|

市場調查報告書

商品編碼

1536961

安全資訊與事件管理:市場佔有率分析、產業趨勢與統計、成長預測(2024-2029)Security Information And Event Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

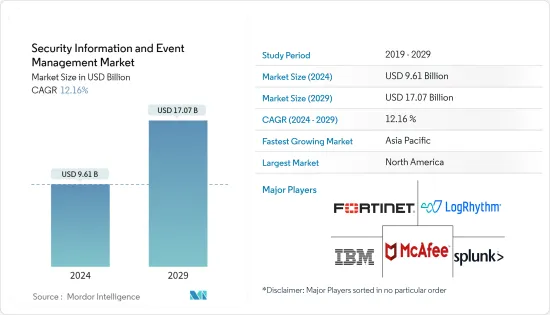

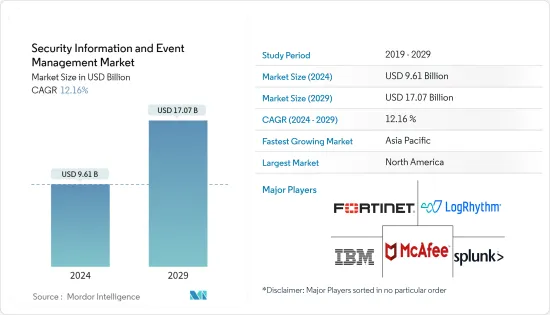

安全資訊與事件管理市場規模預計到 2024 年為 96.1 億美元,預計到 2029 年將達到 170.7 億美元,預測期內(2024-2029 年)複合年成長率為 12.16%。

安全資訊和事件管理 (SIEM) 工具對於資料安全生態系統至關重要。從多個系統集中資料並進行分析,以識別異常行為和潛在的網路攻擊。 SIEM 從網路設備、伺服器、網域控制器等收集安全資料。 SIEM 儲存規範、集中和分析資料,以發現趨勢、偵測威脅並使組織能夠調查警報。

主要亮點

- 第一代 SIEM 於 2005 年推出,整合了先前獨立的日誌和事件管理系統。傳統的 SIEM 需要在資料管道的每個階段進行仔細管理,包括資料攝取、策略、警報審查和異常分析。 SIEM 透過從更多組織來源收集資料並使用人工智慧技術來了解哪些行為構成安全事件,變得更加聰明。

- SIEM 目前的趨勢包括雲端處理(按需和可擴展的服務)、協作(共用威脅情報和分析)和認知技術(幫助做出更明智、更快速決策的人工智慧和自動化),它由三個功能定義:

- 網路犯罪分子正在開發更複雜的威脅,並利用自動化來大量部署它們。組織正在部署更多安全工具來偵測和回應這些威脅。然而,安全工具很難全面了解組織的安全狀況。這項挑戰導致人們擴大採用安全資訊和事件管理 (SIEM) 工具。

- 企業採用自帶設備 (BYOD) 的趨勢是 SIEM 市場的強大驅動力,預計將產生重大的長期影響。在當今的行動世界中,員工希望能夠使用行動電話、平板電腦、筆記型電腦和穿戴式裝置隨時隨地自由工作。組織正在採用 BYOD 計劃來實現這一目標。

- 安全資訊和事件管理 (SIEM) 是關鍵的安全投資之一。 SIEM 可協助您記錄、收集和關聯整個組織的安全事件。然而,SIEM 是一種昂貴的工具,並且總是帶有高昂的價格標籤。安全公司 Lokker 在 2023 年對 248 名技術決策者進行的一項調查發現,超過三分之二的受訪者認為 SIEM 定價是一個關鍵問題。然而,SIEM 仍然很受歡迎,並被許多公司視為管理網路威脅的關鍵技術。此外,近三分之二的公司已採用 SIEM 工具,並主要用於快速威脅偵測。

安全資訊/事件管理市場的趨勢

雲端運算顯著成長

- 隨著基於雲端基礎的工具和解決方案被企業 IT 和安全團隊廣泛接受,SIEM 持續快速發展。根據行業專家預計,到 2024 年,超過 90% 的 SIEM 解決方案將提供僅在雲端中可用的功能(日誌儲存、分析、事件管理),這一比例高於 2020 年的 20%。提供雲端解決方案的主要參與者包括 LogRhythm、Splunk、IBM、Eventsentry、Microsoft、McAfee、Securonix 和 ACE Cloud。

- 雲端 SIEM 解決方案的靈活性、可及性和時間價值優於本地 SIEM 系統。雲端 SIEM 系統允許組織進行擴展,以滿足大量日誌量需求的最後期限。

- 公司必須按照隱私法律法規的要求保存日誌。因此,企業必須確保安全、防篡改的日誌在必要時儲存。雲端 SIEM 解決方案可以以經濟實惠的方式實現這一目標。例如,Log360 Cloud可讓您透過歸檔舊日誌並將其遷移到壓縮冷資料儲存來維護日誌完整性並有效利用儲存空間。

- 由於雲端安裝始終是最新的,因此雲端 SIEM 解決方案消除了處理頻繁產品升級和修補程式的麻煩。透過這種方法,您的員工無需花費時間維護和升級 SIEM,而是可以將更多時間專注於其他重要任務,例如監控網路是否有潛在威脅。

- 該調查由領先的技術解決方案提供商 Unisys 對美國、英國、德國、澳洲和紐西蘭的 2,264 名受訪者進行了調查。 70%的受訪者是IT決策者和開發人員,30%是高階主管,由業務和技術領導者組成,37%的科技公司預計在2023年投資雲端處理。增加。

北美佔據主要市場佔有率

- 人們對IT安全和網路犯罪的日益擔憂正促使企業尋求更強大的安全解決方案。這種緊迫性是由行動裝置使用的激增、雲端服務的採用以及日益複雜的威脅情況所推動的。自帶設備 (BYOD) 的成長趨勢正在推動美國雲端 SIEM 市場的擴張。

- 隨著企業轉向雲端運算,他們面臨過時平台的挑戰。許多公司現在轉向雲端原生 SIEM 技術。這些解決方案可增強您對網路攻擊的防禦能力,並為您的雲端基礎架構提供關鍵的可見性,使您能夠以所需的速度、靈活性和規模解決安全問題。

- 市場正在見證顯著的技術創新,以解決安全問題並提高對網路攻擊的反應速度。例如,2022 年 6 月,下一代 SIEM 和 XDR 領域的領導者 Exabeam 宣布計劃在 Google Cloud 上為其雲端原生 SIEM 和網路安全分析解決方案提供支援。此舉為全球安全團隊提供了增強的資料擷取能力、速度和擴充性,以應對日益複雜的網路威脅。

- 加拿大的網路攻擊正在迅速增加,專家們強調採取主動措施的重要性。 2023年,加拿大網路攻擊大幅增加,對其數位基礎設施和國家安全構成重大風險。隨著加拿大進入數位時代,網路犯罪分子利用漏洞發動了高調的攻擊。

- 2023 年 11 月,全球網路安全領導者 Forescout Canada 在渥太華開設了新的研發辦公室。該設施專為幫助企業更好地管理 IT、OT 和物聯網領域的網路威脅和風險而設計。 ForeScout 的業務遍及全球,包括為加拿大公司提供 10 年服務,與金融、醫療保健和能源領域的領先公司合作。 Forescout 旨在利用其基於 SaaS 的 SIEM 解決方案來滿足最終用戶不斷變化的需求。

- 展望未來,在技術進步、監管合規要求和不斷變化的威脅情勢的推動下,加拿大 SIEM 市場預計將顯著成長和創新。

安全資訊和事件管理產業概述

安全資訊和事件管理市場分散且由大公司主導。主要市場參與者包括 IBM Corporation、Splunk Inc.、Fortinet Inc.、LogRhythm Inc. 和 McAfee LLC。各種正在進行的收購和技術創新正在推動市場成長。此外,SIEM 供應商正在與各種最終用戶公司合作開拓客製化解決方案,以增加市場佔有率。

- 2024 年 2 月,Gem Security 宣布與 IBM Security 領先的安全資訊和事件管理 (SIEM) 平台 QRadar 整合。 Gem Security 的 QRadar 整合旨在幫助客戶簡化其保全行動並提高其事件回應能力。 Gem Security 與 QRadar 整合,在 QRadar 的核心 SIEM 技術中提供整合偵測、警報和回應功能。

- 2023 年 11 月,LogRhythm Inc. 宣布擴大在印度的研發設施。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章 簡介

- 研究成果和先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場動態

- 市場促進因素

- 人們對安全的興趣日益濃厚

- BYOD 採用率增加

- 市場挑戰

- 高實施成本和擴充性

第6章 市場細分

- 按配置

- 本地

- 雲

- 按組織類型

- 中小企業 (SME)

- 主要企業

- 按最終用戶產業

- 零售

- BFSI

- 製造業

- 政府機構

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 亞洲

- 中國

- 日本

- 印度

- 澳洲/紐西蘭

- 拉丁美洲

- 巴西

- 阿根廷

- 中東/非洲

- 阿拉伯聯合大公國

- 北美洲

第7章 競爭格局

- 公司簡介

- IBM Corporation

- Splunk Inc.

- Fortinet Inc.

- LogRhythm Inc.

- McAfee LLC

- Open Text Corporation

- RSA Security LLC(Dell Technologies)

- Rapid7 Inc.

- Exabeam Inc.

- Securonix Inc.

- AlienVault Inc.

- Hewlett Packard Enterprise Company

第8章投資分析

第9章 市場機會及未來趨勢

The Security Information And Event Management Market size is estimated at USD 9.61 billion in 2024, and is expected to reach USD 17.07 billion by 2029, growing at a CAGR of 12.16% during the forecast period (2024-2029).

Security information and event management (SIEM) tools are vital to the data security ecosystem. They aggregate data from multiple systems and analyze it to catch abnormal behavior or potential cyberattacks. They collect security data from network devices, servers, domain controllers, and more. SIEM stores normalize, aggregate, and apply analytics to that data to discover trends, detect threats, and enable organizations to investigate alerts.

Key Highlights

- The first generation of SIEMs, introduced in 2005, combined log management and event management systems, which were previously separate. In the past, SIEMs required diligent management at every stage of the data pipeline, like data ingestion, policies, reviewing alerts, and analyzing anomalies. Increasingly, SIEMs are getting smarter toward pulling data together from more organizational sources and using AI techniques to understand what type of behavior constitutes a security incident.

- The current trend for SIEM has been defined by three capabilities, namely cloud computing (on-demand, extensible services), collaboration (sharing of threat intelligence and analytics), and cognitive technology (artificial intelligence and automation to help in arriving at smarter, faster decision-making).

- Cybercriminals are developing more sophisticated threats and using automation to launch them in high volumes. Organizations are adopting more security tools to help them detect and respond to these threats. However, security tools make it difficult to get a holistic view of the organization's security posture. This challenge drives an increased adoption of security information and event management (SIEM) tools.

- The trend of adopting your own devices (BYOD) in enterprises is a strong driver for the SIEM market, which is expected to have a significant impact in the long term. In the current mobile world, employees want the freedom to work from anywhere using their mobile phones, tablets, laptops, or wearables. Organizations are adopting BYOD programs to make it happen.

- Security information and event management (SIEM) is one of the major crucial security investments. It helps log, collect, and correlate security events across an organization. However, SIEM is an expensive tool that has always come with a steep price tag. In a survey of 248 tech decision-makers conducted in 2023, the security firm Lokker discovered that over two-thirds of respondents perceive SIEM pricing as a critical issue. However, SIEM is still popular and is viewed by many firms as an important technology for managing cyber threats. Furthermore, almost two-thirds of companies have adopted an SIEM tool and use it mostly for faster threat detection.

Security Information And Event Management Market Trends

Cloud to Witness Significant Growth

- SIEM continues to evolve rapidly as cloud-based tools and solutions have gained greater acceptance among enterprise IT and security teams. As per industry experts, in 2024, more than 90% of SIEM solutions are expected to offer capabilities delivered exclusively in cloud-log storage, analytics, and incident management, up from 20% in 2020. Major players offering cloud solutions include LogRhythm, Splunk, IBM, Eventsentry, Microsoft, McAfee, Securonix, and ACE Cloud.

- The flexibility, accessibility, and time value of cloud SIEM solutions are superior to those of on-premises SIEM systems. Organizations can handle scaling up to meet deadlines for massive log volume requirements using a cloud SIEM system.

- Organizations must keep logs as required by privacy laws and regulations. As a result, businesses must guarantee safe, tamper-proof log-keeping for as long as needed. A cloud SIEM solution can accomplish this affordably. For instance, Log360 Cloud enables the user to archive older logs and shift them to compressed cold storage to maintain their integrity and efficient use of the storage space.

- Since cloud installations are always up to date, cloud SIEM solutions eliminate the hassle of dealing with frequent upgrades and patches to the product. In this approach, instead of spending time on SIEM maintenance and upgrades, staff would have more time to concentrate on other crucial tasks like monitoring the network for potential threats.

- A survey by Unisys, a prominent technology solutions provider, polled 2,264 respondents across the United States, United Kingdom, Germany, Australia, and New Zealand. The respondents, comprising business and technology leaders, including 70% IT decision-makers and developers and 30% C-suite executives, revealed that 37% of technology firms planned a significant uptick in cloud computing investments in 2023.

North America to Hold Significant Market Share

- Rising concerns over IT security and cybercrime have prompted organizations to seek more robust security solutions. This urgency has been fueled by the surge in mobile device usage, the adoption of cloud services, and the increasingly intricate threat landscape. The growing acceptance of the Bring Your Own Device (BYOD) trend is propelling the expansion of the cloud SIEM market in the United States.

- As organizations increasingly shift to the cloud, they face challenges with outdated platforms. Many businesses are now turning to cloud-native SIEM technologies. These solutions bolster their defenses against cyberattacks and provide crucial visibility into their cloud infrastructure, enabling them to tackle security issues with the required speed, flexibility, and scale.

- The market has witnessed notable innovations to address security concerns and enhance cyberattack response speed. For instance, in June 2022, Exabeam, a leader in next-gen SIEM and XDR, announced plans to enhance its cloud-native SIEM and cybersecurity analytics solutions on Google Cloud. This move offers global security teams enhanced data ingestion capabilities, speed, and scalability in their battle against increasingly sophisticated cyber threats.

- Canada has seen a surge in cyber attacks, prompting experts to stress the importance of proactive measures. In 2023, the country witnessed a notable uptick in cyber attacks, posing significant risks to its digital infrastructure and national security. As Canada embraced the digital era, cyber criminals capitalized on vulnerabilities, launching high-profile attacks.

- In November 2023, Forescout Canada, a global cybersecurity leader, opened a new R&D office in Ottawa. This facility is dedicated to helping enterprises enhance their management of cyber threats and risks, particularly in their IT, OT, and IoT domains. With a global presence, including a decade-long service to Canadian enterprises, Forescout has collaborated with major players in the finance, healthcare, and energy sectors. Leveraging its SaaS-based SIEM solution, Forescout aims to cater to the evolving needs of its end users.

- Looking ahead, the Canadian SIEM market is poised for substantial growth and innovation, driven by technology advancements, regulatory compliance demands, and the evolving threat landscape.

Security Information And Event Management Industry Overview

The security information and event management market is fragmented and dominated by the major players. Some major market players are IBM Corporation, Splunk Inc., Fortinet Inc., LogRhythm Inc., and McAfee LLC. The various ongoing acquisitions and innovations are leading to the market's growth. In addition, SIEM providers are forming partnerships with different end-user companies and developing customized solutions to increase their market share.

- In February 2024, Gem Security announced the integration of Gem Security with QRadar, IBM Security's leading security information and event management (SIEM) platform. Gem Security's QRadar integration is designed to help customers streamline their security operations and improve their incident response capabilities. Gem Security integrates with QRadar to provide consolidated detection, alerts, and response capabilities within QRadar's leading SIEM technology.

- In November 2023, LogRhythm Inc. announced the expansion of its R&D facilities in India, a move aimed at bolstering cyber resilience in the region.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Degree of Competition

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in Security Concerns

- 5.1.2 Increasing Adoption of BYOD

- 5.2 Market Challenge

- 5.2.1 High Cost of Deployment and Scalability

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Organisation Type

- 6.2.1 Small and Medium Enterprises (SMEs)

- 6.2.2 Large Enterprises

- 6.3 By End-user Industry

- 6.3.1 Retail

- 6.3.2 BFSI

- 6.3.3 Manufacturing

- 6.3.4 Government

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Argentina

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles*

- 7.1.1 IBM Corporation

- 7.1.2 Splunk Inc.

- 7.1.3 Fortinet Inc.

- 7.1.4 LogRhythm Inc.

- 7.1.5 McAfee LLC

- 7.1.6 Open Text Corporation

- 7.1.7 RSA Security LLC (Dell Technologies)

- 7.1.8 Rapid7 Inc.

- 7.1.9 Exabeam Inc.

- 7.1.10 Securonix Inc.

- 7.1.11 AlienVault Inc.

- 7.1.12 Hewlett Packard Enterprise Company