboard used in furniture in order to aid domestic producers. All the construction work and other activities were put on hold to curb the spreading of the virus, thereby negatively affecting the market. However, the market studied is projected to grow steadily, owing to increased building and construction activities since 2021.

Key Highlights

- Over the short term, bullish growth trends in residential and commercial construction, coupled with increasing demand from the furniture industry, are major factors driving the growth of the market studied.

- However, formaldehyde emission from wood-based panels is a key factor anticipated to restrain the growth of the market studied over the forecast period.

- Nevertheless, the increasing application of OSB in structural insulated panels (SIPS) is expected to create lucrative growth opportunities for the global market soon.

- The Asia-Pacific region is estimated to experience growth over the assessment period in the wood-based panel market due to the wide usage of wood-based panels in end-use application segments, such as furniture, construction, and packaging, due to their desirable properties.

Wood-based Panel Market Trends

Increasing Demand from the Furniture Industry

- Due to their several benefits, wood-based panels are extensively used in residential furniture. There are various alternatives to wooden furniture, but the demand for it is still at its peak. Wooden panels are long-lasting, economically friendly, easy to clean, and highly versatile.

- The global furniture market comprises 65% of domestic home furniture, followed by commercials (including offices, hotels, and others). Asia-Pacific is the world's largest home furniture producer, among which China, India, Japan, and others are the leading producers.

- IKEA is one of the largest furniture manufacturers globally. According to public data published by the company, its annual revenue in 2023 increased by about 6.73% and was valued at EUR 47.6 billion (~USD 50.29 billion).

- China is the leading producer of home furniture globally. Due to the growing trend of urbanization, new brands have emerged in the Chinese furniture industry. Their most dedicated customers are younger people who adopt new trends and have tremendous purchasing power. Moreover, the growing technological advancement in the country has brought up a new generation in the furniture industry.

- The Indian furniture industry's largest segment is home furniture. Bedroom furniture has the highest share of the Indian home furniture market, followed by living room furniture. However, wardrobes and kitchens are the most expensive purchases, with customers spending around USD 7,000-10,000 on kitchen furniture.

- The European home furniture industry is heavily dependent on products imported from Asian countries, and recent supply chain interruptions complicate their sourcing strategies. As a result, retailers have increased their share of imports from neighboring countries compared to Asian countries to reduce transportation costs and delivery times.

- In October 2022, MoKo Home + Living raised USD 6.5 billion in a Series B debt-equity funding round, co-led by US-based investment fund Talanton and Swiss investor AlphaMundi Group. The aim is to increase home furniture production and maintain good quality. This initiative has driven the growth of the home furniture segment.

- The ongoing working pattern, such as work-from-home, has increased the demand for compact, durable, and easy-to-handle home furniture. The shift from office workspaces to house settings has increased the demand for more functional and flexible home furniture. Several manufacturers have started offering efficient furniture using wood panels. Whether it is an ergonomic chair, office desk, or study table, working from home puts the focus back on home decor, increasing the growth of the furniture segment.

- All the above factors are expected to drive the market for wood-based panels in the coming years.

Asia-Pacific to Dominate the Market

- The Asia-Pacific region held a major share of the global market. With growing construction activities and the increasing demand for furniture in countries such as China, India, and Japan, the demand for wood-based panels is increasing in the region.

- According to the International Tropical Timber Organisation (ITTO), the production of formaldehyde-free wood-based panel products in China increased by about 36% in 2022 as compared to the previous year and stood at about 8.1 million cubic meters, including formaldehyde-free plywood (1.6 million cubic meters), fibreboard (0.2 million cubic meters) and particleboard (6.3 million cubic meters).

- China's wood-based paneling production is concentrated in the Shandong, Jiangsu, and Guangxi provinces, which account for about 60% of the total production. According to the China Timber and Wood Products Distribution Association, around 44% of China's wood-based panels were used for furniture manufacturing, decoration, or renovation last year.

- China is amid a construction mega-boom. According to the National Bureau of Statistics of China, the gross output value of the construction industry in China in 2023 increased by 1.99% and was valued at CNY 71,284.72 billion (~USD 10,086.78 billion). Furthermore, China is expected to spend nearly USD 13 trillion on buildings by 2030, creating a positive outlook for wood-based panels.

- According to Invest India, India is the 5th largest producer and 4th largest consumer of furniture globally. The furniture market in the country was valued at USD 23.12 billion in 2022. Furthermore, the Indian furniture market is expected to grow at a CAGR of 10.9% during 2023-28 and reach USD 32.7 billion by 2026.

- The Make in India initiative by the government attracted several multinational companies to invest in the country, which is expected to increase the demand for new office buildings in the estimated time, supporting the demand for various wood-based panels, such as particle boards for furniture production.

- The Indian construction sector is expected to become the world's third-largest construction market by 2022. The Smart Cities project and Housing For All by 2022 are policies implemented by the Indian government. These policies are expected to bring the needed impetus to the slowing construction industry.

- The factors above are contributing to the increasing demand for wood-based panel consumption in the region during the forecast period.

Wood-based Panel Industry Overview

The wood based panel market is highly fragmented in nature. The major players (not in any particular order) include Kronoplus Limited, West Fraser, ARAUCO, EGGER, and Kastamonu Entegre.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Bullish Growth Trends in Residential and Commercial Construction

- 4.1.2 Increasing Demand from the Furniture Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Formaldehyde Emission from Wood-based Panels

- 4.2.2 Other Restraints

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Volume)

- 5.1 Product Type

- 5.1.1 Medium-density Fiberboard (MDF)/High-density Fiberboard (HDF)

- 5.1.2 Oriented Strand Board (OSB)

- 5.1.3 Particleboard

- 5.1.4 Hardboard

- 5.1.5 Plywood

- 5.1.6 Other Product Types (Lumber Panels, Softboard, Chipboard, and Beadboard)

- 5.2 Application

- 5.2.1 Furniture

- 5.2.1.1 Residential

- 5.2.1.2 Commercial

- 5.2.2 Construction

- 5.2.2.1 Floor and Roof

- 5.2.2.2 Wall

- 5.2.2.3 Door

- 5.2.2.4 Other Constructions (Decorative Applications, Wooden Frames, and Accessories)

- 5.2.3 Packaging

- 5.2.4 Other Applications (Artistry, Industrial Prototyping, Toys, etc.)

- 5.2.1 Furniture

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Malaysia

- 5.3.1.6 Thailand

- 5.3.1.7 Indonesia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Spain

- 5.3.3.6 NORDIC

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Nigeria

- 5.3.5.4 Qatar

- 5.3.5.5 Egypt

- 5.3.5.6 United Arab Emirates

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ARAUCO

- 6.4.2 CenturyPly

- 6.4.3 VRG Dongwha MDF

- 6.4.4 DEXCO

- 6.4.5 EGGER

- 6.4.6 Georgia-Pacific Wood Products LLC

- 6.4.7 GREENPANEL INDUSTRIES LIMITED

- 6.4.8 Kastamonu Entegre

- 6.4.9 Kronoplus Limited

- 6.4.10 Langboard Inc.

- 6.4.11 Louisiana-Pacific Corporation

- 6.4.12 Pfleiderer

- 6.4.13 Roseburg Forest Products

- 6.4.14 SWISS KRONO Group

- 6.4.15 West Fraser

- 6.4.16 Weyerhaeuser Company

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Application of OSB in Structural Insulated Panels (SIPS)

- 7.2 Other Opportunities