|

市場調查報告書

商品編碼

1687746

矽光電:市場佔有率分析、產業趨勢與統計數據、成長預測(2025-2030 年)Silicon Photonics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

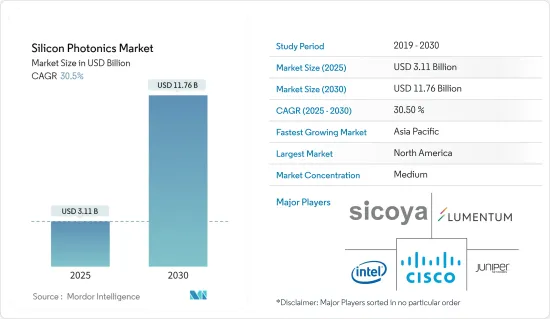

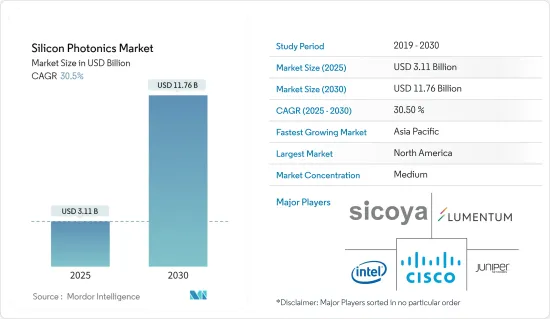

預計 2025 年矽光電市場規模為 31.1 億美元,到 2030 年將達到 117.6 億美元,預測期內(2025-2030 年)的複合年成長率為 30.5%。

矽光電是一種新興技術,利用光線在電腦晶片內部傳輸資料。矽光電是一種旨在取代銅線的技術,可提供更高的頻寬、更長的傳輸距離和更好的能源效率。

關鍵亮點

- 網路流量的快速成長是矽光電市場的主要驅動力之一。隨著對高速資料傳輸的需求不斷增加,資料中心和電信業者正在尋找更有效率、更經濟的解決方案來處理不斷成長的網路流量。矽光電技術為這項挑戰提供了有利的解決方案,與傳統的銅基系統相比,它能夠實現更快、更可靠、更具成本效益的資料傳輸。

- 這有助於利用現有網路基礎設施提供高速寬頻連線和許多寬頻服務。此外,隨著網路用戶逐年增加,用於提高平均下行和上行速度以提供服務的投資也在增加。根據GSMA預測,5G全球市場滲透率將從2024年的22%成長至2030年的64%。

- 此外,各國正採取各種舉措,加速部署5G和6G通訊。例如,2022年8月,國防部推出了三個新的「超越5G創新計畫」計劃,其中包括創建6G技術研發中心。通訊領域的這種加強可能會推動市場成長。

- 熱效應的風險是市場成長面臨的一大挑戰。當矽吸收光時就會產生熱效應,導致機器溫度升高。溫度升高可能會導致設備性能下降甚至故障。

矽光電市場趨勢

汽車產業將強勁成長

- 矽光電是汽車領域的新興技術,它將有助於發展基於事件的感測器 (EBS) 和神經型態相機等感測器,並改進雷射雷達。正在利用矽光電技術升級的汽車產品包括ADAS(高級駕駛輔助系統)、臉部辨識系統、感測器和偵測技術、雷射雷達系統以及許多其他汽車使用的系統。矽光電系統正在提高汽車的安全性、功能性和性能。此外,巡航控制系統中的矽光電具有多種優勢,包括提高準確性、速度和效率。

- 近年來,光電徹底改變了汽車產業,超越了簡單的照明功能,提供了成像、感測、智慧顯示、媒體通訊網路等領域的最尖端科技。因此,光電正在向新的維度發展,遠遠超出汽車照明、汽車製造和品管的範疇。毫不奇怪,汽車產業對矽光電等基於創新光電學的技術表現出越來越大的興趣。

- 公車產量的上升可能為市場成長提供豐厚的機會。例如,根據 OICA 的數據,2022 年印度的公車和客車產量將達到約 75,000 輛,高於 2021 年的 34,700 輛。此外,根據國際能源總署(IEA)的預測,2016年至2022年期間,中國一直是註冊電動公車最多的國家。 2021年和2022年,中國註冊電動公車的數量將分別達到5萬輛和5.4萬輛。

- 自動駕駛和自動駕駛汽車的日益普及是 ADAS 市場的主要成長要素。例如,根據國家安全委員會的數據,到2026年,大約71%的註冊車輛將配備後視攝影機,60%的註冊車輛將配備後停車感應器。預計 ADAS 採用率的提高將推動市場的成長。各類個人和商用車輛製造商正在全球建立工廠,這也推動了市場的發展。

北美佔據主要市場佔有率

- 美國是資料中心市場突出的國家之一。由於該國主要參與者的擴張努力,該國的多租戶資料中心租賃活動正在增加。

- 資料中心流量的增加,以及人工智慧和物聯網等新興領域的技術快速進步,導致全國資料流量的增加。根據思科預測,到 2023 年,連網裝置的數量將從 2018 年的 27 億增加到 46 億。此外,預計到 2023 年,智慧型手機將佔所有連網裝置的 7%。

- 大大小小的企業的數位化以及相關的數位服務正在迅速增加對更大的技術堆疊來儲存、計算、連接和分析資料的需求。這也導致了雲端服務的採用。企業採用數位化將為該地區的矽光電市場創造新的機會。

- 預計加拿大無線通訊業者將在 2020 年至 2026 年期間投資約 258 億美元用於 5G 基礎設施部署。這些措施將擴大該國 5G 基礎設施的覆蓋範圍,為市場研究供應商創造重大機會。

- 據愛立信稱,400 萬加拿大智慧型手機用戶計劃在未來 12 至 15 個月內升級到 5G,而十分之八的現有 5G 用戶表示他們不想回到 4G。過去兩年,5G用戶成長了六倍。然而,消費者的認知度較低,15% 的用戶聲稱在加拿大擁有 5G 網路,但使用的是 4G 設備,另有 18% 的用戶擁有 5G 設備,但未升級到 5G 合約。

- 在終端用戶產業技術進步的推動下,加拿大地區預計也將顯著採用矽光電技術。此外,預計活性化研發活動和技術投資將成為增加招募的主要動力。

矽光電市場概況

矽光電市場高度分散,主要參與者包括 Sicoya GMBH、英特爾公司、思科系統公司、Lumentum Operations LLC(Lumentum Holdings Inc.)和瞻博網路公司。這些公司正在透過夥伴關係和收購來加強其產品供應並獲得永續的競爭優勢。

- 2023年10月,Lumentum Holdings Inc.在蘇格蘭格拉斯哥舉行的2023年歐洲光通訊會議上展示了其最新解決方案並共用了其行業觀點。此外,Lumentum 也展示了其高功率1310 nm分佈回饋回饋雷射 (DFB),在 25°C 時光纖輸出光功率超過 400 mW。據稱,這些新型超高高功率13xx 雷射器採用共封裝光學元件、外部雷射光源解決方案和矽光電收發器,為下一代資料中心的 AI 和 ML 應用提供寬頻化。

- 2023 年 9 月,博通宣布將與台積電和英偉達合作開發矽光電和共封裝光學元件 (CPO)。台積電目前已組建了一支超過200人的研發團隊,瞄準利用矽光電技術研發高速運算晶片的新機會,並計畫最早於2024年下半年開始生產。

其他福利

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 研究範圍

第2章調查方法

第3章執行摘要

第4章 市場洞察

- 市場概覽

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 購買者和消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭強度

- COVID-19 和其他宏觀經濟因素對市場的影響

第5章市場動態

- 市場促進因素

- 透過使用基於矽光電的收發器來降低功耗

- 資料中心之間對高速連線和高資料傳輸容量的需求日益增加

- 市場限制

- 熱效應風險

第6章市場區隔

- 按應用

- 資料中心和高效能運算

- 通訊

- 車

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第7章競爭格局

- 供應商市場佔有率

- 公司簡介

- Sicoya GMBH

- Intel Corporation

- Cisco Systems Inc.

- Lumentum Operations LLC(Lumentum Holdings Inc.)

- Juniper Networks Inc.

- Global Foundries Inc.

- Broadcom Limited

- Molex Inc.(Koch Industries)

- Marvell Technology Inc.

- Macom Technology

- Coherent Corporation

- Hamamatsu Photonics KK

第8章投資分析

第9章:未來市場展望

The Silicon Photonics Market size is estimated at USD 3.11 billion in 2025, and is expected to reach USD 11.76 billion by 2030, at a CAGR of 30.5% during the forecast period (2025-2030).

Silicon photonics is a growing technology that utilizes optical rays to transfer data within computer chips. It is a favorable technology to replace copper wires, providing greater bandwidth, longer transmission distance, and better energy efficiency.

Key Highlights

- The rapidly growing internet traffic is one of the significant drivers of the silicon photonics market. With increasing demand for high-speed data transfer, data centers and telecommunications companies are seeking more efficient and cost-effective solutions to handle the growing volume of Internet traffic. Silicon photonics technology offers a favorable solution to this challenge, providing faster, more reliable, and more cost-effective data transfer than traditional copper-based systems.

- This helps provide high-speed broadband connections and many broadband services over the existing network infrastructure. Additionally, a growing number of Internet users over the years also resulted in rising investments to develop average downlink and uplink speeds to provide services. According to GSMA, 5G is projected to increase from a global market penetration of 22% in 2024 to 64% in 2030.

- In addition, countries are taking various initiatives to boost the deployment of 5G and 6G communication. For instance, in August 2022, the Department of Defense launched three new Innovative Beyond 5G Program projects, including creating an R&D hub for 6G technology. Such enhancement in the telecommunication sector may propel the market's growth.

- The risk of thermal effect significantly challenges the market's growth. The thermal effect occurs due to the absorption of light by silicon, which can increase the temperature in the machine. This increase in temperature can lead to a reduction in performance or even device failure.

Silicon Photonics Market Trends

Automotive Segment to Witness Major Growth

- Silicon photonics is an emerging technology in the automotive sector that helps advance sensors like event-based sensors (EBS) and neuromorphic cameras and improves LIDAR. Some automotive products being upgraded to incorporate silicon photonics technology include Advanced Driver Assistance Systems (ADAS), face recognition systems, sensors & detection technology, LiDAR systems, and many other systems used in vehicles. Silicon photonics-enabled systems enhance a vehicle's safety, functionality, and performance. Moreover, silicon photonics-enabled systems in cruise control offer several benefits, such as enhanced accuracy, speed, and efficiency.

- In recent years, photonics has revolutionized the automotive industry, transitioning from mere lighting functions to providing cutting-edge technology for imaging, sensing, smart displaying, and media communication networks. Consequently, photonics has taken on new dimensions far beyond lighting in cars and automotive manufacturing and quality control. Unsurprisingly, the automotive industry is showing an increased interest in innovative, photonics-based technologies such as silicon photonics.

- The increasing production of buses is likely to offer lucrative opportunities for market growth. For instance, according to OICA, around 75 thousand buses and coaches were produced across India in 2022, an increase from 34.7 thousand buses and coaches in 2021. Furthermore, according to the International Energy Agency (IEA), between 2016 and 2022, China consistently registered the most significant number of electric buses. In 2021 and 2022, the number of electric bus registrations in China amounted to 50 and 54 thousand, respectively.

- The increasing adoption of self-driving or autonomous vehicles is a primary growth factor for the ADAS market. For instance, according to the National Safety Council, by 2026, approximately 71% of registered vehicles will be equipped with rear cameras, while 60% will have rear parking sensors. Such increasing adoption of ADAS would aid the growth of the market studied. Various manufacturers of personal and commercial vehicles are establishing their facilities globally, which is also driving the market studied.

North America Holds Significant Market Share

- The United States is one of the prominent countries in the data center market. Multi-tenant data center leasing activities in the country have been rising owing to expansion activities by some of the major companies in the country.

- The growing data center traffic, along with rapid technological advancements in emerging areas, such as AI and IoT, is leading to increased data traffic across the country. According to the forecasts by Cisco, there will be 4.6 billion networked devices by 2023, rising from 2.7 billion in 2018. In addition, smartphones are expected to account for 7% of all networked devices by 2023.

- The digitization of enterprises, be they small or large, and the resulting digital services rapidly develop a need for larger technology stacks in order to store, compute, connect, and analyze data. It also leads to the adoption of cloud services. The adoption of digitization of enterprises creates new opportunities for the silicon photonics market in the region.

- It is expected that wireless operators in Canada will invest approximately USD 25.8 billion in deploying 5G infrastructure between 2020 and 2026; as a result, the government is also encouraging telecom equipment manufacturing. These initiatives will broaden the scope of the country's 5G infrastructure and provide a massive opportunity for market study vendors.

- As per Ericsson, in Canada, 4 million smartphone users plan to upgrade to 5G over the next 12-15 months; 8 in 10 current 5G users don't want to return to 4G. The 5G user base has increased six-fold over the past two years. However, consumer awareness is low; 15% of users claim they are on 5G but use a 4G handset in Canada, while another 18% own a 5G capable device but have not upgraded to a 5G subscription.

- The Canadian region is also expected to exhibit a significant adoption rate of silicon photonics technology due to technological advancements across its end-user industries. Also, the increasing research and development activities, coupled with several investments in technology, are expected to act as major drivers for the growth in adoption.

Silicon Photonics Market Overview

The silicon photonics market is highly fragmented, with major players like Sicoya GMBH, Intel Corporation, Cisco Systems Inc., Lumentum Operations LLC (Lumentum Holdings Inc.), and Juniper Networks Inc. They are adopting partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- In October 2023, Lumentum Holdings Inc. showcased its latest solutions and shared industry perspectives at the European Conference on Optical Communication 2023 in Glasgow, Scotland. Lumentum's ultra-high power, 1310 nm distributed-feedback laser (DFB) was also demonstrated at over 400 mW optical power ex-fiber at 25°C. These new ultra-high power 13xx lasers were claimed to enable higher bandwidth for AI and ML applications by using co-packaged optics, external laser source solutions, and silicon photonics transceivers for the next generation of data centers.

- In September 2023, Broadcom announced that it is working with TSMC and Nvidia to develop silicon photonics and co-packaged optics (CPO). TSMC has already formed an R&D team of over 200 employees to target emerging opportunities in high-speed computing chips based on silicon photonics technology, with production expected to start as early as the second half of 2024.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyer/consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Reduction in Power Consumption With the Use of Silicon Photonics Based Transceivers

- 5.1.2 Growing Need for High-Speed Connectivity and High Data Transfer Capabilities Across Data Centers

- 5.2 Market Restraints

- 5.2.1 Risk of Thermal Effect

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Data Centers and High-performance Computing

- 6.1.2 Telecommunications

- 6.1.3 Automotive

- 6.1.4 Other Applications

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Vendor Market Share

- 7.2 Company Profiles

- 7.2.1 Sicoya GMBH

- 7.2.2 Intel Corporation

- 7.2.3 Cisco Systems Inc.

- 7.2.4 Lumentum Operations LLC (Lumentum Holdings Inc.)

- 7.2.5 Juniper Networks Inc.

- 7.2.6 Global Foundries Inc.

- 7.2.7 Broadcom Limited

- 7.2.8 Molex Inc. (Koch Industries)

- 7.2.9 Marvell Technology Inc.

- 7.2.10 Macom Technology

- 7.2.11 Coherent Corporation

- 7.2.12 Hamamatsu Photonics KK