|

市場調查報告書

商品編碼

1536934

全球預防資料外泄:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Global Data Loss Prevention - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

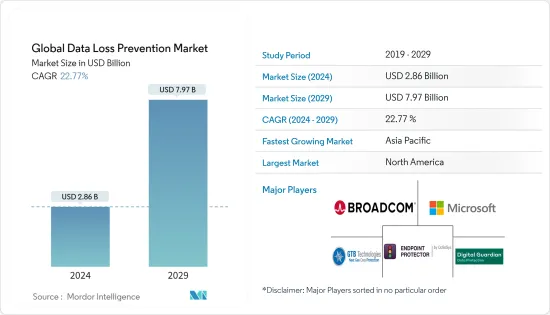

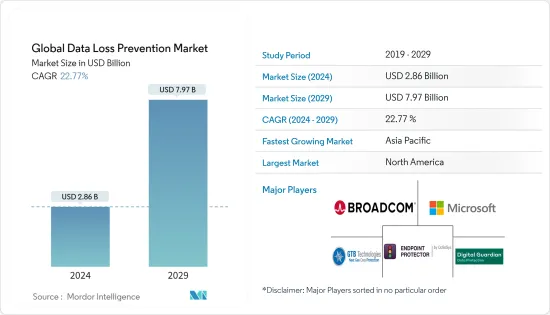

2024年全球預防資料外泄市場規模預計為28.6億美元,預計2029年將達到79.7億美元,在預測期內(2024-2029年)複合年成長率預計為22.77%。

對數位資產需求的激增導致資料的大幅成長。因此,資料保護服務的需求量很大,特別是對於優先考慮以資料為中心的方法的組織而言。

主要亮點

- 傳統上,DLP 解決方案主要應用於醫療保健、金融、製造、能源和政府等受監管部門。然而,隨著資料保護需求的增加,DLP解決方案供應商現在將目標瞄準各行業的諮詢和服務公司。

- 預防資料外泄(DLP) 工具已成為資料保護策略的重要組成部分。這些解決方案可以根據您的特定要求進行客製化,並幫助您遵守 GDPR 和加州消費者隱私法案 (CCPA) 等法規。這些工具可讓企業識別、監控和監管其網路內的敏感資料流。

- 資料外洩在各行業中變得越來越普遍,數以百萬計的消費者記錄暴露給駭客,並對受影響的企業造成重大財務損失。因此,安全解決方案變得越來越重要,特別是在新興國家。

- DLP 不僅僅是一項技術。它依賴強力的政策、程序和員工的專業知識。確保資料安全需要採取綜合措施,包括謹慎的處理和儲存通訊協定以及對安全漏洞的快速回應。 DLP 的有效性也取決於 IT 團隊是否了解資料安全要求以及最終使用者是否了解最佳實踐。

- 後 COVID-19 時代預計預防資料外泄(DLP) 解決方案的採用將會激增。此次疫情不僅加速了向雲端基礎設施和服務的轉變,而且由於網路釣魚嘗試激增,導致安全預算增加。全球健康危機一直是雲端領域的催化劑,導致世界各地各產業的使用量大幅增加。

預防資料外泄市場趨勢

網路 DLP 顯著成長

- 網路 DLP 解決方案可提高網路視覺性,並讓您監控和調節網路、電子郵件和 Web 上的資訊流。 DLP 軟體有助於分析網路流量、制定安全策略、降低資料遺失風險並確保遵守法規和政策。該軟體透過允許、封鎖、標記、審核、加密和隔離違反資訊安全法規的可疑活動來執行安全標準。

- 隨著企業向雲端遷移,資料擴大分佈在多個雲端服務、本地設定甚至 BYOD 設備中。保護資料和智慧財產權免受惡意活動和資料外洩的影響變得越來越困難。資料遺失可能會造成高昂的代價並損害公司的品牌。此外,各種監管合規性要求需要強大的網路預防資料外泄措施。

- 網路 DLP 系統超越了簡單的封包層級審查,擴展到會話層級網路流量分析。由於組織內大多數人類可讀的資料都不是純文本,因此網路 DLP 決策需要深入了解單一資料包之外的資料。這些系統提供對網路通訊協定、通道和應用程式的可見性。網路預防資料外泄系統必須了解不同的網路流量模式、分析人們的通訊方式並有效地提取資訊。

- 此外,物聯網正變得越來越流行。例如,愛立信表示,到 2028 年,物聯網 (IoT) 連接數量預計將達到 60 億,對資料隱私的日益擔憂以及更嚴格法規的出現正在推動人工智慧 (AI) 和網路安全的興起我們正在推動解決方案整合。企業正在優先考慮下一代識別及存取管理、通訊和網路安全,這反映出在這些網路安全領域的大量投資。這些趨勢預計將進一步加速 DLP 市場的成長。

亞太地區預計將佔據主要市場佔有率

- 美國在資料中心方面處於世界領先地位,並且正在見證巨量資料量和流量的爆炸式成長,這在很大程度上是由超大規模資料中心的興起所推動的。世界經濟論壇預測,到 2025 年,全球資料產生量將達到每天 463Exabyte,其中美國佔最大佔有率。然而,透過政府和私營部門的共同努力,該國的資料外洩事件已得到控制。

- 2023 年 11 月,著名的雲端預防資料外泄(Cloud DLP) 供應商 Nightfall AI 宣布推出專為 Microsoft Teams 客製化的創新 DLP 解決方案。由於該平台在高度監管的行業中得到廣泛採用,企業現在正在尋求符合 SOC 2、PCI DSS 和 HIPAA 等框架的 DLP 工具。

- 憑藉其強大的法律體制、不斷發展的網路安全格局和創新的道德規範,美國已成為推動全球預防資料外泄市場的關鍵力量。隨著資料安全和合規性在各行業變得至關重要,DLP 解決方案對於保護敏感資料、降低網路風險和維護資料完整性變得至關重要。

- 不斷變化的威脅、數位化的提高以及對每個部門策略重要性的認知導致加拿大預防資料外泄迅速增加,而這一趨勢預計將持續下去。預防資料外泄現已牢固地成為加拿大數位彈性和國家安全的基石。

- 加拿大政府機構正在提案新的隱私權法,以使個人對公司如何處理其個人資料擁有更多的控制權和透明度。特別是,《2020 年數位憲章實施法案》(C-11 法案)、《消費者隱私保護法案》(CPPA) 和魁北克省第 64 號法案等立法舉措處於領先。其他司法管轄區正在考慮旨在加強資料保護的類似立法。

全球預防資料外泄產業概述

預防資料外泄市場的競爭對手之間的競爭非常激烈,預計在預測期內將會加劇。 Broadcom Inc.、Microsoft Corporation、GTB Technologies Inc.、CoSoSys Group 和 Digital Guardian (Fortra LLC) 等主要公司在研發和整合活動方面對市場具有強大影響力。相反,該市場的特徵是市場滲透率高且碎片化程度不斷提高。

- 2023 年 11 月,Broadcom Inc. 收購了 VMware, Inc.,鞏固了其打造全球領先基礎設施技術公司的道路。 Broadcom 的賽門鐵克多供應商 SASE 和 SSE 產品組合包括安全 Web 閘道 (SWG) 和預防資料外泄(DLP) 解決方案。此次收購將使我們能夠為客戶提供豐富的服務目錄,以實現雲端和邊緣環境的現代化和最佳化,其中包括 VMware Tanzu 及其高級保全服務,以加速應用程式部署。

- 2023 年 10 月, Proofpoint同意收購 Tessian,該公司利用先進的人工智慧來偵測和防止資料遺失。 Tessian 的人工智慧電子郵件安全平台利用行為理解和機器學習來解決 Microsoft 365 和 Google Workspace 部署中的意外資料遺失問題,為 Proofpoint 的電子郵件預防資料外泄(DLP) 解決方案提供協助。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 全球資料外洩和網路攻擊的增加推動市場

- 法規和合規性(GDPR、CCPA、PCI DSS 等)

- 資料的重要性和脆弱性日益增加

- 市場挑戰

- 缺乏完整解決方案實施的意識

- 圍繞進入許可權、加密、擴充性和整合的部署挑戰

第6章 市場細分

- 按發展

- 本地

- 雲端基礎

- 按解決方案

- 網路DLP

- 端點DLP

- 基於資料中心/儲存的 DLP

- 按最終用戶產業

- 資訊科技/通訊

- BFSI

- 政府機構

- 衛生保健

- 製造業

- 零售/物流

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Broadcom Inc.

- Microsoft Corporation

- GTB Technologies Inc.

- CoSoSys Group

- Digital Guardian(Fortra LLC)

- Forcepoint LLC(Francisco Partners Management LP)

- SecureTrust(PurpleSec LLC)

- Trend Micro Inc.

- Check Point Software Technologies Ltd

- Proofpoint Inc.

- Spirion LLC

第8章投資分析

第9章市場的未來

The Global Data Loss Prevention Market size is estimated at USD 2.86 billion in 2024, and is expected to reach USD 7.97 billion by 2029, growing at a CAGR of 22.77% during the forecast period (2024-2029).

The surge in demand for digital assets has led to a substantial surge in structured and unstructured data. This, in turn, is fueling the demand for data protection services, particularly emphasizing organizations that prioritize data-centric approaches.

Key Highlights

- Traditionally, DLP solutions were predominantly employed in regulated sectors like healthcare, finance, manufacturing, energy, and government. However, with the growing need for data protection, DLP solution providers now target advisory and services firms catering to diverse industries.

- Data Loss Prevention (DLP) tools have become indispensable in data protection strategies. These solutions can be customized to meet specific requirements and aid compliance with regulations like GDPR and the California Consumer Privacy Act (CCPA). They enable organizations to identify, monitor, and regulate the flow of sensitive data within their networks.

- The rising frequency of data breaches across industries has exposed millions of consumer records to hackers and led to significant financial losses for affected companies. This has heightened the emphasis on security solutions, particularly in emerging economies.

- DLP comprises more than just technology. It hinges on robust policies, procedures, and staff expertise. Ensuring data security necessitates comprehensive measures, including meticulous handling and storage protocols and swift responses to security breaches. The efficacy of DLP also hinges on the IT team's grasp of data security requirements and end-users' awareness of best practices.

- The post-COVID-19 era is expected to witness a surge in adopting data loss prevention (DLP) solutions. The pandemic has not only expedited the shift to cloud infrastructure and services but has also led to a rise in security budgets fueled by a surge in phishing activities. The global health crisis has acted as a catalyst for the cloud sector, witnessing a substantial uptick in usage across industries worldwide.

Data Loss Prevention Market Trends

Network DLP to Witness Significant Growth

- Network DLP solutions empower customers with enhanced network visibility, enabling them to monitor and regulate information flow across networks, emails, and the web. DLP software aids in analyzing network traffic, establishing security policies, and mitigating data loss risks while ensuring compliance with regulations. This software enforces security standards by allowing, blocking, flagging, auditing, encrypting, or quarantining suspicious activities that violate information security regulations.

- As businesses increasingly transition to the cloud, their data becomes distributed across multiple cloud services, on-premise setups, and even BYOD devices. Safeguarding data and intellectual property from malicious activities and data breaches has become more challenging. Data loss incurs significant costs and tarnishes a company's brand. Moreover, various regulatory compliance mandates necessitate robust network data loss prevention measures.

- Network DLP systems conduct session-level network traffic analysis, going beyond mere packet-level scrutiny. Since most human-readable data in organizations is not plain text, network DLP decisions require insights beyond individual packets. These systems provide visibility into network protocols, channels, and applications. Network data loss prevention systems must comprehend diverse network traffic patterns to analyze how people communicate and extract information effectively.

- Furthermore, the rising adoption of IoT For instance, according to Ericsson, the number of Internet of Things (IoT) connections is expected to be 6 billion by 2028; escalating concerns over data privacy and the advent of stringent regulations are propelling the integration of artificial intelligence (AI) with cybersecurity solutions. Enterprises prioritize next-generation identity and access management, communication, and network security, reflecting significant investments in these cybersecurity domains. These trends are poised to fuel the growth of the DLP market further.

Asia-Pacific is Expected to Hold Significant Market Share

- The United States leads the global data center landscape and is witnessing a surge in Big Data volume and traffic, largely driven by the rise of hyperscale data centers. The World Economic Forum projects that global data creation will hit 463 exabytes per day by 2025, with the United States accounting for a significant share. However, concerted efforts by both the government and private sector are curbing data breach incidents in the country.

- In November 2023, Nightfall AI, a prominent provider of cloud data loss prevention (Cloud DLP), introduced an innovative DLP solution tailored for Microsoft Teams. Given the platform's widespread adoption in highly regulated industries, businesses now seek DLP tools that align with frameworks like SOC 2, PCI DSS, and HIPAA.

- The United States, with its robust legal framework, evolving cybersecurity landscape, and innovative ethos, stands as a pivotal force propelling the global data loss prevention market. As data security and compliance gain paramount importance across sectors, DLP solutions are becoming indispensable, safeguarding confidential data, mitigating cyber risks, and upholding data integrity.

- Canada witnessed a surge in data loss prevention measures, driven by an evolving threat landscape, heightened digitization, and a recognition of its strategic importance across sectors; this trend is poised to persist. Data loss prevention is now firmly entrenched as a cornerstone of Canada's digital resilience and national security.

- Canadian government bodies are proposing new privacy laws to enhance individuals' control and transparency over how companies handle their personal data. Notably, legislative initiatives like the Digital Charter Implementation Act, 2020 (Bill C-11), known as the Consumer Privacy Protection Act (CPPA), and Quebec's Bill 64 are leading the way. Other jurisdictions are also exploring similar legislation aimed at bolstering data protection.

Global Data Loss Prevention Industry Overview

The intensity of competitive rivalry in the data loss prevention market is high and is expected to increase during the forecast period. Major companies such as Broadcom Inc., Microsoft Corporation, GTB Technologies Inc., CoSoSys Group, and Digital Guardian (Fortra LLC) strongly influence the market in terms of R&D and consolidation activities. Conversely, the market can be characterized by high market penetration and increasing fragmentation levels.

- In November 2023, Broadcom Inc. acquired VMware, Inc. to strengthen its journey in building the world's leading infrastructure technology company. Broadcom's Symantec multivendor SASE and SSE portfolio includes secure web gateway (SWG) and data loss prevention (DLP) solutions. The acquisition will offer customers a rich catalog of services to modernize and optimize cloud and edge environments, including VMware Tanzu, which accelerates application deployment and its advanced security services.

- In October 2023, Proofpoint Inc. agreed to acquire Tessian, a company using advanced AI to detect and guard against data loss. Tessian's AI-powered email security platform will enhance Proofpoint's email data loss prevention (DLP) solution by addressing accidental data loss through its Microsoft 365 and Google Workspace deployment, using behavioral understanding and machine learning.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment Of COVID-19 Impact On The Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Data Breaches and Cyber Attacks Worldwide to Drive the Market

- 5.1.2 Regulations and Compliances (GDPR, CCPA, PCI DSS, Etc.)

- 5.1.3 Increasing Data Criticality and Vulnerability

- 5.2 Market Challenges

- 5.2.1 Lack of Awareness About Complete Solution Adoption

- 5.2.2 Deployment Challenges Related to Access Rights, Encryption, Scalability, and Integration

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud-based

- 6.2 By Solution

- 6.2.1 Network DLP

- 6.2.2 Endpoint DLP

- 6.2.3 Datacenter/Storage-based DLP

- 6.3 By End-user Industry

- 6.3.1 IT and Telecommunication

- 6.3.2 BFSI

- 6.3.3 Government

- 6.3.4 Healthcare

- 6.3.5 Manufacturing

- 6.3.6 Retail and Logistics

- 6.3.7 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 Broadcom Inc.

- 7.1.2 Microsoft Corporation

- 7.1.3 GTB Technologies Inc.

- 7.1.4 CoSoSys Group

- 7.1.5 Digital Guardian (Fortra LLC)

- 7.1.6 Forcepoint LLC (Francisco Partners Management LP)

- 7.1.7 SecureTrust (PurpleSec LLC)

- 7.1.8 Trend Micro Inc.

- 7.1.9 Check Point Software Technologies Ltd

- 7.1.10 Proofpoint Inc.

- 7.1.11 Spirion LLC