|

市場調查報告書

商品編碼

1687701

石油和天然氣領域的人工智慧—市場佔有率分析、產業趨勢與統計、成長預測(2025-2030 年)AI In Oil And Gas - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

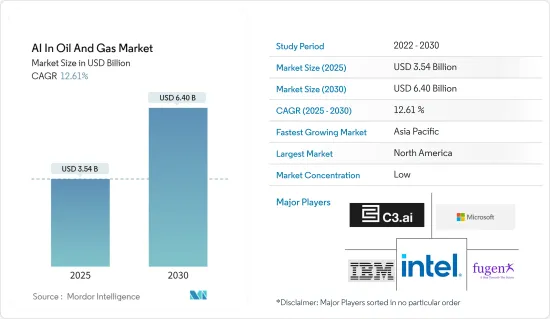

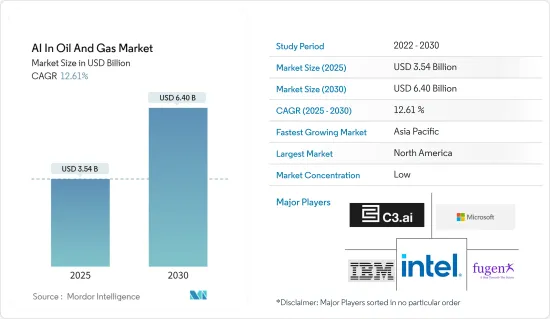

預計 2025 年石油和天然氣市場人工智慧規模為 35.4 億美元,預計到 2030 年將達到 64 億美元,在市場估計和預測期(2025-2030 年)內複合年成長率為 12.61%。

石油和天然氣產業正在經歷人工智慧在儲存分析和鑽井最佳化、安全監控和排放等各個領域的應用激增。這波人工智慧浪潮將重塑探勘、生產和環境永續性,推動市場成長。

人工智慧,尤其是預測性維護形式的人工智慧,正在重塑石油和天然氣產業的資產管理。預計這一趨勢將透過提高可靠性和降低營運風險成為市場成長的主要驅動力。

2023 年 10 月,領先的企業 AI 軟體公司 C3 AI 宣布與殼牌合作,將其預測性維護軟體整合到 C3 AI 可靠性應用程式中。這項策略性夥伴關係關係凸顯了石油和天然氣產業對人工智慧平台的日益採用,支持了市場擴張。

人工智慧技術有望提高石油和天然氣行業的業務效率,使公司能夠識別模式、自動化決策並分析來自感測器和機器的大量資料集。人工智慧預測性維護解決方案可以預防設備故障,使公司能夠規劃維護、最大限度地減少停機時間並最佳化資產利用率。

該市場主要受石油和天然氣行業降低生產成本的需求所驅動。面對波動的油價,企業紛紛轉向人工智慧來簡化業務、提高效率並降低成本。

人工智慧的應用正在加速,尤其是在石油和天然氣行業,因為公司利用其能力從資料中獲得更深入的見解。透過最佳化業務,這些公司不僅降低了成本,還提高了生產力。

俄羅斯入侵烏克蘭後,向歐洲的管道天然氣供應減少了 800 億立方米,從而面臨能源危機。導致中下游油氣公司經營活動受到干擾,市場成長陷入停滯。

歐盟 (EU) 透過可再生能源實現能源獨立的措施對傳統的石油和天然氣產業構成了挑戰。這種轉變間接限制了該地區石油和天然氣產業人工智慧解決方案的應用範圍,影響了市場成長。

全球石油和天然氣產業已經經歷了市場動態,在新冠疫情期間更是遭遇了嚴重挫折。隨後全球各地的停工和經濟活動萎縮導致石油需求大幅下降,引發國際原油價格暴跌。結果,石油業的生產和探勘活動受到阻礙,影響了人工智慧技術的採用。

石油和天然氣領域的人工智慧市場趨勢

上游業務部門預計將實現強勁成長

- 石油和天然氣產業的上游部分包括從地質勘測和土地收購到陸上和海上鑽井的探勘活動。現階段的一個關鍵挑戰是地質學家和探勘團隊尋找新的石油蘊藏量和滲漏點。

- 人工智慧在石油和天然氣領域,尤其是探勘的整合正在獲得越來越大的關注。先進的人工智慧演算法可以處理大量資料集,例如地震探勘、地質構造、測井曲線和衛星影像。這使得能夠精確識別陸地和海上的潛在儲存。

- 知名公司埃克森美孚在石油探勘中運用人工智慧就反映了這一趨勢。該公司正在部署人工智慧模型來分析即時地震資料和歷史鑽井記錄,以提高其檢測海洋環境中天然石油礦藏的能力。

- 世界領先的石油和燃氣公司擴大利用人工智慧來提高其探勘活動的效率。透過利用人工智慧工具將記錄數位化並自動化地質資料分析,這些公司可以快速識別管道腐蝕和設備磨損增加等問題。

- 例如,華為開發了專門針對石油和天然氣探勘的雲端。透過利用人工智慧和巨量資料,該公司正在為客戶重新分析 10 份歷史探勘資料,釋放新的價值並徹底改變地震資料收集方式。

- 雲端基礎的分析的進步和數位孿生的興起正在重塑石油和天然氣行業的預測性維護。特別是,英國石油、埃克森美孚和殼牌等行業巨頭使用預測性維護來評估設備狀況並預測維護需求。

- OPEC 2024年4月的資料顯示,原油需求呈現持續成長的軌跡,反映出石油和天然氣產業不斷成長的生產需求。

- 隨著石油和天然氣產業越來越注重環保實踐,它擴大使用人工智慧來早期發現危險。透過分析航空攝影、衛星影像和遙感探測資料,公司可以快速識別漏油和管道洩漏,從而限制環境破壞並遏制污染物的擴散。總的來說,這些因素支持市場成長預測。

北美佔最大市場佔有率

- 北美是人工智慧的重要基地,尤其是其蓬勃發展的石油和天然氣產業。該地區的經濟實力,加上油田營業單位廣泛採用人工智慧、大量頂級人工智慧供應商以及公共和私營部門的大量共同投資,正在推動石油和天然氣對人工智慧的需求。隨著石油和天然氣產量和投資的增加,市場潛力預計將進一步擴大。

- 美國憑藉其龐大的石油和天然氣產業以及人工智慧整合的顯著成長,預計將引領北美石油和天然氣人工智慧市場。根據美國能源資訊署的資料,美國已連續六年成為全球原油產量第一大國。 2023年,美國將創歷史新高,平均每天生產1,290萬桶原油,超過2019年的1,230萬桶。充足的供應降低了能源成本,鼓勵了私人投資,進一步增強了美國的經濟狀況。

- 人工智慧在石油和天然氣價值鏈中的作用是巨大的,尤其是在以動態能源生產為特徵的行業中。人工智慧重新構想了公司業務,從油藏評估到調整鑽井策略,再到評估油井風險。考慮到北美先進的基礎設施,預計它將引領全球市場。此外,新興企業對人工智慧的投資激增可能在不久的將來促進市場成長。

- 人工智慧在石油和天然氣探勘中的引入從根本上改變了企業發現和開採碳氫化合物資源的方式,開創了精準和高效的新時代。因此,隨著對石油探勘活動的投資增加,人工智慧在該行業的應用也在增加。

- 埃克森美孚、西方石油等美國大公司正在擁抱這股人工智慧浪潮。他們已投入數十億美元用於多元化石油探勘業務,並透過大規模併購來鞏固其地位。

- 2024 年 3 月,Corva LLC 開發的先進人工智慧程式掌控了遠端 Nabors Industries鑽機。利用衛星通訊,該人工智慧可以做出瞬間決策,有可能將鑽井速度提高至少 30%,並減少人工操作員 5,000 條命令的需求。這項技術的主要目標是降低成本並最大限度地提高石油開採量。隨著人工智慧應用的如此大膽飛躍,特別是在石油探勘,美國公司準備重塑市場格局。

石油天然氣產業人工智慧概述

石油和天然氣領域的人工智慧市場較為分散,既有全球巨頭,也有許多小型企業。知名公司包括 IBM Corporation、Fugenx Technologies、C3.AI Inc.、Microsoft Corporation 和 Intel Corporation。這些公司擴大建立策略聯盟和收購來加強產品系列併確保競爭優勢。

2023年1月,專注於AI應用軟體的公司C3 AI推出了C3 Generative AI產品套件,並以C3 Generative AI for Enterprise Search首次亮相。該套件擁有先進的變壓器模型,可簡化跨不同價值鏈的整合。 C3 生成式人工智慧的採用將推動包括石油和天然氣在內的各行各業的轉型。

2023 年 8 月 Winterskjärl Dyer 是一家領先的歐洲天然氣和石油公司,專注於石油和天然氣以及碳管理,該公司與 IBM Consulting 合作建立了 AI 能力中心 (CoC)。該戰略聯盟以微軟為共用技術合作夥伴,旨在推動提高能源生產的人工智慧應用。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭強度

- 評估影響市場的宏觀經濟因素

- 技術簡介 - 按下應用

- 品管

- 生產計畫

- 預測性維護

- 其他應用

第5章市場動態

- 市場促進因素

- 越來越重視輕鬆處理巨量資料

- 降低生產成本的趨勢日益增強

- 市場限制

- 初期實施成本高

- 石油和天然氣行業熟練專業人員短缺

- 關鍵使用案例

第6章市場區隔

- 按操作

- 上游

- 中游

- 下游

- 按類型

- 平台

- 按服務

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東和非洲

第7章競爭格局

- 公司簡介

- IBM Corporation

- FuGenX Technologies

- C3.AI Inc.

- Microsoft Corporation

- Intel Corporation

- ABB Ltd

- Honeywell International Inc.

- Huawei Technologies Co. Ltd

- NVIDIA Corporation

- Infosys Limited

- oPRO.ai Inc.

第8章投資分析

第9章:市場的未來

The AI In Oil And Gas Market size is estimated at USD 3.54 billion in 2025, and is expected to reach USD 6.40 billion by 2030, at a CAGR of 12.61% during the forecast period (2025-2030).

The oil and gas industry is witnessing a surge in AI applications, spanning reservoir analysis and drilling optimization to safety monitoring and emissions reduction. This AI wave is set to reshape exploration, production, and environmental sustainability, propelling market growth.

Artificial intelligence, particularly in the form of predictive maintenance, is reshaping asset management in the oil and gas industry. This trend is poised to be a key driver of market growth by bolstering reliability and mitigating operational risks.

In October 2023, C3 AI, a leading Enterprise AI software firm, announced a collaboration with Shell, integrating predictive maintenance software into the C3 AI reliability application. This strategic partnership underscored the increased adoption of AI platforms in the oil and gas industry, underpinning market expansion.

AI technologies promise heightened operational efficiency in oil and gas, enabling companies to identify patterns, automate decisions, and analyze vast datasets from sensors and machinery. Equipped with AI, predictive maintenance solutions can preempt equipment breakdowns, allowing businesses to plan maintenance, minimize downtime, and optimize asset utilization.

The market is primarily driven by the oil and gas industry's need to lower production costs. Faced with volatile oil prices, companies are turning to AI to streamline operations, enhance efficiency, and cut costs.

As AI adoption accelerates, especially in the oil and gas industry, companies are leveraging its capabilities to extract deeper insights from their data. By optimizing their operations, these firms are not only cutting costs but also boosting productivity.

Russia faced an energy crisis following the 80 billion cubic meters (BCM) cut in pipeline gas supplies to Europe after its Ukraine invasion. This, in turn, hampered the operations of midstream and downstream players in the oil and gas industry, stalling market growth.

The European Union's push for energy self-sufficiency through renewable sources poses a challenge to the traditional oil and gas industry. This shift indirectly curtails the scope for AI solutions in the region's oil and gas industry, impacting market growth.

The global oil and gas industry, already navigating market dynamics, faced a severe setback during the COVID-19 pandemic. The ensuing global shutdown and reduced economic activities led to a significant drop in oil demand, plummeting international crude oil prices. Consequently, production and exploration activities in the industry were hampered, affecting the adoption of AI technologies.

AI In Oil And Gas Market Trends

The Upstream Operations Segment is Expected to Witness Significant Growth

- Upstream operations in the oil and gas industry encompass exploration activities, from geological surveys and land acquisition to onshore and offshore drilling. A key challenge in this phase is the search for new oil reserves and seeps by geologists and exploration teams.

- The integration of AI in oil and gas, particularly in exploration, is gaining traction. Advanced AI algorithms can process vast datasets, including seismic surveys, geological formations, well logs, and satellite imagery. This enables precise identification of potential oil reservoirs, both on land and in the ocean.

- ExxonMobil, a prominent player, exemplifies this trend by harnessing AI for oil exploration. By deploying AI models, the company can analyze real-time seismic data and historical drilling records, enhancing its ability to detect natural oil seeps in oceanic settings.

- Major global oil and gas corporations are increasingly turning to AI to bolster the efficiency of their exploration endeavors. By leveraging AI tools to digitize records and automate geological data analysis, these companies can swiftly identify issues like pipeline corrosion or heightened equipment wear.

- Huawei, for instance, developed a specialized cloud for oil and gas exploration. By harnessing AI and Big Data, the company reanalyzed a massive 10 PB of historical exploration data for a customer, extracting new value and revolutionizing seismic data collection.

- Advancements in cloud-based analytics and the rise of digital twins are reshaping predictive maintenance in the oil and gas industry. Notably, industry giants like BP, ExxonMobil, and Shell are utilizing predictive maintenance to assess equipment conditions and anticipate maintenance needs.

- As per OPEC's April 2024 data, the demand for crude oil is on a consistent growth trajectory, reflecting the escalating production needs in the oil and gas industry, which bodes well for the market's future.

- With a heightened focus on environmentally friendly practices, the oil and gas industry is increasingly turning to AI for early hazard detection. By analyzing aerial photos, satellite imagery, and remote sensing data, companies can swiftly identify oil spills and pipeline leaks, curbing environmental damage and limiting pollutant spread. These factors collectively underpin the market's projected growth.

North America Holds the Largest Market Share

- North America is a pivotal hub for AI, particularly in terms of its robust oil and gas industry. The region's economic prowess, coupled with widespread AI adoption among oilfield entities, a rich landscape of top AI suppliers, and substantial joint investments from both public and private sectors, propels the demand for AI in oil and gas. With oil and gas production and investments increasing, the market's potential is expected to expand further.

- The United States is poised to lead North America's AI in oil and gas market, owing to its expansive oil and gas industry and a notable uptick in AI integration. According to data from the US EIA, the United States outpaced all other nations in crude oil production for six consecutive years. In 2023, the United States hit a record high, producing an average of 12.9 million barrels of crude oil daily, surpassing the previous record of 12.3 million set in 2019. This abundant supply lowered energy costs and catalyzed private investments, further bolstering the nation's economic landscape.

- The role of AI in the oil and gas value chain is profound, especially in an industry marked by dynamic energy production. Ai has reshaped companies' operations, ranging from reservoir valuation to tailoring drilling strategies and assessing well risks. Given North America's advanced infrastructure, it is expected to lead the global market. Moreover, the surge in AI investments among start-ups is set to amplify market growth in the near future.

- The infusion of AI in oil and gas exploration has ushered in a new era of precision and efficiency, fundamentally altering how companies locate and extract hydrocarbon resources. Consequently, as investments in oil exploration activities rise, the utilization of AI in the industry also increases.

- Major US players like ExxonMobil and Occidental Petroleum are making use of this AI wave. They are channeling billions into diverse oil exploration ventures and consolidating their positions through substantial mergers and acquisitions.

- In March 2024, an advanced AI program developed by Corva LLC took the reins at a remote Nabors Industries Ltd rig. Leveraging satellite communication, this AI made split-second decisions, enhancing drilling speed by at least 30% and potentially reducing human operator commands by 5,000. The primary aim behind this technology is to cut costs and maximize oil extraction. With such bold strides in AI adoption, especially in oil exploration, US companies are poised to reshape the market landscape.

AI In Oil And Gas Industry Overview

The AI in oil and gas market is fragmented, featuring a mix of global giants and numerous small and medium-sized enterprises. Noteworthy players include IBM Corporation, Fugenx Technologies, C3.AI Inc., Microsoft Corporation, and Intel Corporation. These companies are increasingly turning to strategic collaborations and acquisitions to bolster their product portfolios and secure a competitive edge.

January 2023: C3 AI, specializing in AI application software, unveiled its C3 Generative AI Product Suite, debuting with the C3 Generative AI for Enterprise Search. This suite boasts advanced transformer models, streamlining integration across diverse value chains. The introduction of C3 Generative AI is poised to boost transformative efforts in various industries, including oil and gas.

August 2023: Wintershall Dea, a leading European player in natural gas and oil, pivoting toward a focus on gas and carbon management, joined hands with IBM Consulting to establish an AI Center of Competence (CoC). This strategic alliance, with Microsoft as a shared technology partner, is geared toward driving forward AI applications that elevate energy production.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Macroeconomic Factors on the Market

- 4.4 Technology Snapshot - By Application

- 4.4.1 Quality Control

- 4.4.2 Production Planning

- 4.4.3 Predictive Maintenance

- 4.4.4 Other Applications

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Focus to Easily Process Big Data

- 5.1.2 Rising Trend to Reduce Production Cost

- 5.2 Market Restraints

- 5.2.1 Initial High Cost of Adoption

- 5.2.2 Lack of Skilled Professionals in the Oil and Gas Industry

- 5.3 Key Use Cases

6 MARKET SEGMENTATION

- 6.1 By Operation

- 6.1.1 Upstream

- 6.1.2 Midstream

- 6.1.3 Downstream

- 6.2 By Type

- 6.2.1 Platform

- 6.2.2 Services

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 FuGenX Technologies

- 7.1.3 C3.AI Inc.

- 7.1.4 Microsoft Corporation

- 7.1.5 Intel Corporation

- 7.1.6 ABB Ltd

- 7.1.7 Honeywell International Inc.

- 7.1.8 Huawei Technologies Co. Ltd

- 7.1.9 NVIDIA Corporation

- 7.1.10 Infosys Limited

- 7.1.11 oPRO.ai Inc.